Hyliion Holdings Corp. (NYSE: HYLN) (“Hyliion”), a developer of

sustainable electricity-producing technology, today reported its

first-quarter 2024 financial results.

Key Business Highlights

- Announced that H2 Energy Group has executed a letter of intent

to purchase up to 10 KARNO generator units that will operate on

hydrogen rich syngas produced from sustainable processes

- Announced partnership with BayoTech to introduce Hyliion and

BayoTech’s innovative solutions to each other’s customers

- Reiterated plans to deliver initial KARNO generator units to

customers in late 2024

- Reported today that customer commitments are secured for 2024

production capacity and actively building a backlog of commitments

for 2025 generator deliveries

- Hosted event with customers and other stakeholders to showcase

KARNO technology and development progress

- Repurchased 8.7 million shares for $11.3 million as part of the

company’s $20 million Stock Repurchase Program

- Ended the quarter with $264 million of cash and

investments

- Reaffirmed guidance of $40 to $50 million cash expenditures in

2024 for KARNO development and capital investments

Executive Commentary

“I'm excited with the progress we've achieved in the past

quarter as we remain on course for the initial deployment of KARNO

generators to customers later this year," stated Thomas Healy,

Hyliion’s Founder and CEO. "The growing interest from customers in

our technology is promising, and we anticipate expanding our order

backlog throughout this year for 2025. Additionally, we're swiftly

increasing our production capacity by introducing additive printers

to our Austin, Texas facility to meet rising demand."

KARNO Commercial Updates

Hyliion is initially developing a locally-deployable 200kW

generating system which it intends to deliver to initial deployment

customers in late 2024. Target markets in the commercial power

space include EV Charging, Waste Gas, Prime Power and Mobility

applications. Initial customer deployments will target each of

these markets to demonstrate the versatility of the KARNO generator

as well as key product attributes and differentiators versus

competing technologies, including efficiency, emissions, fuel

flexibility, and operating and maintenance costs.

Hyliion also recently announced that H2 Energy Group has

executed a non-binding letter of intent for the purchase of up to

10 KARNO generators that will be fueled by hydrogen-rich syngas. H2

Energy specializes in the production of hydrogen using completely

sustainable and renewable biomass. The letter of intent outlines

the plan for five KARNO generator units to be installed in 2025 and

includes an option for the purchase of five additional generators

upon successful deployment of the initial units. Hyliion also

announced a partnership with BayoTech, a full-service hydrogen

supplier, allowing the companies to introduce their innovative

solutions to each other’s customers, enhancing the product

offerings of both companies.

Hyliion recently hosted a KARNO generator showcase event at its

Cincinnati engineering and development facility, welcoming guests

including customers, regulators, media representatives, government

officials, supplier partners, and other stakeholders. Attendees had

the opportunity to witness the KARNO generator in action and

explore its underlying technology, including additive manufacturing

and the fuel oxidation process with hydrogen. Additionally, the

company provided updates on recent development progress, plans for

initial generator deployments and the scaling up of production

capacity.

KARNO Generator Development

Hyliion is developing a revolutionary new electrical generator

powered by a linear heat motor that is expected to deliver

step-change improvements in performance characteristics compared to

conventional electricity generating systems, including efficiency,

emissions, maintenance requirements, noise levels and fuel

flexibility. The KARNO generator is enabled by the latest advances

in additive manufacturing technology.

The development of the KARNO generator remains on track for

initial customer deployments in late 2024. The company has been

testing its Alpha version of the generator and earlier this year

began printing components for its BETA version, which is the

production-intent design. The company is taking delivery of

additive manufacturing machines at its Austin, Texas facility,

slated to become Hyliion’s primary KARNO generator printing,

manufacturing and assembly center starting in 2025. Additive

printers on hand and on order account for most of the capacity

required for planned generator production in 2025.

Powertrain Wind-Down

In November 2023, Hyliion announced that it was winding down its

powertrain business segment to maintain the company’s strong cash

position as it furthers development of KARNO generator technology.

The company has retained the powertrain technology, enabling it to

explore future use or sale of the technology and tangible assets.

Most wind-down activities were completed through the first quarter

of 2024, while efforts to monetize powertrain assets and technology

will continue throughout the year.

Financial Highlights and Guidance

First quarter operating expenses totaled $19.0 million, compared

to $31.9 million in the prior-year quarter. First quarter expenses

include $4.4 million of exit and termination charges directly

related to the wind down of the powertrain business. Net loss in

the quarter was $15.6 million, compared to $28.8 million in the

first quarter of 2023.

The company repurchased 8.7 million shares of stock in the first

quarter for $11.3 million as part of the $20 million share

repurchase program announced in late 2023. Total cash expenditures

for the quarter were $35.3 million, including share repurchases,

$14.1 million for KARNO development, SG&A expenses, and capital

spending and $9.9 million for outlays related to powertrain

wind-down activities, net of asset sales. Total cash and

investments remaining at the end of the quarter were $264

million.

For 2024, total cash consumed by KARNO development and capital

investments is expected to be between $40 and $50 million, down

compared to $131 million in cash consumed by the company in 2023.

This estimate excludes cash payments associated with the stock

repurchase program, payments associated with the ongoing wind down

of powertrain operations, and cash generated from the sale of

powertrain assets. Hyliion expects to achieve commercialization of

the KARNO generator with the capital on hand.

Projections for 2025 include growth of KARNO generator

deliveries with proceeds from sales in the low double-digit

millions of dollars. The company also projects gross margins to be

approximately break-even or slightly negative and cash spending to

grow modestly compared to 2024.

About Hyliion

Hyliion is committed to creating innovative solutions that

enable clean, flexible and affordable electricity production. The

Company’s primary focus is to provide distributed power generators

that can operate on various fuel sources to future-proof against an

ever-changing energy economy. Headquartered in Austin, Texas, and

with research and development in Cincinnati, Ohio, Hyliion is

initially targeting the commercial and waste management industries

with a locally deployable generator that can offer prime power as

well as energy arbitrage opportunities. Beyond stationary power,

Hyliion will address mobile applications such as vehicles and

marine. The KARNO generator is a fuel-agnostic solution, enabled by

additive manufacturing, that leverages a linear heat generator

architecture. The Company aims to offer innovative, yet practical

solutions that contribute positively to the environment in the

energy economy. For further information, please visit

www.hyliion.com.

Forward Looking Statements

The information in this press release includes “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. All statements, other than statements of

present or historical fact included in this press release,

regarding Hyliion and its future financial and operational

performance, as well as its strategy, future operations, estimated

financial position, estimated revenues, and losses, projected

costs, prospects, plans and objectives of management are forward

looking statements. When used in this press release, including any

oral statements made in connection therewith, the words “could,”

“should,” “will,” “may,” “believe,” “anticipate,” “intend,”

“estimate,” “expect,” “project,” the negative of such terms and

other similar expressions are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. These forward-looking statements are based

on management’s current expectations and assumptions about future

events and are based on currently available information as to the

outcome and timing of future events. Except as otherwise required

by applicable law, Hyliion expressly disclaims any duty to update

any forward-looking statements, all of which are expressly

qualified by the statements herein, to reflect events or

circumstances after the date of this press release. Hyliion

cautions you that these forward-looking statements are subject to

numerous risks and uncertainties, most of which are difficult to

predict and many of which are beyond the control of Hyliion. These

risks include, but are not limited to, our status as an early stage

company with a history of losses, and our expectation of incurring

significant expenses and continuing losses for the foreseeable

future; our ability to develop to develop key commercial

relationships with suppliers and customers; our ability to retain

the services of Thomas Healy, our Chief Executive Officer; the

expected performance of the KARNO generator and system; the

execution of the strategic shift from our powertrain business to

our KARNO business, and the other risks and uncertainties described

under the heading “Risk Factors” in our SEC filings including in

our Annual Report (See item 1A. Risk Factors) on Form 10-K filed

with the Securities and Exchange Commission (the “SEC”) on February

13, 2024 for the year ended December 31, 2023. Given these risks

and uncertainties, readers are cautioned not to place undue

reliance on such forward-looking statements. Should one or more of

the risks or uncertainties described in this press release occur,

or should underlying assumptions prove incorrect, actual results

and plans could differ materially from those expressed in any

forward-looking statements. Additional information concerning these

and other factors that may impact Hyliion’s operations and

projections can be found in its filings with the SEC. Hyliion’s SEC

Filings are available publicly on the SEC’s website at www.sec.gov,

and readers are urged to carefully review and consider the various

disclosures made in such filings.

HYLIION HOLDINGS CORP.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Dollar amounts in thousands,

except share and per share data)

Three Months Ended March

31,

2024

2023

Revenues

Product sales and other

$

—

$

310

Total revenues

—

310

Cost of revenues

Product sales and other

—

691

Total cost of revenues

—

691

Gross loss

—

(381

)

Operating expenses

Research and development

7,968

20,918

Selling, general and administrative

6,592

10,981

Exit and termination costs

4,431

—

Total operating expenses

18,991

31,899

Loss from operations

(18,991

)

(32,280

)

Interest income

3,396

3,462

Gain on disposal of assets

3

2

Other expense, net

—

(15

)

Net loss

$

(15,592

)

$

(28,831

)

Net loss per share, basic and diluted

$

(0.09

)

$

(0.16

)

Weighted-average shares outstanding, basic

and diluted

178,482,894

180,118,044

HYLIION HOLDINGS CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Dollar amounts in thousands,

except share data)

March 31, 2024

December 31,

2023

(Unaudited)

Assets

Current assets

Cash and cash equivalents

$

14,715

$

12,881

Accounts receivable

122

40

Prepaid expenses and other current

assets

6,559

18,483

Short-term investments

126,703

150,297

Assets held for sale

5,973

—

Total current assets

154,072

181,701

Property and equipment, net

12,701

9,987

Operating lease right-of-use assets

6,992

7,070

Other assets

1,360

1,439

Long-term investments

122,529

128,186

Total assets

$

297,654

$

328,383

Liabilities and stockholders’

equity

Current liabilities

Accounts payable

$

2,119

$

4,224

Current portion of operating lease

liabilities

1,436

847

Accrued expenses and other current

liabilities

6,948

10,051

Total current liabilities

10,503

15,122

Operating lease liabilities, net of

current portion

6,207

6,792

Other liabilities

534

203

Total liabilities

17,244

22,117

Commitments and contingencies

Stockholders’ equity

Common stock, $0.0001 par value;

250,000,000 shares authorized; 184,016,695 and 183,071,317 shares

issued at March 31, 2024 and December 31, 2023, respectively;

175,304,238 and 183,034,255 shares outstanding as of March 31, 2024

and December 31, 2023, respectively

18

18

Additional paid-in capital

405,118

404,045

Treasury stock, at cost; 8,712,457 and

37,062 shares as of March 31, 2024 and December 31, 2023,

respectively

(11,370

)

(33

)

Accumulated deficit

(113,356

)

(97,764

)

Total stockholders’ equity

280,410

306,266

Total liabilities and stockholders’

equity

$

297,654

$

328,383

HYLIION HOLDINGS CORP.

UNAUDITED CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Dollar amounts in

thousands)

Three Months Ended March

31,

2024

2023

Cash flows from operating

activities

Net loss

$

(15,592

)

$

(28,831

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

572

524

Amortization and accretion of investments,

net

(973

)

(194

)

Noncash lease expense

78

302

Inventory write-down

—

231

Gain on disposal of assets

(572

)

(2

)

Share-based compensation

1,320

2,040

Carrying value adjustment to assets held

for sale

5,564

—

Changes in operating assets and

liabilities:

Accounts receivable

(82

)

299

Inventory

—

(1,026

)

Prepaid expenses and other assets

(7,382

)

(5,313

)

Accounts payable

(2,573

)

215

Accrued expenses and other liabilities

(3,066

)

(1,144

)

Operating lease liabilities

4

(340

)

Net cash used in operating activities

(22,702

)

(33,239

)

Cash flows from investing

activities

Purchase of property and equipment and

other

(2,818

)

(2,988

)

Proceeds from sale of property and

equipment

572

2

Purchase of investments

(23,707

)

(31,394

)

Proceeds from sale and maturity of

investments

53,861

33,533

Net cash provided by (used in) investing

activities

27,908

(847

)

Cash flows from financing

activities

Proceeds from exercise of common stock

options

48

19

Taxes paid related to net share settlement

of equity awards

(295

)

(195

)

Repurchase of treasury stock

(11,043

)

—

Net cash used in financing activities

(11,290

)

(176

)

Net decrease in cash and cash equivalents

and restricted cash

(6,084

)

(34,262

)

Cash and cash equivalents and restricted

cash, beginning of period

21,464

120,133

Cash and cash equivalents and restricted

cash, end of period

$

15,380

$

85,871

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240430068077/en/

Hyliion Holdings Corp. press@hyliion.com

ir@hyliion.com

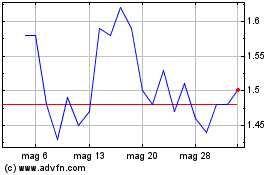

Grafico Azioni Hyliion (NYSE:HYLN)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Hyliion (NYSE:HYLN)

Storico

Da Mag 2023 a Mag 2024