false

0001314052

0001314052

2024-05-09

2024-05-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May

9, 2024

ANAVEX

LIFE SCIENCES CORP.

(Exact name of registrant as specified in its charter)

| Nevada |

001-37606 |

98-0608404 |

| (State or other jurisdiction |

(Commission |

(IRS Employer |

| of incorporation) |

File Number) |

Identification No.) |

630 5th Avenue, 20th Floor, New York, NY USA

10111

(Address of principal executive offices) (Zip Code)

1-844-689-3939

Registrant’s telephone number, including area

code

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2. below):

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e -4(c))

Securities registered pursuant to Section 12(b) of

the Act:

| Title of Each Class |

|

Trading Symbol(s) |

|

Name of Each Exchange on which

Registered |

| Common Stock, par value $0.001 per share |

|

AVXL |

|

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 9, 2024, Anavex Life Sciences

Corp. (the “Company”) issued a press release reporting financial results for its fiscal quarter ended March 31, 2024

(the “Press Release”). A copy of the Press Release is furnished as Exhibit 99.1 to this Current Report and is incorporated

herein by reference.

The information furnished pursuant

to Item 2.02 of this Current Report, including Exhibit 99.1 attached hereto, shall not be considered “filed” for purposes

of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liability of such section, nor shall it be incorporated by reference into future filings by the Company under the Securities Act of 1933,

as amended, or under the Exchange Act, unless the Company expressly sets forth in such future filing that such information is to be considered

“filed” or incorporated by reference therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

ANAVEX LIFE SCIENCES CORP. |

| |

|

| |

/s/ Christopher Missling |

| |

Name: |

Christopher Missling, PhD |

| |

Title: |

Chief Executive Officer |

| |

|

| Date: May 9, 2024 |

|

EXHIBIT 99.1

Anavex Life Sciences Reports

Fiscal 2024 Second Quarter Financial Results and

Provides Business Update

Company to host a webcast

today at 8:30 a.m. Eastern Time

NEW YORK – May 9, 2024 – Anavex

Life Sciences Corp. (“Anavex” or the “Company”) (Nasdaq: AVXL), a clinical-stage biopharmaceutical company developing

differentiated therapeutics for the treatment of neurodegenerative, neurodevelopmental and neuropsychiatric disorders including Alzheimer’s

disease, Parkinson’s disease, Rett syndrome, schizophrenia, and other central nervous system (CNS) diseases, today reported financial

results for its fiscal quarter ended March 31, 2024.

“We are encouraged by the very recently issued

FDA guidance for Early Alzheimer’s disease, which states that one cognitive measurement alone, like ADAS-Cog13, could

be a sufficient primary endpoint for early Alzheimer’s disease.[1] We appreciate this new guidance and believe this

opens another possible pathway for us to move forward in parallel to the initiated process of Marketing Authorisation application to

the European Medicines Agency (EMA) for blarcamesine related to the treatment of Alzheimer’s disease, which is underway. We are

also pleased to report that the first cohort of schizophrenia patients in the ongoing ANAVEX®3-71-SZ-001 Phase 2 trial of ANAVEX®3-71

has been fully enrolled,” said Christopher U Missling, PhD, President and Chief Executive Officer of Anavex. “Moreover, we

remain committed to the development of our programs within neurodegenerative, neurodevelopmental disorders, which could further expand

our portfolio of transformative investigational therapies and utilizing

our differentiated precision medicine platform to deliver easy access and scalable treatment options for brain disorders.”

Key

Pipeline Updates:

| ● | Full

data from the blarcamesine in Alzheimer’s disease Phase 2b/3 placebo-controlled clinical

trial will be published in an upcoming peer-reviewed journal. The initiated process for submitting

a Marketing Authorisation application to the European Medicines Agency (EMA) under the Centralised

Procedure is underway. The Marketing Authorisation would allow direct market access throughout

the European Union for oral blarcamesine for the treatment of Alzheimer’s disease.

There are an estimated 7 million people in Europe with Alzheimer’s disease, a number

expected to double by 2030, according to the European Brain Council.[2] |

| ● | Analysis

of RNA sequencing (RNA-seq) of the placebo-controlled Phase 2b/3 blarcamesine trial

in early Alzheimer’s disease is underway. Interim data expected by mid 2024. |

| ● | Ongoing

ATTENTION-AD open-label extension 96-week trial. Interim data expected in the second half

of 2024. |

[1]

https://www.fda.gov/regulatory-information/search-fda-guidance-documents/early-alzheimers-disease-developing-drugs-treatment

[2] https://www.braincouncil.eu/projects/rethinking-alzheimers-disease/

| ● | Schizophrenia:

The placebo-controlled ANAVEX®3-71-SZ-001 Phase 2 clinical study of ANAVEX®3-71

for the treatment of schizophrenia is well underway with the first cohort of schizophrenia

patients fully enrolled. |

| ● | Parkinson’s

disease: Initiation of ANAVEX®2-73 imaging-focused trial and Phase 2b/3 6 month trial

is expected in the second half of 2024. |

| ● | Rett

syndrome: Continued positive Real World Evidence (RWE) feedback from Rett syndrome patients

and caregivers from the ongoing open-label extension trial and Compassionate Use Program

for patients who participated in the Phase 2/3 EXCELLENCE trial encourages us to continue

our partnership with the Rett syndrome community and to proceed with

a Phase 3 12-week efficacy study. An educational presentation will be provided at the 2024

IRSF Rett Syndrome Scientific Meeting, taking place June 18 – June 19, 2024. ANAVEX®2-73

had previously received Fast Track designation, Rare Pediatric Disease designation and Orphan

Drug designation from the FDA for the treatment of Rett syndrome. |

| ● | Fragile

X: New disease-specific, translatable, and objective biomarker data generated with ANAVEX®2-73,

supporting the initiation of the potentially pivotal ANAVEX®2-73 Phase 2/3 clinical trial

will be presented at the 19th National Fragile X Foundation Conference, taking

place July 25 – July 28, 2024. |

| ● | New

Rare disease: Initiation of potentially pivotal ANAVEX®2-73 Phase 2/3 clinical trial. |

| ● | Publications:

Continued clinical publications involving ANAVEX®2-73 and ANAVEX®3-71. |

Recent

Business Highlights:

| ● | On

March 18, 2024, the Company announced that the first patient in its U.S. FDA cleared placebo-controlled

Phase 2 clinical study of ANAVEX®3-71 for the treatment of schizophrenia had been screened,

ahead of schedule. |

| ● | On

January 24, 2024, the Company announced a peer-reviewed publication in Clinical Pharmacology

in Drug Development, findings from the ANAVEX®3-71 first-in-human study which achieved

its safety objectives. The publication is entitled, ‘Population-Based Characterization

of the Pharmacokinetics and Food Effect of ANAVEX3-71, a Novel Sigma-1 Receptor and Allosteric

M1 Muscarinic Receptor Agonist in Development for Treatment of Frontotemporal Dementia, Schizophrenia,

and Alzheimer Disease’.[3] The publication reports pharmacokinetic (PK)

dose proportionality of ANAVEX®3-71 in humans and food had no effect on the PK of ANAVEX®3-71.

This data also expands the safety objectives met in this first-in-human study of ANAVEX®3-71,

further supporting its drug development program. |

| ● | On

January 8, 2024, the Company announced that the United States Patent and Trademark Office

(USPTO) granted U.S. Patent No. 11,839,600 entitled “NEURODEVELOPMENTAL DISORDER THERAPY”

from the United States Patent and Trademark Office (USPTO) for its patent application number

17/890,083. Anavex’s newest patent expands coverage of ANAVEX®2-73

(blarcamesine) therapy to ameliorate various conditions associated with loss-of-function

mutations of the gene encoding methyl-CpG binding protein (MeCP2). |

[3] Fadiran EO, Hammond E, Tran J, Missling

CU, Ette E. Population-Based Characterization of the Pharmacokinetics and Food Effect of ANAVEX3-71, a Novel Sigma-1 Receptor and Allosteric

M1 Muscarinic Receptor Agonist in Development for Treatment of Frontotemporal Dementia, Schizophrenia, and Alzheimer Disease. Clin

Pharmacol Drug Dev. 2024;13(1):21-31. doi:10.1002/cpdd.1323

Financial Highlights:

| ● | Cash

and cash equivalents of $139.4 million at March 31, 2024 compared to $151.0 million at fiscal

yearend September 30, 2023. The Company anticipates at the current cash utilization rate

a runway of approximately 4 years. |

| ● | General

and administrative expenses for the quarter of $2.8 million compared to $2.9 million for

the comparable quarter of fiscal 2023. |

| ● | Research

and development expenses for the quarter of $9.7 million compared to $11.3 million for the

comparable quarter of fiscal 2023. |

| ● | Net

loss for the quarter of $10.5 million, or $0.13 per share, compared to a net loss of $13.1

million, or $0.17 per share for the comparable quarter of fiscal 2023. |

The

financial information for the fiscal quarter ended March 31, 2024, should be read in conjunction with the Company’s condensed consolidated

interim financial statements, which will appear on EDGAR, www.sec.gov and will be available on the Anavex website at www.anavex.com.

Webcast

/ Conference Call Information:

The live webcast of the conference

call will be available on Anavex’s website at www.anavex.com.

The conference call can be also accessed by dialing

1 929 205 6099 for participants in

the U.S. using the Meeting ID# 815 2682 8440 and reference passcode 121725. A replay of the conference call will also be available

on Anavex’s website for up to 30 days.

About Anavex Life Sciences Corp.

Anavex Life Sciences Corp. (Nasdaq: AVXL) is a publicly

traded biopharmaceutical company dedicated to the development of novel therapeutics for the treatment of neurodegenerative, neurodevelopmental,

and neuropsychiatric disorders, including Alzheimer’s disease, Parkinson’s disease, Rett syndrome, schizophrenia and other

central nervous system (CNS) diseases, pain, and various types of cancer. Anavex’s lead drug candidate, ANAVEX®2-73 (blarcamesine),

has successfully completed a Phase 2a and a Phase 2b/3 clinical trial for Alzheimer’s disease, a Phase 2 proof-of-concept study

in Parkinson’s disease dementia, and both a Phase 2 and a Phase 3 study in adult patients and one Phase 2/3 in pediatric patients

with Rett syndrome. ANAVEX®2-73 is an orally available drug candidate that restores cellular homeostasis by targeting SIGMAR1 and

muscarinic receptors. Preclinical studies demonstrated its potential to halt and/or reverse the course of Alzheimer’s disease. ANAVEX®2-73

also exhibited anticonvulsant, anti-amnesic, neuroprotective, and anti-depressant properties in animal models, indicating its potential

to treat additional CNS disorders, including epilepsy. The Michael J. Fox Foundation for Parkinson’s Research previously awarded

Anavex a research grant, which fully funded a preclinical study to develop ANAVEX®2-73 for the treatment of Parkinson’s disease.

We believe that ANAVEX®3-71,

which targets SIGMAR1 and M1 muscarinic receptors, is a promising clinical stage drug candidate demonstrating

disease-modifying activity against the major hallmarks of Alzheimer’s disease in transgenic (3xTg-AD) mice, including cognitive

deficits, amyloid, and tau pathologies. In preclinical trials, ANAVEX®3-71 has shown beneficial effects on mitochondrial dysfunction

and neuroinflammation. Further information is available at www.anavex.com.

You can also connect with the Company on Twitter, Facebook, Instagram, and LinkedIn.

Forward-Looking Statements

Statements in this press release that

are not strictly historical in nature are forward-looking statements. These statements are only predictions based on current information

and expectations and involve a number of risks and uncertainties. Actual events or results may differ materially from those projected

in any of such statements due to various factors, including the risks set forth in the Company’s most recent Annual Report on Form

10-K filed with the SEC. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of

the date hereof. All forward-looking statements are qualified in their entirety by this cautionary statement and Anavex Life Sciences

Corp. undertakes no obligation to revise or update this press release to reflect events or circumstances after the date hereof.

| Anavex Life Sciences Corp. |

| Condensed Consolidated Interim Statements of Operations and Comprehensive Loss |

| (in thousands, except share and per share amounts) |

| |

| | |

Three months ended March 31, |

| | |

2024 | |

2023 |

| Operating Expenses | |

| | | |

| | |

| General and administrative | |

$ | 2,790 | | |

$ | 2,883 | |

| Research and development | |

| 9,729 | | |

| 11,307 | |

| Total operating expenses | |

| 12,519 | | |

| 14,190 | |

| Operating loss | |

| (12,519 | ) | |

| (14,190 | ) |

| | |

| | | |

| | |

| Other income | |

| | | |

| | |

| Research and development incentive income | |

| 472 | | |

| 750 | |

| Interest income, net | |

| 1,756 | | |

| 1,465 | |

| Other financing expense | |

| — | | |

| (964 | ) |

| Foreign exchange gain (loss), net | |

| (150 | ) | |

| (118 | ) |

| Total other income, net | |

| 2,078 | | |

| 1,133 | |

| Net loss before provision for income taxes | |

| (10,441 | ) | |

| (13,057 | ) |

| Income tax expense, current | |

| (105 | ) | |

| (50 | ) |

| Net loss and comprehensive loss | |

$ | (10,546 | ) | |

$ | (13,107 | ) |

| | |

| | | |

| | |

| Net loss per share | |

| | | |

| | |

| Basic and diluted | |

$ | (0.13 | ) | |

$ | (0.17 | ) |

| | |

| | | |

| | |

| Weighted average number of shares outstanding | |

| | | |

| | |

| Basic and diluted | |

| 82,464,226 | | |

| 78,304,363 | |

| Anavex Life Sciences Corp. |

| Condensed Consolidated Interim Statements of Operations and Comprehensive Loss |

| (in thousands, except share and per share amounts) |

| |

| | |

Six months ended March 31, |

| | |

2024 | |

2023 |

| Operating Expenses | |

| | | |

| | |

| General and administrative | |

$ | 5,399 | | |

$ | 6,200 | |

| Research and development | |

| 18,413 | | |

| 23,373 | |

| Total operating expenses | |

| 23,812 | | |

| 29,573 | |

| Operating loss | |

| (23,812 | ) | |

| (29,573 | ) |

| | |

| | | |

| | |

| Other income | |

| | | |

| | |

| Grant income | |

| — | | |

| 25 | |

| Research and development incentive income | |

| 1,064 | | |

| 1,483 | |

| Interest income, net | |

| 3,764 | | |

| 2,733 | |

| Other financing expense | |

| — | | |

| (964 | ) |

| Foreign exchange gain (loss), net | |

| 7 | | |

| 247 | |

| Total other income, net | |

| 4,835 | | |

| 3,524 | |

| Net loss before provision for income taxes | |

| (18,977 | ) | |

| (26,049 | ) |

| Income tax expense, current | |

| (191 | ) | |

| (30 | ) |

| Net loss and comprehensive loss | |

$ | (19,168 | ) | |

$ | (26,079 | ) |

| | |

| | | |

| | |

| Net loss per share | |

| | | |

| | |

| Basic and diluted | |

$ | (0.23 | ) | |

$ | (0.33 | ) |

| | |

| | | |

| | |

| Weighted average number of shares outstanding | |

| | | |

| | |

| Basic and diluted | |

| 82,269,965 | | |

| 78,138,940 | |

| Anavex Life Sciences Corp. |

| Condensed Consolidated Interim Balance Sheets |

| (in thousands, except share and per share amounts) |

| | |

|

| | |

March 31, | |

September 30, |

| | |

2024 | |

2023 |

| Assets | |

| | | |

| | |

| Current | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 139,386 | | |

$ | 151,024 | |

| Incentive and tax receivables | |

| 3,785 | | |

| 2,709 | |

| Prepaid expenses and other current assets | |

| 1,345 | | |

| 653 | |

| Total Assets | |

$ | 144,516 | | |

$ | 154,386 | |

| | |

| | | |

| | |

| Liabilities and stockholders’ equity | |

| | | |

| | |

| Current Liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 3,726 | | |

$ | 4,322 | |

| Accrued liabilities | |

| 4,915 | | |

| 7,295 | |

| Deferred grant income | |

| 917 | | |

| 917 | |

| Total Liabilities | |

| 9,558 | | |

| 12,534 | |

| Capital Stock | |

| 84 | | |

| 82 | |

| Additional paid-in capital | |

| 447,345 | | |

| 434,839 | |

| Share proceeds receivable | |

| (234 | ) | |

| — | |

| Accumulated deficit | |

| (312,237 | ) | |

| (293,069 | ) |

| Total Stockholders’ Equity | |

| 134,958 | | |

| 141,852 | |

| Total Liabilities and Stockholders’ Equity | |

$ | 144,516 | | |

$ | 154,386 | |

For Further Information:

Anavex Life Sciences Corp.

Research & Business Development

Toll-free: 1-844-689-3939

Email: info@anavex.com

Investors:

Andrew

J. Barwicki

Investor

Relations

Tel:

516-662-9461

Email:

andrew@barwicki.com

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

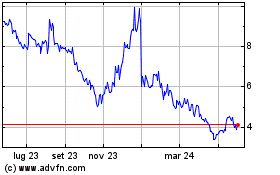

Grafico Azioni Anavex Life Sciences (NASDAQ:AVXL)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Anavex Life Sciences (NASDAQ:AVXL)

Storico

Da Feb 2024 a Feb 2025