Martin Marietta Announces Pricing Terms of Debt Offering

31 Ottobre 2024 - 10:42PM

Martin Marietta Materials, Inc. (NYSE:MLM) (“Martin Marietta” or

the “Company”) announced today the pricing of its offering of $750

million aggregate principal amount of 5.150% Senior Notes due 2034

(the “2034 Notes”) and $750 million aggregate principal amount of

5.500% Senior Notes due 2054 (the “2054 Notes” and, together with

the 2034 Notes, the “Notes”). The 2034 Notes will mature on

December 1, 2034, will have an interest rate of 5.150% per annum

and will be issued at 99.266% of par value. The 2054 Notes will

mature on December 1, 2054, will have an interest rate of 5.500%

per annum and will be issued at 98.006% of par value. Interest on

each series of Notes will be paid semiannually on June 1 and

December 1, commencing June 1, 2025. The Notes will be sold

pursuant to Martin Marietta’s shelf registration statement, base

prospectus and prospectus supplement on file with the Securities

and Exchange Commission (“SEC”).

The Company intends to use a portion of the net

proceeds of the Notes for the repayment of all borrowings

outstanding under its revolving credit facility and trade

receivables securitization facility. The remaining net proceeds of

the Notes are expected to be used for general corporate purposes,

which may include financing potential acquisitions, land purchases

or other capital needs. Closing of the offering is expected to

occur on November 4, 2024, subject to the satisfaction of customary

closing conditions.

Deutsche Bank Securities Inc., J.P. Morgan

Securities LLC, Truist Securities, Inc., PNC Capital Markets LLC

and Wells Fargo Securities, LLC will serve as underwriters and

joint book-running managers for the offering.

Martin Marietta has filed a shelf registration

statement on Form S-3 (including a base prospectus) with the SEC

for the offering to which this communication relates. Before you

invest, you should read the prospectus in that registration

statement and the prospectus supplement thereto and the other

documents that Martin Marietta has filed or will file with the SEC

for more complete information about Martin Marietta and this

offering. The offering will be made only pursuant to the terms of

the relevant prospectus supplement (including the prospectus).

These documents will be available at no charge by visiting EDGAR on

the SEC website at www.sec.gov. Alternatively, these documents

will be made available upon request to any underwriter

participating in the offering. Interested parties may obtain a

prospectus and the related prospectus supplement from: Deutsche

Bank Securities Inc., 1 Columbus Circle, New York, New York 10019,

Attn: Prospectus Group, by telephone at (800) 503-4611 or by email

at prospectus.CPDG@db.com; or J.P. Morgan Securities LLC, 383

Madison Avenue, New York, New York 10179, Attn: Investment Grade

Syndicate Desk—3rd Floor or by telephone at (212) 834-4533.

This press release does not constitute an offer

to sell or a solicitation of an offer to buy any securities. Offers

of securities will be made only by means of a prospectus filed with

the SEC. The prospectus is part of a shelf registration statement

that has become effective under the Securities Act of 1933, as

amended.

Company Description

Martin Marietta, a member of the S&P 500

Index, is an American-based company and a leading supplier of

building materials, including aggregates, cement, ready mixed

concrete and asphalt. Through a network of operations spanning 28

states, Canada and The Bahamas, dedicated Martin Marietta teams

supply the resources for building the solid foundations on which

our communities thrive. Martin Marietta’s Magnesia Specialties

business produces high-purity magnesia and dolomitic lime products

used worldwide in environmental, industrial, agricultural and

specialty applications.

Investor Contact: Jacklyn Rooker Director,

Investor Relations+1 (919)

510-4736Jacklyn.Rooker@martinmarietta.com

MLM-G

Cautionary Statement About

Forward-Looking Statements

Investors are cautioned that all statements in

this release that relate to the future involve risks and

uncertainties, and are based on assumptions that the Company

believes in good faith are reasonable but which may be materially

different from actual results. These statements, which are

forward-looking statements under the Private Securities Litigation

Reform Act of 1995, provide the investor with the Company’s

expectations or forecasts of future events. You can identify these

statements by the fact that they do not relate only to historical

or current facts. They may use words such as “anticipate”, “may”,

“expect”, “should”, “believe”, “project”, “intend”, “will”, and

other words of similar meaning in connection with future events or

future operating or financial performance. Any, or all of,

management’s forward-looking statements herein and in other

publications may turn out to be wrong.

Statements and assumptions on future revenues,

income and cash flows, performance, economic trends, the outcome of

litigation, regulatory compliance and environmental remediation

cost estimates are examples of forward-looking statements. Numerous

factors could affect our forward-looking statements and actual

performance. In addition, other risks and uncertainties not

presently known to us or that we currently consider immaterial

could affect the accuracy of our forward-looking statements.

Except as required by law, we undertake no

obligation to update any forward-looking statements in order to

reflect any event or circumstance that may arise after the date of

this press release.

You should consider these forward-looking

statements in light of risk factors discussed in the preliminary

prospectus supplement filed with the SEC on October 31, 2024 and

those in our Annual Report on Form 10-K for the year ended December

31, 2023 and other periodic filings made with the SEC. All of our

forward-looking statements should be considered in light of these

factors. In addition, other risks and uncertainties not presently

known to us or that we consider immaterial could affect the

accuracy of our forward-looking statements, or adversely affect or

be material to the Company. The Company assumes no obligation to

update any such forward-looking statements.

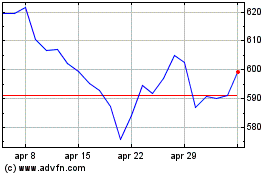

Grafico Azioni Martin Marietta Materials (NYSE:MLM)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Martin Marietta Materials (NYSE:MLM)

Storico

Da Dic 2023 a Dic 2024