LAKEWOOD, Colo., Aug. 28, 2018 /PRNewswire/ -- Pershing Gold

Corporation (NASDAQ:PGLC) (TSX: PGLC) (FWB:7PG1) ("Pershing Gold"

or the "Company"), an emerging Nevada gold producer advancing the Relief

Canyon Mine, announced today that it has completed the exercise of

a right of first offer to acquire all of the Newmont USA Limited ("Newmont") royalty and other

rights on specified lands around the Relief Canyon

project.

This transaction is another significant step in securing

Pershing Gold's land package around Relief Canyon. Pershing Gold

secured the lands in the immediate vicinity of Relief Canyon

through the transaction announced in January of 2015. This purchase

provides the Company with enhanced access to expansion

opportunities through its holdings near Relief Canyon.

"This transaction gives Pershing Gold secure tenure throughout

our 45 square mile land position and relieves the Company's work

commitments to Newmont on this highly prospective ground,"

commented Alfers, Pershing Gold's Chairman and CEO. "It unlocks the

value of the land through the elimination of impediments to

exploration and development, and it increases the potential

profitability from production on these areas through the

extinguishing of royalties, clawbacks and other burdens," explained

Alfers. "This ground contains known targets we have developed in

the last two years. The transaction allows the Company to advance

known targets, increasing the potential for discovery of satellite

deposits that could be brought into a near-term production profile

at Relief Canyon upon commencement of operations," stated

Alfers.

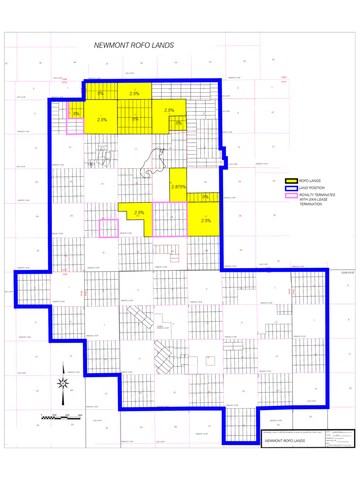

The transaction announced today includes the acquisition of

Newmont mining leases and claims lands located in the vicinity of

Pershing Gold's Relief Canyon Mine and covers 4,235 acres of fee

mineral rights and mining claims in Pershing County, Nevada. The area affected by

the transaction is shown on Figure 1. In addition, Pershing extinguishes corresponding Newmont

royalties on these lands, which range from 2.5-5%, as a result of

this transaction. Finally, the transaction terminates the 51%

clawback option that Newmont formerly held on a total of 5,635

acres. See Figure 1. Pershing Gold paid $US1.1 million to complete this transaction.

About Pershing Gold Corporation

Pershing Gold is an emerging gold producer whose primary asset is

the Relief Canyon open-pit gold mine in Pershing County, Nevada. Under the Feasibility

Study released in May 2018, Relief

Canyon is expected to have an average life-of-mine gold production

of 91,000 ounces per year with cash costs of US$769 per ounce and AISC of $802 per ounce. Upon successful project

financing, Relief Canyon is expected to have a short six-to-nine

month construction period before commencing production.

Pershing Gold's landholdings cover over 29,000 acres that

include Relief Canyon Mine and surrounding lands in all directions.

This provides Pershing Gold with the opportunity to expand the

Relief Canyon Mine deposit and to explore and make new discoveries

nearby. Pershing Gold is currently permitted to resume mining at

Relief Canyon under the existing Plan of Operations.

Pershing Gold is listed on the NASDAQ Global Market and the

Toronto Stock Exchange under the symbol "PGLC" and on the Frankfurt

Stock Exchange under the symbol "7PG1".

Legal Notice and Safe Harbor Statement

This press release contains "forward-looking statements" within the

meaning of the safe harbor provisions of the U.S. Private

Securities Litigation Reform Act of 1995 and applicable Canadian

securities laws. All statements, other than statements of

historical fact, are "forward-looking statements," including the

Company's plans for exploration around the Relief Canyon Mine; the

exploration, development prospects, and potential profitability in

those areas; estimates and forecasts about the Relief Canyon Mine

in the Feasibility Study; the availability of financing to advance

the mine to production and the presumed construction

timeline. Although the Company's management believes

that such forward-looking statements are reasonable, it cannot

guarantee that such expectations are, or will be, correct. These

forward-looking statements involve a number of risks and

uncertainties, which could cause the Company's future results to

differ materially from those anticipated. Potential risks and

uncertainties include, among others, interpretations or

reinterpretations of geologic information, unfavorable exploration

results, inability to obtain permits required for future

exploration, development or production, general economic conditions

and conditions affecting the industries in which the Company

operates; the uncertainty of regulatory requirements and approvals;

fluctuating mineral and commodity prices; final investment

approval; and the ability to obtain necessary financing on

acceptable terms or at all.. Additional information regarding the

factors that may cause actual results to differ materially from

these forward-looking statements is available in the Company's

filings with the Securities and Exchange Commission, including the

Annual Report on Form 10-K for the year ended December 31, 2017, and on SEDAR at www.sedar.com.

The Company assumes no obligation to update any of the information

contained or referenced in this press release.

View original content with

multimedia:http://www.prnewswire.com/news-releases/pershing-gold-announces-mineral-lands-acquisition-to-further-consolidate-relief-canyon-land-position-300703133.html

View original content with

multimedia:http://www.prnewswire.com/news-releases/pershing-gold-announces-mineral-lands-acquisition-to-further-consolidate-relief-canyon-land-position-300703133.html

SOURCE Pershing Gold Corporation