Capital Automotive Announces Planned Convertible Notes Offering

06 Maggio 2004 - 12:24AM

PR Newswire (US)

Capital Automotive Announces Planned Convertible Notes Offering

MCLEAN, Va., May 5 /PRNewswire-FirstCall/ -- Capital Automotive

REIT , the nation's leading specialty finance company for

automotive retail real estate, today announced that it will file

with the Securities and Exchange Commission a preliminary

prospectus supplement to a shelf registration statement for the

public offering of $100 million of convertible notes due 2024. The

Company will also grant the underwriter an option to purchase up to

an additional $10 million aggregate principal amount of convertible

notes. All of the unsecured convertible notes are being sold by the

Company. Credit Suisse First Boston is expected to be the sole

manager of the offering. Copies of the prospectus supplement may be

obtained from the offices of Credit Suisse First Boston, Prospectus

Department, One Madison Avenue, New York, New York 10010,

telephone: 212-325-2580, or by faxing your request to 212-325-8057.

About Capital Automotive Capital Automotive, headquartered in

McLean, Virginia, is a self- administered, self-managed real estate

investment trust that acquires real property and improvements used

by operators of multi-site, multi-franchised automotive dealerships

and related businesses. Additional information on Capital

Automotive is available on the Company's Web site at

http://www.capitalautomotive.com/. DATASOURCE: Capital Automotive

REIT CONTACT: David S. Kay, Senior Vice President, Chief Financial

Officer and Treasurer of Capital Automotive REIT, +1-703-394-1302

Web site: http://www.capitalautomotive.com/

Copyright

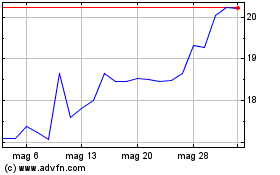

Grafico Azioni Cars com (NYSE:CARS)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Cars com (NYSE:CARS)

Storico

Da Lug 2023 a Lug 2024