Abaxx Technologies Inc.

(

NEO:ABXX)(

OTCQX:ABXXF)

(“

Abaxx Tech” or the “Company”), a financial

software and market infrastructure company and majority shareholder

of Abaxx Singapore Pte. Ltd. (“

Abaxx Singapore”),

the owner of Abaxx Commodity Exchange and Clearinghouse

(individually, “

Abaxx Exchange” and “

Abaxx

Clearing”), and producer of the SmarterMarkets™ Podcast,

is pleased to announce that Abaxx Singapore has closed its best

efforts equity private placement as previously announced on January

3, 2024 (the “

Offering”) for gross proceeds of

US$27,323,013. The Offering consisted of the issuance of 953,787

preferred shares (the “

Preferred Shares”) to

strategic partners and 4,837,392 ordinary shares (the

“

Ordinary Shares”) and 3,730,362 Ordinary Share

purchase warrants (the “

Warrants”). The investors

for Preferred Shares are Abaxx’s first group of globally recognized

strategic participants in the market infrastructure and commodity

ecosystems (CBOE III LLC “

Cboe”, TLW Trading LLC

“

TLW”, Traxys Lithium Investments Limited

“

Traxys”), while Abaxx Tech (through an indirect

wholly-owned subsidiary) is the investor for the Ordinary Shares

and Warrants.

“We are proud to have Cboe, TLW, and Traxys join

us as strategic partners,” said Nancy Seah, CEO of Abaxx Exchange.

“We appreciate their confidence in us and their support, and we

look forward to working together to build smarter markets for

energy transition-related commodities in Singapore. This funding

supports the launch of our exchange and clearinghouse and its

growth and development.”

The Preferred Shares have been offered solely to

strategic partners at a price of US$4.718 per Preferred Share (the

“Purchase Price”). The Preferred Shares will be

convertible into Ordinary Shares of Abaxx Singapore at the holder’s

option or upon the occurrence of specific events, as well as a put

right that, upon the occurrence of certain events, will allow

purchasers of Preferred Shares the ability to sell their Preferred

Shares back to Abaxx Singapore at the Purchase Price. In addition,

strategic partners will be granted some limited pre-emptive rights

in connection with any future capital raising by Abaxx Singapore.

The holders of the Preferred Shares will also have, subject to

regulatory approval, the right to nominate one director to serve on

the Abaxx Singapore board of directors.

Abaxx Technologies Corp. (Barbados)

(“Abaxx Barbados”), an indirect wholly-owned

subsidiary of the Company, has subscribed for 3,730,362 units (the

“Units”) of Abaxx Singapore at the Purchase Price,

with each Unit consisting of one Ordinary Share and one Warrant

exercisable at a price of US$4.718 for a period of 12 months. Abaxx

Singapore has also issued 1,107,030 Ordinary Shares to Abaxx

Barbados for settlement of intercorporate debts at the deemed

Purchase Price, for an aggregate total of 4,837,392 Ordinary Shares

and 3,730,362 Warrants being issued to Abaxx Barbados in connection

with the Offering. The issuance of securities to Abaxx Barbados and

the Preferred Shares to strategic partners under the Offering will

result in Abaxx Barbados owning not less than 88.24% of the voting

shares in Abaxx Singapore, assuming all Preferred Shares are

converted into Ordinary Shares, and assuming the exercise of all of

the Warrants issued to Abaxx Barbados.

Net proceeds from the Offering will be used for

working capital and reserve capital purposes.

This announcement has been prepared for

publication in Canada and may not be released to U.S. wire services

or distributed in the United States. This announcement does not

constitute an offer to sell, or a solicitation of an offer to buy,

securities in the United States or any other jurisdiction. Any

securities described in this announcement have not been, and will

not be, registered under the US Securities Act of 1933, as amended

(the “US Securities Act”), or any state securities laws, and may

not be offered or sold in the United States except in transactions

exempt from, or not subject to, registration under the US

Securities Act and applicable US state securities laws.

About Abaxx TechnologiesAbaxx

is a development-stage financial software and market infrastructure

company creating proprietary technological infrastructure for both

global commodity exchanges and digital marketplaces. The Company’s

formative technology increases transaction velocity, data security,

and facilitates improved risk management through its indirect

majority-owned subsidiaries Abaxx Exchange and Abaxx Clearing

which, respectively, operate a commodity futures exchange and

clearinghouse that have recently obtained final regulatory

approvals to operate as a Recognized Market Operator (“RMO”) and an

Approved Clearing House (“ACH”) with the Monetary Authority of

Singapore (“MAS”).

Abaxx is a founding shareholder in Base Carbon

Inc. and the creator and producer of the SmarterMarkets™

podcast.

For more information, please visit abaxx.tech,

abaxx.exchange and smartermarkets.media.

For more information about this press

release, please contact:Steve Fray, CFOTel:

416-786-4381

Media and investor

inquiries:Abaxx Technologies Inc.Investor Relations

TeamTel: +1 246 271 0082E-mail: ir@abaxx.tech

Forward-Looking StatementsThis

News Release includes certain "forward-looking information"

(sometimes also referred to as “forward-looking statements”) which

does not consist of historical facts. Forward-looking information

includes estimates and statements that describe Abaxx or the

Company’s future plans, objectives, or goals, including words to

the effect that Abaxx expects a stated condition or result to

occur. Forward-looking information may be identified by such terms

as “seeking”, “believes”, “anticipates”, “expects”, “estimates”,

“may”, “could”, “would”, “will”, or “plan”. Since forward-looking

information is based on assumptions and addresses future events and

conditions, by their very nature they involve inherent risks and

uncertainties.

Although forward-looking information is based on

information currently available to Abaxx, Abaxx does not provide

any assurance that actual results will meet management’s

expectations. Risks, uncertainties, and other factors involved with

forward-looking information could cause actual events, results,

performance, prospects, and opportunities to differ materially from

those expressed or implied by such forward-looking information.

Forward-looking information in this news release includes but is

not limited to, Abaxx and Abaxx Singapore’s objectives, goals or

future plans, statements regarding the use of proceeds from the

Offering, receipt and timing of regulatory approvals, the Company’s

anticipated future holdings of Abaxx Singapore, timing of the

commencement of operations and financial predictions and estimates

of market conditions. Such factors include, among others: risks

relating to the global economic climate; dilution; the Company’s

limited operating history; future capital needs and uncertainty of

additional financing, as well as capital market conditions in

general; the competitive nature of the industry; currency exchange

risks; the need for Abaxx to manage its planned growth and

expansion; the effects of product development and need for

continued technology change; protection of proprietary rights; the

effect of government regulation and compliance on Abaxx and the

industry; failure to obtain requisite approvals from regulatory

authorities in a timely fashion or at all; the ability to list the

Company’s securities on stock exchanges in a timely fashion or at

all; network security risks; the ability of Abaxx to maintain

properly working systems; reliance on key personnel; global

economic and financial market deterioration impeding access to

capital or increasing the cost of capital; and volatile securities

markets impacting security pricing unrelated to operating

performance. In addition, particular factors which could impact

future results of the business of Abaxx include but are not limited

to: operations in foreign jurisdictions; protection of intellectual

property rights; contractual risk and third-party risk;

clearinghouse risk, malicious actor risks, third-party software

license risk, system failure risk, risk of technological change and

dependence of technical infrastructure; capital market conditions

and share dilution resulting from equity issuances; an inability of

Abaxx Singapore to raise sufficient funds; and restrictions on

labor and international travel and supply chains. Abaxx has also

assumed that no significant events occur outside of Abaxx’s normal

course of business.

Abaxx cautions that the foregoing list of

material factors is not exhaustive. In addition, although Abaxx has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated, or intended. When

relying on Abaxx's forward-looking information to make decisions,

investors and others should carefully consider the foregoing

factors and other uncertainties and potential events. Abaxx has

assumed that the material factors referred to in the previous

paragraph will not cause such forward-looking information to differ

materially from actual results or events. However, the list of

these factors is not exhaustive and is subject to change and there

can be no assurance that such assumptions will reflect the actual

outcome of such items or factors.

The forward-looking information contained in

this press release represents the expectations of Abaxx as of the

date of this press release and, accordingly, is subject to change

after such date. Readers should not place undue importance on

forward-looking information and should not rely upon this

information as of any other date. Abaxx does not undertake to

update this information at any particular time except as required

in accordance with applicable laws. CBOE Canada does not accept

responsibility for the adequacy or accuracy of this press

release.

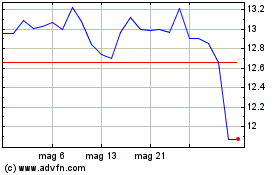

Grafico Azioni Abaxx Technologies (NEO:ABXX)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Abaxx Technologies (NEO:ABXX)

Storico

Da Gen 2024 a Gen 2025