Abaxx Technologies Inc. (NEO:ABXX)(OTCQX:ABXXF)

(“Abaxx” or the “Company”), a financial software and market

infrastructure company, majority shareholder of

Abaxx

Singapore Pte Ltd. (“Abaxx Singapore”), the owner of

Abaxx Commodity Exchange and Clearinghouse

(individually, “Abaxx Exchange” and “Abaxx Clearing”), and producer

of the

SmarterMarkets™ Podcast, summarizes

development activities over the past quarter and the general

progress of the Company’s business plans.

The Company plans to host an investor call and

presentation on Tuesday, February 6th, with details outlined in

this release.

Abaxx Corporate Milestone Highlights

- Risk and Regulatory: Received three

regulatory licenses from the Monetary Authority of Singapore

(“MAS”) in December 2023 to operate a recognised market operator,

an approved clearing house and an approved holding company. Engaged

with prospective members on onboarding processes and sharing of

risk frameworks.

- Commercial: Approved applications

for two initial clearing members and announced Abaxx Singapore’s

membership approval into the Futures Industry Association (FIA).

Began onboarding global inter-dealer broker networks — key in

building market liquidity for the debut of Abaxx product verticals.

Conducted extensive series of demos intended to familiarize brokers

with the Abaxx Trade Registration Platform for block trade entry.

Finalizing additional membership approvals to build a key group of

clearing members at launch.

- Exchange Product Development:

Continued to enhance readiness of trading participants by ensuring

adequacy of product knowledge of our launch suite of LNG, Carbon

and Nickel Sulphate futures contracts. Lithium futures progressed

to Stage 2 (Scoping/Design/Drafting). Precious Metals solutions in

Stage 3 (Industry Review/Risk/Regulatory).

- Systems and Operations: Completed

Abaxx Exchange and Abaxx Clearing ISV certification process.

Integration, training and onboarding of all user classes (trading

firm, broker firm and clearing firm) into production and payment

network underway and on time for targeted 1Q -2024 launch. Abaxx

Singapore completed the onboarding of a multinational bank as Abaxx

Clearing’s second settlement bank and Abaxx Clearing is now active

on the Swift network.

- Strategic Financing: Closed equity

private placement as previously announced on January 10, 2024 with

Abaxx’s first group of strategic investors including Cboe, TLW, and

Traxys.

- Abaxx Console Apps and ID++

Protocol: Continued to advance design and development work on

prototypes and advanced foundational productization. Held our first

private demo day, reviewing our full slate of product applications

and prototypes. Advanced work on prototyping processes and tooling

for a novel, privacy-preserving deployment of Large Language Model

(LLMs) applications within the Abaxx Console Suite using ID++.

Last quarter included the completion of multiple

critical milestones toward the launch of Abaxx Exchange and

Clearinghouse, including the grant of an Approved Clearinghouse

(“ACH”) license and Recognised Market Operator (“RMO”) license to

Abaxx Singapore’s fully owned subsidiaries, Abaxx Clearing and

Abaxx Exchange, respectively, as announced on December 7th, 2023.

The Company’s ongoing efforts continue around technological

advancements, regulatory engagements and expanding Abaxx’s market

presence to offer smarter markets for transition-related

commodities with better tools to manage risk.

The following provides a detailed update on these

developments.

Abaxx Exchange and Abaxx Clearing

Developments

Risk and

Regulatory: The remaining regulatory

licensing processes were successfully completed in Q4, leading to

the grant of MAS licenses in early December 2023. Teams completed

internal default management drill; margins and guaranty fund

frameworks shared with clearing members.

Commercial: Last quarter,

commercial activities remained active across Clearing Members,

Trading Firms and Brokers for all three product asset classes.

Clearing firms are now in User Testing across our Abaxx Exchange

systems and have completed Abaxx-provided product knowledge

workshops with special attention paid to the physical settlement

attribute of Abaxx Exchange futures. Trading firms are working with

their Clearing firms to ensure connectivity for Day 1 trading.

Commercial teams are working to onboard global inter-dealer brokers

and conducted numerous demo sessions of the Abaxx “Block Trade

Registration Platform” for brokers in Houston, London, New York and

Singapore. The Abaxx commercial team has also increased the

frequency of market workshops leading up to launch, with the intent

of growing the understanding of our innovative markets. Their

upcoming “roadshow”' will include co- sponsored events with leading

market Clearing firms, Brokers and Price reporting agencies. It

will include a mix of in person and online sessions.

Systems and Operations:

Integration, training and onboarding of all user classes (trading

firms, broker firms and clearing firms) into Abaxx production

systems and payment network is well underway and on time for

targeted launch in Q1 of 2024. Abaxx staff is heavily engaged with

a focus on training clearing and broker firms in administration and

use of systems that support order routing, trade entry and post

trade activities. Industry-leading Exchange and Clearing ISVs have

deployed their software packages for authorized use by the Abaxx

community. Abaxx Clearing is now active on the Swift network and is

in process of activating accounts for its Clearing Members at

settlement banks through which margin deposits and payments will be

managed. Final live production system end-to-end checks have been

scheduled to accommodate a Q1 launch.

Exchange Product Development:

LNG, Carbon and Nickel Sulphate futures contracts are prepped for

launch. Further development work continues on a number of fronts as

momentum grows and we transition to production and scaling our

enterprise. Development work on additional battery and initial

precious metals products is a priority. We are encouraged by the

enthusiasm and demand for these product futures to extend the

battery metals category and we have progressed to Stage 2

(Scoping/Design/Drafting). Precious Metals solutions are in Stage 3

(Industry Review/Risk/Regulatory).

Additional Corporate

Updates

Abaxx Console Apps: In Q4 2023, our Digital

Product and Engineering Teams marked the completion of the “Project

Venice'' pilot with an internal demo day that highlighted the

capabilities of pairing Abaxx’s console apps with newly developed

tools to connect qualified participants looking to transact in

global carbon markets. The teams deployed release updates to

Verifier and foundational infrastructure to support

interoperability and security. In addition, the team advanced work

on prototyping privacy-preserving processes and tooling for AI and

large language models.

Q1 2024 Business Update Investor

Call

The Company plans to host a quarterly business

update investor presentation, to provide a business update and

respond to investor questions.

The Company will hold the investor presentation

via Zoom Meetings on Tuesday, February 6th at 10:00 a.m. Eastern

Standard Time Zone (EST). The Company invites current and

prospective shareholders to attend this quarterly business update

and Q&A session with the Abaxx executive team. Attendees may

email their questions in advance to ir@abaxx.tech.

Registration will be required to access the

meeting. Following the presentation, a recording of the session

will be made available on the Abaxx Investor Relations website at

investors.abaxx.tech.

PRESENTATION DETAILSDATE:

Tuesday, February 6th, 2024TIME: 11:00 AM Eastern Standard Time

(EST)LOCATION: Zoom MeetingTo receive the meeting link and

passcode, please register here.QUESTIONS: Please submit questions

ahead of the presentation to: ir@abaxx.tech

About Abaxx Technologies

Abaxx is building Smarter Markets — markets

empowered by better financial technology and market infrastructure

to address our biggest challenges, including the energy transition.

In addition to developing and deploying financial technologies that

make communication, trade, and transactions easier and more secure,

Abaxx is a majority-owner of Abaxx Exchange and Abaxx Clearing,

subsidiaries recognized by MAS as an RMO and ACH, respectively.

Abaxx Exchange and Abaxx Clearing are a

Singapore-based commodity futures exchange and clearinghouse,

introducing centrally cleared, physically deliverable commodities

futures and derivatives to provide better price discovery and risk

management tools for the commodities critical to our transition to

a lower-carbon economy.

For more information please visit abaxx.tech,

abaxx.exchange and smartermarkets.media.

For more information about this press release, please

contact:Steve Fray, CFOTel: 416-786-4381

Media and investor inquiries:

Abaxx Technologies Inc.Investor Relations TeamTel: +1 246 271

0082E-mail: ir@abaxx.tech

Forward-Looking Statements

This News Release includes certain

“forward-looking statements” which do not consist of historical

facts. Forward-looking statements include estimates and statements

that describe Abaxx or the Company’s future plans, objectives,

or goals, including words to the effect that Abaxx expects a stated

condition or result to occur. Forward-looking statements may

be identified by such terms as “seeking”,

“believes”, “anticipates”, “expects”, “estimates”, “may”,

“could”, “would”, “will”, or “plan”. Since

forward-looking statements are based on assumptions and

address future events and conditions, by their very nature

they involve inherent risks and uncertainties. Although these

statements are based on information currently available to

Abaxx, Abaxx does not provide any assurance that actual results

will meet management’s expectations. Risks, uncertainties, and

other factors involved with forward-looking information could

cause actual events, results, performance, prospects, and

opportunities to differ materially from those expressed or

implied by such forward-looking information. Forward-looking

information in this news release includes but is not limited to,

Abaxx’s objectives, goals or future plans, statements about

anticipated membership approvals and timing of the Abaxx

Exchange launch, statements about anticipated network launch

dates and the timing of network launch, statements about

Abaxx’s product development and anticipated timing for product

deployment, statements regarding anticipated exchange listings,

receipt and timing of regulatory approvals, timing of the

commencement of operations, financial predictions, intended use

of proceeds from previous financings, and estimates of market

conditions. Such factors include, among others: risks relating

to the global economic climate; dilution; the Company’s limited

operating history; future capital needs and uncertainty of

additional financing; the competitive nature of the

industry; currency exchange risks; regulatory risks; the need

for Abaxx to manage its planned growth and expansion; the

effects of product development and need for continued technology

change; protection of proprietary rights; the effect of

government regulation and compliance on Abaxx and the industry; the

ability to list the Company’s securities on stock exchanges in

a timely fashion or at all; network security risks; the ability

of Abaxx to maintain properly working systems; reliance on key

personnel; global economic and financial market deterioration

impeding access to capital or increasing the cost of capital; and

volatile securities markets impacting security pricing

unrelated to operating performance. In addition, particular

factors which could impact future results of the business of

Abaxx include but are not limited to: operations in foreign

jurisdictions, protection of intellectual property rights,

contractual risk, third-party risk; clearinghouse risk,

malicious actor risks, third-party software license risk, system

failure risk, risk of technological change; dependence of

technical infrastructure; and changes in the price of

commodities, capital market conditions, restriction on labor

and international travel and supply chains. Abaxx has

also assumed that no significant events occur outside of

Abaxx’s normal course of business.

Abaxx cautions that the foregoing list of

material factors is not exhaustive. In addition, although Abaxx

has attempted to identify important factors that could cause

actual results to differ materially, there may be other

factors that cause results not to be as anticipated, estimated, or

intended. When relying on Abaxx’s forward-looking statements

and information to make decisions, investors and others should

carefully consider the foregoing factors and other

uncertainties and potential events. Abaxx has assumed that

the material factors referred to in the previous paragraph

will not cause such forward-looking statements and information

to differ materially from actual results or events. However, the

list of these factors is not exhaustive and is subject to

change and there can be no assurance that such assumptions will

reflect the actual outcome of such items or factors. The

forward-looking information contained in this press

release represents the expectations of Abaxx as of the date of

this press release and, accordingly, is subject to change

after such date. Readers should not place undue importance on

forward-looking information and should not rely upon this

information as of any other date. Abaxx does not undertake to

update this information at any particular time except as

required in accordance with applicable laws. Cboe

Canada Exchange does not accept responsibility for the

adequacy or accuracy of this press release.

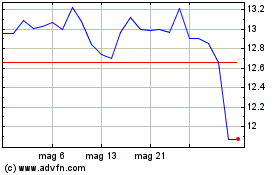

Grafico Azioni Abaxx Technologies (NEO:ABXX)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Abaxx Technologies (NEO:ABXX)

Storico

Da Gen 2024 a Gen 2025