As filed with the Securities and Exchange Commission on December 4, 2014

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-11

FOR REGISTRATION

UNDER

THE SECURITIES ACT OF 1933

OF

SECURITIES OF CERTAIN REAL ESTATE COMPANIES

City Office REIT, Inc.

(Exact name of registrant as specified in governing instruments)

1075 West Georgia Street

Suite 2600

Vancouver, British Columbia, V6E 3C9

Tel:

(604) 806-3366

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Anthony Maretic

Chief Financial Officer

City Office REIT, Inc.

1075 West

Georgia Street

Suite 2600

Vancouver, British Columbia, V6E 3C9

Tel:

(604) 806-3366

(Name, address, including zip code, and telephone number, including area code, of agent for service)

COPIES TO:

|

|

|

| Stephen T. Giove, Esq.

Robert Evans III, Esq. Shearman &

Sterling LLP 599 Lexington Avenue New

York, New York 10022 Telephone: (212) 848-4000

Facsimile: (212) 848-7179 |

|

David C. Wright, Esq.

Trevor K. Ross, Esq. Hunton & Williams

LLP Riverfront Plaza, East Tower 951

E. Byrd Street Richmond, Virginia 23219

Telephone: (804) 788-8200 Facsimile: (804)

788-8218 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this registration statement.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act, check the following box. ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. x Registration No. 333-199319

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

Indicate by check mark whether the registrant is a

large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in

Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

|

|

|

|

| Non-accelerated filer |

|

x (Do not check if a smaller reporting company) |

|

Smaller reporting company |

|

¨ |

CALCULATION OF REGISTRATION FEE

|

|

|

|

|

| |

Title of Each Class of

Securities to be Registered |

|

Proposed

maximum aggregate offering

price(1)(2) |

|

Amount of

registration fee(3) |

| Common stock, $0.01 par value per share |

|

$9,052,800 |

|

$1,052 |

| |

| |

| (1) |

The registrant previously registered shares of its common stock for a proposed maximum aggregate offering price of $45,264,000 pursuant to a Registration Statement on Form S-11 (File No. 333-199319), as amended,

which registration statement was declared effective by the Securities and Exchange Commission on December 4, 2014, for which a registration fee of $5,259.68 was previously paid. This Registration Statement is for an increase in the maximum

aggregate offering price of $9,052,800. |

| (2) |

Includes shares subject to the underwriters’ option to purchase additional shares. |

| (3) |

In reliance upon Rule 457(p) under the Securities Act of 1933, as amended, the registration filing fee of $1,052 due for this offering is offset by $52 of $152.73 which was previously paid with respect to unsold

securities that were previously registered pursuant to the registration statement on Form S-11 (File No. 333-193219), initially filed with the U.S. Securities and Exchange Commission on January 7, 2014 by City Office REIT, Inc.

|

This registration statement shall become effective upon filing with the Securities and Exchange Commission in accordance with Rule 462(b) under the

Securities Act of 1933, as amended.

EXPLANATORY NOTE AND INCORPORATION BY REFERENCE

This registration statement is being filed by City Office REIT, Inc. (the “Company”) pursuant to Rule 462(b) under the Securities

Act of 1933, as amended, and General Instruction G to Form S-11. This registration statement relates to the Company’s prior registration statement on

Form S-11 (Registration No. 333-199319), originally filed on October 14, 2014, as amended (the “Prior Registration Statement”), which was

declared effective on December 4, 2014. The contents of the Prior Registration Statement, including all exhibits thereto, are incorporated by reference herein. This registration statement covers the registration of additional shares of the

Company’s common stock described in the prospectus constituting a part of the Prior Registration Statement having a maximum aggregate offering price of $9,052,800.

The required opinions and consents are listed on the Exhibit Index attached hereto and are filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-11 and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Vancouver, Canada, on December 4, 2014.

|

|

|

| CITY OFFICE REIT, INC. |

|

|

| By: |

|

/s/ James Farrar |

|

|

Name: James Farrar |

|

|

Title: Chief Executive Officer |

Pursuant to the requirements of the Securities Act of 1933, as amended, this registration statement has

been signed by the following persons in the capacities and on the dates indicated.

|

|

|

|

|

| SIGNATURE |

|

TITLE |

|

DATE |

|

|

|

| /s/ James Farrar

James Farrar |

|

Chief Executive Officer and Director

(Principal Executive Officer) |

|

December 4, 2014 |

|

|

|

| /s/ Anthony Maretic

Anthony Maretic |

|

Chief Financial Officer, Treasurer and Secretary

(Principal Financial and Accounting Officer) |

|

December 4, 2014 |

|

|

|

| /s/ Gregory Tylee

Gregory Tylee |

|

Chief Operating Officer and President |

|

December 4, 2014 |

|

|

|

| *

Samuel Belzberg |

|

Director |

|

December 4, 2014 |

|

|

|

| *

William Flatt |

|

Director |

|

December 4, 2014 |

|

|

|

| *

John McLernon |

|

Director |

|

December 4, 2014 |

|

|

|

| *

Mark Murski |

|

Director |

|

December 4, 2014 |

|

|

|

| *

Stephen Shraiberg |

|

Director |

|

December 4, 2014 |

|

|

|

| *By: |

|

/s/ James Farrar |

|

|

Name: James Farrar Title:

Attorney-in-fact |

II-1

EXHIBIT INDEX

All exhibits previously filed or incorporated by reference in the registrant’s prior registration statement (Registration

No. 333-199319), as amended, are incorporated by reference into, and shall be deemed to be a part of this filing, except for the following, which are filed herewith.

|

|

|

| Exhibit

number |

|

Description |

|

|

| 5.1 |

|

Opinion of Ballard Spahr LLP regarding validity of the shares registered |

|

|

| 8.1 |

|

Opinion of Shearman & Sterling LLP regarding certain tax matters |

|

|

| 23.1 |

|

Consent of KPMG LLP |

|

|

| 23.2 |

|

Consent of Ballard Spahr LLP (included in the opinion filed as Exhibit 5.1) |

|

|

| 23.3 |

|

Consent of Shearman & Sterling LLP (included in the opinion filed as Exhibit 8.1) |

Exhibit 5.1

December 4, 2014

City Office REIT, Inc.

1075 West Georgia Street

Suite 2600

Vancouver, British Columbia, V6E 3C9

|

|

|

| Re: |

|

City Office REIT, Inc., a Maryland corporation (the “Company”) – Registration Statement on Form S-11 (File No. 333-199319), as amended, pertaining to the issuance and sale by the Company of up to 4,312,500 shares (the

“Shares”) of common stock, $0.01 par value per share, of the Company (including up to 562,500 Shares that the underwriters have the option to purchase solely to cover over-allotments) |

Ladies and Gentlemen:

We have acted as Maryland corporate counsel to the Company in connection with the registration by the Company of the Shares under the

Securities Act of 1933, as amended (the “Act”), pursuant to the Registration Statement on Form S-11 (File No. 333-199319), originally filed with the Securities and Exchange Commission (the “Commission”) on or about

October 14, 2014, as amended (the “Registration Statement”). You have requested our opinion with respect to the matters set forth below.

In our capacity as Maryland corporate counsel to the Company and for the purposes of this opinion, we have examined originals, or copies

certified or otherwise identified to our satisfaction, of the following documents (collectively, the “Documents”):

| |

(i) |

the corporate charter of the Company (the “Charter”) represented by Articles of Amendment and Restatement filed with the State Department of Assessments and Taxation of Maryland (the “Department”) on

April 10, 2014; |

| |

(ii) |

the Amended and Restated Bylaws of the Company, adopted on or as of April 10, 2014 (the “Bylaws”); |

| |

(iii) |

the Action by Written Consent of Board of Directors in Lieu of an Organizational Meeting, dated as of November 27, 2013 (the “Organizational Minutes”); |

| |

(iv) |

resolutions adopted by the Board of Directors of the Company on or as of October 9, 2014 relating to, among other things, the authorization of the issuance and sale of the Shares (the “Directors’

Resolutions”); |

Atlanta | Baltimore | Bethesda |

Denver | Las Vegas | Los Angeles | New Jersey | New

York | Philadelphia | Phoenix | Salt Lake City | San

Diego | Washington, DC | Wilmington | www.ballardspahr.com

BALLARD SPAHR LLP

City Office REIT, Inc.

December 4, 2014

Page

2

| |

(v) |

the Registration Statement and the related form of prospectus included therein, in substantially the form filed or to be filed with the Commission pursuant to the Act; |

| |

(vi) |

a status certificate of the Department, dated as of a recent date, to the effect that the Company is duly incorporated and existing under the laws of the State of Maryland; |

| |

(vii) |

a certificate of one or more officers of the Company, dated as of a recent date (the “Officers’ Certificate”), certifying that, as a factual matter, the Charter, the Bylaws, the Organizational Minutes and

the Directors’ Resolutions are true, correct and complete, and have not been rescinded or modified except as noted therein, and as to the manner of adoption of the Directors’ Resolutions; and |

| |

(viii) |

such other documents and matters as we have deemed necessary and appropriate to render the opinions set forth in this letter, subject to the limitations, assumptions, and qualifications noted below. |

In reaching the opinions set forth below, we have assumed the following:

| |

(a) |

each person executing any of the Documents on behalf of any party (other than the Company) is duly authorized to do so; |

| |

(b) |

each natural person executing any of the Documents is legally competent to do so; |

| |

(c) |

any of the Documents submitted to us as originals are authentic; the form and content of any Documents submitted to us as unexecuted drafts do not differ in any respect relevant to this opinion from the form and content

of such documents as executed and delivered; any of the Documents submitted to us as certified, facsimile or photostatic copies conform to the original document; all signatures on all of the Documents are genuine; all public records reviewed or

relied upon by us or on our behalf are true and complete; all statements and information contained in the Documents are true and complete; there has been no modification of, or amendment to, any of the Documents; and there has been no waiver of any

provision of any of the Documents by action or omission of the parties or otherwise; |

| |

(d) |

the Officers’ Certificate and all other certificates submitted to us are, as to factual matters, true and correct both when made and as of the date hereof; |

| |

(e) |

none of the Shares will be issued or transferred in violation of the provisions of Article VII of the Charter relating to restrictions on ownership and transfer of capital stock; and |

| |

(f) |

prior to the issuance of the Shares subsequent to the date hereof, the Board of Directors of the Company, or a duly authorized committee thereof, will adopt resolutions that determine the consideration to be received by

the Company for the issuance and sale of the Shares (the “Final Determination”). |

BALLARD SPAHR LLP

City Office REIT, Inc.

December 4, 2014

Page

3

Based on our review of the foregoing and subject to the assumptions and qualifications set

forth herein, it is our opinion that, as of the date of this letter:

| |

(1) |

The Company has been duly incorporated and is validly existing as a corporation in good standing under the laws of the State of Maryland. |

| |

(2) |

The issuance of the Shares has been duly authorized by all necessary corporate action on the part of the Company, and when such Shares are issued and delivered by the Company in exchange for the consideration therefor

as provided in, and in accordance with, the Directors’ Resolutions and the Final Determination, such Shares will be validly issued, fully paid and non-assessable. |

The foregoing opinion is limited to the laws of the State of Maryland, and we do not express any opinion herein concerning any other law. We

express no opinion as to the applicability or effect of any federal or state securities laws, including the securities laws of the State of Maryland, or as to federal or state laws regarding fraudulent transfers. To the extent that any matter as to

which our opinion is expressed herein would be governed by the laws of any jurisdiction other than the State of Maryland, we do not express any opinion on such matter.

This opinion letter is issued as of the date hereof and is necessarily limited to laws now in effect and facts and circumstances presently

existing and brought to our attention. We assume no obligation to supplement this opinion letter if any applicable laws change after the date hereof, or if we become aware of any facts or circumstances that now exist or that occur or arise in the

future and may change the opinions expressed herein after the date hereof.

We consent to the incorporation by reference of this opinion

in the Registration Statement and further consent to the filing of this opinion as an exhibit to the applications to securities commissioners for the various states of the United States for registration of the Shares. We also consent to the

identification of our firm as Maryland counsel to the Company in the section of the Registration Statement entitled “Legal Matters.” In giving this consent, we do not admit that we are within the category of persons whose consent is

required by Section 7 of the Act.

Very truly yours,

/s/ Ballard Spahr LLP

Exhibit 8.1

December 4, 2014

City Office REIT, Inc.

1075 West Georgia Street, Suite 2600

Vancouver, British Columbia, V6E 3C9

City Office

REIT, Inc.

Ladies and Gentlemen:

We have

acted as United States federal income tax counsel to City Office REIT, Inc., a Maryland corporation (the “Company”), in connection with the filing of a registration statement on Form S-11 dated October 15, 2014 (File

No. 333-199319) (such registration statement, as amended through the date hereof, the “Registration Statement”), filed by the Company with the Securities and Exchange Commission under the Securities Act of 1933, as amended (the

“Securities Act”), in connection with the registration of up to 4,312,500 million shares of common stock of the Company, $0.01 par value per share (the “Common Stock”). In that capacity, you have requested our opinion regarding

the ability of the Company to elect to be treated, and to qualify, for United States federal income tax purposes as a real estate investment trust (a “REIT”) within the meaning of Section 856(a) of the Internal Revenue Code of 1986,

as amended (the “Code”).

In rendering this opinion, we have relied as to certain factual matters upon the statements and

representations contained in the certificate provided to us by the Company (the “Officer’s Certificate”) dated December 4, 2014. We have assumed that the statements made in the Officer’s Certificate are true and correct, and will

remain true and correct through the effective date of the Registration Statement, and that the Officer’s Certificate has been executed by appropriate and authorized officers of the Company. We have made no independent investigation or audit of

all of the factual representations in the Officer’s Certificate. No facts have come to our attention that would cause us to question the accuracy and completeness of the factual representations in the Officer’s Certificate. Furthermore,

where the factual representations in the Officer’s Certificate involve terms defined in the Code, the regulations promulgated thereunder, published rulings of the Internal Revenue Service, or other relevant authority, we have reviewed with the

individual making such representations the relevant provisions of the Code, the applicable regulations thereunder, the published rulings of the Internal Revenue Service, and other relevant authority. We have also assumed that the board of directors

of the Company will not exercise its discretion under the charter to authorize the Company to revoke or otherwise terminate its REIT election pursuant to Section 856(g).

In our capacity as United States federal income tax counsel, we have reviewed copies of the Registration Statement, and have reviewed or

relied upon originals or copies of such other agreements and documents as we have deemed necessary or appropriate for purposes of the opinions rendered herein (collectively, the “Governing Documents”). In performing such review we have

assumed the genuineness of all signatures on all Governing Documents reviewed by us, the legal capacity of all natural persons and the authenticity of all Governing Documents submitted to us as originals, the conformity to the original documents of

all documents submitted to us as copies and the authenticity of the originals of such latter documents. In making our examination of any documents executed by the parties indicated therein, we have also assumed, without independent verification or

inquiry, that each party had the power, corporate or other, to enter into and perform all obligations thereunder, and have assumed the due authorization by all requisite action, corporate or other, and execution and delivery by each party indicated

in the documents that such documents constitute valid and binding obligations of each party.

|

| ABU DHABI | BEIJING | BRUSSELS | FRANKFURT |

HONG KONG | LONDON | MILAN | NEW YORK | PALO

ALTO PARIS | ROME | SAN

FRANCISCO | SÃO PAULO | SHANGHAI | SINGAPORE |

TOKYO | TORONTO | WASHINGTON, DC |

SHEARMAN & STERLING LLP IS A LIMITED LIABILITY PARTNERSHIP ORGANIZED IN THE UNITED STATES UNDER THE LAWS OF THE STATE

OF DELAWARE, WHICH LAWS LIMIT THE PERSONAL LIABILITY OF PARTNERS.

Based on the foregoing and in reliance thereon, and on an analysis of the Code, the regulations

promulgated thereunder, judicial authority and current administrative rulings and such other laws as we have deemed relevant and necessary, and subject to the qualifications, exceptions and limitations contained therein, we are of the opinion that,

for United States federal income tax purposes:

| |

1. |

commencing with its taxable year ending on December 31, 2014, the Company has been organized in conformity with the requirements for qualification and taxation as a REIT under the Code, and that its current and

proposed method of operation will enable it to meet the requirements for qualification and taxation as a REIT under the Code for its taxable year ending December 31, 2014 and thereafter; and |

| |

2. |

the statements in the Registration Statement under the caption “U.S. Federal Income Tax Considerations,” insofar as such statements constitute summaries of legal matters referred to therein, fairly summarize

in all material respects the legal matters referred to therein. |

As described in the Registration Statement, qualification

of the Company as a REIT will depend upon the satisfaction by the Company, through actual operating results, distribution levels, diversity of stock ownership and otherwise, of the applicable asset composition, source of income, shareholder

distribution, recordkeeping and other requirements of the Code necessary for a corporation to qualify as a REIT. Accordingly, no assurance can be given that the actual results of the Company’s operations for any taxable year will satisfy all

such requirements. We do not undertake to monitor whether the Company actually will satisfy the various qualification tests. In addition, no assurance can be given that the conclusions of United States federal income tax law will not be successfully

challenged by the Internal Revenue Service or significantly altered by new legislation, changes in Internal Revenue Service positions or judicial decisions, any of which challenges or alterations may be applied retroactively with respect to

completed transactions.

The opinion set forth herein is limited to those matters expressly covered and is as of the date hereof. No

opinion is to be implied with respect to any other matter. We expressly disclaim any responsibility to advise you of any development or circumstance of any kind, including any change of law or fact, that may occur after the date of this opinion that

might affect the opinion expressed herein. Please be advised that our opinion is not binding on the Internal Revenue Service or the courts, and that no assurances can be given that the Internal Revenue Service will not take a contrary position upon

examination, or that a court will not reach a contrary conclusion in litigation.

Very truly yours,

/s/ Shearman & Sterling LLP

Shearman & Sterling LLP

2

Exhibit 23.1

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We consent to the use of our reports with respect to the following financial statements:

| |

• |

|

our report dated March 11, 2014 with respect to the combined balance sheets of City Office REIT, Inc. Predecessor as of December 31, 2013 and 2012 and the related combined statements of operations, changes in

equity and cash flows for each of the years in the two year period ended December 31, 2013 and the financial statement schedule III for the year ended December 31, 2013; |

| |

• |

|

our report dated March 6, 2014 with respect to the balance sheet of City Office REIT, Inc. as of December 31, 2013; |

| |

• |

|

our report dated March 11, 2014 with respect to the balance sheets of ROC-SCCP Cherry Creek I, LP as of December 31, 2013 and 2012 and the related statements of operations, changes in partners’ capital

and cash flows for each of the years in the two year period ended December 31, 2013; |

| |

• |

|

our report dated January 9, 2014 with respect to the statement of revenues and certain expenses of Washington Group Plaza for the year ended December 31, 2012; |

| |

• |

|

our report dated January 9, 2014 with respect to the statement of revenues and certain expenses of Corporate Parkway for the year ended December 31, 2012; |

| |

• |

|

our report dated August 5, 2014 with respect to the statement of revenues and certain expenses of Plaza 25 for the year ended December 31, 2013; |

| |

• |

|

our report dated October 1, 2014 with respect to the statement of revenues and certain expenses of Lake Vista Pointe for the year ended December 31, 2013, and |

| |

• |

|

our report dated December 2, 2014 with respect to the statement of revenues and certain expenses of Florida Research Park for the year ended December 31, 2013, |

all incorporated by reference herein and to the reference to our firm under the heading “Experts” in the prospectus.

/s/ KPMG LLP

Chartered Accountants

Vancouver, Canada

December 4, 2014

KPMG LLP is a Canadian limited liability partnership and a member firm of the

KPMG network of independent member firms

affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. KPMG

Canada provides services to

KPMG LLP.

KPMG Confidential

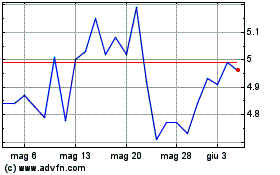

Grafico Azioni City Office REIT (NYSE:CIO)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni City Office REIT (NYSE:CIO)

Storico

Da Lug 2023 a Lug 2024