GRAY TELEVISION INC false 0000043196 0000043196 2023-10-17 2023-10-17 0000043196 gtn:ClassACommonStockNoParValueMember 2023-10-17 2023-10-17 0000043196 gtn:CommonStockNoParValueMember 2023-10-17 2023-10-17

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) October 17, 2023

Gray Television, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

| Georgia |

|

001-13796 |

|

58-0285030 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 4370 Peachtree Road, NE, Atlanta, Georgia |

|

30319 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

404-504-9828

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each Class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class A common stock (no par value) |

|

GTN.A |

|

New York Stock Exchange |

| common stock (no par value) |

|

GTN |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. |

Regulation FD Disclosure. |

On October 17, 2023, Gray Television, Inc. (“Gray”) issued a press release announcing that it had released a new investor presentation providing Gray’s perspective on the broadcast industry and the company in the current network and retransmission landscape. Exhibits 99.1 and 99.2 provide a copy of the press release and investor presentation, respectively, and are incorporated herein by reference.

The information set forth under this Item 7.01 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as may be expressly set forth by specific reference in such filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

Gray Television, Inc. |

|

|

|

|

| October 17, 2023 |

|

|

|

By: |

|

/s/ James C. Ryan |

|

|

|

|

Name: |

|

James C. Ryan |

|

|

|

|

Title: |

|

Executive Vice President and Chief Financial Officer |

Exhibit 99.1

NEWS RELEASE

Gray Issues Investor Deck Addressing Network and Retransmission Landscape

Atlanta, Georgia – October 17, 2023… Gray Television, Inc. (“Gray”) (NYSE: GTN) has released a new

investor presentation providing Gray’s perspective on the broadcast industry and the company in the current network and retransmission landscape. The presentation outlines Gray’s belief that the Broadcast Industry and Gray are positioned

well for continued growth in retransmission revenues in light of the continuing market trends and recent industry developments. The presentation is available on Gray’s website at https://gray.tv/investorrelations#presentations.

Forward-Looking Statements:

This press

release and the presentation contains certain forward-looking statements that are based largely on Gray’s current expectations and reflect various estimates and assumptions by Gray. These statements may be identified by words such as

“estimates”, “expect,” “anticipate,” “will,” “implied,” “assume” and similar expressions. In addition, statements in this press release and the presentation relating to the value and growth

opportunities for retransmission revenues are based on Gray’s current expectations and beliefs and therefore constitute forward-looking statements. Forward-looking statements are subject to certain risks, trends and uncertainties that could

cause actual results and achievements to differ materially from those expressed in such forward-looking statements. Such risks, trends and uncertainties which in some instances are beyond Gray’s control, including estimates of future

retransmission revenue, future expenses and other future events.

Gray is subject to additional risks and uncertainties described in

Gray’s quarterly and annual reports filed with the Securities and Exchange Commission from time to time, including in the “Risk Factors,” and management’s discussion and analysis of financial condition and results of operations

sections contained therein. Any forward-looking statements in this press release and the presentation should be evaluated in light of these important risk factors. This press release and the presentation reflects management’s views as of the

date hereof. Except to the extent required by applicable law, Gray undertakes no obligation to update or revise any information contained in this press release and the presentation beyond the published date, whether as a result of new information,

future events or otherwise.

About Gray:

Gray Television, Inc. is a multimedia company headquartered in Atlanta, Georgia. Gray is the nation’s largest owner of top-rated local television stations and digital assets in the United States. Its television stations serve 113 television markets that collectively reach approximately 36 percent of US television households.

This portfolio includes 80 markets with the top-rated television station and 102 markets with the first and/or second highest rated television station. Gray also owns video program companies Raycom Sports,

Tupelo Media Group, and PowerNation Studios, as well as the studio production facilities Assembly Atlanta and Third Rail Studios. Gray owns a majority interest in Swirl Films. For more information, please visit www.gray.tv.

Gray Contacts:

Jim Ryan, Executive Vice President and Chief Financial Officer,

404-504-9828

Kevin P. Latek, Executive Vice President, Chief Legal

and Development Officer, 404-266-8333

# # #

Exhibit 99.2 Gray Television in the Current Network and Retransmission

Landscape October 2023

Notes and Disclaimer Gray Television, Inc. (“Gray”) owns

local network-affiliated television stations in 113 markets. Station rankings (i.e., number 1, number 2) reflect all-day ratings in 2022 according to Comscore. DMA population estimates and ranks according to Nielsen. This presentation contains

certain forward-looking statements that are based largely on Gray’s current expectations and reflect various estimates and assumptions by Gray. These statements may be identified by words such as “estimates”, “expect,”

“anticipate,” “will,” “implied,” “assume” and similar expressions. In addition, statements in this presentation relating to the value and growth opportunities for retransmission revenues are based on

Gray’s current expectations and beliefs and therefore constitute forward looking statements. Forward looking statements are subject to certain risks, trends and uncertainties that could cause actual results and achievements to differ

materially from those expressed in such forward-looking statements. Such risks, trends and uncertainties which in some instances are beyond Gray’s control, including estimates of future retransmission revenue, future expenses and other future

events. Gray is subject to additional risks and uncertainties described in Gray’s quarterly and annual reports filed with the Securities and Exchange Commission from time to time, including in the “Risk Factors,” and

management’s discussion and analysis of financial condition and results of operations sections contained therein. Any forward-looking statements in this presentation should be evaluated in light of these important risk factors. This

presentation reflects management’s views as of the date hereof. Except to the extent required by applicable law, Gray undertakes no obligation to update or revise any information contained in this presentation beyond the published date,

whether as a result of new information, future events or otherwise. 2

Gray Is Well Positioned to Continue Growing Revenue in the Current

Network and Retrans Landscape ü Gray Owns Local Stations Providing Premium Content Across the U.S. ü We Believe That Broadcast Retrans Remains Significantly Undervalued ü We Believe That the Current Environment Favors Continued Growth

for Retrans Revenues ü We Believe That the Network/Affiliate Model Aligns Participants’ Interests in Curbing MVPD Sub Churn and in Growing Retrans for Affiliates ü Network Programming Contributes Important, Albeit Minority, Portion

of Gray’s Television Ad Revenues ü Gray’s Own Content Vastly Outperforms Viewership in Its Markets of NFL, Broadcast Prime, and Cable News Networks 3

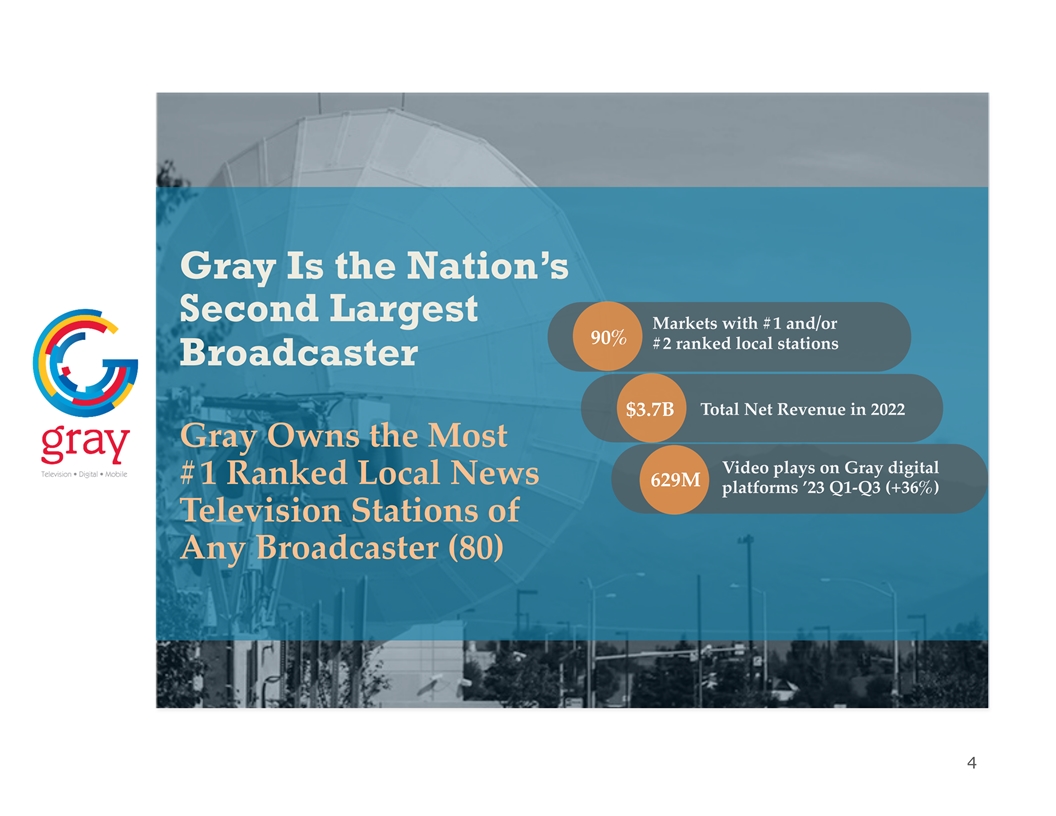

Gray Is the Nation’s Second Largest Markets with #1 and/or 90% #2

ranked local stations Broadcaster Total Net Revenue in 2022 $3.7B Gray Owns the Most Video plays on Gray digital #1 Ranked Local News 629M platforms ’23 Q1-Q3 (+36%) Television Stations of Any Broadcaster (80) 4

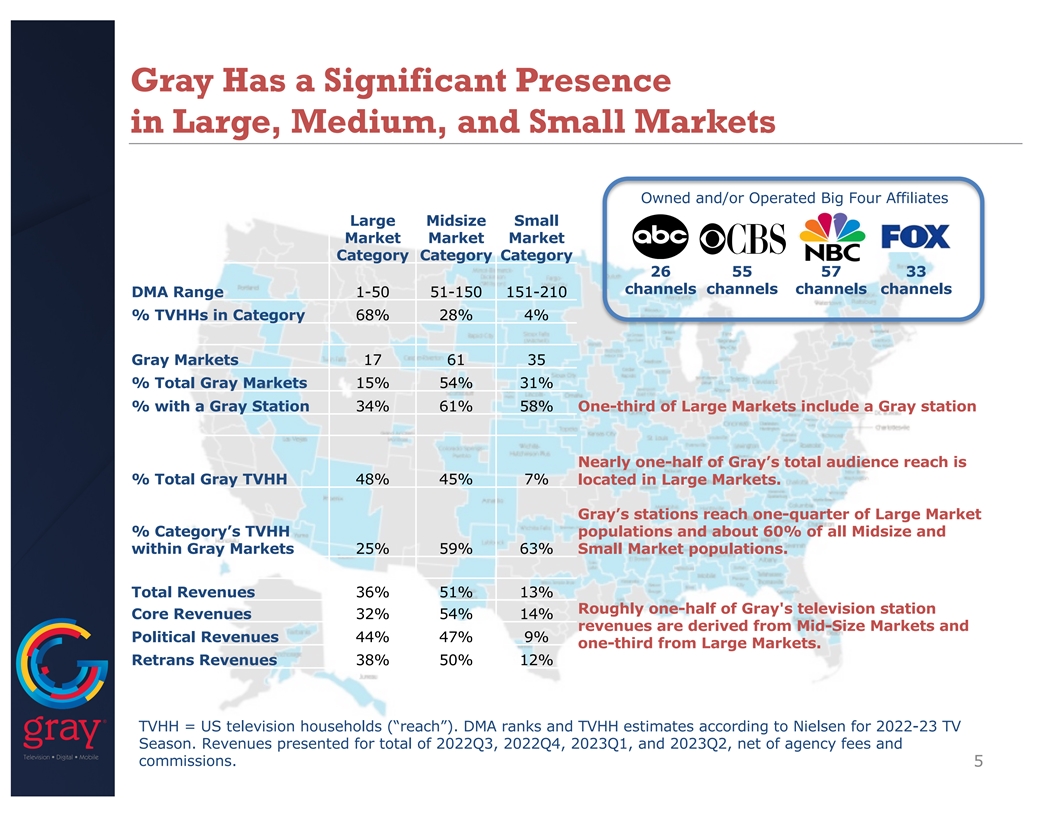

Gray Has a Significant Presence in Large, Medium, and Small Markets

Owned and/or Operated Big Four Affiliates Large Midsize Small Market Market Market Category Category Category 26 55 57 33 channels channels channels channels DMA Range 1-50 51-150 151-210 % TVHHs in Category 68% 28% 4% Gray Markets 17 61 35 % Total

Gray Markets 15% 54% 31% % with a Gray Station 34% 61% 58% One-third of Large Markets include a Gray station Nearly one-half of Gray’s total audience reach is % Total Gray TVHH 48% 45% 7% located in Large Markets. Gray’s stations reach

one-quarter of Large Market % Category’s TVHH populations and about 60% of all Midsize and within Gray Markets 25% 59% 63% Small Market populations. Total Revenues 36% 51% 13% Roughly one-half of Gray's television station Core Revenues 32% 54%

14% revenues are derived from Mid-Size Markets and Political Revenues 44% 47% 9% one-third from Large Markets. Retrans Revenues 38% 50% 12% TVHH = US television households (“reach”). DMA ranks and TVHH estimates according to Nielsen for

2022-23 TV Season. Revenues presented for total of 2022Q3, 2022Q4, 2023Q1, and 2023Q2, net of agency fees and commissions. 5

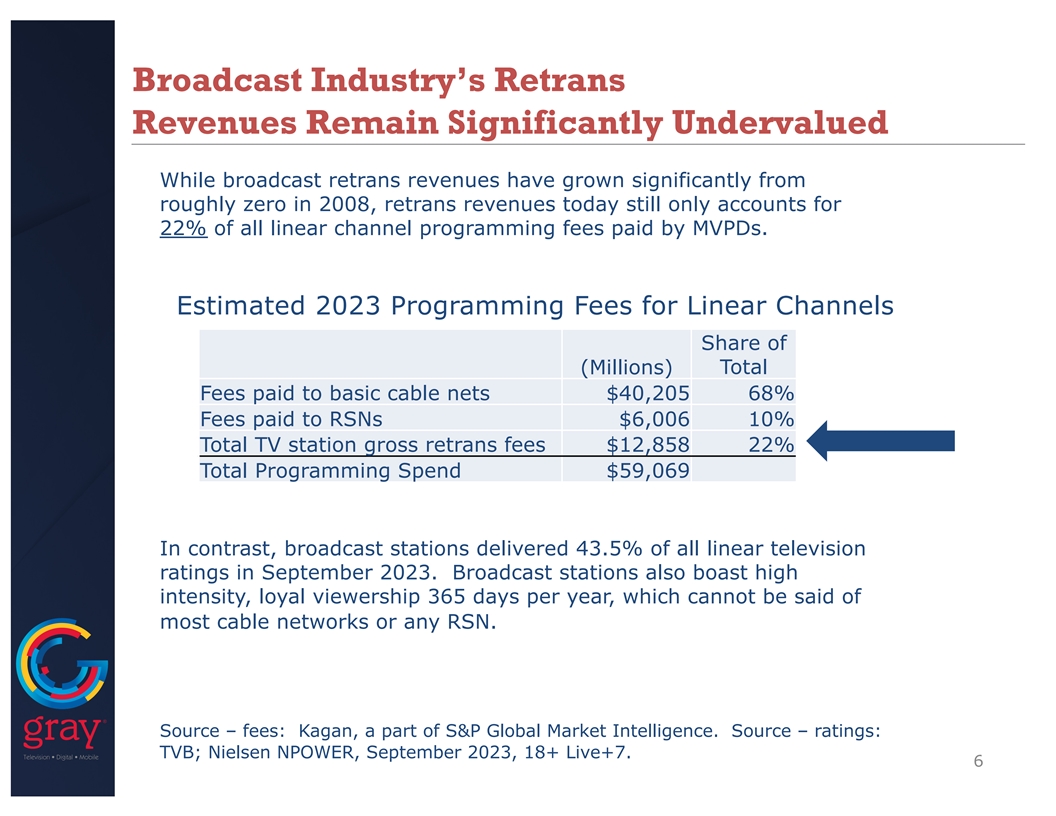

Broadcast Industry’s Retrans Revenues Remain Significantly

Undervalued While broadcast retrans revenues have grown significantly from roughly zero in 2008, retrans revenues today still only accounts for 22% of all linear channel programming fees paid by MVPDs. Estimated 2023 Programming Fees for Linear

Channels Share of (Millions) Total Fees paid to basic cable nets $40,205 68% Fees paid to RSNs $6,006 10% Total TV station gross retrans fees $12,858 22% Total Programming Spend $59,069 In contrast, broadcast stations delivered 43.5% of all linear

television ratings in September 2023. Broadcast stations also boast high intensity, loyal viewership 365 days per year, which cannot be said of most cable networks or any RSN. Source – fees: Kagan, a part of S&P Global Market Intelligence.

Source – ratings: TVB; Nielsen NPOWER, September 2023, 18+ Live+7. 6

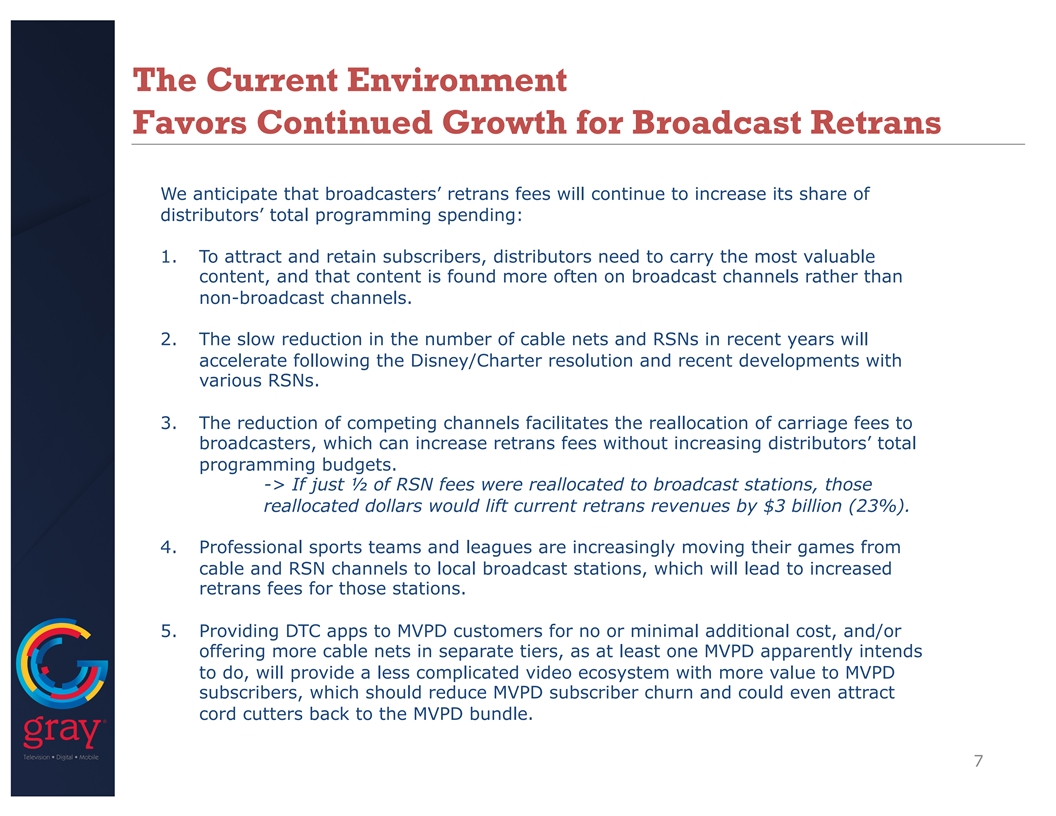

The Current Environment Favors Continued Growth for Broadcast Retrans We

anticipate that broadcasters’ retrans fees will continue to increase its share of distributors’ total programming spending: 1. To attract and retain subscribers, distributors need to carry the most valuable content, and that content is

found more often on broadcast channels rather than non-broadcast channels. 2. The slow reduction in the number of cable nets and RSNs in recent years will accelerate following the Disney/Charter resolution and recent developments with various RSNs.

3. The reduction of competing channels facilitates the reallocation of carriage fees to broadcasters, which can increase retrans fees without increasing distributors’ total programming budgets. -> If just ½ of RSN fees were reallocated

to broadcast stations, those reallocated dollars would lift current retrans revenues by $3 billion (23%). 4. Professional sports teams and leagues are increasingly moving their games from cable and RSN channels to local broadcast stations, which

will lead to increased retrans fees for those stations. 5. Providing DTC apps to MVPD customers for no or minimal additional cost, and/or offering more cable nets in separate tiers, as at least one MVPD apparently intends to do, will provide a less

complicated video ecosystem with more value to MVPD subscribers, which should reduce MVPD subscriber churn and could even attract cord cutters back to the MVPD bundle. 7

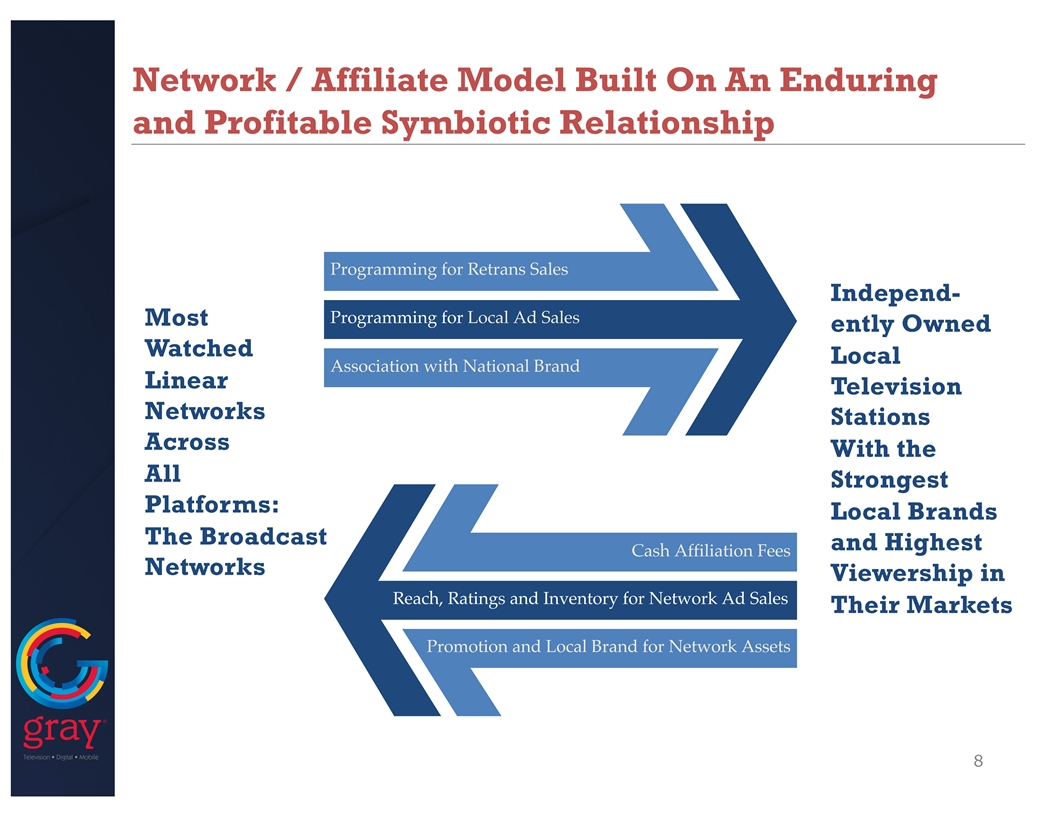

Network / Affiliate Model Built On An Enduring and Profitable Symbiotic

Relationship Programming for Retrans Sales Independ- Programming for Local Ad Sales Most ently Owned Watched Local Association with National Brand Linear Television Networks Stations Across With the All Strongest Platforms: Local Brands The

Broadcast and Highest Cash Affiliation Fees Networks Viewership in Reach, Ratings and Inventory for Network Ad Sales Their Markets Promotion and Local Brand for Network Assets 8

Network Revenues Are Driven by Local Affiliates Estimated 2023 Big Four

Networks Revenue $6,000 $5,392 $5,227 $5,000 $1,170 Affiliate Affiliate $1,112 Contribution Contribution $3,997 $4,000 $3,699 $877 $985 $2,110 $2,153 $3,000 $1,468 $2,000 $283 $1,739 $251 $524 $222 $358 $475 $1,000 $216 $1,320 $1,293 $229 $939 $491

$- ABC CBS FOX NBC Affiliate Contribution: Est. Net Ad Revenue Attributable to O&O Reach Est. Net Ad Revenue Attributable to Broadcast Est. O&O Retrans from MVPDs Affiliate Stations vMVPD Revenue Affiliation Fees Paid By Broadcast Affiliate

Stations Other Network Revenue 9 Source: Kagan, a part of S&P Global Market Intelligence Revenues in Millions

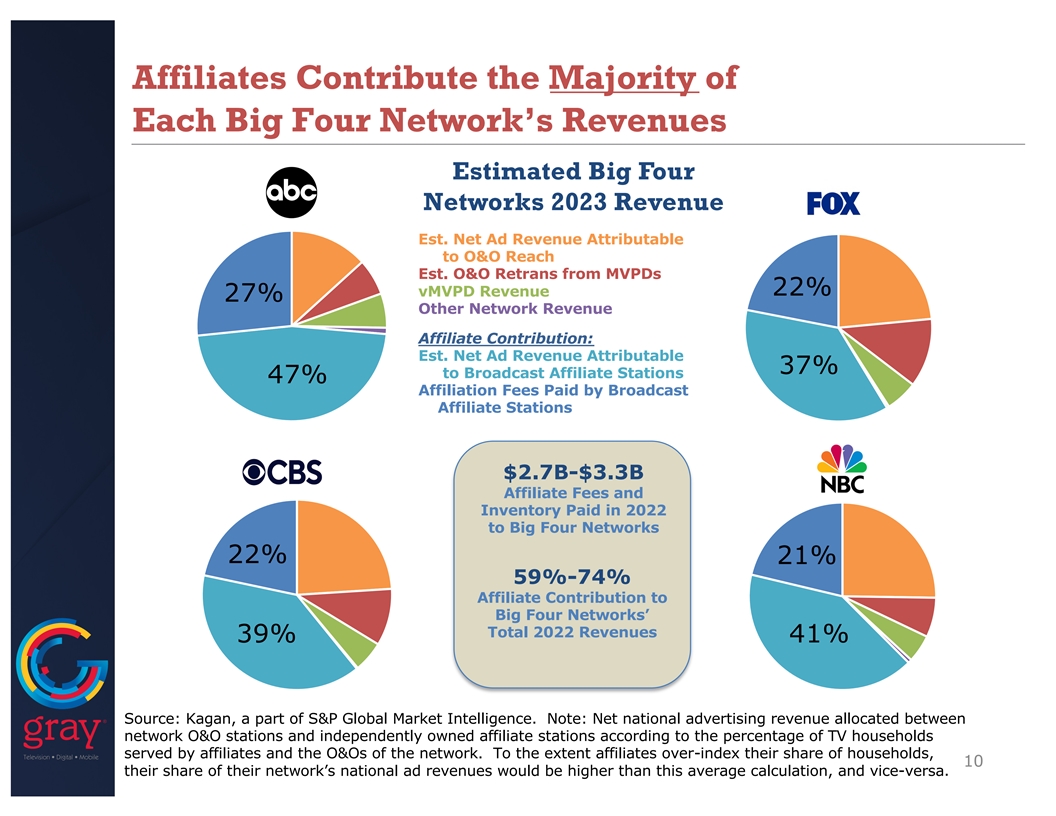

Affiliates Contribute the Majority of Each Big Four Network’s

Revenues Estimated Big Four Networks 2023 Revenue Est. Net Ad Revenue Attributable to O&O Reach Est. O&O Retrans from MVPDs 22% vMVPD Revenue 27% Other Network Revenue Affiliate Contribution: Est. Net Ad Revenue Attributable 37% to Broadcast

Affiliate Stations 47% Affiliation Fees Paid by Broadcast Affiliate Stations $2.7B-$3.3B Affiliate Fees and Inventory Paid in 2022 to Big Four Networks 22% 21% 59%-74% Affiliate Contribution to Big Four Networks’ Total 2022 Revenues 39% 41%

Source: Kagan, a part of S&P Global Market Intelligence. Note: Net national advertising revenue allocated between network O&O stations and independently owned affiliate stations according to the percentage of TV households served by

affiliates and the O&Os of the network. To the extent affiliates over-index their share of households, 10 their share of their network’s national ad revenues would be higher than this average calculation, and vice-versa.

Gray Local Newscasts Deliver More Household Viewership in Their Markets

than All Competing Premium Content Household Viewership in Gray’s 113 Markets 101,383,761 (September 5-11, 2023) 99,877,664 More than Total All Day 99,877,664 Viewership of FOX News, 70,424,405 MSNBC and CNN Combined More than Total Network

Prime Viewership on NBC, CBS, ABC and FOX Combined 34,599,792 More than Total NFL Game Viewership on ABC (MNF), CBS, FOX, and NBC Combined Gray Local Three Cable Network NFL on News News Nets Prime Broadcast Combined Combined Combined 11 Source:

Comscore TV

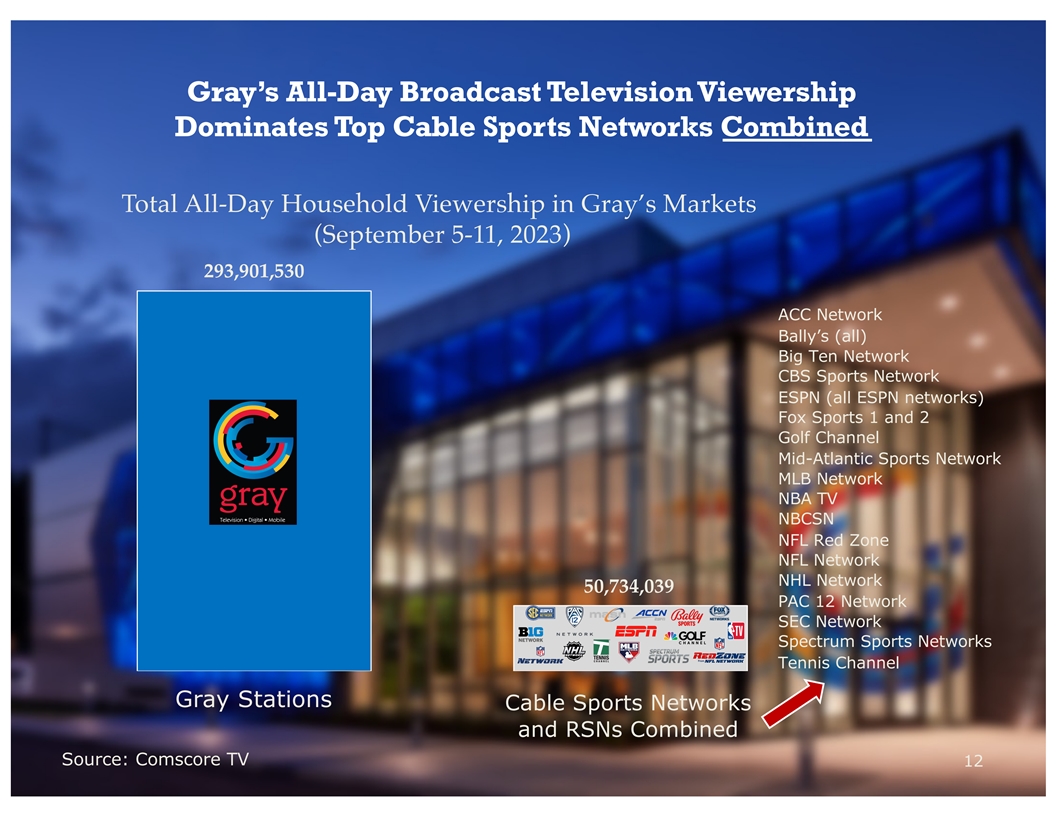

Gray’s All-Day Broadcast Television Viewership Dominates Top

Cable Sports Networks Combined Total All-Day Household Viewership in Gray’s Markets (September 5-11, 2023) 293,901,530 ACC Network Bally’s (all) Big Ten Network CBS Sports Network ESPN (all ESPN networks) Fox Sports 1 and 2 Golf Channel

Mid-Atlantic Sports Network MLB Network NBA TV NBCSN NFL Red Zone NFL Network NHL Network 50,734,039 PAC 12 Network SEC Network Spectrum Sports Networks Tennis Channel Gray Stations Cable Sports Networks and RSNs Combined Source: Comscore TV

12

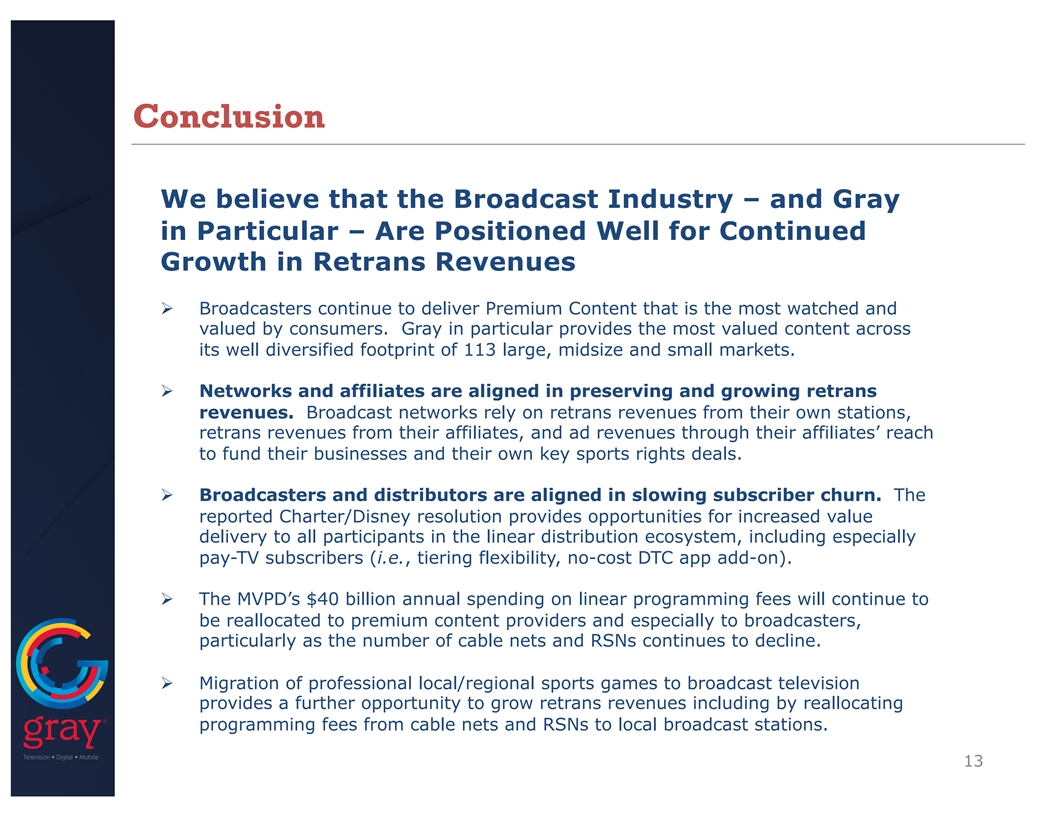

Conclusion We believe that the Broadcast Industry – and Gray in

Particular – Are Positioned Well for Continued Growth in Retrans Revenues Ø Broadcasters continue to deliver Premium Content that is the most watched and valued by consumers. Gray in particular provides the most valued content across its

well diversified footprint of 113 large, midsize and small markets. Ø Networks and affiliates are aligned in preserving and growing retrans revenues. Broadcast networks rely on retrans revenues from their own stations, retrans revenues from

their affiliates, and ad revenues through their affiliates’ reach to fund their businesses and their own key sports rights deals. Ø Broadcasters and distributors are aligned in slowing subscriber churn. The reported Charter/Disney

resolution provides opportunities for increased value delivery to all participants in the linear distribution ecosystem, including especially pay-TV subscribers (i.e., tiering flexibility, no-cost DTC app add-on). Ø The MVPD’s $40 billion

annual spending on linear programming fees will continue to be reallocated to premium content providers and especially to broadcasters, particularly as the number of cable nets and RSNs continues to decline. Ø Migration of professional

local/regional sports games to broadcast television provides a further opportunity to grow retrans revenues including by reallocating programming fees from cable nets and RSNs to local broadcast stations. 13

Gray Television, Inc. 4370 Peachtree Rd., NE Atlanta, Georgia 30319

www.gray.tv

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gtn_ClassACommonStockNoParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=gtn_CommonStockNoParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

Grafico Azioni Gray Television (NYSE:GTN.A)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Gray Television (NYSE:GTN.A)

Storico

Da Mag 2023 a Mag 2024