Aames Investment Corporation Closes $1.14 Billion Asset-Backed Securitization

01 Giugno 2005 - 12:30AM

Business Wire

Aames Investment Corporation (NYSE:AIC), a mortgage real estate

investment trust, today closed a securitization and related

offering by Aames Mortgage Investment Trust 2005-2 of approximately

$1.14 billion of notes backed by non-conforming mortgage loans

transferred to the trust. The securitization lead managers were

Countrywide Securities Corporation and Citigroup Global Markets

Inc. and co-managers were Bear, Stearns & Co. Inc., Credit

Suisse First Boston LLC, Friedman Billings Ramsey & Co., Inc.,

Lehman Brothers Inc., Morgan Stanley & Co. and RBS Greenwich

Capital. The notes are characterized as debt for both tax and

financial reporting purposes and represent obligations of Aames

Mortgage Investment Trust 2005-2, a Delaware statutory trust. The

assets of the trust included two groups of mortgage loans secured

by one-to-four family residential mortgages. The notes do not

represent a financial obligation of Aames Investment but will be

consolidated onto Aames Investment's consolidated financial

statements under generally accepted accounting principles. -0- *T

Class Class Principal Summary Interest Rate Rating Amount Formula

Moody's /S&P

----------------------------------------------------------------------

1A1 $143,042,000 1 month LIBOR plus 0.080% Aaa/AAA 1A2 $289,696,000

1 month LIBOR plus 0.220% Aaa/AAA 1A3 $17,300,000 1 month LIBOR

plus 0.360% Aaa/AAA 2A1 $449,414,000 1 month LIBOR plus 0.230%

Aaa/AAA M1 $40,542,000 1 month LIBOR plus 0.450% Aa1/AA+ M2

$41,121,000 1 month LIBOR plus 0.470% Aa2/AA+ M3 $24,325,000 1

month LIBOR plus 0.500% Aa3/AA M4 $22,008,000 1 month LIBOR plus

0.630% A1/AA M5 $19,113,000 1 month LIBOR plus 0.660% A2/AA M6

$16,796,000 1 month LIBOR plus 0.720% N/R/AA- M7 $18,533,000 1

month LIBOR plus 1.200% Baa1/A+ M8 $14,479,000 1 month LIBOR plus

1.350% Baa2/A M9 $13,321,000 1 month LIBOR plus 1.850% Baa3/A- B1

$12,700,000 1 month LIBOR plus 3.000% N/R/BBB+ B2 $5,833,000 1

month LIBOR plus 3.000% N/R/BBB B3 $6,950,000 1 month LIBOR plus

3.000% N/R/BBB B4 $9,264,000 1 month LIBOR plus 3.000% N/R/BBB-

--------------- Total: $1,144,437,000 *T Contact Information For

more information contact Steven C. Canup, Senior Vice President -

Corporate Development and Investor Relations, in Aames Investment's

Investor Relations Department at (323) 210-5311 or at

info@aamescorp.com via email. Additional information may also be

obtained by visiting www.aames.net, Aames Investment's website.

Information Regarding Forward Looking Statements This press release

may contain forward-looking statements under federal securities

laws. These statements are based on management's current

expectations and beliefs and are subject to a number of trends and

uncertainties that could cause actual results to differ materially

from those described in the forward-looking statements. The risks

and uncertainties that may cause our performance and results to

vary include: (i) changes in overall economic conditions and

interest rates; (ii) an inability to originate subprime

hybrid/adjustable mortgage loans; (iii) increased delinquency rates

in our portfolio; (iv) adverse changes in the securitization and

whole loan market for mortgage loans; (v) declines in real estate

values; (vi) limited cash flow to fund operations and dependence on

short-term financing facilities; (vii) concentration of operations

in California, Florida, New York and Texas; (viii) extensive

government regulation;(ix) intense competition in the mortgage

lending industry and (x) an inability to comply with the federal

tax requirements applicable to REITs and effectively operate within

limitations imposed on REITs by federal tax rules. For a more

complete discussion of these risks and uncertainties and

information relating to the company, see the Form 10-K for the year

ended December 31, 2004 and other filings with the SEC made by the

company pursuant to the Securities Exchange Act of 1934. Aames

Investment expressly disclaims any obligation to update or revise

any forward-looking statements in this press release.

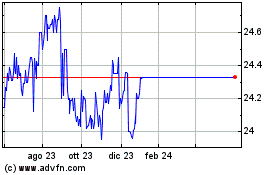

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Arlington Asset Investment (NYSE:AIC)

Storico

Da Dic 2023 a Dic 2024