Apartment Investment and Management Company (“Aimco”) (NYSE:

AIV) announced today first quarter results for 2023 and provided

highlights on recent activities.

Wes Powell, Aimco President and Chief Executive Officer,

comments: “The fundamentals of the U.S. apartment market in

general, and Aimco’s business in particular, remain strong. Demand

for living space continues to outpace supply in most markets and

that trend is evident across the Aimco portfolio as Net Operating

Income ("NOI") for our stabilized properties has grown by 10% or

more, year-over-year, for six consecutive quarters. In the first

quarter of 2023, revenue and NOI were up 11.4% and 13.1%

respectively over the prior year. Leasing activity for the month of

April proved promising with double digit blended lease to lease

growth.

“The Aimco team continues its track record of adding value

through our development program. Active projects remain on budget

and on track to produce more than $55 million of annual NOI upon

their stabilization. At The Hamilton, in Miami, Florida,

construction was completed in April and the property is now 90%

leased at rental rates well ahead of initial projections.

“We are also adding value through the planning and entitlement

of our future development opportunities having invested

approximately $6 million in those activities during the first

quarter. Aimco maintains considerable optionality in regard to its

development pipeline given the ability to extract value, and

maximize risk adjusted returns, at various points in the

pre-development process.

“The previously announced sale of our Parkmerced mezzanine loan

investment remains on track. The buyer’s deposit became

non-refundable in April and closing is scheduled for the second

quarter. Together with the monetization of the swaption purchased

to hedge against interest rate increases, we expect the sale to

result in gross proceeds of approximately $220 million and the

further simplification of the Aimco business.

“Our balance sheet remains safe and benefits from attractive,

primarily assumable, in place financing. Including extensions, we

have only $75 million of debt coming due over the next 36 months,

the majority of which we plan to opportunistically retire when the

loans are open for repayment, without penalty, later in 2023.

“The Aimco board and management team remain committed to

maximizing and unlocking value for Aimco shareholders.

Year-to-date, through April 30, we acquired more than 2.4 million

shares of Aimco common stock at an average price of $7.36 per

share.

“I offer my thanks to the Aimco team for their hard work and

continued good results.”

Financial Results and Recent

Highlights

- Net loss attributable to common stockholders per share, on a

fully dilutive basis, was $0.06 for the quarter ended March 31,

2023, compared to net income per share of $0.05 for the same period

in 2022, due primarily to a reduction in accrued mezzanine loan

income recognition and fair value adjustments on Aimco's interest

hedging instruments.

- First Quarter 2023 Revenue, Expenses, and NOI from Aimco’s

Stabilized Operating Properties were up 11.4%, 7.6%, and 13.1%,

respectively, year over year, with average revenue per apartment

home of $2,227, up $238 year over year.

- Construction has been completed at The Hamilton, in Miami,

Florida, where, as of April 30, 2023, the building's 276 apartment

homes were 90% leased at rental rates well ahead of underwritten

estimates.

- As of April 30, 2023, total shareholder return ("TSR") since

the December 15, 2020 spin-off of AIR Communities was 43.2% and

year-to-date was 9.8%.

Value Add, Opportunistic &

Alternative Investments

Development and Redevelopment

Aimco generally seeks development and redevelopment

opportunities where barriers to entry are high, target customers

can be clearly defined, and Aimco has a comparative advantage over

others in the market. Aimco’s Value Add and Opportunistic

investments may also target portfolio acquisitions, operational

turnarounds, and re-entitlements.

As of March 31, 2023, Aimco had five active development and

redevelopment projects located in four U.S. markets, in varying

phases of construction and lease-up. These projects remain on

track, as measured by construction budget and lease-up metrics.

Additionally, Aimco has a pipeline of future value-add

opportunities totaling approximately 14 million gross square feet

of development in Aimco's target markets of Southeast Florida, the

Washington D.C. Metro, and Colorado's Front Range. During the first

quarter, Aimco invested $64.8 million in development and

redevelopment activities. Updates include:

- In Miami, Florida, construction and repositioning of The

Hamilton is now complete. Demand for rental housing in Southeast

Florida remains robust, especially for unique waterfront

properties. As of April 30, 2023, 90% of the building's 276 units

were leased or pre-leased at rates well ahead of underwritten

rents.

- In Bethesda, Maryland, construction is progressing on plan at

the first phase of Strathmore Square, which will contain 220 highly

tailored apartment homes when complete in 2025. This suburban

infill project is located adjacent to the Grosvenor-Strathmore

Metro station and the Strathmore Performing Arts Campus, and is 1.5

miles from The National Institutes of Health main campus. Funding

for the $164.0 million project is fully secured with Aimco having a

remaining equity commitment, as of April 30, 2023, of $7.4

million.

- In upper northwest Washington D.C., construction at Upton Place

continues on schedule and on budget. Aimco plans to start

pre-leasing Upton’s 689 apartment homes during the summer of 2023

in anticipation of initial delivery in the fourth quarter of 2023.

To date, 80% of the project's 105K square feet of retail space has

been leased and Aimco has received letters of intent from retailers

on another 16%.

- In Corte Madera, California, construction is ongoing at Oak

Shore where 16 luxury single family rental homes and eight

accessory dwelling units are being developed. Aimco expects to

deliver the first homes in the third quarter with pre-leasing

efforts having begun in the first quarter of 2023.

- In Aurora, Colorado, The Benson Hotel and Faculty Club, a

106-key boutique hotel and event center with 18K square feet of

event space, is complete and open to guests. As the only ‘on

campus’ accommodations, The Benson is garnering strong interest

from the many departments and offices located on the surrounding

Anschutz Medical Campus, which includes The University of Colorado

Medical School, UC Health Hospital, Children’s Hospital Colorado,

The Rocky Mountain VA Medical Center and the burgeoning Fitzsimons

Innovation Community.

- In the first quarter 2023, Aimco invested $5.7 million into

future development pipeline projects located in Southeast Florida,

the Washington D.C. Metro, and Colorado’s Front Range. Programming,

design, documentation and entitlement efforts continue with

projected unit counts and rentable square footage on track to meet

or exceed initial projections. Aimco has received Urban Development

Review Board approvals related to its 34th Street and Biscayne

Boulevard properties in Miami’s Edgewater neighborhood, conditional

approvals on its Broward Boulevard sites in Fort Lauderdale, and

earlier this month submitted a major amendment to the existing

approval for the first phase of development at its site in Fort

Lauderdale’s Flagler Village neighborhood. As part of Aimco's

capital allocation strategy, it may choose to monetize certain

pipeline assets prior to vertical construction in an effort to

maximize value add and risk adjusted returns.

Alternative Investments

Aimco’s current alternative investments are primarily those

investments originated prior to the separation from AIR Communities

and include a mezzanine loan secured by a stabilized multifamily

property with an option to participate in future multifamily

development, as well as three passive equity investments. Over

time, we plan to significantly reduce capital allocated to these

investments. Updates include:

- In February 2023, Aimco entered into an agreement to sell the

Parkmerced mezzanine loan for $167.5 million. The initial $5

million deposit received by the purchaser became nonrefundable in

April 2023 when various conditions, including transfer consents,

were cleared. The sale is scheduled to close in the second quarter

of 2023. Together with the monetization of the $1.5 billion

notional swaption, purchased in conjunction with the mezzanine loan

investment to protect against future interest rate increases, Aimco

expects gross proceeds from these transactions to be approximately

$220 million.

Investment Activity

Aimco is focused on growing the business, and delivering strong

investment returns, through development and redevelopment

activities, funded primarily through third-party capital. Updates

include:

- In February 2023, Aimco entered into an option agreement with

the Fitzsimons Redevelopment Authority. If exercised, the option

allows for the long-term lease of 4.8 acres of land located on the

Anschutz Medical Campus in Aurora, Colorado that can accommodate

approximately 850K square feet of commercial life science

development built out over multiple phases. The option's annual

cost is approximately $0.5 million.

Operating Property

Results

Aimco owns a diversified portfolio of operating apartment

communities located in eight major U.S. markets with average rents

in line with local market averages.

Aimco’s operating properties produced solid results for the

quarter ended March 31, 2023.

First Quarter

Stabilized Operating Properties

Year-over-Year

Sequential

($ in millions)

2023

2022

Variance

4Q 2022

Variance

Average Daily Occupancy

98.0%

98.5%

(0.5)%

97.4%

0.6%

Revenue, before utility reimbursements

$36.7

$32.9

11.4%

$35.9

2.1%

Expenses, net of utility

reimbursements

11.2

10.4

7.6%

10.1

11.1%

Net operating income (NOI)

25.5

22.5

13.1%

25.9

(1.5%)

- Revenue in the first quarter 2023 was $36.7 million, up 11.4%

year-over-year, resulting from a $238 increase in average monthly

revenue per apartment home to $2,227, offset by a 50-basis point

decrease in Average Daily Occupancy to 98.0%.

- New lease rents increased 7.0% and Aimco retained 54.5% of

residents whose leases were expiring during the quarter at rents

9.0% higher, on average, than the previous lease.

- The median annual household income of new residents was more

than $125,000 in the first quarter 2023, representing a rent to

income ratio of 19.5%.

- Expenses in the first quarter 2023 were up 7.6% year over year

due primarily to higher net utilities and insurance. Sequentially,

expenses in the first quarter 2023 were higher than the fourth

quarter 2022 due primarily to seasonally higher costs related to

winter weather in Boston and Chicago.

- Net operating income in the first quarter 2023 was $25.5

million, up 13.1% year-over-year.

- During April, the preliminary results show steady demand with

10.3% blended rent increases for transactions across the

portfolio.

Other Real Estate Operations

Aimco also owns 1001 Brickell Bay Drive, a waterfront office

building in Miami, Florida, owned as part of a larger assemblage

with substantial development potential. Leases within the building

have been executed on terms of less than four years or contain

redevelopment provisions as needed to maximize the value of the

underlying development rights.

The Miami office market remains active. Following first quarter

lease expirations, as of March 31, 2023, the building was 77%

occupied, and by the end of April the building was 79% leased.

Balance Sheet and Financing

Activity

Aimco is highly focused on maintaining a strong balance sheet,

including having at all times ample liquidity. As of March 31,

2023, Aimco had access to $336.1 million, including $163.6 million

of cash on hand, $22.5 million of restricted cash, and the capacity

to borrow up to $150.0 million on its revolving credit

facility.

Aimco’s net leverage as of March 31, 2023, was as follows:

as of March 31, 2023

Proportionate, $ in thousands

Amount

Weighted Avg. Maturity

(Yrs.)

Total non-recourse fixed rate debt

$

779,395

7.9

Total non-recourse floating rate debt

156,486

1.9

Total non-recourse construction loan

debt

152,734

2.8

Cash and restricted cash

(186,090

)

Net Leverage

$

902,525

As of March 31, 2023, 98% of Aimco's total debt was either fixed

rate or hedged with interest rate cap protection. Aimco's total

debt maturities for the next 36 months, inclusive of all

contractual extension rights, total approximately $75 million and

the majority of which are higher cost loans prepayable at par later

this summer when Aimco intends to retire approximately $60

million.

Partner Equity Financing

- In March, Alaska Permanent Fund Corporation made an initial

funding payment to Aimco towards its share of land and

pre-development costs at Aimco's Fitzsimons 4 pipeline project,

located on the Anschutz Medical Campus in Aurora, Colorado,

representing the first investment to be funded pursuant to the

programmatic equity agreement signed in August 2022. Land and

pre-development costs are estimated to be approximately $7 million,

of which Aimco’s share is $1.75 million.

Public Market Equity

Common Stock Repurchases

- In the first quarter, Aimco repurchased 2.0 million shares of

its common stock at a weighted average price of $7.27 per share. In

2023, through April 30, Aimco has repurchased more than 2.4 million

shares of its common stock at a weighted average price of

approximately $7.36 per share.

Commitment to Enhance Stockholder Value

- As previously announced, the Aimco Board of Directors, in

consultation with management and its corporate advisory team, is

overseeing the review of a broad range of options to further

enhance and unlock value for Aimco stockholders. The review, and

the timing of any action that may result, is taking into

consideration a host of factors including the health and stability

of financial markets as well as the continued advancement of

Aimco’s previously defined strategic plan. There can be no

assurance that the ongoing review will result in any

transaction.

2023 Outlook

2023 Outlook

$ in millions (except per share amounts),

Square Feet in millions

2023 Full Year

Forecast

First Quarter

2023

Net income (loss) per share –

diluted

$(0.33) - $(0.23)

$(0.06)

Active Developments and

Redevelopments

Total Direct Costs of Projects Underway

[1]

$815

$815

Direct Project Costs

$165 - $185

$47.7

Other Capitalized Costs

$30 - $31

$10.0

Construction Loan Draws

$150 - $170

$36.5

JV Partner Equity Funding

$0

$0

AIV Equity Funding

~$45

$21.2

Pipeline Projects

Pipeline Size Gross Square Feet [1]

14.0

14.0

Pipeline Size Multifamily Units [1]

6,544

6,544

Pipeline Size Commercial Sq Ft [1]

1.7

1.7

Planning Costs

$20 - $25

$5.7

Real Estate Transactions

Acquisitions

None

None

Dispositions [2]

$220

None

Operating Properties

Revenue Growth, before utility

reimbursements

5.0% - 7.0%

11.4%

Operating Expense Growth, net of utility

reimbursements

5.25% - 7.25%

7.6%

Net Operating Income Growth

5.0% - 7.0%

13.1%

Recurring Capital Expenditures

$11 - $13

$2.3

General and Administrative

$33 - $35

$8.6

Leverage

Interest Expense, net of capitalization

[3]

$38 - $41

$7.0

[1] Includes land or leasehold value, calculated as the

quarterly average. [2] Dispositions include the expected gross

proceeds from the sale of the Parkmerced mezzanine investment and

the monetization of the related swaption. [3] Includes contractual

interest expense, exclusive of the amortization of deferred

financing costs, and reduced by interest rate option payments which

are included in the Realized and unrealized gains (losses) on

interest rate options line on Aimco's income statement.

Supplemental Information

The full text of this Earnings Release and the Supplemental

Information referenced in this release are available on Aimco’s

website at investors.aimco.com.

Glossary & Reconciliations of

Non-GAAP Financial and Operating Measures

Financial and operating measures found in this Earnings Release

and the Supplemental Information include certain financial measures

used by Aimco management that are measures not defined under

accounting principles generally accepted in the United States, or

GAAP. Certain Aimco terms and Non-GAAP measures are defined in the

Glossary in the Supplemental Information and Non-GAAP measures

reconciled to the most comparable GAAP measures.

About Aimco

Aimco is a diversified real estate company primarily focused on

value add, opportunistic investments, targeting the U.S.

multifamily sector. Aimco’s mission is to make real estate

investments where outcomes are enhanced through our human capital

so that substantial value is created for investors, teammates, and

the communities in which we operate. Aimco is traded on the New

York Stock Exchange as AIV. For more information about Aimco,

please visit our website www.aimco.com.

Team and Culture

Aimco has a national presence with corporate headquarters in

Denver, Colorado and Washington, D.C. Our investment platform is

managed by experienced professionals based in three regions, where

it will focus its new investment activity: Southeast Florida, the

Washington D.C. Metro Area and Colorado's Front Range. By

regionalizing this platform, Aimco is able to leverage the in-depth

local market knowledge of each regional leader, creating a

comparative advantage when sourcing, evaluating, and executing

investment opportunities and is essential to the execution of our

mission and realization of our vision.

Above all else, Aimco is committed to a culture of integrity,

respect, and collaboration.

Forward-Looking

Statements

This document contains forward-looking statements within the

meaning of the federal securities laws. Forward-looking statements

include all statements that are not historical statements of fact

and those regarding our intent, belief, or expectations, including,

but not limited to, the statements in this document regarding our

future plans and goals, including our pipeline investments and

projects, our plans to eliminate certain near term debt maturities,

our estimated value creation and potential, our timing, scheduling

and budgeting, projections regarding lease growth, our plans to

form joint ventures, our plans for new acquisitions or

dispositions, our strategic partnerships and value added therefrom,

and changes to our corporate governance. We caution investors not

to place undue reliance on any such forward-looking statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),”

“plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,”

“seek(s)” and similar expressions, or the negative of these terms,

are intended to identify such forward-looking statements. These

forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the control of Aimco that could

cause actual results or outcomes to differ materially from those

discussed in the forward-looking statement. Important factors,

among others, that may affect actual results or outcomes include,

but are not limited to: (i) the risk that the 2023 plans and goals

may not be completed, as expected, in a timely manner or at all,

(ii) the inability to recognize the anticipated benefits of the

pipeline investments and projects, and (iii) changes in general

economic conditions, including, increases in interest rates and

other force-majeure events. Although we believe that the

assumptions underlying the forward-looking statements are

reasonable, we can give no assurance that our expectations will be

attained.

Readers should carefully review Aimco’s financial statements and

the notes thereto, as well as the section entitled “Risk Factors”

in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended

December 31, 2022, and subsequent Quarterly Reports on Form 10-Q

and other documents Aimco files from time to time with the SEC.

These filings identify and address important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking

statements.

These forward-looking statements reflect management’s judgment

and expectations as of this date, and Aimco assumes no (and

disclaims any) obligation to revise or update them to reflect

future events or circumstances.

Consolidated

Statements of Operations

(in thousands, except per share data)

(unaudited)

Three Months Ended March

31,

2023

2022

REVENUES:

Rental and other property revenues

$

44,268

$

49,994

OPERATING EXPENSES:

Property operating expenses

17,504

19,221

Depreciation and amortization

16,271

23,118

General and administrative expenses

8,403

9,472

Total operating expenses

42,178

51,811

Interest income

2,058

555

Interest expense

(9,725

)

(14,601

)

Mezzanine investment income (loss),

net

(128

)

8,237

Realized and unrealized gains (losses) on

interest rate options

(1,057

)

18,778

Realized and unrealized gains (losses) on

equity investments

137

(4,332

)

Income from unconsolidated real estate

partnerships

174

256

Other income (expense), net

(3,498

)

(1,020

)

Income (loss) before income tax

benefit

(9,949

)

6,056

Income tax benefit (expense)

4,196

4,056

Net income (loss)

(5,753

)

10,112

Net (income) loss attributable to

redeemable noncontrolling interests in consolidated real estate

partnerships

(3,274

)

(1,470

)

Net (income) loss attributable to

noncontrolling interests in consolidated real estate

partnerships

(264

)

2

Net (income) loss attributable to common

noncontrolling interests in Aimco Operating Partnership

474

(435

)

Net income (loss) attributable to

Aimco

$

(8,817

)

$

8,209

Net income (loss) attributable to common

stockholders per share – basic

$

(0.06

)

$

0.05

Net income (loss) attributable to common

stockholders per share – diluted

$

(0.06

)

$

0.05

Weighted-average common shares outstanding

– basic

145,827

149,790

Weighted-average common shares outstanding

– diluted

145,827

150,348

Consolidated

Balance Sheets

(in thousands) (unaudited)

March 31,

December 31,

2023

2022

Assets

Buildings and improvements

$

1,391,963

$

1,322,381

Land

640,892

641,102

Total real estate

2,032,855

1,963,483

Accumulated depreciation

(545,604

)

(530,722

)

Net real estate

1,487,251

1,432,761

Cash and cash equivalents

166,149

206,460

Restricted cash

22,485

23,306

Mezzanine investments

158,430

158,558

Interest rate options

60,508

62,387

Unconsolidated real estate

partnerships

16,470

15,789

Notes receivable

39,363

39,014

Right-of-use lease assets - finance

leases

110,625

110,269

Other assets, net

127,894

132,679

Total assets

$

2,189,175

$

2,181,223

Liabilities and Equity

Non-recourse property debt, net

$

929,291

$

929,501

Construction loans, net

155,691

118,698

Total indebtedness

1,084,982

1,048,199

Deferred tax liabilities

114,883

119,615

Lease liabilities - finance leases

116,212

114,625

Accrued liabilities and other

97,220

106,600

Total liabilities

1,413,297

1,389,039

Redeemable noncontrolling interests in

consolidated real estate partnerships

167,129

166,826

Equity:

Common Stock

1,448

1,466

Additional paid-in capital

489,304

496,482

Retained earnings

41,087

49,904

Total Aimco equity

531,839

547,852

Noncontrolling interests in consolidated

real estate partnerships

48,321

48,294

Common noncontrolling interests in Aimco

Operating Partnership

28,589

29,212

Total equity

608,749

625,358

Total liabilities and equity

$

2,189,175

$

2,181,223

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230504005959/en/

Matt Foster, Sr. Director, Capital Markets and Investor

Relations Investor Relations 303-793-4661, investor@aimco.com

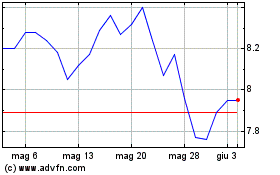

Grafico Azioni Apartment Investment and... (NYSE:AIV)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Apartment Investment and... (NYSE:AIV)

Storico

Da Nov 2023 a Nov 2024