false

0001346830

0001346830

2023-12-18

2023-12-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported)

December 18, 2023

CARA THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-36279 |

|

75-3175693 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

|

4 Stamford Plaza

107 Elm Street, 9th Floor

Stamford, Connecticut |

|

|

|

06902 |

| (Address of principal executive offices) |

|

|

|

(Zip Code) |

| |

|

|

|

|

| Registrant's telephone number, including area code (203) 406-3700 |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol |

Name

of each exchange on which registered |

| Common Stock, par value $0.001 per share |

CARA |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by

check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨.

| Item 7.01. |

Regulation FD Disclosure. |

On December 18, 2023, Cara Therapeutics, Inc. (the “Company”)

issued a press release (the “Press Release”) announcing the outcome from the dose-finding Part A of the KIND 1 study

evaluating the efficacy and safety of oral difelikefalin as adjunct therapy to topical corticosteroids (“TCS”) for moderate-to-severe

pruritus in adult patients with atopic dermatitis (“AD”). Oral difelikefalin as adjunct to TCS did not demonstrate a meaningful

clinical benefit compared to TCS alone, resulting in the Company’s decision to discontinue its clinical program in pruritus associated

with AD. A copy of the press release is being furnished to the Securities and Exchange Commission as Exhibit 99.1 to this Current

Report on Form 8-K and is incorporated by reference to this Item 7.01.

The information furnished under this Item 7.01, including Exhibit 99.1,

shall not be deemed to be "filed" for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange

Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed to be incorporated by reference into any of

the Company’s filings with the Securities and Exchange Commission under the Exchange Act or the Securities Act of 1933, as amended,

whether made before or after the date hereof, regardless of any general incorporation language in such a filing.

| Item 8.01. |

Other Information. |

On December 18, 2023, the Company issued the Press Release announcing

the outcome from the dose-finding Part A of the KIND 1 study evaluating the efficacy and safety of oral difelikefalin as adjunct

therapy to TCS for moderate-to-severe pruritus in adult patients with AD. Oral difelikefalin as adjunct to TCS did not demonstrate a meaningful

clinical benefit compared to TCS alone, resulting in the Company’s decision to discontinue its clinical program in pruritus associated

with AD.

The Phase 3, two-part, multicenter, randomized, double-blind, placebo-controlled,

12-week study was designed to investigate the use of oral difelikefalin as adjunctive treatment to topical corticosteroids in approximately

287 patients with AD. Patients were randomized to receive oral difelikefalin 0.25 mg tablets twice a day (“BID”) plus TCS,

difelikefalin 0.5 mg tablets BID plus TCS, placebo tablets BID plus TCS or placebo tablets BID plus vehicle.

Primary Endpoint

The primary efficacy endpoint was the proportion of patients with a

≥4-point improvement at Week 12 from baseline in the worst itch numerical rating scale.

Oral difelikefalin as adjunct therapy to TCS did not demonstrate a

meaningful clinical benefit compared to TCS alone. Oral difelikefalin was generally well tolerated with a safety profile similar to prior

trials.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| CARA THERAPEUTICS, INC. |

|

| |

|

| By: |

/s/ RYAN MAYNARD |

|

| |

Ryan Maynard |

|

| |

Chief Financial Officer |

|

| |

(Principal Financial and Accounting Officer) |

|

Date: December 18, 2023

Exhibit 99.1

Cara Therapeutics Announces Outcome from Dose-Finding

Part A of KIND 1 Study Evaluating Oral Difelikefalin for Moderate-to-Severe Pruritus in Patients with Atopic Dermatitis

– Oral difelikefalin as adjunct to topical

corticosteroids (TCS) did not demonstrate meaningful clinical benefit compared to TCS alone; As a result, Cara will discontinue its clinical

program in pruritus associated with atopic dermatitis –

– Late-stage oral difelikefalin clinical

programs for pruritus associated with notalgia paresthetica and advanced chronic kidney disease continue to enroll on track with key data

readouts expected in 2H24 –

– Cara expects to end 2023 with approximately

$100 million in cash –

STAMFORD, Conn., December 18, 2023 – Cara Therapeutics, Inc. (Nasdaq:

CARA), a commercial-stage biopharmaceutical company leading a new treatment paradigm to improve the lives of patients suffering from pruritus,

today announced the outcome from the dose-finding Part A of the KIND 1 study evaluating the efficacy and safety of oral difelikefalin

as adjunct therapy to topical corticosteroids (TCS) for moderate-to-severe pruritus in adult patients with atopic dermatitis (AD). Oral

difelikefalin as adjunct to TCS did not demonstrate a meaningful clinical benefit compared to TCS alone, resulting in the Company’s

decision to discontinue its clinical program in pruritus associated with atopic dermatitis.

“We are disappointed with the outcome of this study recognizing

that comparing the adjunctive use of oral difelikefalin with TCS to TCS alone represented a high clinical bar based on anticipated real-world

commercial use. Importantly, we believe that there is no readthrough to our other late-stage clinical programs for oral difelikefalin

as monotherapy without TCS in different indications and patient populations, namely notalgia paresthetica (NP) and advanced chronic kidney

disease (CKD),” said Joana Goncalves, MD, Chief Medical Officer of Cara Therapeutics. “On behalf of the Cara team, I

would like to thank the patients and investigators who participated in this trial and our team for their unwavering commitment to its

execution.”

KIND 1 was a Phase 3, two-part, multicenter, randomized, double-blind,

controlled study to evaluate the efficacy and safety of oral difelikefalin as adjunct therapy to TCS for moderate-to-severe pruritus in

adults with AD. In Part A, patients (n=287) were randomized to receive oral difelikefalin 0.25 mg tablets twice a day (BID) plus

TCS, difelikefalin 0.5 mg tablets BID plus TCS, placebo tablets BID plus TCS or placebo tablets BID plus vehicle. The primary endpoint

was the proportion of patients with a ≥4-point improvement at Week 12 from baseline in the worst itch NRS.

Oral difelikefalin as adjunct therapy to TCS did not demonstrate a

meaningful clinical benefit compared to TCS alone. Oral difelikefalin was generally well tolerated with a safety profile similar to prior

trials.

Cara expects to end 2023 with approximately $100 million in cash. This

amount includes the $17.5 million already received from HealthCare Royalty, less certain expenses, and the first milestone payment of

$20 million, which was triggered by the achievement of the milestone this month and is expected to be received by year-end 2023.

About Cara Therapeutics

Cara Therapeutics is

a commercial-stage biopharmaceutical company leading a new treatment paradigm to improve the lives of patients suffering from pruritus.

The Company’s KORSUVA® (difelikefalin) injection is the first and only FDA-approved treatment for moderate-to-severe pruritus

associated with chronic kidney disease in adults undergoing hemodialysis. The Company is developing an oral formulation of difelikefalin

and has a Phase 3 program ongoing for the treatment of moderate-to-severe pruritus in patients with advanced chronic kidney disease and

a Phase 2/3 program for moderate-to-severe pruritus in patients with notalgia paresthetica. For more information, visit www.CaraTherapeutics.com

and follow the company on X (Twitter), LinkedIn and Instagram.

Forward-looking Statements

Statements contained in this press release regarding matters that are

not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of

1995. Examples of these forward-looking statements include statements concerning the Company’s plans to discontinue its clinical

program in pruritus associated with atopic dermatitis, timing of enrollment and data readouts from the Company’s planned and ongoing

clinical trials, and the Company’s cash balance at year end. Because such statements are subject to risks and uncertainties, actual

results may differ materially from those expressed or implied by such forward-looking statements. These risks and uncertainties include

the risks inherent in the launch of new products, including that our commercial partners may not perform as expected, risks inherent in

the clinical and regulatory development of pharmaceutical products, and the risks described more fully in Cara Therapeutics’ filings

with the Securities and Exchange Commission, including the “Risk Factors” section of the Company’s Annual Report on

Form 10-K for the year ending December 31, 2022 and its other documents subsequently filed with or furnished to the Securities

and Exchange Commission, including its Form 10-Q for the quarter ended September 30, 2023. All forward-looking statements contained

in this press release speak only as of the date on which they were made. Cara Therapeutics undertakes no obligation to update such statements

to reflect events that occur or circumstances that exist after the date on which they were made, except as required by law.

MEDIA CONTACT:

Annie Spinetta

6 Degrees

973-768-2170

aspinetta@6degreespr.com

INVESTOR CONTACT:

Iris Francesconi, Ph.D.

Cara Therapeutics

203-406-3700

investor@caratherapeutics.com

v3.23.4

Cover

|

Dec. 18, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Dec. 18, 2023

|

| Entity File Number |

001-36279

|

| Entity Registrant Name |

CARA THERAPEUTICS, INC.

|

| Entity Central Index Key |

0001346830

|

| Entity Tax Identification Number |

75-3175693

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

4 Stamford Plaza

|

| Entity Address, Address Line Two |

107 Elm Street

|

| Entity Address, Address Line Three |

9th Floor

|

| Entity Address, City or Town |

Stamford

|

| Entity Address, State or Province |

CT

|

| Entity Address, Postal Zip Code |

06902

|

| City Area Code |

203

|

| Local Phone Number |

406-3700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

CARA

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

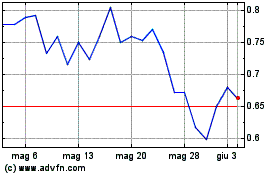

Grafico Azioni Cara Therapeutics (NASDAQ:CARA)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Cara Therapeutics (NASDAQ:CARA)

Storico

Da Nov 2023 a Nov 2024