0001789029false00017890292024-03-052024-03-050001789029us-gaap:CommonStockMember2024-03-052024-03-050001789029aeva:WarrantsToPurchaseMember2024-03-052024-03-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 05, 2024 |

Aeva Technologies, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39204 |

84-3080757 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

555 Ellis Street |

|

Mountain View, California |

|

94043 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (650) 481-7070 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, par value $0.0001 per share |

|

AEVA |

|

New York Stock Exchange LLC |

Warrants to purchase one share of common stock |

|

AEVA.WS |

|

New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On March 5, 2024, Aeva Technologies, Inc. issued a press release announcing financial results for the quarter and the year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information set forth in Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Aeva Technologies, Inc. |

|

|

|

|

Date: |

March 5, 2024 |

By: |

/s/ Saurabh Sinha |

|

|

|

Saurabh Sinha

Chief Financial Officer |

Exhibit 99.1

Aeva Reports Fourth Quarter and Full Year 2023 Results

Selected by Daimler Truck for Series Production Program with an Order Book* of $1Bn

Announced and Demonstrated Atlas, World’s First Automotive-Grade 4D LiDAR for Mass Production

Growing Momentum in Automotive with Multiple Passenger Vehicle RFQs, Including with a New Global Top 10 Passenger Vehicle OEM

MOUNTAIN VIEW, Calif., Mar. 5, 2024 –Aeva® (NYSE: AEVA), a leader in next-generation sensing and perception systems, today announced its fourth quarter and full year 2023 results.

Key Company Highlights

•Daimler Truck selected Aeva to supply long and ultra-long range LiDARs and perception software for its series production vehicle program with an order book* of $1 billion and Aeva SOP in 2026

•Advancing on multiple passenger vehicle RFQs, including with a new global top 10 passenger vehicle OEM

•Announced Aeva Atlas™, world’s first automotive-grade 4D LiDAR that is powered by Aeva’s latest silicon innovations, including the Aeva CoreVision™ fourth-generation LiDAR-on-Chip module, and Aeva X1™ System-on-Chip processor

•On track for first industrial program deployment with Nikon by end of 2024

“2023 was a landmark year for Aeva, as we secured multiple production awards, including our first major automotive production win with Daimler Truck, one of the world’s largest commercial trucking OEMs,” said Soroush Salehian, Co-Founder and CEO at Aeva. “We believe this win is just the beginning of the growing consensus around FMCW as OEMs look to introduce highway speed autonomy at mass scale. The unique performance and maturity of Aeva’s 4D LiDAR, along with our financial strength, position us to lead this adoption, as we progress on multiple additional automotive RFQs anticipated to be awarded this year.”

Fourth Quarter and Full Year 2023 Financial Highlights

•Cash, Cash Equivalents and Marketable Securities

oCash, cash equivalents and marketable securities of $221.0 million and undrawn facility of $125.0 million as of December 31, 2023

oRevenue of $1.6 million in Q4 2023, compared to revenue of $0.2 million in Q4 2022

oRevenue of $4.3 million for full year 2023, compared to revenue of $4.2 million for full year 2022

•GAAP and Non-GAAP Operating Loss**

oGAAP operating loss of $36.8 million in Q4 2023, compared to GAAP operating loss of $44.4 million in Q4 2022

oGAAP operating loss of $147.8 million for full year 2023, compared to GAAP operating loss of $152.0 million for full year 2022

oNon-GAAP operating loss of $31.3 million in Q4 2023, compared to non-GAAP operating loss of $38.5 million in Q4 2022

oNon-GAAP operating loss of $124.1 million for full year 2023, compared to non-GAAP operating loss of $127.7 million for full year 2022

•GAAP and Non-GAAP Net Loss per Share**

oGAAP net loss per share of $0.18 in Q4 2023, compared to GAAP net loss per share of $0.20 in Q4 2022

oGAAP net loss per share of $0.66 for full year 2023, compared to GAAP net loss per share of $0.68 for full year 2022

oNon-GAAP net loss per share of $0.12 in Q4 2023, compared to non-GAAP net loss per share of $0.17 in Q4 2022

oNon-GAAP net loss per share of $0.51 for full year 2023, compared to non-GAAP net loss per share of $0.57 for full year 2022

oWeighted average shares outstanding of 245.0 million in Q4 2023 and 227.1 million for full year 2023

*Order Book is defined as the forward-looking cumulative billings estimate of Aeva’s products over the estimated lifetime of given production programs which Aeva expects to be integrated into or provided for, based primarily on projected pricing terms and our good faith estimates of “take rate” of Aeva’s technology on production programs. “Take rates” are the anticipated percentage of new vehicles or products to be equipped with Aeva’s technology based on Aeva’s projected product offerings and growth rates.

**Tables reconciling GAAP to non-GAAP measures are provided at the end of this release. Aeva believes that such non-GAAP measures are useful as supplemental measures of Aeva’s performance.

Conference Call Details

The company will host a conference call and live webcast to discuss results at 2:00 p.m. PT / 5:00 p.m. ET today, March 5, 2024. The live webcast and replay can be accessed at investors.aeva.com.

About Aeva Technologies, Inc. (NYSE: AEVA)

Aeva’s mission is to bring the next wave of perception to a broad range of applications from automated driving to industrial robotics, consumer electronics, consumer health, security and beyond. Aeva is transforming autonomy with its groundbreaking sensing and perception technology that integrates all key LiDAR components onto a silicon photonics chip in a compact module. Aeva 4D LiDAR sensors uniquely detect instant velocity in addition to 3D position, allowing autonomous devices like vehicles and robots to make more intelligent and safe decisions. For more information, visit www.aeva.com, or connect with us on X or LinkedIn.

Aeva, the Aeva logo, Aeva 4D LiDAR, Aeva Atlas, Aeries, Aeva Ultra Resolution, Aeva CoreVision, and Aeva X1 are trademarks/registered trademarks of Aeva, Inc. All rights reserved. Third-party trademarks are the property of their respective owners.

Forward looking statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Forward-looking statements in this press release include our beliefs regarding our financial position and operating performance for the fourth quarter and full year 2023 and business objectives for 2024, along with our expectations with respect to the production agreements with Daimler Truck, including our forward-looking order book, and Nikon, as well as engagement and deployments with other customers, anticipated benefits of the

capital raise and our ability to access capital under the Facility Agreement. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including, but not limited to: (i) the fact that Aeva is an early stage company with a history of operating losses and may never achieve profitability, (ii) Aeva’s limited operating history, (iii) the ability to implement business plans, forecasts, and other expectations and to identify and realize additional opportunities, (iv) the ability for Aeva to have its products selected for inclusion in OEM products, (v) the ability to manufacture at volumes and costs needed for commercial programs, (vi) no assurance or guarantee that any of our customers, including any programs which we included in our order book estimates will ever complete such testing and validation with us or that we will receive any billings or revenues forecasted in connection with such program, and (vii) other material risks and other important factors that could affect our financial results. Please refer to our filings with the SEC, including our most recent Form 10-Q and Form 10-K. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Aeva assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Aeva does not give any assurance that it will achieve its expectations.

Contacts

Investors:

Andrew Fung

investors@aeva.ai

Media:

Michael Oldenburg

press@aeva.ai

|

|

|

|

|

|

|

|

|

AEVA TECHNOLOGIES, INC. |

|

Condensed Consolidated Balance Sheets |

|

(Unaudited) |

|

(In thousands) |

|

|

|

|

|

|

|

|

|

|

December 31,

2023 |

|

|

December 31,

2022 |

|

|

|

|

|

|

|

|

ASSETS |

|

|

|

|

|

|

CURRENT ASSETS: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

38,547 |

|

|

$ |

67,420 |

|

Marketable securities |

|

|

182,481 |

|

|

|

256,392 |

|

Accounts receivable |

|

|

628 |

|

|

|

2,887 |

|

Inventories |

|

|

2,374 |

|

|

|

2,951 |

|

Other current assets |

|

|

5,195 |

|

|

|

5,473 |

|

Total current assets |

|

|

229,225 |

|

|

|

335,123 |

|

Operating lease right-of-use assets |

|

|

7,289 |

|

|

|

7,402 |

|

Property, plant and equipment, net |

|

|

12,114 |

|

|

|

9,720 |

|

Intangible assets, net |

|

|

2,625 |

|

|

|

3,525 |

|

Other noncurrent assets |

|

|

6,132 |

|

|

|

862 |

|

TOTAL ASSETS |

|

$ |

257,385 |

|

|

$ |

356,632 |

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

CURRENT LIABILITIES: |

|

|

|

|

|

|

Accounts payable |

|

$ |

3,602 |

|

|

$ |

5,182 |

|

Accrued liabilities |

|

|

2,648 |

|

|

|

9,063 |

|

Accrued employee costs |

|

|

6,043 |

|

|

|

4,721 |

|

Lease liability, current portion |

|

|

3,587 |

|

|

|

2,667 |

|

Other current liabilities |

|

|

2,524 |

|

|

|

194 |

|

Total current liabilities |

|

|

18,404 |

|

|

|

21,827 |

|

Lease liability, noncurrent portion |

|

|

3,767 |

|

|

|

4,789 |

|

Warrant liabilities |

|

|

6,772 |

|

|

|

90 |

|

TOTAL LIABILITIES |

|

|

28,943 |

|

|

|

26,706 |

|

STOCKHOLDERS’ EQUITY: |

|

|

|

|

|

|

Common stock |

|

|

26 |

|

|

|

22 |

|

Additional paid-in capital |

|

|

688,103 |

|

|

|

643,756 |

|

Accumulated other comprehensive loss |

|

|

(87 |

) |

|

|

(3,585 |

) |

Accumulated deficit |

|

|

(459,600 |

) |

|

|

(310,267 |

) |

TOTAL STOCKHOLDERS’ EQUITY |

|

|

228,442 |

|

|

|

329,926 |

|

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

$ |

257,385 |

|

|

$ |

356,632 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AEVA TECHNOLOGIES, INC. |

|

Condensed Consolidated Statements of Operations |

|

(Unaudited) |

|

(In thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Revenue |

|

$ |

1,611 |

|

|

$ |

188 |

|

|

$ |

4,312 |

|

|

$ |

4,192 |

|

Cost of revenue (1) |

|

|

2,483 |

|

|

|

3,316 |

|

|

|

10,198 |

|

|

|

8,447 |

|

Gross loss |

|

|

(872 |

) |

|

|

(3,128 |

) |

|

|

(5,886 |

) |

|

|

(4,255 |

) |

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses (1) |

|

|

26,197 |

|

|

|

32,211 |

|

|

|

102,503 |

|

|

|

109,587 |

|

General and administrative expenses (1) |

|

|

7,741 |

|

|

|

7,428 |

|

|

|

31,761 |

|

|

|

31,070 |

|

Selling and marketing expenses (1) |

|

|

2,035 |

|

|

|

1,628 |

|

|

|

7,638 |

|

|

|

7,043 |

|

Total operating expenses |

|

|

35,973 |

|

|

|

41,267 |

|

|

|

141,902 |

|

|

|

147,700 |

|

Operating loss |

|

|

(36,845 |

) |

|

|

(44,395 |

) |

|

|

(147,788 |

) |

|

|

(151,955 |

) |

Interest income |

|

|

2,417 |

|

|

|

1,674 |

|

|

|

8,925 |

|

|

|

3,707 |

|

Other income (expense), net |

|

|

(10,538 |

) |

|

|

47 |

|

|

|

(10,470 |

) |

|

|

943 |

|

Loss before income taxes |

|

$ |

(44,966 |

) |

|

$ |

(42,674 |

) |

|

$ |

(149,333 |

) |

|

$ |

(147,305 |

) |

Income tax provision |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Net loss |

|

$ |

(44,966 |

) |

|

$ |

(42,674 |

) |

|

$ |

(149,333 |

) |

|

$ |

(147,305 |

) |

Net loss per share, basic and diluted |

|

$ |

(0.18 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.66 |

) |

|

$ |

(0.68 |

) |

Weighted-average shares used in computing net loss per share, basic and diluted |

|

|

245,035,523 |

|

|

|

218,407,208 |

|

|

|

227,060,773 |

|

|

|

217,307,896 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes stock-based compensation as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Cost of revenue |

|

$ |

107 |

|

|

$ |

423 |

|

|

$ |

965 |

|

|

$ |

1,161 |

|

Research and development expenses |

|

|

4,043 |

|

|

|

4,045 |

|

|

|

16,760 |

|

|

|

17,197 |

|

General and administrative expenses |

|

|

1,142 |

|

|

|

1,205 |

|

|

|

5,131 |

|

|

|

4,972 |

|

Selling and marketing expenses |

|

|

230 |

|

|

|

216 |

|

|

|

819 |

|

|

|

917 |

|

Total stock-based compensation expense |

|

$ |

5,522 |

|

|

$ |

5,889 |

|

|

$ |

23,675 |

|

|

$ |

24,247 |

|

|

|

|

|

|

|

|

|

|

AEVA TECHNOLOGIES, INC. |

|

Condensed Consolidated Statements of Cash Flows |

|

(Unaudited) |

|

(In thousands) |

|

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(149,333 |

) |

|

$ |

(147,305 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

4,622 |

|

|

|

3,265 |

|

Impairment of inventories |

|

|

224 |

|

|

|

1,664 |

|

Fair value at issuance of Series A warrants |

|

|

6,500 |

|

|

|

— |

|

Change in fair value of warrant liabilities |

|

|

182 |

|

|

|

(970 |

) |

Stock-based compensation |

|

|

23,675 |

|

|

|

24,247 |

|

Amortization of right-of-use assets |

|

|

3,108 |

|

|

|

2,882 |

|

Realized loss on available-for-sale securities |

|

|

— |

|

|

|

29 |

|

Amortization of premium and accretion of discount on available-for-sale securities, net |

|

|

(2,973 |

) |

|

|

389 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

2,259 |

|

|

|

(546 |

) |

Inventories |

|

|

353 |

|

|

|

(2,552 |

) |

Other current assets |

|

|

279 |

|

|

|

3,634 |

|

Other noncurrent assets |

|

|

(270 |

) |

|

|

(3 |

) |

Accounts payable |

|

|

(1,592 |

) |

|

|

1,287 |

|

Accrued liabilities |

|

|

(6,415 |

) |

|

|

4,953 |

|

Accrued employee costs |

|

|

1,322 |

|

|

|

2,525 |

|

Lease liability |

|

|

(3,097 |

) |

|

|

(2,871 |

) |

Other current liabilities |

|

|

2,330 |

|

|

|

(539 |

) |

Net cash used in operating activities |

|

|

(118,826 |

) |

|

|

(109,911 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchase of property, plant and equipment |

|

|

(6,104 |

) |

|

|

(7,439 |

) |

Purchase of non-marketable equity investments |

|

|

(5,000 |

) |

|

|

— |

|

Purchase of available-for-sale securities |

|

|

(152,364 |

) |

|

|

(210,197 |

) |

Proceeds from maturities of available-for-sale securities |

|

|

232,745 |

|

|

|

328,526 |

|

Net cash provided by investing activities |

|

|

69,277 |

|

|

|

110,890 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from issuance of stock in private placement |

|

|

21,455 |

|

|

|

— |

|

Transaction costs related to issuance of stock in private placement |

|

|

(818 |

) |

|

|

— |

|

Payments of taxes withheld on net settled vesting of restricted stock units |

|

|

(199 |

) |

|

|

(720 |

) |

Proceeds from exercise of stock options |

|

|

238 |

|

|

|

350 |

|

Proceeds from exercise of warrants |

|

|

— |

|

|

|

1 |

|

Net cash provided by (used in) financing activities |

|

|

20,676 |

|

|

|

(369 |

) |

Net (decrease) increase in cash and cash equivalents |

|

|

(28,873 |

) |

|

|

610 |

|

Beginning cash and cash equivalents |

|

|

67,420 |

|

|

|

66,810 |

|

Ending cash and cash equivalents |

|

$ |

38,547 |

|

|

$ |

67,420 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AEVA TECHNOLOGIES, INC. |

|

Reconciliation of GAAP to Non-GAAP Operating Results |

|

(Unaudited) |

|

(In thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation from GAAP to non-GAAP operating loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

GAAP operating loss |

|

$ |

(36,845 |

) |

|

$ |

(44,395 |

) |

|

$ |

(147,788 |

) |

|

$ |

(151,955 |

) |

Stock-based compensation |

|

|

5,522 |

|

|

|

5,889 |

|

|

|

23,675 |

|

|

|

24,247 |

|

Non-GAAP operating loss |

|

$ |

(31,323 |

) |

|

$ |

(38,506 |

) |

|

$ |

(124,113 |

) |

|

$ |

(127,708 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation from GAAP to non-GAAP net loss |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

GAAP net loss |

|

$ |

(44,966 |

) |

|

$ |

(42,674 |

) |

|

$ |

(149,333 |

) |

|

$ |

(147,305 |

) |

Stock-based compensation |

|

|

5,522 |

|

|

|

5,889 |

|

|

|

23,675 |

|

|

|

24,247 |

|

Financing charges |

|

|

3,788 |

|

|

|

— |

|

|

|

3,788 |

|

|

|

— |

|

Fair value at issuance of Series A warrants |

|

|

6,500 |

|

|

|

— |

|

|

|

6,500 |

|

|

|

— |

|

Change in fair value of warrant liabilities |

|

|

250 |

|

|

|

(48 |

) |

|

|

182 |

|

|

|

(970 |

) |

Non-GAAP net loss |

|

$ |

(28,906 |

) |

|

$ |

(36,833 |

) |

|

$ |

(115,188 |

) |

|

$ |

(124,028 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation between GAAP and non-GAAP net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended December 31, |

|

|

Year Ended December 31, |

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Shares used in computing GAAP net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

|

245,035,523 |

|

|

|

218,407,208 |

|

|

|

227,060,773 |

|

|

|

217,307,896 |

|

GAAP net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.18 |

) |

|

$ |

(0.20 |

) |

|

$ |

(0.66 |

) |

|

$ |

(0.68 |

) |

Stock-based compensation |

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.11 |

|

|

|

0.11 |

|

Financing charges |

|

|

0.01 |

|

|

|

— |

|

|

|

0.01 |

|

|

|

— |

|

Fair value at issuance of Series A warrants |

|

|

0.03 |

|

|

|

— |

|

|

|

0.03 |

|

|

|

— |

|

Change in fair value of warrant liabilities |

|

|

0.00 |

|

|

|

(0.00 |

) |

|

|

0.00 |

|

|

|

(0.00 |

) |

Non-GAAP net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted |

|

$ |

(0.12 |

) |

|

$ |

(0.17 |

) |

|

$ |

(0.51 |

) |

|

$ |

(0.57 |

) |

v3.24.0.1

Document And Entity Information

|

Mar. 05, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 05, 2024

|

| Entity Registrant Name |

Aeva Technologies, Inc.

|

| Entity Central Index Key |

0001789029

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39204

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

84-3080757

|

| Entity Address, Address Line One |

555 Ellis Street

|

| Entity Address, City or Town |

Mountain View

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94043

|

| City Area Code |

(650)

|

| Local Phone Number |

481-7070

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

AEVA

|

| Security Exchange Name |

NYSE

|

| Warrants to Purchase [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of common stock

|

| Trading Symbol |

AEVA.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aeva_WarrantsToPurchaseMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

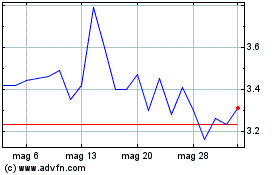

Grafico Azioni Aeva Technologies (NYSE:AEVA)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Aeva Technologies (NYSE:AEVA)

Storico

Da Mar 2024 a Mar 2025