UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

Juniper Networks, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| | |

Delaware | | 001-34501 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) |

| | |

1133 Innovation Way,

Sunnyvale, California | | 94089 |

(Address of principal executive offices) | | (Zip Code) |

Robert Mobassaly (408) 745-2000

(Name and telephone number, including area code, of the

person to contact in connection with this report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

| | | | | |

| ☒ | Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2023. |

Section 1—Conflict Minerals Disclosure

Item 1.01 Conflict Minerals Disclosure and Report

Conflict Minerals Disclosure

In accordance with Rule 13p-l promulgated under the Securities Exchange Act of 1934, as amended, and this Specialized Disclosure Report on Form SD (this “Form”), Juniper Networks, Inc. has filed a Conflict Minerals Report, which is attached as Exhibit 1.01. A copy of this Form and the Conflict Minerals Report are publicly available at https://www.juniper.net/us/en/company/citizenship-sustainability/supply-chain/#tab=dtabs-4.

The content of any website referred to in this Form, including any exhibit hereto, is included for general information only and is not incorporated by reference in this Form.

Item 1.02 Exhibit

The Conflict Minerals Report described in Item 1.01 is filed as Exhibit 1.01 to this Form SD.

Section 3 —Exhibits

Item 3.01 Exhibits

| | | | | | |

| Exhibit No. | | Description |

| Exhibit 1.01 | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

Juniper Networks, Inc.

(Registrant)

| | | | | | | | | | | | | | |

| By: | | /s/ Robert Mobassaly | | Date: May 24, 2024 |

| Name: | | Robert Mobassaly | | |

| Title: | | Senior Vice President, General Counsel and Secretary | | |

Exhibit 1.01

Juniper Networks, Inc.

Conflict Minerals Report for the Year Ended December 31, 2023

This Conflict Minerals Report (this “Report”) for Juniper Networks, Inc. (the “Company”, “Juniper”, “our” or “we”) covers the reporting period from January 1, 2023 to December 31, 2023, and is presented in accordance with Rule 13p-1 promulgated under the Securities Exchange Act of 1934, as amended, and Form SD (collectively, the “Rule”). The Rule imposes certain reporting obligations on U.S. Securities and Exchange Commission (“SEC”) registrants whose manufactured products contain “conflict minerals” that are necessary to the functionality or production of their products. The term “conflict minerals” is defined in the Rule as (A) cassiterite, columbite-tantalite (coltan), gold, wolframite, or their derivatives, which are currently limited to tin, tantalum and tungsten (collectively, “3TG”); or (B) any other mineral or its derivatives determined by the Secretary of State to be financing conflict in the Democratic Republic of the Congo (“DRC”) or any adjoining country that shares an internationally recognized border with the DRC (collectively, the “Covered Countries”). The adjoining countries are the Republic of the Congo, the Central African Republic, South Sudan, Rwanda, Uganda, Zambia, Burundi, Tanzania and Angola.

Throughout this Report, whenever a reference is made to any document, third-party material or website (including Juniper’s website), such reference is for general information only and does not incorporate information from such document, material or website into this Report, unless expressly incorporated by reference herein.

Overview

Company Overview

Juniper delivers reliable and secure networking technology to our customers, including network operators, telecommunication and cloud providers, enterprise IT teams, lines of businesses and network users such as individual devices, machines, applications, microservices and data stores. Businesses across the world use our solutions to access the internet and digital services, and our networks support their mission critical tasks. Since our inception, we believe that our solutions have led the way in high-performance networking when scaling the internet was a top priority. As organizations shift to remote work models, and adopt hybrid and multi-cloud architectures, our customers are facing greater challenges operating increasingly complex networks and handling more traffic with fewer staff members and lower IT budgets. Our cloud-driven, Artificial Intelligence ("AI") native technology simplifies network operations and meaningfully improves end-user experience by proactively resolving problems, resulting in fewer support tickets and less time to deploy, manage, and maintain the network than other competitive solutions. We believe this is our key differentiator.

Our solutions address secure connectivity needs for:

• Cloud and telecommunication service providers who build and operate the most mission critical networks in the world.

• Enterprises in a broad array of industries including financial services, education, healthcare, retail, government agencies who are increasingly building mission critical networks to support their digital strategies.

Our AI-native, enterprise networking operations ("AIOps") software-as-a-service ("SaaS") platform leverages data and automation to enable reliable, predictable, measurable user experience and superior performance for operators by simplifying deployment and day-to-day operations across the entire network.

Our supply chain and operations team manage relationships with our global supply chain, which includes our contract manufacturers, original design manufacturers, certain components suppliers, warehousing, and logistics. Our contract manufacturers and original design manufacturers are responsible for all phases of manufacturing, from prototypes to full production, and assist with activities such as material procurement. Given our downstream position in the supply chain, we do not have any direct purchasing relationships with the smelters or refiners in our supply chain, and we therefore rely on our first-tier suppliers to provide information about the sources of 3TG used in our products.

Industry Alignment Overview

Since 2011, Juniper has supported the development of industry tools and programs that provide a common means to report or collect due diligence information on the source and chain of custody of 3TG through our membership in the Responsible Minerals Initiative ("RMI"). The RMI is a recognized industry coalition focused on addressing and advancing the responsible sourcing of 3TG in the supply chain. Through the RMI and its workgroup, the Due Diligence Practices Team, Juniper has been engaged and continues to work with industry peers to ensure that our reasonable country of origin inquiry (“RCOI”) and due diligence processes are aligned with industry approaches. The primary objective of this alignment is to help ensure that minerals in our products are sourced responsibly.

Through our participation in the RMI, we seek to maximize the efficiency and effectiveness of our efforts to identify 3TG smelters and refiners in our supply chain and to encourage their participation in the RMI’s Responsible Minerals Assurance Process (the “RMAP”). The RMAP is a voluntary initiative in which an independent third-party validates the operations, audit practices, and management systems of smelters and refiners in line with the Organisation for Economic Co-operation and

Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas, including the supplements thereto (the “Guidance”). As it is a standardized protocol, we, along with other participants in the electronics industry, rely on the RMAP or equivalent industry-wide programs for audits of 3TG smelters and refiners.

Additionally, through the RMI and its Due Diligence Practices Team workgroup, as well as through our own due diligence, Juniper monitors the social, health and safety, and human rights impacts of the industry’s efforts to promote responsible sourcing in the Covered Countries, as well as Conflict-Affected and High-Risk Areas (CAHRAs), and uses that information to inform our compliance program. To avoid negative impact on the livelihoods of those in the mining communities in the Covered Countries or CAHRAs, we do not embargo the sourcing of 3TG from them.

Products Covered by this Report

The Company determined that 3TG was necessary to the functionality or production of products that we manufactured or contracted to be manufactured during the 2023 calendar year. We determined that our routing, switching, Wi-Fi, network security, and software-defined networking hardware products that were manufactured were within the scope of the Rule, based on the criteria that they contain components that may contain 3TG that is necessary to the functionality or production of the products.

For further information concerning our products, see “Item 1. Business” of our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on February 7, 2024.

Reasonable Country of Origin Inquiry

RCOI Overview and Process

Juniper is required to undertake an RCOI with respect to the necessary 3TG in its in-scope products that is reasonably designed to determine whether any of the necessary 3TG originated in any of the Covered Countries and whether they were not from recycled or scrap resources. Based on our RCOI design, utilizing RMI’s Conflict Minerals Reporting Template (“CMRT”), we surveyed suppliers that provide physical components that become part of our end products or directly manufacture our end products (collectively, “direct material suppliers”). Our direct material suppliers cover all critical technologies that are within our end products and necessary for their functionality or production. For the reporting period covered by this Report, the direct material suppliers surveyed represent all of our contract manufacturers and original design manufacturers and more than 98% of our total direct materials expenditures in 2023.

To determine whether necessary 3TG in our products originated in the Covered Countries, we retained a third-party service provider to assist us with the survey and to provide an analysis of the resulting data. We utilized the most current available CMRT to survey suppliers through our third-party platform.

We requested that all these suppliers complete a CMRT, and we provided educational materials to assist such suppliers on best practices and the completion of the CMRT. We monitor and track all communications via a conflict minerals data management platform. Both Juniper and our third-party service provider continued to contact suppliers that were initially unresponsive in completing a CMRT.

We performed data validation based on completion of questions in the CMRT and through our analysis of internal consistency among responses in the CMRT. Following the data validation process, CMRTs were accepted and classified as valid or invalid. Suppliers that submitted an invalid CMRT, meaning that the CMRT contained contradictory, incomplete or outdated information, were contacted and requested to resubmit a valid and complete form. Unresolved, contradictory, incomplete or outdated information impacts the accuracy and completeness of Juniper’s smelter and refiner list.

Based on data collected through May 15, 2024, 100% of the suppliers we surveyed submitted a CMRT.

RCOI Results

Based on Juniper’s RCOI, we determined that at least 74 suppliers identified use of smelters and refiners that sourced 3TG in whole or in part from within the Covered Countries. In addition to information provided by suppliers, Juniper’s conclusions concerning the origin of 3TG from identified smelters and refiners is based on RCOI information provided by the RMI to its members.

For the 2023 reporting period, Juniper was unable to determine the origin of at least a portion of the necessary 3TG in its in-scope products. Based on the results of our RCOI, we conducted due diligence for 2023. These due diligence efforts are discussed below.

Due Diligence

Design of Due Diligence Program

We designed our due diligence measures to conform to the framework in the Guidance. The Guidance identifies five steps for due diligence that should be implemented and provides guidance as to how to achieve each step. We developed our due diligence process to address each of these five steps.

The following describes activities undertaken by Juniper with respect to each of the due diligence-related steps set forth in the Guidance.

Step 1: Establish Strong Company Management Systems

We have established management systems that conform to Step 1 of the Guidance and that include the following elements:

Conflict Minerals Policy: Juniper has published and communicated to our suppliers a company policy stating our commitment to responsible sourcing of 3TG and our ongoing effort with suppliers to achieve a conflict-free supply chain. This policy can be viewed on our website at https://www.juniper.net/us/en/company/citizenship-sustainability/supply-chain. The policy is periodically reviewed by our internal conflict minerals operations team and has been approved by Juniper’s conflict minerals executive champions, who are currently the Corporate Vice President of Supply Chain Operations and the Senior Vice President, General Counsel. It is also integrated into our Juniper Business Partner Code of Conduct (https://www.juniper.net/assets/us/en/local/pdf/additional-resources/business-partner-code-of-conduct.pdf), which requires suppliers to exercise due diligence on the source of 3TG and make this information available to Juniper upon request.

Governance Structure: Juniper has established a conflict minerals governance structure that includes executive management and Board oversight for the program. A conflict minerals operations team comprised of individuals from Supply Chain Operations and Legal supports the program during all stages. We also inform our Engineering and Design Teams regarding conflict mineral requirements and integrate our due diligence requirements for products supplied to Juniper to drive the sourcing of conflict-free components. The conflict minerals operations team attempts to collect accurate and complete CMRTs from suppliers, delivers Juniper's company-level CMRT to customers, and meets when there are significant changes to the development, implementation, or maintenance of Juniper’s conflict minerals program. A team responsible for SEC filings, comprised of individuals from Legal and Finance, draft and review the Form SD filing and Conflict Minerals Report, for final review and signature by the General Counsel. The Audit Committee of the Board of Directors receives the Conflict Minerals Report findings for review.

Juniper uses a third party to assist us with collecting and evaluating supply chain information regarding 3TG, labeling high risk smelters, and identifying potential sourcing risks, and in the development and implementation of additional due diligence steps with suppliers in regard to conflict minerals.

Juniper also is engaged in multi-stakeholder initiatives to address responsible sourcing of 3TG. Through its membership in the RMI, Juniper engages with public policy issues relating to the responsible sourcing of 3TG and works to advance initiatives to reduce the use of raw materials that may support conflict or human rights violations.

Control Systems and Transparency: Juniper expects all of our in-scope suppliers to exercise due diligence on the source and chain of custody of any 3TG used in the production of the in-scope products, materials, or components sold to Juniper. These expectations are communicated to our suppliers through the supplier onboarding process, through the yearly Supplier Sustainability Attestation to which suppliers are expected to consent, and through ongoing business reviews. Juniper seeks to strengthen our relationship with our suppliers by providing educational materials and through our Business Partner Code of Conduct. If suppliers do not abide by Juniper’s policies or meet Juniper’s performance expectations, we escalate the matter in the supplier business review process and take the non-compliance into account in supplier performance scorecards. Supplier non-compliance and poor performance on scorecards may result in a determination to suspend the supplier, disengage from the supplier, or take other corrective actions with respect to the supplier.

Supplier Engagement: We request that suppliers complete a CMRT for the in-scope products that are supplied to us. Our in-scope suppliers are reviewed yearly against our approved vendor list and current orders to ensure we have a comprehensive list of in-scope products and suppliers. Juniper has adopted engagement procedures that include steps for supplier engagement and escalation such as in-person meetings, business reviews, outreach conducted by commodity managers, sharing of best practices and educational resources, and identification of corrective actions. When entering into or renewing supplier agreements, we include our Business Partner Code of Conduct and require our suppliers to comply with this Code of Conduct, including compliance with our conflict minerals due diligence. We provide all in-scope suppliers with yearly training on supply chain sustainability, which includes updated information and reinforcing expectations on responsible mineral sourcing and available resources. The last training was completed in Q1 2024. Additional guidance is provided to certain suppliers who report smelters or refiners of potential concern.

Grievance Mechanisms: All stakeholders, at any place in Juniper’s supply chain, are requested to immediately alert Juniper to any events of a questionable, fraudulent, or illegal nature that are, or may be, in violation of Juniper’s Worldwide Code of Business Conduct or Juniper’s Business Partner Code of Conduct, including any events relating to the source of 3TG in products supplied by our suppliers. Information may be submitted through email to integrity@juniper.net, by phone to the toll-free Juniper Integrity Hotline at +1-855-410-5445, or directly to Juniper’s Chief Compliance Officer. Information can be submitted anonymously and will be kept confidential as practicable and allowed by law.

Records Maintenance: Juniper has implemented an electronic document retention policy to retain 3TG-related documents for a period of five years, including supplier responses to CMRTs.

Step 2: Identify and Assess Risk in the Supply Chain

We identify and assess risk in our supply chain in conformance with Step 2 of the Guidance. Our compliance steps include surveying our supply chain using the CMRT, aggregating and analyzing the responses, and following up with suppliers for clarification or with requests for further information when their responses trigger specified quality control flags. For purposes of this report, we assess risk of sourcing in Covered Countries that could support armed groups or conflict, but more broadly we assess risk associated with CAHRAs. As referenced in the Product and Supply Chain Overview Section, we are a downstream company and reliant on suppliers for 3TG source information, therefore our risk identification and assessment measures largely relate to actions of our first-tier suppliers. We also utilize the RMI Due Diligence Practices Team and our third-party service provider to assess risk and perform direct outreach to smelters, most importantly those that do not participate in industry recognized audits/assessments. The primary guidance we use to understand the risks we should identify and assess is the European Commission Recommendation ((EU) 2018/1149) “on non-binding guidelines for the identification of conflict-affected and high-risk areas and other supply chain risks.”

In this Report we use “Conformant” to denote that the smelter or refiner participates in the RMAP and has been listed as Conformant by the RMI, within the meaning of the RMI standards, which includes those smelters and refiners described as “re-audit in progress.” We use “Active” to denote that the smelter or refiner is a participant in the RMAP and has committed to undergo an RMAP assessment, has completed the relevant documents, and has scheduled the on-site assessment. High-risk smelters are determined by factoring geographic risk (minerals originate or transit through Covered Countries or CAHRAs), audit status (such as RMAP), assessments of smelters done by credible third parties, and links smelters have to concerned parties. Smelter and refiner status reflected in this Report is based solely on information made publicly available by the RMI as of May 24, 2024, without independent verification by Juniper.

The proximate risks we identified with respect to the 2023 reporting period include:

•Sourcing from 177 smelters that are not RMAP Conformant or Active, including some high-risk, and whose practices are less transparent;

•All of the suppliers we surveyed responded, but due to some CMRT information remaining invalid, and smelter sources changing in response to our requests there is uncertainty around all sourcing practices;

•There was 1 supplier reporting incomplete smelter or refiner information indicating possible inaccurate source information;

•At least 74 suppliers indicated sourcing from Covered Countries, or were uncertain about sourcing from Covered Countries, and 16 suppliers reported sourcing from high-risk smelters, increasing the risk of minerals that support conflict entering our supply chain;

•Approximately 9% of suppliers indicated not receiving information from their entire supply base creating risk our smelter list is not comprehensive; and

•Due to not exhibiting policies or practices, or negative responses to other indicative CMRT questions, approximately 14% of suppliers have weak conflict mineral programs, meaning there is more uncertainty regarding the quality of the data provided by direct suppliers.

Approximately 58% of suppliers provided data at a company level as opposed to product level or user-defined level, and as a result, some smelters and refiners reported by those suppliers that provided company-level CMRTs may not be within our supply chain.

We compared the smelters and refiners listed in the CMRTs received to the status list maintained by the RMI.

We use suppliers’ CMRT responses to evaluate risk associated with program strength. We use the following criteria to evaluate the strength of a program: (1) whether the supplier has a conflict minerals sourcing policy; (2) whether the supplier has implemented 3TG due diligence measures; (3) whether the supplier reviews due diligence information received from its own suppliers against the expectations set forth in its policy; and (4) whether the supplier has a corrective action process.

Step 3: Design and Implement a Strategy to Respond to Identified Risks

The results of our due diligence are shared with the executive champions (currently our Corporate Vice President of Supply Chain Operations and Senior Vice President, General Counsel), as well as with the Audit Committee of our Board of Directors, which, among other responsibilities, is charged with oversight of risk management and financial reporting and compliance.

We address any risks identified through the process described in Step 2 on a case-by-case basis. Regarding suppliers who do not respond to third-party outreach, Juniper’s conflict minerals and supply chain operations teams contact these suppliers directly and request that such suppliers submit a CMRT. Other actions contemplated by our corrective action framework include, depending upon the particular circumstances, requesting a product-level CMRT and that the supplier take corrective action to ensure that any high-risk smelters or refiners are not in Juniper’s supply chain. We may also provide a supplier with additional guidance and education regarding the Rule, the Guidance, and/or our compliance expectations.

Through our participation in the RMI, we address smelter- and refiner-related risks and seek to exercise leverage over smelters and refiners to encourage smelters and refiners to become Conformant. We provide the RMI with Juniper’s lists of smelters and refiners that are not Conformant or Active and those entities disclosed by suppliers that are not listed as known smelters or refiners by the RMI in order to assist the RMI with prioritizing (1) outreach to those known smelters and refiners that are not participating in the RMAP and (2) research regarding those commonly reported entities that are not identified as a smelter or a refiner. We also work through our third-party service provider to directly alert smelters that they must participate in industry-recognized audits/assessments.

Step 4: Carry Out Independent Third-Party Audits of Supply Chain Due Diligence at Identified Points in the Supply Chain

Given that we are a downstream company, many steps removed from the mining or processing of 3TG, and that we do not purchase raw ore or refined 3TG, Juniper relies on independent third-party audits of smelters and refiners. Juniper supports such independent third-party audits, including those conducted by the RMAP, through our financial support for the RMI.

Juniper also actively supports the goal of increasing smelter and refiner participation in the RMAP through our participation in the RMI and direct outreach through our third-party service provider. This assists the RMI with prioritizing outreach to known smelters and refiners to encourage them to participate in the RMAP.

Step 5: Report on Supply Chain Due Diligence

This Report and the associated Form SD are filed annually with the SEC and are made publicly available on our website at https://www.juniper.net/us/en/company/corporate-responsibility/supply-chain.html.

Continuous Efforts to Mitigate Risk

As part of our ongoing efforts, in addition to the actions described above, we intend to take the following steps to support our due diligence process for future reporting periods:

•Request that suppliers complete CMRTs on a product-specific basis, to enable us to determine which smelters and refiners actually process 3TG contained in our products.

•Require suppliers to remove all high-risk smelters within two reporting cycles otherwise face removal as an approved vendor, and engage with them consistently to review corrective action progress.

•Encourage key direct material suppliers who receive a scorecard from us to source only from Conformant smelters and refiners by awarding higher supplier Compliance, Risk and Sustainability scores to those suppliers that utilize only Conformant smelters and refiners.

•Request that suppliers notify smelters or refiners that are not listed as Conformant by the RMI to obtain an independent third-party audit or be removed as a source.

•Notify suppliers at least twice per year of high-risk smelters that we expect to be removed from their sourcing.

•Update training materials yearly to progressively increase expectations of conflict-free sourcing.

Due Diligence Results

Survey Results

For the 2023 reporting year, Juniper received CMRTs from 100% of the suppliers we surveyed.

Smelters and Refiners Potentially in Juniper’s Supply Chain

Based on our RCOI and due diligence, our suppliers identified 424 smelters and refiners of 3TG that may be in our supply chain in 2023. Our tabulation includes some smelters that, as of May 24, 2024, were not listed on the RMI’s list of known smelters and refiners.

A summary of the known smelters and refiners for the 3TG that may be in our supply chain and their RMAP conformance status is provided here:

•Of the known gold refiners in our supply chain, 49% (93) are Conformant or Active.

•Of the known tantalum smelters in our supply chain 81% (41) are Conformant.

•Of the known tin smelters in our supply chain 66% (75) are Conformant or Active.

•Of the known tungsten smelters that may be in our supply chain 56% (38) are Conformant or Active.

As of the date of this Report and for the reporting period covered by this Report, we have not identified a supplier, smelter or refiner that we have reason to believe is sourcing 3TG contained in our in-scope products that is directly or indirectly financing or benefiting armed groups in Covered Countries. We took steps to remove high-risk smelters for reporting year 2023 by alerting all suppliers twice during the year of the high-risk smelters and requesting suppliers to remove these smelters by the end of 2023. However, given that we have received insufficient information with respect to certain smelters and refiners that may have processed 3TG in our products, we have not determined that any of our products are “DRC conflict-free.”

Country of Origin Information and Efforts to Determine Mine Location

Based on information provided by suppliers and the RMI, the identified countries of origin of the 3TG processed by the smelters and refiners listed in Juniper's supply chain could include the countries listed below. The listed countries of origin are derived from information made available by the RMI to its members on March 29, 2024.

| | | | | | | | | | | |

| Algeria* | Denmark | Latvia | Russia |

| Andorra | Dominican Republic | Lebanon* | Rwanda* |

| Antigua and Barbuda** | Ecuador* | Liberia* | Saint Kitts and Nevis** |

| Argentina | Egypt | Liechtenstein* | Saint Maarten** |

| Australia | El Salvador** | Lithuania | Saudi Arabia |

| Austria | Estonia | Luxembourg | Senegal |

| Azerbaijan* | Fiji* | Macao* | Serbia |

| Bahamas | Finland | Madagascar | Sierra Leone* |

| Bangladesh | France | Malaysia | Singapore |

| Barbados** | French Guiana* | Mali | Slovakia |

| Belarus | Georgia* | Malta | Slovenia |

| Belgium | Germany | Mauritania* | South Africa |

| Benin | Ghana* | Mauritius* | Spain |

| Bolivia | Greece | Mexico | St Vincent and Grenadines** |

| Bolivia* | Grenada | Monaco* | Sudan* |

| Bosnia and Herzegovina | Guatemala | Mongolia* | Suriname* |

| Botswana* | Guinea* | Morocco | Sweden |

| Brazil | Guyana* | Mozambique* | Switzerland |

| Bulgaria | Honduras | Myanmar* | Tajikistan |

| Burkina Faso | Hong Kong | Namibia* | Tanzania* |

| Burundi* | Hungary | Netherlands | Thailand |

| Cambodia* | Iceland* | New Zealand | Trinidad and Tobago |

| Cameroon** | India | Nicaragua* | Tunisia |

| Canada | Indonesia | Niger | Turkey |

| Cayman Islands** | Ireland | Nigeria | Turks and Caicos** |

| Chile | Israel | Norway* | Uganda* |

| China | Italy | Oman | Ukraine* |

| Chinese Taipei | Jamaica* | Pakistan | United Arab Emirates |

| Colombia | Japan | Panama | United Kingdom of Great Britain and Northern Ireland |

| Congo, Democratic Republic of the* | Jordan | Papua New Guinea* | United States of America |

| Costa Rica** | Kazakhstan* | Peru | Uruguay |

| Côte d'Ivoire | Kenya* | Philippines | Uzbekistan |

| Croatia | Korea, Republic of | Poland | Vietnam |

| Curacao** | Kuwait** | Portugal | Zambia* |

| Cyprus | Kyrgyzstan* | Puerto Rico | Zimbabwe* |

| Czech Republic | Laos* | Romania | |

_______________________________________

*indicates sourcing from mines only

**indicates sourcing from scrap/recycling only

Approximately 34% of the smelters and refiners in our supply chain sourced in-part from recycled or scrap sources. Of those, 31 smelters or refiners listed only sourcing from recycled or scrap sources. Each of the 3TG minerals were used in recycling or scrap sourcing.

Juniper endeavored to determine the mine or location of origin of the necessary 3TG contained in its in-scope products by conducting a supply-chain survey with suppliers using the CMRT and through the information made available by the RMI to its members, as well as by implementing the other measures described in this Report.

Forward-Looking Statements

This Report, including the section entitled “Continuous Efforts to Mitigate Risk,” contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 regarding our business, products and 3TG compliance efforts, including steps we intend to take to mitigate the risk that the 3TG in our products benefits armed groups, and the industry’s 3TG-related compliance efforts. Words such as “expects,” “anticipates,” “targets,” “goals,” “projects,” “would,” “could,” “intends,” “plans,” “believes,” “seeks,” “estimates,” variations of such words, and similar expressions are intended to identify such forward-looking statements. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, and these forward-looking statements are only predictions and are subject to risks, uncertainties, and assumptions that are difficult to predict. While forward-looking statements in this Report are based on reasonable expectations of our management at the time that they are made, you should not rely on them. Forward-looking statements are inherently subject to risks and uncertainties and actual results and outcomes may differ materially from the results and outcomes discussed in or anticipated by the forward-looking statements. Factors that could cause or contribute to such differences in results and outcomes include, without limitation, the risk that information reported to us by our direct suppliers or industry information used by us may be inaccurate; the risk that smelters or refiners may not participate in the RMAP; political and regulatory developments, whether in the Covered Countries, the United States or elsewhere; the risk that industry organizations and initiatives, such as the RMI and the RMAP, may not be an effective source of external support in our conflict minerals compliance process; as well as risks discussed under the heading “Risk Factors” in our most recent Annual Report on 10-K or subsequent Quarterly Report on Form 10-Q and in other reports we file with the SEC. Readers are urged not to place undue reliance on these forward-looking statements, which speak only as of the date of this Report. We undertake no obligation to revise or update any forward-looking statements in order to reflect any event or circumstance that may arise after the date of this Report.

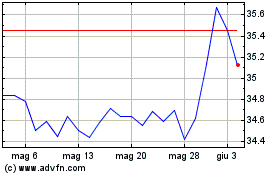

Grafico Azioni Juniper Networks (NYSE:JNPR)

Storico

Da Mag 2024 a Giu 2024

Grafico Azioni Juniper Networks (NYSE:JNPR)

Storico

Da Giu 2023 a Giu 2024