UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 6, 2015

City Office REIT, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Maryland |

|

001-36409 |

|

98-1141883 |

| (State or other jurisdiction of

incorporation or organization) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

|

|

| 1075 West Georgia Street, Suite 2600,

Vancouver, British Columbia, |

|

V6E 3C9 |

| (Address of principal executive offices) |

|

(Zip Code) |

(604) 806-3366

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 2.02. |

Results of Operations and Financial Condition. |

City Office REIT, Inc. (the

“Company”) issued a press release on November 6, 2015 announcing its financial results for the quarter ended September 30, 2015. A copy of the press release is attached hereto as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1 furnished pursuant to Item 9.01, shall not

be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities under that Section. Furthermore, the information in Item 2.02 of this Current Report on Form 8-K,

including Exhibit 99.1 furnished pursuant to Item 9.01, shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933.

| Item 9.01 |

Financial Statements and Exhibits. |

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

City Office REIT, Inc. Press Release, dated November 6, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the

undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CITY OFFICE REIT, INC. |

|

|

|

|

| Date: November 6, 2015 |

|

|

|

By: |

|

/s/ James Farrar |

|

|

|

|

Name: |

|

James Farrar |

|

|

|

|

Title: |

|

Chief Executive Officer |

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 99.1 |

|

City Office REIT, Inc. Press Release, dated November 6, 2015. |

Exhibit 99.1

City Office REIT Reports Third Quarter 2015 Results

VANCOUVER—November 6, 2015—City Office REIT, Inc. (NYSE: CIO) (the “Company” or “City Office”), today announced its results for

the quarter ended September 30, 2015.

Third Quarter Highlights

| |

• |

|

Achieved Core Funds From Operations (“Core FFO”) of $5.1 million, or $0.33 per fully diluted share; |

| |

• |

|

Reported Adjusted Funds From Operations (“AFFO”) of $4.2 million, or $0.26 per fully diluted share; |

| |

• |

|

Increased in-place and committed occupancy from 95.2% to 95.4% representing the sixth consecutive quarter of increases; |

| |

• |

|

Executed approximately 95,000 square feet of new and renewal leases during the quarter, including leases which will commence subsequent to quarter end; |

| |

• |

|

Completed the previously announced 190 Office Center (previously called “Granite 190”) and Intellicenter acquisitions in Dallas, Texas and Tampa, Florida for a combined purchase price of $101 million; and

|

| |

• |

|

Subsequent to the end of the third quarter, entered into definitive agreements to internalize its’ management effective February 1, 2016. |

“City Office executed well against a number of our key priorities during the third quarter,” commented James Farrar, City Office’s Chief

Executive Officer. “We closed on $101 million of acquisitions, continued with our strong leasing momentum and achieved solid results with $0.33 of Core FFO per share and $0.26 of AFFO per share. This is a testament to the quality of execution

by our team and the impressive leasing fundamentals in our target markets. Furthermore, as announced in our press release on November 2nd, we have made the decision to become an internally

managed company on February 1, 2016. This decision positions us to secure a committed and aligned management team, realize economies of scale as we grow and expand our potential investor universe.”

Financial Results for the Third Quarter 2015

Core FFO

was $5.1 million or $0.33 per fully diluted share. AFFO was $4.2 million, or $0.26 per fully diluted share. Net loss attributable to the Company for the three months ended September 30, 2015 was $2.5 million, or ($0.20) per share.

A reconciliation of Core FFO, AFFO and NOI to GAAP net income can be found at the end of this release.

Portfolio Operations

The Company reported that its total

portfolio as of September 30, 2015 contained 3.3 million net rentable square feet and was 95.4% occupied, including recently signed leases not commenced at the end of the third quarter. Excluding the impact of acquisitions that occurred

during the quarter, this represents approximately a 20 basis point increase compared to the end of the prior quarter. City Office’s net

1

operating income (“NOI”) was $9.1 million on a GAAP basis and $8.4 million on a cash basis during the third quarter of 2015. NOI included limited results from both 190 Office Center and

Intellicenter, which were both acquired on September 3, 2015.

Leasing Activity

During the third quarter of 2015, the Company commenced three new leases for 5,000 square feet and seven renewals for 14,000 square feet. Early renewals signed

in the third quarter totalled 15,000 square feet, taking the total leasing activity in the quarter to 34,000 square feet.

New Leasing – During the

third quarter of 2015, the Company signed 61,000 square feet of new leases with a weighted average lease term of 7.0 years at an average rent per square foot of $22.75 and at an average cost of $2.45 per square foot per year. The new leasing

includes 33,424 square feet leased to Kaiser Foundation Health Plan, Inc., at the Company’s Amberglen property. This ten year lease will commence on April 1, 2016 for the 2430 building where a known vacate will occur on December 31,

2015.

Renewal Leasing – The Company signed 15,000 square feet of renewal leases at an average rent per square foot of $26.28 and at an average cost

of $1.63 per square foot per year.

Investment Activity

The Company completed the acquisition of the 190 Office Center, a 302,829 square foot Class A multi-tenant property in Dallas, Texas for $54.4 million, or

$179 per square foot. 190 Office Center is a two building property constructed in 2001 and 2008 that is 98% leased to a variety of strong credit tenants. It is well located in the growing Richardson/Plano submarket of Dallas with frontage on the

President George Bush Turnpike. The property has quality amenities including nine foot clear ceiling heights, excellent window lines, one of the highest parking ratios in the submarket and large efficient 50,000 square foot floorplates that are well

suited to the market’s corporate tenant base. The acquisition is anticipated to generate an initial full-year cash net operating income yield of approximately 7.5% based on the purchase price, inclusive of free rent credits funded by the seller

at closing. The acquisition was financed with a $41.3 million mortgage that has been fixed at a 4.79% interest rate for 10 years.

The Company completed

the acquisition of Intellicenter, a 203,509 square foot Class A multi-tenant property in Tampa, Florida for $44.6 million, or $219 per square foot. Intellicenter is a four story office building constructed in 2008 that is 100% leased to a

variety of strong credit tenants. The property is well located on the I-75 Corridor submarket in the Tampa Telecom Park and is in close proximity to the University of South Florida. Intellicenter caters to large corporate tenants that require

efficient floorplates and a premium quality office environment. The building offers impressive features such as nine foot ceiling heights, raised access flooring with underfloor air distribution and a desirable 5.6 per 1,000 square foot parking

ratio. The acquisition is anticipated to generate an initial full-year cash net operating income yield of approximately 7.3%. In addition, as part of the transaction the Company has also purchased an adjacent 14.1 acre development site for $2.0

million. The combined purchase price of Intellicenter and the land is $46.6 million, and is anticipated to generate a combined initial full-year cash net operating income yield of 7.0%. The acquisition was financed with a $33.6 million mortgage

that has been fixed at a 4.65% interest rate for 10 years and a $14.0 million one year floating rate term loan with KeyBank.

2

Management Internalization

On November 2, 2015, the Company announced that it has entered into definitive agreements to internalize its management effective February 1, 2016.

The Company believes that internalization will allow City Office to realize economies of scale and enhance its earnings potential as it grows. The transaction, which was negotiated and approved by a committee of independent directors, provides

for the Company to acquire its current external advisor and directly employ the advisor’s existing management team and other employees. The independent directors of the Company believe that the effective termination of the external

advisory relationship and internalization of management will reduce expenses as the Company grows and further align the interests of management, the Board of Directors and shareholders.

Key Aspects of the Internalization:

| |

• |

|

Continuity of Management Team – The management team of the Company’s external advisor, including the Company’s current executive officers, will become employees of City Office. The Company

will enter into employment agreements with each of its Chief Executive Officer, its President and its Chief Financial Officer providing a seamless transition and clarity as to future senior leadership. |

| |

• |

|

Favorable Internalization Economics – In connection with the internalization, City Office will enter into an administrative services agreement to provide certain affiliates of the external advisor

administrative services and support and will receive an aggregate of $3.25 million for such services over the three years following closing of the internalization. In addition, the agreements provide for the immediate elimination of the 1.0%

acquisition fee payable by the Company to the advisor under the advisory agreement. |

| |

• |

|

Economies of Scale and Accretion – Through the immediate elimination of the acquisition fee and the elimination of the base management fee effective February 1, 2016, the transaction permits economies

of scale as the Company’s equity capital grows. Excluding the one-time costs associated with the internalization, the Company expects the transaction to be accretive to FFO, and as the Company grows, accretive to both Core FFO and AFFO.

|

| |

• |

|

Alignment of Interests – The internal management structure creates a stronger alignment of interests among management, the Board of Directors and shareholders. It also empowers the Board of Directors

and the internal management team with full strategic and operational control. The Company also believes an internal management structure is preferred by the investment community over an external management structure allowing for greater

diversity in its shareholder base. |

The Company’s current Advisory Agreement, amended to provide for elimination of the acquisition fee

payable, remains in effect until February 1, 2016. Effective February 1, 2016, City Office will acquire the external advisor (City Office Real Estate Management Inc.), in exchange for an aggregate of 297,321 shares of City Office

common stock. This was determined based on a $3.5 million purchase price and using the 10 day volume weighted average stock price of approximately $11.77 at October 30, 2015. City Office will also pay up to an additional $3.5 million

of cash if, but only if, the Company achieves the following fully diluted market capitalization thresholds prior to December 31, 2016: $1.0 million upon achieving a $200 million fully diluted market capitalization, an additional $1.0 million

upon achieving a $225 million fully diluted market capitalization and an additional $1.5 million upon achieving a $250 million fully diluted market capitalization.

3

Capital Structure

As of September 30, 2015, the Company had total outstanding debt of approximately $344.9 million. 81.4% of the Company’s outstanding debt was fixed

rate, with a weighted average maturity of 6.1 years.

Dividend

On September 15, 2015, the Company’s board of directors declared a cash dividend of $0.235 per share for the three months ended September 30,

2015. The dividend was paid on October 19, 2015 to stockholders and common unitholders of record on October 5, 2015.

Webcast and Conference

Call Details

City Office’s management will hold a conference call at 11:00 am Eastern Time on November 6, 2015.

The webcast will be available under the “Investor Relations” section of the Company’s website at www.cityofficereit.com. The conference

call can be accessed by dialing 1-866-262-0919 for domestic callers and 1-412-902-4106 for international callers.

A replay of the call will be available

later in the day on November 6, 2015, continuing through 11:59pm Eastern Time on February 6, 2016 and can be accessed by dialing 1-877-344-7529 for domestic callers and 1-412-317-0088 for international callers. The passcode for the replay

is 10074251. A replay will also be available for twelve months following the call at “Webcasts & Events” in the “Investor Relations” section of the company’s website.

A supplemental financial package to accompany the discussion of the results will be posted on www.cityofficereit.com under the “Investor

Relations” section.

Non-GAAP Financial Measures

FFO, Core FFO, AFFO and NOI are supplemental non-GAAP financial measures.

Funds from Operations (“FFO”) – The National Association of Real Estate Investment Trusts (“NAREIT”) states FFO should

represent net income or loss (computed in accordance with GAAP) plus real estate related depreciation and amortization (excluding amortization of deferred financing costs) and after adjustments of unconsolidated partnerships and joint ventures,

gains or losses on the sale of property and impairments to real estate.

The Company uses FFO as a supplemental performance measure because it

believes that FFO is beneficial to investors as a starting point in measuring the Company’s operational performance. We also believe that, as a widely recognized measure of the performance of REITs, FFO will be used by investors as a basis to

compare the Company’s operating performance with that of other REITs.

However, because FFO excludes depreciation and amortization and captures

neither the changes in the value of the Company’s properties that result from use or market conditions nor the level of capital

4

expenditures and leasing commissions necessary to maintain the operating performance of the Company’s properties, all of which have real economic effects and could materially impact the

Company’s results from operations, the utility of FFO as a measure of the Company’s performance is limited. In addition, other equity REITs may not calculate FFO in accordance with the NAREIT definition as the Company does, and,

accordingly, the Company’s FFO may not be comparable to such other REITs’ FFO. Accordingly, FFO should be considered only as a supplement to net income as a measure of the Company’s performance.

Core Funds from Operations (“Core FFO”) – We calculate Core FFO by using FFO as defined by NAREIT and adjusting for certain other

non-core items. We also exclude from our Core FFO calculation acquisition costs, loss on early extinguishment of debt, changes in the fair value of the earn-out and the amortization of stock based compensation.

Adjusted Funds From Operations (“AFFO”) – We compute AFFO by adding to Core FFO the non-cash amortization of deferred financing fees,

and non-real estate depreciation, and then subtracting cash paid for recurring tenant improvements, leasing commissions, and capital expenditures, and eliminating the net effect of straight-line rents, deferred market rent and debt fair value

amortization. Recurring capital expenditures exclude development / redevelopment activities, capital expenditures planned at acquisition and costs to reposition a property. We exclude first generation leasing costs within the first two years of our

initial public offering or acquisition, which are generally to fill vacant space in properties we acquire or were planned at acquisition. We have further excluded all costs associated with tenant improvements, leasing commissions and capital

expenditures which were funded by the entity contributing the properties at closing.

Forward-looking Statements

This press release contains “forward looking statements” within the meaning of the “safe harbor” provisions of the Private Securities

Litigation Reform Act of 1995 and other federal securities laws. All statements that are not statements of historical facts are, or may be deemed to be, forward looking statements. These factors include, but are not limited to, the

Company’s ability to source and acquire properties on attractive terms, or at all; the Company’s expectations and forecasts of future leasing activity at its current and future properties, and the Company’s ability to accurately model

the income yield, capitalization rate, and other financial metrics used to evaluate its properties. These and other material risks are described in the Company’s Annual Report on 10-K for the year ended December 31, 2014 and any other

documents filed by the Company from time to time, which are available from the Company and from the SEC, and you should read and understand these risks when evaluating any forward-looking statement. The Company does not have any obligation to

publicly update any forward looking statements to reflect subsequent events or circumstances.

5

City Office REIT, Inc. and Predecessor

Condensed Consolidated and Combined Balance Sheets

(Unaudited)

(In

thousands, except par value and share data)

|

|

|

|

|

|

|

|

|

| |

|

September 30,

2015 |

|

|

December 31,

2014 |

|

| Assets |

|

|

|

|

|

|

|

|

| Real estate properties, cost |

|

|

|

|

|

|

|

|

| Land |

|

$ |

90,205 |

|

|

$ |

66,204 |

|

| Buildings and improvements |

|

|

254,934 |

|

|

|

132,964 |

|

| Tenant improvement |

|

|

34,509 |

|

|

|

27,773 |

|

| Furniture, fixtures and equipment |

|

|

198 |

|

|

|

198 |

|

|

|

|

|

|

|

|

|

|

|

|

|

379,846 |

|

|

|

227,139 |

|

| Accumulated depreciation |

|

|

(23,304 |

) |

|

|

(15,311 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

356,542 |

|

|

|

211,828 |

|

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

10,516 |

|

|

|

34,862 |

|

| Restricted cash |

|

|

17,420 |

|

|

|

11,093 |

|

| Rents receivable, net |

|

|

12,676 |

|

|

|

7,981 |

|

| Deferred financing costs, net of accumulated amortization |

|

|

3,585 |

|

|

|

2,901 |

|

| Deferred leasing costs, net of accumulated amortization |

|

|

4,936 |

|

|

|

2,618 |

|

| Acquired lease intangibles assets, net |

|

|

44,245 |

|

|

|

29,391 |

|

| Prepaid expenses and other assets |

|

|

1,396 |

|

|

|

832 |

|

|

|

|

|

|

|

|

|

|

| Total Assets |

|

$ |

451,316 |

|

|

$ |

301,506 |

|

|

|

|

|

|

|

|

|

|

| Liabilities and Equity |

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

| Debt |

|

$ |

344,946 |

|

|

$ |

189,940 |

|

| Accounts payable and accrued liabilities |

|

|

10,615 |

|

|

|

4,080 |

|

| Deferred rent |

|

|

3,147 |

|

|

|

2,212 |

|

| Tenant rent deposits |

|

|

2,184 |

|

|

|

1,862 |

|

| Acquired lease intangibles liability, net |

|

|

2,534 |

|

|

|

606 |

|

| Dividend distributions payable |

|

|

3,663 |

|

|

|

3,571 |

|

| Earn-out liability |

|

|

5,437 |

|

|

|

8,000 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities |

|

|

372,526 |

|

|

|

210,271 |

|

|

|

|

|

|

|

|

|

|

| Commitments and Contingencies Equity: |

|

|

|

|

|

|

|

|

| Common stock, $0.01 par value, 100,000,000 shares authorized, 12,517,777 shares issued and outstanding |

|

|

125 |

|

|

|

123 |

|

| Additional paid-in capital |

|

|

94,814 |

|

|

|

91,308 |

|

| Accumulated deficit |

|

|

(25,104 |

) |

|

|

(11,320 |

) |

|

|

|

|

|

|

|

|

|

| Total Stockholders’ Equity |

|

|

69,835 |

|

|

|

80,111 |

|

| Operating Partnership unitholders’ non-controlling interests |

|

|

9,648 |

|

|

|

11,878 |

|

| Non-controlling interests in properties |

|

|

(693 |

) |

|

|

(754 |

) |

|

|

|

|

|

|

|

|

|

| Total Equity |

|

|

78,790 |

|

|

|

91,235 |

|

|

|

|

|

|

|

|

|

|

| Total Liabilities and Equity |

|

$ |

451,316 |

|

|

$ |

301,506 |

|

|

|

|

|

|

|

|

|

|

6

City Office REIT, Inc. and Predecessor

Condensed Consolidated and Combined Statements of Operations

(Unaudited)

(In

thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

| |

|

2015 |

|

|

2014 |

|

|

2015 |

|

|

2014 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rental income |

|

$ |

12,601 |

|

|

$ |

9,037 |

|

|

$ |

32,838 |

|

|

$ |

23,988 |

|

| Expense reimbursement |

|

|

1,701 |

|

|

|

844 |

|

|

|

3,737 |

|

|

|

1,796 |

|

| Other |

|

|

313 |

|

|

|

118 |

|

|

|

934 |

|

|

|

590 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Revenues |

|

|

14,615 |

|

|

|

9,999 |

|

|

|

37,509 |

|

|

|

26,374 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Property operating expenses |

|

|

5,521 |

|

|

|

3,929 |

|

|

|

13,764 |

|

|

|

10,190 |

|

| Acquisition costs |

|

|

1,802 |

|

|

|

401 |

|

|

|

2,893 |

|

|

|

1,551 |

|

| Stock based compensation |

|

|

487 |

|

|

|

382 |

|

|

|

1,403 |

|

|

|

667 |

|

| General and administrative |

|

|

411 |

|

|

|

407 |

|

|

|

1,313 |

|

|

|

821 |

|

| Base management fee |

|

|

322 |

|

|

|

226 |

|

|

|

981 |

|

|

|

411 |

|

| External advisor acquisition |

|

|

174 |

|

|

|

— |

|

|

|

174 |

|

|

|

— |

|

| Depreciation and amortization |

|

|

5,888 |

|

|

|

4,058 |

|

|

|

14,788 |

|

|

|

10,634 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total Operating Expenses |

|

|

14,605 |

|

|

|

9,403 |

|

|

|

35,316 |

|

|

|

24,274 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating income |

|

|

10 |

|

|

|

596 |

|

|

|

2,193 |

|

|

|

2,100 |

|

| Interest Expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Contractual interest expense |

|

|

(2,798 |

) |

|

|

(1,867 |

) |

|

|

(6,910 |

) |

|

|

(5,821 |

) |

| Amortization of deferred financing costs |

|

|

(196 |

) |

|

|

(160 |

) |

|

|

(550 |

) |

|

|

(1,289 |

) |

| Loss on early extinguishment of Predecessor debt |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,655 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2,994 |

) |

|

|

(2,027 |

) |

|

|

(7,460 |

) |

|

|

(8,765 |

) |

| Change in fair value of earn-out |

|

|

— |

|

|

|

(943 |

) |

|

|

(600 |

) |

|

|

(1,048 |

) |

| Gain on equity investment |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

4,475 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

|

|

(2,984 |

) |

|

|

(2,374 |

) |

|

|

(5,867 |

) |

|

|

(3,238 |

) |

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net (income)/loss attributable to noncontrolling interests in properties |

|

|

(116 |

) |

|

|

(87 |

) |

|

|

(371 |

) |

|

|

(8 |

) |

| Net loss/(income) attributable to Predecessor |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,973 |

) |

| Net loss attributable to Operating Partnership unitholders’ noncontrolling interests |

|

|

601 |

|

|

|

694 |

|

|

|

1,199 |

|

|

|

1,508 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss attributable to stockholders |

|

$ |

(2,499 |

) |

|

$ |

(1,767 |

) |

|

$ |

(5,039 |

) |

|

$ |

(3,711 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

(0.20 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.46 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

$ |

12,473 |

|

|

$ |

8,193 |

|

|

$ |

12,373 |

|

|

$ |

8,134 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Dividends/distributions declared per common share and unit |

|

$ |

0.235 |

|

|

$ |

0.235 |

|

|

$ |

0.705 |

|

|

$ |

0.418 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

7

City Office REIT, Inc.

Reconciliation of Net Operating Income

(Unaudited)

(In

thousands)

|

|

|

|

|

| |

|

Three Months

Ended Sept 30,

2015 |

|

| Net loss |

|

$ |

(2,984 |

) |

| Adjustments to net loss: |

|

|

|

|

| General and administrative |

|

|

411 |

|

| Contractual interest expense |

|

|

2,798 |

|

| Amortization of deferred financing costs |

|

|

196 |

|

| Depreciation and amortization |

|

|

5,888 |

|

| Acquisition costs |

|

|

1,802 |

|

| Stock based compensation |

|

|

487 |

|

| Base management fee |

|

|

322 |

|

| External advisor acquisition |

|

|

174 |

|

|

|

|

|

|

| Net Operating Income (“NOI”) |

|

$ |

9,094 |

|

| Net straight line rent adjustment |

|

|

(760 |

) |

| Net amortization of above and below market leases |

|

|

72 |

|

|

|

|

|

|

| Portfolio Adjusted Cash NOI |

|

$ |

8,406 |

|

| Non-controlling interests in properties – share in cash NOI |

|

|

(305 |

) |

|

|

|

|

|

| Adjusted Cash NOI (CIO share) |

|

$ |

8,101 |

|

|

|

|

|

|

8

City Office REIT, Inc.

Reconciliation of Net Income (Loss) to Funds from Operations (“FFO”) Core FFO and Adjusted FFO

(Unaudited)

(In

thousands, except share and per share data)

|

|

|

|

|

| |

|

Three Months

Ended Sept 30,

2015 |

|

| Net loss attributable to stockholders |

|

$ |

(2,499 |

) |

| (+) Depreciation and amortization |

|

|

5,888 |

|

| (-) Operating Partnership unitholders’ noncontrolling interest |

|

|

(601 |

) |

|

|

|

|

|

|

|

|

2,788 |

|

| Non-controlling interests in properties: |

|

|

|

|

| (-) Share of net loss |

|

|

116 |

|

| (-) Share of FFO |

|

|

(221 |

) |

|

|

|

|

|

| Funds from Operations (“FFO”) |

|

$ |

2,683 |

|

|

|

|

|

|

| (+) Acquisition costs |

|

|

1,802 |

|

| (+) Stock based compensation |

|

|

487 |

|

| (+) Change in fair value of earn-out |

|

|

— |

|

| (+) External advisor acquisition |

|

|

174 |

|

|

|

|

|

|

| Core FFO |

|

$ |

5,146 |

|

|

|

|

|

|

| (-) Net straight line rent adjustment |

|

|

(760 |

) |

| (+) Net amortization of above and below market leases |

|

|

72 |

|

| (+) Net amortization of deferred financing costs |

|

|

191 |

|

| (-) Net recurring tenant improvement |

|

|

(53 |

) |

| (-) Net recurring leasing commissions |

|

|

(92 |

) |

| (-) Net recurring capital expenditures |

|

|

(347 |

) |

|

|

|

|

|

| Adjusted Funds from Operations (“AFFO”) |

|

$ |

4,157 |

|

|

|

|

|

|

| Core FFO per share and common unit |

|

$ |

0.33 |

|

|

|

|

|

|

| AFFO per share and common unit |

|

$ |

0.26 |

|

|

|

|

|

|

| Dividends per share and common unit |

|

$ |

0.235 |

|

| Core FFO Payout Ratio |

|

|

72 |

% |

| AFFO Payout Ratio |

|

|

89 |

% |

| Weighted average common stock and common units outstanding |

|

|

15,809,435 |

|

9

Contact

City Office REIT, Inc.

Anthony Maretic, CFO

+1-604-806-3366

investorrelations@cityofficereit.com

10

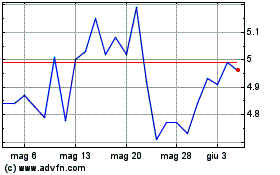

Grafico Azioni City Office REIT (NYSE:CIO)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni City Office REIT (NYSE:CIO)

Storico

Da Lug 2023 a Lug 2024