GGP shareholders can elect to receive for each

GGP share either $23.50 in cash, or either one BPY unit or one

share of a newly created U.S. REIT, subject to proration, for an

aggregate cash / equity consideration ratio of approximately 61% /

39% Transaction expected to be immediately accretive to

FFO/unit for BPY unitholders; BPY’s current per unit distribution

is more than 40% higher than the per share dividend currently

received by GGP shareholders Special Committee of GGP unanimously

recommends the transaction

Brookfield Property Partners L.P. (“BPY”) (NASDAQ:BPY) (TSX:BPY.UN)

and the Special Committee of the Board of Directors of GGP Inc.

(the “Special Committee”) today announced that BPY and GGP Inc.

(“GGP”) (NYSE:GGP) have entered into a definitive agreement for BPY

to acquire all of the outstanding shares of common stock of GGP

other than those shares currently held by BPY and its affiliates.

In the transaction, GGP shareholders will be

entitled to elect to receive, for each GGP common share, either

$23.50 in cash or either one BPY unit or one share of a new BPY

U.S. REIT security, subject to proration based on aggregate cash

consideration of $9.25 billion.

As compared to the offer to acquire GGP that BPY

publicly announced on November 13, 2017, the transaction

includes:

- An increase in the cash consideration from $23.00 to $23.50 per

GGP share;

- A $1.85 billion increase in the aggregate cash consideration,

from $7.4 billion to $9.25 billion;

- An increase in the exchange ratio from 0.9656 to 1.0000;

and

- The creation of a new BPY U.S. REIT (“BPR”) that will qualify

as a REIT for tax purposes and issue shares in the transaction.

Shares in BPR are structured with the intention of providing an

economic return equivalent to BPY units, including identical

distributions. BPR shareholders will have the right to exchange

each BPR share for one BPY unit, or the cash equivalent of one BPY

unit, at the election of BPY. Brookfield Asset Management

(“BAM”) (NYSE: BAM; TSX: BAM.A; Euronext: BAMA) has agreed that,

for a period of at least 20 years, it will guarantee the BPR

shareholders’ right to exchange a BPR share for a BPY unit or the

cash equivalent of a BPY unit, as described above.

The Special Committee, comprised of

non-executive, independent directors, has unanimously recommended

that GGP shareholders approve the transaction. The Special

Committee believes the transaction is fair to and in the best

interests of GGP shareholders.

As a result of the transaction, GGP shareholders

who receive equity consideration will be entitled to receive the

same amount as BPY’s current distribution on the BPY units or BPR

shares they receive, which is over 40% higher than GGP’s dividend

(BPY annual distribution of $1.26 per unit vs. GGP dividend of

$0.88 per share).

Brian Kingston, CEO of Brookfield Property

Partners, said, “This is a compelling transaction that enables GGP

shareholders to receive premium value for their shares and gives

them the ability to participate in the long-term upside of their

investment. We are pleased to have reached an agreement and are

excited about combining Brookfield’s access to large-scale capital

and deep operating expertise across multiple real estate sectors

with GGP’s portfolio of irreplaceable retail assets.”

He continued, “The introduction of the new BPR

shares will allow GGP shareholders to efficiently participate in

the transaction.”

Daniel Hurwitz, Lead Director and Chairman of

the Special Committee, said, “Since receiving Brookfield’s initial

proposal in November, the Special Committee has conducted extensive

due diligence, specifically evaluating the optimal consideration

structure for GGP’s shareholders. After careful consideration,

assisted by our independent advisors, the Special Committee

determined that Brookfield’s improved proposal, which includes an

increase in the cash portion of the consideration and the ability

to receive shares in a newly listed REIT entity, provides GGP

shareholders with certainty of value, as well as upside potential

through ownership in a globally diversified real estate company. We

are pleased to have reached this agreement, which we believe is in

the best interests of GGP and our shareholders.”

With an ownership interest in approximately $90

billion in total assets and annual net operating income of more

than $4 billion, the combined company will be one of the world’s

largest commercial real estate enterprises. Following completion of

the transaction, GGP shareholders will own approximately 26% of the

combined company (calculated based on all BPR shares having been

exchanged for BPY units and pro forma for the proposed BAM

preferred share conversion as described below), which will possess

one of the highest quality and most diverse portfolios of property

globally, with a fortress balance sheet and strong overall

financial profile.

Transaction Details

GGP shareholders will be entitled to elect to

receive, for each GGP common share, either $23.50 in cash or either

one BPY unit or one BPR share. Elections are subject to

proration which will be based on aggregate consideration in the

transaction of (1) a fixed amount of $9.25 billion in cash and (2)

approximately 254 million BPY units / BPR shares, which represents

aggregate consideration of approximately 61% cash and approximately

39% of BPY or BPR equity.

The consideration in the transaction will be

structured as (1) a dividend by GGP paid in cash and equity

(subject to proration) and (2) merger consideration paid in

cash. As a result, all GGP shareholders will receive a

portion of the consideration in cash (regardless of their

election).

The cash portion of the consideration will be

funded by a combination of approximately $4 billion from joint

venture equity partners, and financings from a syndicate of lenders

led by Deutsche Bank, Morgan Stanley, RBC Capital Markets and Wells

Fargo Bank, National Association, with additional commitments from

Bank of America Merrill Lynch, Barclays, HSBC, SMBC, and The

Toronto-Dominion Bank.

In conjunction with and in support of the

proposed transaction, BAM has stated its intention to convert $500

million currently held in BPY Class C Junior Preferred Shares into

BPY units at a price of $23.50 per unit, resulting in BAM’s

acquisition of approximately 21.3 million BPY units.

In addition, to allow for synergies and cost

savings between BPY and GGP to be effectuated following closing of

the transaction, BAM, which provides management services to BPY and

will also provide services to BPR following closing, has agreed to

waive, for one year, the management fees payable by BPR and the

incremental management fees BPY would otherwise be required to pay

in respect of the units issued in exchange for GGP shares.

The transaction is subject to the approval of

(1) GGP shareholders representing at least two-thirds of the

outstanding GGP common stock and (2) GGP shareholders representing

a majority of the outstanding GGP common stock not owned by BPY and

its affiliates. BPY and its affiliates have agreed to vote in favor

of the transaction. The transaction is also subject to other

customary closing conditions and is expected to close early in the

third quarter of 2018.

GGP shareholders will receive a second quarter

dividend of up to $0.22 per share (final amount to be prorated in

the event the transaction closes prior to June 30).

Weil, Gotshal & Manges LLP, Goodwin Procter

LLP and Torys LLP are serving as legal counsel to BPY and PwC is

serving as tax advisor to BPY.

Goldman Sachs & Co. LLC is serving as financial advisor and

Simpson Thacher & Bartlett LLP is serving as legal counsel to

GGP’s Special Committee. Citigroup Global Markets Inc. is serving

as financial advisor and Sullivan & Cromwell LLP is serving as

legal counsel to GGP.

All dollar references are in U.S. dollars,

unless noted otherwise.

Brookfield Property Partners

Brookfield Property Partners is one of the

world’s largest commercial real estate companies, with

approximately $68 billion in total assets. We are leading owners,

operators and investors in commercial real estate, with a

diversified portfolio of premier office and retail assets, as well

as interests in multifamily, triple net lease, industrial,

hospitality, self-storage, student housing and manufactured housing

assets. Brookfield Property Partners is listed on the New York and

Toronto stock exchanges. Further information is available at

bpy.brookfield.com.

Brookfield Property Partners is the flagship

listed real estate company of Brookfield Asset Management, a

leading global alternative asset manager with over $285 billion

in assets under management.

GGP Inc.GGP Inc. is an S&P

500 company focused exclusively on owning, managing, leasing and

redeveloping high-quality retail properties throughout the United

States. GGP is headquartered in Chicago, Illinois, and publicly

traded on the NYSE under the symbol GGP.

Brookfield

Contacts:

Suzanne Fleming Managing Partner,

Communications O: (212) 417-2421

suzanne.fleming@brookfield.com

Matt CherrySVP, Investor Relations & CommunicationsO: (212)

417-7488matthew.cherry@brookfield.com

GGP Inc. Contact:

Kevin BerrySVP, Investor & Public RelationsO: (312)

960-5529M: (708) 308-5999kevin.berry@ggp.com

Additional Information and Where to Find It

This communication is being made in respect of the proposed

transaction contemplated by the Agreement and Plan of Merger, dated

as of March 26, 2018, among Brookfield Property Partners L.P.

(“BPY”), Goldfinch Merger Sub Corp. and GGP Inc. (“GGP”). This

communication may be deemed to be solicitation material in respect

of the proposed transaction involving BPY and GGP. In

connection with the proposed transaction, BPY will file with the

SEC a registration statement on Form F-4 that will include a

prospectus of BPY, and GGP will file with the SEC a registration

statement on Form S-4 that will include a proxy

statement/prospectus of GGP. The BPY prospectus and the GGP

proxy statement/prospectus will be mailed to GGP stockholders in

connection with the proposed transaction. INVESTORS AND

SECURITY HOLDERS ARE URGED TO READ THE ABOVE-REFERENCED AND OTHER

RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY AND

IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT BPY, GGP, THE PROPOSED

TRANSACTION AND RELATED MATTERS. Investors and stockholders

will be able to obtain free copies of the above-referenced and

other documents filed with the SEC by BPY and GGP through the SEC’s

website at http://www.sec.gov. In addition, investors will be

able to obtain free copies of the above-referenced and other

documents filed with the SEC by BPY, when available, by contacting

BPY Investor Relations at bpy.enquiries@brookfield.com or +1 (855)

212-8243 or at BPY’s website at bpy.brookfield.com, and will be

able to obtain free copies of the above-referenced and other

documents filed with the SEC by GGP, when available, by contacting

GGP Investor Relations at (312) 960-5000 or at GGP’s website at

http://www.ggp.com.

Non-solicitation

This communication shall not constitute an offer to sell or the

solicitation of an offer to buy any securities, nor shall there be

any sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such

jurisdiction. No offering of securities shall be made except

by means of a prospectus meeting the requirements of Section 10 of

the U.S. Securities Act of 1933, as amended.

Participants in Solicitation

BPY, GGP and their respective directors and executive officers

and other persons may be deemed to be participants in the

solicitation of proxies from GGP stockholders in respect of the

proposed transaction that will be described in the proxy

statement/prospectus. Information regarding the persons who

may, under the rules of the SEC, be deemed participants in the

solicitation of proxies from GGP stockholders in connection with

the proposed transaction, including a description of their direct

or indirect interests, by security holdings or otherwise, will be

set forth in the proxy statement/prospectus when it is filed with

the SEC. You may also obtain the documents that BPY and GGP

file electronically free of charge from the SEC’s website at

http://www.sec.gov. Information regarding BPY’s directors and

executive officers is contained in BPY’s 2017 Annual Report on Form

20-F filed with the SEC on March 9, 2018. Information

regarding GGP’s directors and executive officers is contained in

GGP’s 2017 Annual Report on Form 10-K filed with the SEC on

February 22, 2018 and its 2017 Proxy Statement on Schedule 14A

filed with the SEC on April 3, 2017.

Forward-Looking Statements

This press release contains “forward-looking information” within

the meaning of Canadian provincial securities laws and applicable

regulations and “forward-looking statements” within the meaning of

“safe harbor” provisions of applicable U.S. securities laws,

including the United States Private Securities Litigation Reform

Act of 1995. Forward-looking statements include statements

that are predictive in nature or depend upon or refer to future

events or conditions, include statements regarding the expected

timing, completion and effects of the proposed transaction, our

operations, business, financial condition, expected financial

results, performance, prospects, opportunities, priorities,

targets, goals, ongoing objectives, strategies and outlook, as well

as the outlook for North American and international economies for

the current fiscal year and subsequent periods, and include words

such as “expects,” “anticipates,” “plans,” “believes,” “estimates,”

“seeks,” “intends,” “targets,” “projects,” “forecasts,” “likely,”

or negative versions thereof and other similar expressions, or

future or conditional verbs such as “may,” “will,” “should,”

“would” and “could.”

Although we believe that our anticipated future results,

performance or achievements expressed or implied by the

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on forward-looking statements and information

because they involve known and unknown risks, uncertainties and

other factors, many of which are beyond our control, which may

cause our actual results, performance or achievements to differ

materially from anticipated future results, performance or

achievement expressed or implied by such forward-looking statements

and information.

Factors that could cause actual results to differ materially

from those contemplated or implied by forward-looking statements

include, but are not limited to: the occurrence of any event,

change or other circumstance that could affect the proposed

transaction on the anticipated terms and timing, including the risk

that the proposed transaction may not be consummated; risks related

to BPY’s ability to integrate GGP’s business into our own and the

ability of the combined company to attain expected benefits

therefrom; risks incidental to the ownership and operation of real

estate properties including local real estate conditions; the

impact or unanticipated impact of general economic, political and

market factors in the countries in which we do business; the

ability to enter into new leases or renew leases on favorable

terms; business competition; dependence on tenants’ financial

condition; the use of debt to finance our business; the behavior of

financial markets, including fluctuations in interest and foreign

exchange rates; uncertainties of real estate development or

redevelopment; global equity and capital markets and the

availability of equity and debt financing and refinancing within

these markets; risks relating to our insurance coverage; the

possible impact of international conflicts and other developments

including terrorist acts; potential environmental liabilities;

changes in tax laws and other tax related risks; dependence on

management personnel; illiquidity of investments; the ability to

complete and effectively integrate other acquisitions into existing

operations and the ability to attain expected benefits therefrom;

operational and reputational risks; catastrophic events, such as

earthquakes and hurricanes; and other risks and factors detailed

from time to time in our documents filed with the securities

regulators in Canada and the United States.

We caution that the foregoing list of important factors that may

affect future results is not exhaustive. When relying on our

forward-looking statements or information, investors and others

should carefully consider the foregoing factors and other

uncertainties and potential events. Except as required by

law, we undertake no obligation to publicly update or revise any

forward-looking statements or information, whether written or oral,

that may be as a result of new information, future events or

otherwise.

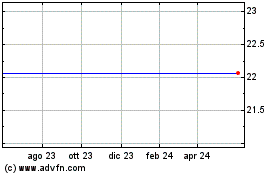

Grafico Azioni GGP Inc. (NYSE:GGP)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni GGP Inc. (NYSE:GGP)

Storico

Da Dic 2023 a Dic 2024