Abaxx Technologies Inc. (NEO:ABXX)(OTCQX:ABXXF) (“Abaxx” or the

“Company”), a financial software and market infrastructure company,

majority shareholder of Abaxx Singapore Pte Ltd. (“Abaxx

Singapore”), the owner of Abaxx Commodity Exchange and

Clearinghouse (individually, “Abaxx Exchange” and “Abaxx

Clearing”), and producer of the SmarterMarkets™ Podcast, announces

the initiation of the final exchange trading launch sequence for

Abaxx Exchange and Clearinghouse to open the market in each of its

commodity futures contracts.

Highlights

- Abaxx Exchange and Abaxx Clearing

will request approval from their respective Boards of Directors to

provide final notices to open Abaxx markets pending the near-term

finalization of a third clearing member application approval.

- With Abaxx Exchange and Clearing

operational and markets open, the arrangement of first block trades

in each market will be finalized and announced.

- Pending final notices, Abaxx

Exchange and Abaxx Clearing will open with three approved clearing

members, while additional clearing firms onboard through these

clearing members or via applications as direct members of Abaxx

Clearing.

- Abaxx has worked closely with

market participants in three launch product verticals - LNG, Carbon

and Nickel Sulphate to initiate trading.

Abaxx Commodity Futures Exchange and

Clearinghouse Initiating Final Launch Sequence

The management and directors of Abaxx Exchange

and Clearing have prepared resources, policies, procedures and

systems of the exchange and clearinghouse and will attest to launch

readiness pending final clearing member readiness requirements.

Abaxx Clearing is in final review of an application from its third

clearing member, following the approval of StoneX Financial Pte.

Ltd. and KGI Securities (Singapore) Pte. Ltd.

Upon approval of this third clearing member

application, Abaxx Clearing Singapore Pte. Ltd will request

approval from its Board of Directors to provide final readiness

attestations. We anticipate that this final Board review process,

approval for launch, and submission of required notice will require

approximately two weeks. Barring any unanticipated regulatory

concerns in the final notice period, Abaxx Exchange and Abaxx

Clearing will be operational and markets open.

Abaxx Exchange & Clearinghouse will commence

with LNG, Carbon, and Nickel Sulphate futures contracts. We

anticipate that first trades of these products will be block

trades, and that trading activity will ramp up over a number of

quarters as open interest and liquidity builds in these new futures

contracts. We will update following the successful launch of

trading in these individual future contracts as open interest

develops in each market.

First Trades on Abaxx

Exchange

The ‘go live’ phase of futures block trades has

been facilitated by our global broker partners. Broker firms have

been engaged with trading firms across the three initial product

verticals to enlist their interest in ‘first trades’. It is general

practice with new market launches that trading and clearing firms

confirm all trade information and data has been correctly routed to

the proper clearing entities before continuing to trade.

At launch, market participants that have

completed onboarding will be able to engage the Abaxx Exchange

central limit order book or report Block and Exchange of Futures

for Related Product (“EFRP”) trades through the Abaxx trade

reporting system. Market data including trade volume and open

interest will be available at www.abaxx.exchange and through market

data channels provided by approved Independent Software Vendors

(“ISVs”) and data vendors.

Connecting to Abaxx

Exchange

In addition to the current clearing members,

customers of Marex and an Asian financial institution are expected

to be able to access the Abaxx suite of physically-deliverable

futures contracts via an arrangement with carry brokers in

Singapore.

We are continuing to assist global clearing

firms gain access to our markets via their trading customers.

Additionally, we are continuing to address pent up demand by

onboarding relevant execution brokers to facilitate and submit

block trades into Abaxx’s Clearinghouse. Contact information for

our Clearing and Execution broker partners will be listed on our

website shortly.

Abaxx requests market trading participants

contact their clearing service provider to inform them of their

interest to trade Abaxx Futures contracts. To reach our commercial

team about connecting to Abaxx Exchange, please contact

onboarding@abaxx.exchange.

Abaxx’s Suite of First-of-Their-Kind

Physically Settled Futures Contracts

LNG Futures

Abaxx’s initial suite of first-of-their-kind LNG

futures products are uniquely designed to empower participants in

the global LNG markets with a benchmark that will be physically

deliverable, contain all the protections of regulated futures

markets, and offer daily and final settlements against actual

transactions on a regulated market versus index settled products

that have been the only solution offered to the market to date.

North Pacific Asia LNG: This

contract will cover deliveries across the Asian region including

Japan, China and South Korea.

North West Europe LNG: This

contract will cover deliveries in the ARA range down to the

Mediterranean.

USG: This contract will cover deliveries to the

U.S. Gulf of Mexico region.

Nickel Sulphate Futures

To date, the supply chain transformation has

created a growing disconnect between the forms of nickel being

produced and traded in the physical market, and the form being

traded in legacy contracts. Abaxx intends to resolve this

dislocation with its industry-first, physically-deliverable nickel

sulphate contract.

This innovative, new regulated futures contract

was designed in collaboration with a broad range of participants

and will offer the ability to directly hedge against both price and

delivery exposure via a direct delivery structure versus any

warehouse delivery system. There will be three distinct delivery

contracts, covering markets in Asia, Europe and the Americas.

Environmental Futures

As the Voluntary Carbon Markets continue to

evolve, the demand for more oversight and verification of quality

offsets continues to grow. The Abaxx approach, consistent with all

of our futures contract development, involves collaboration with

market stakeholders and participants in the pursuit of Smarter

Markets. We intend to introduce two futures contracts designed to

recognize improving standards of quality in the voluntary carbon

market and the advancing stages of Paris Agreement’s Article 6

market development. The need for better price discovery in the

markets we are aligned with is imperative for those seeking to

demonstrate compliance with their corporate and sovereign climate

commitments.

JREDD Futures: Abaxx

Jurisdictional Baseline-Related REDD+ 21-25 Carbon Mitigation

Outcome Unit Futures Contract improves the market’s standards of

quality and price transparency of nature-based avoidance credits.

Building on the inherent strengths of jurisdictional projects,

while at the same time providing clear linkages to Paris aligned

markets, countries have the ability to monetize their nature based

carbon assets.

CORSIA Phase One Carbon

Futures: This contract is designed to address some of the

challenges airlines face in meeting their offsetting obligations

under the Carbon Offsetting and Reduction Scheme for International

Aviation (“CORSIA”) in addition to serving the needs of non-airline

market actors who value CORSIA-eligible credits as a benchmark of

quality to meet their voluntary offsetting goals.

Product Pipeline: In addition

to the multiple first-to-market futures contracts included in our

launch product suite, the Abaxx product development team, in close

collaboration with global market participants, are actively

developing innovative new products in new energy markets,

additional environmental markets and precious and battery

metals.

About Abaxx TechnologiesAbaxx

is building Smarter Markets — markets empowered by better financial

technology and market infrastructure to address our biggest

challenges, including the energy transition. In addition to

developing and deploying financial technologies that make

communication, trade, and transactions easier and more secure,

Abaxx is a majority-owner of Abaxx Exchange and Abaxx Clearing,

subsidiaries recognized by MAS as an RMO and ACH, respectively.

Abaxx Exchange and Abaxx Clearing are a

Singapore-based commodity futures exchange and clearinghouse,

introducing centrally cleared, physically deliverable commodities

futures and derivatives to provide better price discovery and risk

management tools for the commodities critical to our transition to

a lower-carbon economy.

For more information please

visit abaxx.tech, abaxx.exchange

and smartermarkets.media.

For more information about this press

release, please contact:

Steve Fray, CFO Tel: 416-786-4381

Media and investor

inquiries:

Abaxx Technologies Inc. Investor Relations Team

Tel: +1 246 271 0082E-mail: ir@abaxx.tech

Cautionary Statement Regarding

Forward-Looking Information

This press release includes certain

“forward-looking statements” which do not consist of historical

facts. Forward-looking statements include estimates and statements

that describe Abaxx’s future plans, objectives, or goals, including

words to the effect that Abaxx expects a stated condition or result

to occur. Forward-looking statements may be identified by such

terms as “seeking”, “should”, “intend”, “predict”, “potential”,

“believes”, “anticipates”, “expects”, “estimates”, “may”, “could”,

“would”, “will”, “continue”, “plan” or the negative of these terms

and similar expressions. Since forward-looking statements are based

on current expectations and assumptions and address future events

and conditions, by their very nature they involve inherent risks

and uncertainties. Although these statements are based on

information currently available to Abaxx, Abaxx does not provide

any assurance that actual results will meet respective management

expectations. Risks, uncertainties, assumptions, and other factors

involved with forward-looking information could cause actual

events, results, performance, prospects, and opportunities to

differ materially from those expressed or implied by such

forward-looking information.

Forward-looking information related to Abaxx in

this press release includes but is not limited to, Abaxx’s

objectives, goals or future plans, timing and sequencing of the

launch of the exchange and clearinghouse business, timing and

completion of new commodity contracts, expectations related to the

onboarding of new clearing members, the ability to utilize the ACH

and RMO licenses to launch a regulated trading marketplace on an

economic basis, in a timely fashion, or at all, maintenance of

regulatory approvals including the ACH and RMO licenses,

expectations related to the receipt of new regulatory approvals,

financial predictions, estimates of market conditions, including

market conditions for energy transition commodities, benefits of

collaborations with other firms and members and future product

offerings. Such factors include, among others: risks relating to

the global economic climate; dilution; Abaxx’s limited operating

history; future capital needs and uncertainty of additional

financing; the competitive nature of the industry; currency

exchange risks; the need for Abaxx to manage its planned growth and

expansion; the effects of product development and need for

continued technology change; protection of proprietary rights; the

effect of government regulation and compliance on Abaxx and the

industry; the ability to list Abaxx’s securities on stock exchanges

in a timely fashion or at all; network security risks; the ability

of Abaxx to maintain properly working systems; reliance on key

personnel; global economic and financial market deterioration

impeding access to capital or increasing the cost of capital; and

volatile securities markets impacting security pricing unrelated to

operating performance. In addition, particular factors which could

impact future results of the business of Abaxx include but are not

limited to: operations in foreign jurisdictions, protection of

intellectual property rights, contractual risk, third-party risk;

clearinghouse risk, malicious actor risks, third-party software

license risk, system failure risk, risk of technological change;

dependence of technical infrastructure; and changes in the price of

commodities, capital market conditions, restriction on labor and

international travel and supply chains. Abaxx has also assumed that

no significant events occur outside of Abaxx’s normal course of

business.

Abaxx cautions that the foregoing list of

material factors is not exhaustive. In addition, although Abaxx has

attempted to identify important factors that could cause actual

results to differ materially, there may be other factors that cause

results not to be as anticipated, estimated, or intended. When

relying on forward-looking statements and information to make

decisions, investors and others should carefully consider the

foregoing factors and other uncertainties and potential events.

Abaxx has assumed that the material factors referred to in the

previous paragraphs will not cause such forward-looking statements

and information to differ materially from actual results or events.

However, the list of these factors is not exhaustive and is subject

to change and there can be no assurance that such assumptions will

reflect the actual outcome of such items or factors. The

forward-looking statements and information contained in this press

release represents the expectations of Abaxx as of the date of this

press release and, accordingly, is subject to change after such

date. Abaxx undertakes no obligation to update or revise any

forward-looking statements and information, whether as a result of

new information, future events or otherwise, except as required by

law. Accordingly, readers are cautioned not to place undue reliance

on these forward-looking statements and information. CBOE Canada

does not accept responsibility for the adequacy or accuracy of this

press release.

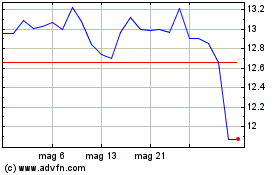

Grafico Azioni Abaxx Technologies (NEO:ABXX)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Abaxx Technologies (NEO:ABXX)

Storico

Da Mar 2024 a Mar 2025