0001641398

false

00000

0001641398

2023-06-26

2023-06-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of

earliest event reported): June 26, 2023

GD Culture Group Limited

(Exact name of Company as specified in charter)

| Nevada |

|

001-37513 |

|

47-3709051 |

(State or other jurisdiction

of incorporation) |

|

(Commission File No.) |

|

(IRS Employer

Identification No.) |

c/o GD Culture Group Limited

Flat 1512, 15F, Lucky Centre,

No.165-171 Wan Chai Road

Wan Chai, Hong Kong

(Address of Principal Executive Offices) (Zip

code)

+852-95791074

(Company’s Telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the Company under any of the following provisions (see General Instruction

A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, par value $0.0001 |

|

GDC |

|

Nasdaq Capital Market |

Item 1.01 Entry into a Material Definitive

Agreement.

On June 26, 2023, GD Culture Group Limited (the “Company”)

entered into a share purchase agreement (the “Agreement”) with a buyer unaffiliated with the Company (the “Buyer”).

Pursuant to the Agreement, the Company agreed to sell and the Buyer agreed to purchase all the issued and outstanding equity interest

in TMSR Holdings Limited (“TMSR”), a company incorporated under the laws of Hong Kong and an indirect subsidiary of Company.

The purchase price for the transaction contemplated by the Agreement shall be $100,000. TMSR has a direct wholly-owned subsidiary, Makesi

Iot Technology (Shanghai) Co., Ltd. (“Makesi”), and an indirect wholly-owned subsidiary, Shanghai Yuanma Food and Beverage

Management Co., Ltd. (“Yuanma”). The sale of TMSR will include the sale of Makesi and Yuanma. None of TMSR, Makesi or Yuanma

has any assets, employees or operation. The sale of TMSR will not have any impact on the Company’s consolidated financial statements.

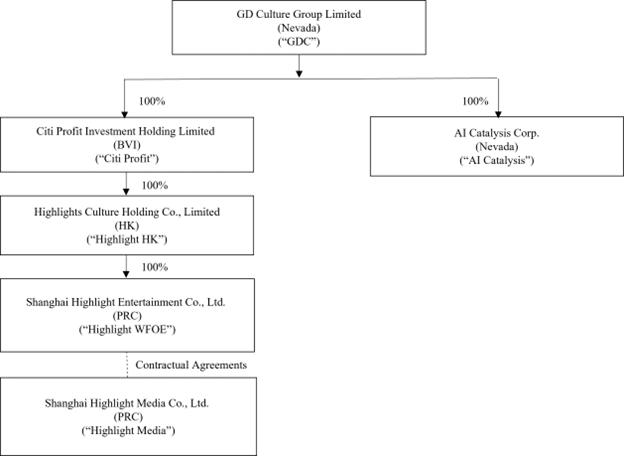

The following diagram illustrates

the corporate structure of the Company and its subsidiaries after giving effect to the transaction:

AI Catalysis Corp. is a Nevada corporation, incorporated on May 18,

2023. The Company plans to develop video games through AI Catalysis Corp.

The foregoing description of the Agreement does

not purport to be complete and is qualified in its entirety by reference to the complete text of the Agreement, which is filed as Exhibit

10.1 hereto.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

GD CULTURE GROUP LIMITED |

| |

|

| Date: June 28, 2023 |

By: |

/s/ Xiao Jian Wang |

| |

Name: |

Xiao Jian Wang |

| |

Title: |

Chief Executive Officer, President and

Chairman of the Board |

3

Exhibit 10.1

SHARE PURCHASE AGREEMENT

This Share Purchase Agreement

(this “Agreement”), dated as of June 26, 2023, is entered into among GD Culture Group Limited, a Nevada corporation

(“Seller”) and Hao Li (“Buyer”). Capitalized terms used in this Agreement have the meanings given to

such terms herein.

RECITALS

WHEREAS, Seller owns

all of the issued and outstanding equity interest in TMSR Holdings Limited (“TMSR”), a company incorporated under

the laws of Hong Kong and an indirect subsidiary of Seller; and

WHEREAS, Seller wishes

to sell to Buyer, and Buyer wishes to purchase from Seller, all the issued and outstanding equity interest in TMSR, subject to the terms

and conditions set forth herein;

NOW, THEREFORE, in

consideration of the mutual covenants and agreements hereinafter set forth and for other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

Purchase and sale

Section

1.01 Purchase and Sale. Subject to the terms and conditions

set forth herein, at the Closing (as defined in Section 2.01), Seller shall sell to Buyer, and Buyer shall purchase from Seller, all

the issued and outstanding equity interest in TMSR, free and clear of any mortgage, pledge, lien, charge, security interest, claim, community

property interest, option, equitable interest, restriction of any kind (including any restriction on use, voting, transfer, receipt of

income, or exercise of any other ownership attribute), or other encumbrance

(each, an “Encumbrance”).

Section 1.02 Purchase

Price. The aggregate purchase price for the issued and outstanding equity interest in TMSR shall

be $100,000 (the “Purchase Price”), pursuant to the wire instruction provided by the Seller.

ARTICLE II

CLOSING

Section 2.01 Closing.

The closing of the transactions contemplated by this Agreement (the “Closing”)

shall take place on a date mutually agreed by the parties within ten (10) days after the date of this Agreement (the “Closing

Date”).

Section 2.02 Seller

Closing Deliverables. At the Closing, Seller shall deliver to Buyer

the following:

(a) Stock

certificates or equivalent evidencing the issued and outstanding equity interest in TMSR, free and clear of all Encumbrances, duly endorsed

in blank or accompanied by stock powers or other instruments of transfer duly executed in blank, with all required share transfer tax

stamps affixed thereto.

(b) Copies

of all resolutions of the board of directors and the shareholders of Seller authorizing the execution, delivery, and performance of this

Agreement, and the other agreements, instruments, and documents required to be delivered in connection with this Agreement or at the

Closing (collectively, the “Transaction Documents”) to which Seller is a party and the consummation of the transactions

contemplated hereby and thereby.

Section 2.03 Buyer

Closing Deliverables. At the Closing, Buyer shall deliver to Seller the Purchase Price.

ARTICLE III

Representations and warranties of seller

Seller represents and warrants

to Buyer that the statements contained in this Article III are true and correct as of the date hereof. For purposes of this Article III,

“Seller’s knowledge,” “knowledge of Seller,” and any similar phrases shall mean the actual or constructive knowledge

of any director or officer of Seller, after due inquiry.

Section

3.01 Organization and Authority of Seller. Seller is a corporation

duly organized, validly existing, and in good standing under the Laws (as defined in Section 3.05) of the state of Nevada. Seller has

full corporate power and authority to enter into this Agreement and the other Transaction Documents to which Seller is a party, to carry

out its obligations hereunder and thereunder, and to consummate the transactions contemplated hereby and thereby. The execution and delivery

by Seller of this Agreement and any other Transaction Document to which Seller is a party, the performance by Seller of its obligations

hereunder and thereunder, and the consummation by Seller of the transactions contemplated hereby and thereby have been duly authorized

by all requisite corporate action on the part of Seller. This Agreement and each Transaction Document to which Seller is a party constitute

legal, valid, and binding obligations of Seller enforceable against Seller in accordance with their respective terms.

Section

3.02 Organization, Authority, and Qualification of TMSR and its subsidiaries. TMSR

is a company duly organized, validly existing, and in good standing under the Laws of Hong Kong. It is a holding company that does not

have any assets, employees or operation. Makesi Iot Technology (Shanghai) Co., Ltd., a direct wholly-owned subsidiary of TMSR, is a company

duly organized, validly existing, and in good standing under the Laws of the PRC. It is a holding company that does not have any assets,

employees or operation. Shanghai Yuanma Food and Beverage Management Co., Ltd., an indirect wholly-owned subsidiary of TMSR, is a company

duly organized, validly existing, and in good standing under the Laws of the PRC. It does not have any assets, employees or operation.

Section

3.03 No Conflicts or Consents. The execution, delivery,

and performance by Seller of this Agreement and the other Transaction Documents to which it is a party, and the consummation of the transactions

contemplated hereby and thereby, do not and will not: (a) violate or conflict with any provision of the certificate of incorporation,

by-laws, or other governing documents of Seller or TMSR or its subsidiaries; (b) violate or conflict with any provision of any statute,

law, ordinance, regulation, rule, code, treaty, or other requirement of any Governmental Authority (collectively, “Law”)

or any order, writ, judgment, injunction, decree, determination, penalty, or award entered by or with any Governmental Authority (“Governmental

Order”) applicable to Seller or TMSR or its subsidiaries; (c) require the consent, notice, or filing with or other action by

any Person or require any Permit, license, or Governmental Order; (d) violate or conflict with, result in the acceleration of, or create

in any party the right to accelerate, terminate, or modify any contract, lease, deed, mortgage, license, instrument, note, indenture,

joint venture, or any other agreement, commitment, or legally binding arrangement, whether written or oral (collectively, “Contracts”),

to which Seller or TMSR or its subsidiaries is a party or by which Seller or TMSR or its subsidiaries is bound or to which any of their

respective properties and assets are subject; or (e) result in the creation or imposition of any Encumbrance on any properties or assets

of TMSR or its subsidiaries.

ARTICLE IV

Representations and warranties of buyer

Buyer represents and warrants

to Seller that the statements contained in this Article IV are true and correct as of the date hereof. For purposes of this Article IV,

“Buyer’s knowledge,” “knowledge of Buyer,” and any similar phrases shall mean the actual or constructive knowledge

of any director or officer of Buyer, after due inquiry.

Section 4.01 No

Conflicts; Consents. The

execution, delivery, and performance by Buyer of this Agreement and the other Transaction Documents to which it is a party,

and the consummation of the transactions contemplated hereby and thereby, do not and will not: (a) violate or conflict with any provision

of any Law or Governmental Order applicable to Buyer; or (b) require the consent, notice, declaration, or filing with or other action

by any Person or require any Permit, license, or Governmental Order.

ARTICLE V

Miscellaneous

Section

5.01 Interpretation; Headings. This Agreement shall be construed

without regard to any presumption or rule requiring construction or interpretation against the party drafting an instrument or causing

any instrument to be drafted. The headings in this Agreement are for reference only and shall not affect the interpretation of this Agreement.

Section

5.02 Severability. If any term or provision of this Agreement

is invalid, illegal, or unenforceable in any jurisdiction, such invalidity, illegality, or unenforceability shall not affect any other

term or provision of this Agreement.

Section

5.03 Entire Agreement. This Agreement and the other Transaction

Documents constitute the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein

and therein, and supersede all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject

matter. In the event of any inconsistency between the statements in the body of this Agreement and those in the other Transaction Documents,

any exhibits, the statements in the body of this Agreement will control.

Section

5.04 Successors and Assigns. This Agreement shall be binding

upon and shall inure to the benefit of the parties hereto and their respective successors and permitted assigns. Neither party may assign

its rights or obligations hereunder without the prior written consent of the other party, which consent shall not be unreasonably withheld

or delayed. No assignment shall relieve the assigning party of any of its obligations hereunder.

Section 5.05 Amendment

and Modification; Waiver. This Agreement may only be amended,

modified, or supplemented by an agreement in writing signed by each party hereto. No waiver by any party of any of the provisions

hereof shall be effective unless explicitly set forth in writing and signed by the party so waiving. No failure to exercise, or delay

in exercising, any right or remedy arising from this Agreement shall operate or be construed as a waiver thereof. No single or partial

exercise of any right or remedy hereunder shall preclude any other or further exercise thereof or the exercise of any other right or

remedy.

Section

5.06 Governing Law; Submission to Jurisdiction. This Agreement

shall be governed by and construed in accordance with the internal laws of the State of New York, without giving effect to any choice

or conflict of law provision or rule (whether of the State of New York or any other jurisdiction). Any legal suit, action, proceeding,

or dispute arising out of or related to this Agreement, the other Transaction Documents, or the transactions contemplated hereby or thereby

may be instituted in the federal courts of the United States of America or the courts of the State of New York in each case located in

the city of New York and county of New York, and each party irrevocably submits to the exclusive jurisdiction of such courts in any such

suit, action, proceeding, or dispute.

Section

5.07 Counterparts. This Agreement may be executed in counterparts,

each of which shall be deemed an original, but all of which together shall be deemed to be one and the same agreement. A signed copy

of this Agreement delivered by email or other means of electronic transmission shall be deemed to have the same legal effect as delivery

of an original signed copy of this Agreement.

[signature

page follows]

IN WITNESS WHEREOF,

the parties hereto have caused this Agreement to be executed as of the date first written above by their respective officers thereunto

duly authorized.

| |

SELLER |

| |

|

| |

GD Culture Group Limited |

| |

|

| |

By |

/s/ Xiao Jian Wang |

| |

Name: |

Xiao Jian Wang |

| |

Title: |

Chief Executive Officer and

Chairman of the Board |

| |

|

|

| |

BUYER |

| |

|

|

| |

Hao Li |

| |

|

|

| |

/s/ Hao Li |

4

v3.23.2

Cover

|

Jun. 26, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 26, 2023

|

| Entity File Number |

001-37513

|

| Entity Registrant Name |

GD Culture Group Limited

|

| Entity Central Index Key |

0001641398

|

| Entity Tax Identification Number |

47-3709051

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

c/o GD Culture Group Limited

|

| Entity Address, Address Line Two |

Flat 1512, 15F, Lucky Centre,

|

| Entity Address, Address Line Three |

No.165-171 Wan Chai Road

|

| Entity Address, City or Town |

Wan Chai

|

| Entity Address, Country |

HK

|

| Entity Address, Postal Zip Code |

00000

|

| City Area Code |

+852

|

| Local Phone Number |

95791074

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001

|

| Trading Symbol |

GDC

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 3 such as an Office Park

| Name: |

dei_EntityAddressAddressLine3 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Grafico Azioni GD Culture (NASDAQ:GDC)

Storico

Da Mag 2024 a Giu 2024

Grafico Azioni GD Culture (NASDAQ:GDC)

Storico

Da Giu 2023 a Giu 2024