Aimco Closes on Partial Sale of Parkmerced Mezzanine Loan and Announces Amended Agreement for Sale of Remaining Investment

23 Giugno 2023 - 12:58PM

Business Wire

Apartment Investment and Management Company (“Aimco”) (NYSE:

AIV) announced today it has closed on the sale of a 20%,

non-controlling position in its Parkmerced mezzanine loan

investment for $33.5 million.

Pursuant to the terms of the amended agreement, the purchaser

will have the option to acquire the remaining 80% for an additional

$134 million plus interest accruing at no less than 19% annually

through May 2024. The purchaser pre-paid $4 million of interest at

the time of closing.

So long as the purchaser’s option remains unexercised, Aimco

will receive a first priority return from any payments made to

service or pay down the mezzanine loan equal to $134 million plus

no less than a 19% annualized return as well as 80% of any residual

payments after the purchaser receives a 10% annualized return on

its subordinate investment.

Separately, Aimco monetized its associated interest rate

swaption for $54 million and invested the proceeds in a short-term

treasury instrument as an ongoing hedge of the Parkmerced mezzanine

loan investment.

In total, Aimco has monetized $91.5 million of its Parkmerced

mezzanine investments and, subject to the purchaser’s exercise of

its option, would realize gross proceeds of approximately $248

million, to be adjusted for timing of the transaction.

“This partial sale and amended agreement represent significant

progress towards Aimco’s goals to reduce exposure to west coast

markets and passive investments. I am thankful to the Aimco team

for their work and creativity in the face of challenging market

conditions,” commented Wes Powell, Aimco Chief Executive

Officer.

About Aimco

Aimco is a diversified real estate company primarily focused on

value add, opportunistic, and alternative investments, targeting

the U.S. multifamily sector. Aimco’s mission is to make real estate

investments where outcomes are enhanced through its human capital

so that substantial value is created for investors, teammates, and

the communities in which we operate. Aimco is traded on the New

York Stock Exchange as AIV. For more information about Aimco,

please visit its website www.aimco.com.

Forward-Looking Statements

This document contains forward-looking statements within the

meaning of the federal securities laws. Forward-looking statements

include all statements that are not historical statements of fact

and those regarding our intent, belief, or expectations. We caution

investors not to place undue reliance on any such forward-looking

statements.

Words such as “anticipate(s),” “expect(s),” “intend(s),”

“plan(s),” “believe(s),” “may,” “will,” “would,” “could,” “should,”

“seek(s)” and similar expressions, or the negative of these terms,

are intended to identify such forward-looking statements. These

forward-looking statements are not guarantees of future

performance, conditions or results, and involve a number of known

and unknown risks, uncertainties, assumptions and other important

factors, many of which are outside the control of Aimco that could

cause actual results or outcomes to differ materially from those

discussed in the forward-looking statement. Important factors,

among others, that may affect actual results or outcomes include,

but are not limited to: (i) the risk that the expectations may not

be completed, as expected, in a timely manner or at all and (ii)

changes in general economic conditions, including, increases in

interest rates and as a result of the COVID-19 pandemic. Although

we believe that the assumptions underlying the forward-looking

statements are reasonable, we can give no assurance that our

expectations will be attained.

Readers should carefully review Aimco’s financial statements and

the notes thereto, as well as the section entitled “Risk Factors”

in Item 1A of Aimco’s Annual Report on Form 10-K for the year ended

December 31, 2022, and subsequent Quarterly Reports on Form 10-Q

and other documents Aimco files from time to time with the SEC.

These filings identify and address important risks and

uncertainties that could cause actual events and results to differ

materially from those contained in the forward-looking

statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230623066252/en/

Matt Foster, Sr. Director, Capital Markets and Investor

Relations Investor Relations 303-793-4661, investor@aimco.com

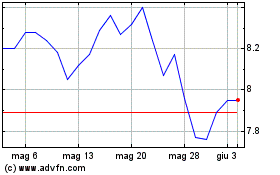

Grafico Azioni Apartment Investment and... (NYSE:AIV)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Apartment Investment and... (NYSE:AIV)

Storico

Da Nov 2023 a Nov 2024