Lucky Friday restarts production

Hecla Mining Company (NYSE:HL) today announced its preliminary

silver and gold production for the fourth quarter and full year

2023.

HIGHLIGHTS

- Silver production of 14.3 million ounces exceeded 2022

production of 14.2 million ounces, despite the temporary shutdown

at the Lucky Friday mine since August 2023

- As expected, annual gold production decreased 14% as Casa

Berardi transitions to an open pit mine; Greens Creek gold

production increased 26%

- Commenced restart at the Lucky Friday; ramp-up to full

production and receipt of insurance payments expected to commence

in the first quarter of 2024

- Keno Hill produced 1.5 million ounces, with the Bermingham

deposit achieving the highest mined tonnage in December; initiated

a safety action plan to build a strong operational foundation at

the mine

"Hecla faced multiple challenges in 2023 with the fire at the

Lucky Friday mine and improving the safety culture at Keno Hill,

but despite these challenges, silver production exceeded last year

as Greens Creek delivered another strong year, Lucky Friday's

production through July with our patented UCB method produced more

silver than the mine typically produced in a full year with the old

mining method, and the roughly half year of production at Keno Hill

shows its potential to be a meaningful producer,” said Phillips S.

Baker, Jr., Hecla's President and CEO. "As planned, we began the

transition of Casa Berardi’s production to surface mining, which

lowered production but increased margins."

Baker continued, “We look forward to a strong year in 2024 as we

execute our growth strategy to deliver up to 20 million ounces of

silver production by 2025. With silver's critical role in energy

transition and its application in solar electricity generation,

Hecla will play an important role in producing silver as the

world’s fastest-growing established silver producer and the

dominant producer of silver in the U.S. and soon Canada."

OPERATIONS

Greens Creek

The Greens Creek mine produced 9.7 million ounces of silver and

60,896 ounces of gold for the year. Fourth quarter production was

2.3 million ounces of silver and 14,651 ounces of gold. Throughput

for the quarter was 2,393 tons per day (tpd), 4% lower compared to

the third quarter, and was impacted by two significant weather

events in November and one in December, causing road blockages and

unplanned mill downtime, resulting in approximately 12 days of lost

production. The mill achieved a throughput of 2,600 tpd when

operating. Annual throughput averaged 2,506 tpd, an increase of 9%

over the prior year. Annual silver production was unchanged from

2022 as higher throughput offset lower grades and recoveries.

Annual gold production increased by 26% due to higher throughput,

grades, and recoveries.

Lucky Friday

The Lucky Friday mine produced 3.1 million ounces of silver in

2023, 30% lower than in 2022, due to the suspension of production

since August due to a fire in the secondary escapeway (#2 shaft).

Fourth quarter production was nominal as the mill processed

residual material from ore pockets.

The mine restarted production on January 9th and is expected to

ramp up to full production in the first quarter. The plans to

resume production were completed on schedule and involved

developing a new secondary egress consisting of a ramp of 1,600

feet and a 290-foot vertical escapeway. The Company received a

favorable coverage determination letter and expects to start

receiving insurance proceeds during the first quarter.

Keno Hill

Keno Hill produced 1.5 million ounces of silver in 2023, with

608,301 ounces produced in the fourth quarter. Throughput for the

quarter averaged 214 tpd with silver grades of 32 ounces per ton.

As safety has improved, so has mining, with Bermingham achieving

the highest production in December, exceeding 9,500 tons mined. Ore

inventory at the end of the year was approximately 3,000 tons at a

silver grade of 27 ounces per ton.

Hecla's injury-free standard drives the pace of production and

development at Keno Hill. A safety action plan, which will be

executed over the year, has been initiated, focusing on training,

supervision, mining practices, and implementation of the safety

processes.

Casa Berardi

The Casa Berardi mine produced 90,363 and 22,517 ounces of gold

in 2023 and the fourth quarter, respectively. As expected, annual

gold production declined by 29% due to wildfire-related closures in

June and lower underground tonnage as the mine transitions to a

surface operation by mid-2024. Fourth quarter gold production was

7% lower than the third quarter due to lower milled grades

partially offset by higher throughput. The mine set another

quarterly record for surface tonnage handled as the in-house

equipment fleet was fully commissioned. The mill operated at an

average of 3,859 tpd in the fourth quarter, a 3% increase over the

third quarter attributable to improved performance of the gravity

circuit.

PRODUCTION SUMMARY

Three Months Ended

Twelve Months Ended

December 31,

September 30,

December 31,

December 31,

2023

2023

2023

2022

Production

Increase/ (Decrease)

Increase/ (Decrease)

Silver (oz)

2,935,632

3,533,704

(17)%

14,342,863

14,182,987

1 %

Gold (oz)

37,168

39,269

(5)%

151,259

175,807

(14)%

Lead (tons)

5,282

8,276

(36)%

40,347

48,250

(16)%

Zinc (tons)

12,669

14,980

(15)%

60,579

63,463

(5)%

Greens Creek - Silver (oz)

2,260,027

2,343,192

(4)%

9,731,752

9,741,935

(0)%

Greens Creek - Gold (oz)

14,651

15,010

(2)%

60,896

48,217

26 %

Lucky Friday - Silver (oz)

61,574

475,414

(87)%

3,086,119

4,412,763

(30)%

Keno Hill - Silver (oz)

608,301

710,012

(14)%

1,502,577

-

NA

Casa Berardi - Gold (oz)

22,517

24,259

(7)%

90,363

127,590

(29)%

(1) See the cautionary statement regarding

preliminary statements at the end of this release.

(2) Silver and gold equivalent calculation

based on the respective average annual metal prices as follows:

$23.39 for Ag, $1,942.74 for Au, $0.97 for Pb, and $1.20 for

Zn.

ABOUT HECLA

Founded in 1891, Hecla Mining Company (NYSE: HL) is the largest

silver producer in the United States. Hecla operates mines in

Alaska, Idaho, Quebec, Canada, and Yukon, Canada, and owns a number

of exploration and pre-development projects in world-class silver

and gold mining districts throughout North America.

Cautionary Statements Regarding Estimates and Forward-Looking

Statements

All measures of the Company's fourth quarter and full year 2023

operating results contained in this release are preliminary and

reflect the Company’s expected results as of the date of this

release. Actual reported fourth quarter and full year 2023 results

are subject to management's final review as well as review by the

Company's independent registered accounting firm and may vary

significantly from current expectations because of a number of

factors, including, without limitation, additional or revised

information and changes in accounting standards or policies or in

how those standards are applied.

Statements made or information provided in this news release

that are not historical facts are "forward-looking statements"

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended, which are intended to be covered by the safe harbor

created by such sections and other applicable laws, and

"forward-looking information" within the meaning of Canadian

securities laws. When a forward-looking statement expresses or

implies an expectation or belief as to future events or results,

such expectation or belief is expressed in good faith and believed

to have a reasonable basis. However, such statements are subject to

risks, uncertainties, and other factors, which could cause actual

results to differ materially from future results expressed,

projected, or implied by the forward-looking statements.

Forward-looking statements often address our expected future

business and financial performance and financial condition and

often contain words such as “anticipate,” “intend,” “plan,” “will,”

“could,” “would,” “estimate,” “should,” “expect,” “believe,”

“project,” “target,” “indicative,” “preliminary,” “potential” and

similar expressions. Forward-looking statements in this news

release may include, without limitation: (i) Casa Berardi will

transition to a complete surface operation by the end of this year;

(ii) the Company will produce up to 20 million ounces of silver by

2025; (iii) the Company will soon be the dominant producer of

silver in Canada; (iv) Lucky Friday is expected to ramp up to full

production in the first quarter of the year; (v) insurance proceeds

for Lucky Friday will commence in the first quarter of 2024 and

(vi) the Company expects safety at Keno Hill to improve through a

safety action plan. Estimates or expectations of future events or

results are based upon certain assumptions, which may prove to be

incorrect, which could cause actual results to differ from

forward-looking statements. Such assumptions, include, but are not

limited to: (i) there being no significant change to current

geotechnical, metallurgical, hydrological and other physical

conditions; (ii) permitting, development, operations and expansion

of the Company’s projects being consistent with current

expectations and mine plans; (iii) political/regulatory

developments in any jurisdiction in which the Company operates

being consistent with its current expectations; (iv) certain price

assumptions for gold, silver, lead and zinc; (v) prices for key

supplies being approximately consistent with current levels; (vi)

the accuracy of our current mineral reserve and mineral resource

estimates; (vii) the Company’s plans for development and production

will proceed as expected and will not require revision as a result

of risks or uncertainties, whether known, unknown or unanticipated;

(viii) sufficient workforce is available and trained to perform

assigned tasks; (ix) weather patterns and rain/snowfall within

normal seasonal ranges so as not to impact operations; (x)

relations with interested parties, including Native Americans,

remain productive; and (xi) factors do not arise that reduce

available cash balances.

In addition, material risks that could cause actual results to

differ from forward-looking statements include but are not limited

to: (i) gold, silver and other metals price volatility; (ii)

operating risks; (iii) currency fluctuations; (iv) increased

production costs and variances in ore grade or recovery rates from

those assumed in mining plans; (v) community relations; and (vi)

litigation, political, regulatory, labor and environmental risks.

For a more detailed discussion of such risks and other factors, see

the Company's 2022 Form 10-K filed on February 17, 2023 for a more

detailed discussion of factors that may impact expected future

results. The Company undertakes no obligation and has no intention

of updating forward-looking statements other than as may be

required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240110415705/en/

Anvita M. Patil Vice President – Investor Relations and

Treasurer Cheryl Turner Communications Coordinator 800-HECLA91

(800-432-5291) Investor Relations Email: hmc-info@hecla.com

Website: www.hecla.com

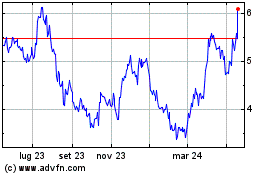

Grafico Azioni Hecla Mining (NYSE:HL)

Storico

Da Dic 2024 a Gen 2025

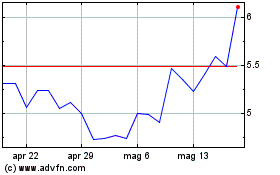

Grafico Azioni Hecla Mining (NYSE:HL)

Storico

Da Gen 2024 a Gen 2025