Current Report Filing (8-k)

06 Luglio 2015 - 10:10PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 30, 2015

City Office REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Maryland

(State or other jurisdiction of

incorporation or organization) |

|

001-36409

(Commission File Number) |

|

98-1141883

(I.R.S. Employer Identification

No.) |

|

|

| 1075 West Georgia Street, Suite 2600,

Vancouver, British Columbia,

(Address of principal executive offices) |

|

V6E 3C9

(Zip Code) |

(604) 806-3366

(Registrant’s telephone number, including area code)

Not Applicable

(Former name

or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

On June 30, 2015, City Office REIT, Inc. (the

“Company”) issued a press release announcing that the Company closed on the acquisition of the property known as DTC Crossroads, a 191,402 square foot Class A multi-tenant office property in the Denver Technological Center submarket

of Denver, Colorado (the “Property”). The Property was purchased from an unaffiliated third-party seller for a purchase price of $35 million, exclusive of closing costs.

| Item 9.01 |

Financial Statements and Exhibits. |

(a) Financial Statements of Property Acquired

To the extent required by this item, historical financial statements for the Property will be filed in an amendment to this current report on Form 8-K no

later than 71 calendar days after the date of this report.

(b) Pro Forma Financial Information

To the extent required by this item, pro forma financial information relating to the acquisition of the Property will be filed in an amendment to this current

report on Form 8-K no later than 71 calendar days after the date of this report.

(c) Not applicable.

(d) Exhibits:

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

City Office REIT, Inc. Press Release, dated June 30, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CITY OFFICE REIT, INC. |

|

|

|

|

| Date: July 6, 2015 |

|

|

|

By: |

|

/s/ James

Farrar

|

|

|

|

|

Name: |

|

James Farrar |

|

|

|

|

Title: |

|

Chief Executive Officer |

EXHIBIT INDEX

|

|

|

Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

City Office REIT, Inc. Press Release, dated June 30, 2015. |

Exhibit 99.1

City Office REIT Announces Closing of Office Property in Denver, Colorado

VANCOUVER—June 30, 2015—City Office REIT, Inc. (NYSE: CIO) announced today the closing of the previously announced acquisition of

DTC Crossroads in Denver, Colorado for a purchase price of $35 million, exclusive of closing costs. DTC Crossroads is a 191,402 square foot Class A multi-tenant office property that is 91% occupied at June 30, 2015 in the Denver

Technological Center (“DTC”) submarket. “We are very pleased with the DTC Crossroads acquisition”, said Greg Tylee, President and Chief Operating Officer of City Office REIT. “Crossroads is one of the top buildings in the

DTC submarket, acquired at a compelling yield and cost base. Denver is one of our leading target markets, and we have achieved market scale with well-located assets across Denver’s strongest submarkets.”

The acquisition is anticipated to generate an initial full-year cash net operating income yield of approximately 7.6% based on the purchase

price.

About City Office REIT, Inc.

City Office REIT is a real estate company focused on acquiring, owning and operating high-quality (Class A and B) office properties located in

attractive target markets primarily in the Southern and Western United States. City Office REIT currently owns or has an interest in 2.7 million square feet of office properties. Additional information about City Office REIT is available on the

company’s website at www.cityofficereit.com. The Company intends to elect to be taxed as a real estate investment trust for U.S.

federal income tax purposes.

Forward-looking Statements

This press release contains “forward looking statements” within the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995 and other federal securities laws. All statements that are not statements of historical facts are, or may be deemed to be, forward looking statements. Forward looking statements reflect our current

expectations concerning future results, objectives, plans and goals, and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause future results, performance or achievements to differ. These

risks, uncertainties and other factors include factors described in our news releases and filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the year ended December 31, 2014, which has been filed

with the Securities and Exchange Commission. Readers of this press release are cautioned to consider these risks and uncertainties and not to place undue reliance on any forward-looking statements. The Company does not undertake any obligation

to update any forward-looking statement, whether written or oral, relating to matters discussed in this press release, except as may be required by applicable securities laws.

Contact

City Office REIT, Inc.

Anthony Maretic, CFO

+1-604-806-3366

investorrelations@cityofficereit.com

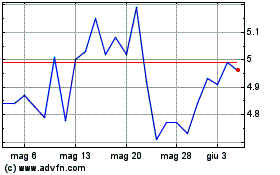

Grafico Azioni City Office REIT (NYSE:CIO)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni City Office REIT (NYSE:CIO)

Storico

Da Lug 2023 a Lug 2024