UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933

PITNEY BOWES INC.

(Exact name of registrant as specified in its charter)

| | | | | |

Delaware

(State or Other Jurisdiction

of Incorporation or Organization) | 06-0495050

(I.R.S. Employer

Identification No.) |

3001 Summer Street

Stamford, Connecticut 06926

(Address of Principal Executive Offices, Zip Code)

Pitney Bowes Inc. 2024 Stock Plan

1996 Pitney Bowes Employee Stock Purchase Plan, as amended and restated

(Full title of the Plan)

Lauren Freeman-Bosworth

Executive Vice President, General Counsel and Corporate Secretary

Pitney Bowes Inc.

3001 Summer Street

Stamford, Connecticut 06926

(Name and address of agent for service)

(203) 356-5000

(Telephone number, including area code, of agent for service)

Copy to:

Sean C. Feller, Esq.

Gibson, Dunn & Crutcher LLP

2029 Century Park East

Los Angeles, CA 90067-3026

Telephone: (310) 551-8746

Facsimile: (310) 552-7033

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer”, “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | |

| Large accelerated filer | þ | Accelerated filer | ¨ |

| Non-accelerated filer | ¨ | Smaller reporting company | ¨ |

| | Emerging growth company | ¨ |

| | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨ |

EXPLANATORY NOTE

This Registration Statement on Form S-8 is filed by Pitney Bowes Inc. (the “Registrant”), relating to up to (i) 8,400,000 shares of its common stock, par value $1.00 per share (“Common Stock”), issuable to eligible employees of the Registrant and its affiliates under the Pitney Bowes Inc. 2024 Stock Plan (the “2024 Stock Plan”), plus (A) any shares that remain available as of May 6, 2024 for future grant under the Registrant’s 2018 Stock Plan, as amended and restated (the “2018 Plan”), and (B) any shares subject to outstanding awards under the Registrant’s Stock Plan, as amended and restated, the Registrant’s 2007 Stock Plan, as amended and restated, the Registrant’s 2013 Stock Plan, as amended and restated, and the 2018 Plan, in each case, as of May 6, 2024, that on or after such date cease for any reason to be subject to such awards (other than by reason of exercise or settlement of the awards to the extent they are exercised for or settled in vested and nonforfeitable shares of Common Stock) and (ii) an additional 3,000,000 shares of Common Stock issuable to eligible employees of the Registrant and its affiliates under the 1996 Pitney Bowes Employee Stock Purchase Plan, as amended and restated (the “ESPP”).

PART I

INFORMATION REQUIRED IN THE SECTION 10(a) PROSPECTUS

The information required by this Part I has been omitted from this Registration Statement pursuant to the Note to Part I of Form S-8.

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

Item 3. Incorporation of Documents by Reference.

The following documents filed by the Registrant with the Securities and Exchange Commission (the "Commission"), are incorporated by reference herein and shall be deemed to be a part hereof:

•the Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on February 20, 2024;

•the Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2024, filed with the Commission on May 2, 2024;

•the Current Reports on Form 8-K filed with the Commission on May 8, 2024;

•the description of the Registrant’s Common Stock set forth under the caption “Description of Registrant’s Securities to be Registered” filed as Exhibit 4 to the Registrant’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, filed with the Commission on February 20, 2024, together with any amendment or report filed with the Commission for the purpose of updating such description.

In addition, all documents filed by the Registrant pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) after the date hereof, but

prior to the filing of a post-effective amendment to this Registration Statement that indicates that all securities offered hereby have been sold or that deregisters all such securities then remaining unsold, shall be deemed to be incorporated by reference in this Registration Statement and to be a part hereof from the date of filing of such documents. Notwithstanding the foregoing, unless specifically stated to the contrary in such filing, none of the information that the Registrant discloses under Items 2.02 or 7.01 of any Current Report on Form 8-K that it may from time to time furnish to the Commission will be incorporated by reference into, or otherwise be included in or deemed to be a part of, this Registration Statement.

For purposes of this Registration Statement, any document or any statement contained in a document incorporated or deemed to be incorporated herein by reference shall be deemed to be modified or superseded to the extent that a subsequently filed document or a statement contained herein or in any other subsequently filed document that also is or is deemed to be incorporated herein by reference modifies or supersedes such document or such statement in such document. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute a part of this Registration Statement. Subject to the foregoing, all information in this Registration Statement is so qualified in its entirety by the information appearing in the documents incorporated herein by reference.

Item 4. Description of Securities.

Not applicable.

Item 5. Interests of Named Experts and Counsel.

Not applicable.

Item 6. Indemnification of Directors and Officers.

Section 145 of the Delaware General Corporation Law allows for indemnification of any person who has been made, or threatened to be made, a party to any threatened, pending or completed action, suit or proceeding, whether civil, criminal, administrative or investigative by reason of the fact that he or she is or was serving as a director, officer, employee or agent of the registrant or by reason of the fact that he or she is or was serving at the request of the registrant as a director, officer, employee or agent of another corporation, partnership, joint venture, trust or other enterprise. In certain circumstances, indemnity may be provided against expenses (including attorneys’ fees), judgments, fines and amounts paid in settlement if the person acted in good faith and in the manner reasonably believed by him to be in, or not opposed to, the best interests of the registrant and, with respect to any criminal action or proceeding, had no reasonable cause to believe his conduct was unlawful. In any proceeding by or in the right of the registrant, no indemnification may be made if the person is found to be liable to the corporation,

unless and only to the extent the court in which the proceeding is brought or the Delaware Court of Chancery orders such indemnification.

Section 102(b)(7) of the Delaware General Corporation Law provides that a certificate of incorporation may contain a provision eliminating or limiting the personal liability of a director to the corporation or its stockholders for monetary damages for breach of fiduciary duty as a director provided that such provision shall not eliminate or limit the liability of a director (i) for any breach of the director’s duty of loyalty to the corporation or its stockholders, (ii) for acts or omissions not in good faith or which involve intentional misconduct or a knowing violation of law, (iii) under Section 174 (relating to liability for unauthorized acquisitions or redemptions of, or dividends on, capital stock) of the Delaware General Corporation Law, or (iv) for any transaction from which the director derived an improper personal benefit. The Registrant’s Amended and Restated Certificate of Incorporation includes a provision limiting such liability.

The Amended and Restated Certificate of Incorporation of the Registrant provides that each person who was or is made a party to or is threatened to be made a party to or is involved in any action, suit or proceeding, whether civil, criminal, administrative or investigative (a “proceeding”), by reason of the fact that he or she, or a person of whom he or she is the legal representative, is or was a director or officer of the Registrant or is or was serving at the request of the Registrant as a director, officer, employee or agent of another corporation or of a partnership, joint venture, trust or other enterprise, including service with respect to employee benefit plans, whether the basis of such proceeding is alleged action in an official capacity as a director, officer, employee or agent or in any other capacity while serving as a director, officer, employee or agent, shall be indemnified and held harmless by the Registrant to the fullest extent authorized by the Delaware General Corporation Law, as the same exists or may hereafter be amended (but, in the case of any such amendment, only to the extent that such amendment permits the Registrant to provide broader indemnification rights than said law permitted the Registrant to provide prior to such amendment), against all expense, liability and loss (including attorneys’ fees, judgments, fines, ERISA excise taxes or penalties and amounts paid or to be paid in settlement) reasonably incurred or suffered by such person in connection therewith and such indemnification shall continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of his or her heirs, executors and administrators. Such right to indemnification is a contract right and includes the right to be paid by the Registrant the expenses incurred in defending any such proceeding in advance of its final disposition; provided, however, that, if the Delaware General Corporation Law requires, the payment of such expenses incurred by a director or officer in his or her capacity as a director or officer (and not in any other capacity in which service was or is rendered by such person while a director or officer, including, without limitation, service to an employee benefit plan) in advance of the final disposition of a proceeding, shall be made only upon delivery to the Registrant of an undertaking, by or on behalf of such director or officer, to repay all amounts so advanced if it shall ultimately be determined that such director or officer is not entitled to such indemnity.

The foregoing statements are specifically made subject to the detailed provisions of the Delaware General Corporation Law and the Restated Certificate of Incorporation of the Registrant.

The Registrant has a directors and officers liability insurance policy that will reimburse the Registrant for any payments that it shall make to directors and officers pursuant to law or the indemnification provisions of its Restated Certificate of Incorporation and that will, subject to certain exclusions contained in the policy, further pay any other costs, charges and expenses and settlements and judgments arising from any proceeding involving any director or officer of the Registrant in his or her past or present capacity as such, and for which he may be liable, except as to any liabilities arising from acts that are deemed to be uninsurable.

The Registrant has entered into indemnification agreements with its directors and executive officers, and intends to enter into indemnification agreements with any new directors and executive officers in the future. Such indemnification agreements provide for indemnification and advancement of expenses consistent with the Restated Certificate of Incorporation of the Registrant, and against all expenses, liabilities and loss incurred in connection with their service as a director or executive officer on behalf of the Registrant, with certain limited exceptions. The preceding discussion of the Registrant’s indemnification agreements is not intended to be exhaustive and is qualified in its entirety by reference to such indemnification agreements.

Insofar as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of the Registrant pursuant to the foregoing provisions, the Registrant has been informed that in the opinion of the Commission such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

Item 7. Exemption from Registration Claimed.

Not applicable.

Item 8. Exhibits.

Exhibit No. Exhibit Description

____________

*Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8 and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Stamford, State of Connecticut, on May 10, 2024.

| | | | | |

| |

Pitney Bowes Inc. |

| |

By: | /s/ Lauren Freeman-Bosworth |

Name: | Lauren Freeman-Bosworth |

| Title: | Executive Vice President, General Counsel and Corporate Secretary |

POWER OF ATTORNEY

KNOW ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Lauren Freeman-Bosworth his or her true and lawful attorney-in-fact and agent, each with full power of substitution and resubstitution, for him or her and in his name, place and stead, and in any and all capacities, to sign any and all amendments (including post-effective amendments) to this Registration Statement, and to file the same, with exhibits thereto and other documents in connection therewith, with the Securities and Exchange Commission, granting to the attorney-in-fact and agent, and each of them, full power and authority to do and perform each and every act and thing requisite or necessary to be done in or about the premises, as full to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that the attorney-in-fact and agent or their substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, as amended, this Registration Statement has been signed by the following persons in the capacities indicated on the dates indicated.

| | | | | | | | |

| Signature | Title | Date

|

/s/ Jason C. Dies Jason C. Dies | Interim Chief Executive Officer (Principal Executive Officer) | May 10, 2024 |

/s/ John A. Witek

John A. Witek | Interim Chief Financial Officer (Principal Financial Officer) | May 10, 2024 |

/s/ Joseph R. Catapano

Joseph R. Catapano | Vice President, Chief Accounting Officer (Principal Accounting Officer) | May 10, 2024 |

/s/ Jill Sutton Jill Sutton | Non-Executive Chairman - Director | May 10, 2024 |

/s/ Milena Alberti-Perez Milena Alberti-Perez | Director | May 10, 2024 |

/s/ Todd Everett Todd Everett | Director | May 10, 2024 |

/s/ Lance Rosenzweig Lance Rosenzweig | Director | May 10, 2024 |

/s/ Kurt Wolf Kurt Wolf | Director | May 10, 2024 |

Exhibit 107.1

Calculation of Filing Fee Tables

FORM S-8

(Form Type)

PITNEY BOWES INC.

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title (1) | Fee Calculation Rule | Amount Registered | Proposed Maximum

Offering Price Per Share | Maximum

Aggregate

Offering Price | Fee Rate | Amount of

Registration Fee |

| Equity | Common stock, par value $1.00 per share(1) | Rule 457(a) (2) | 8,400,000 (3) | $5.11 | $42,924,000 | $147.60 per $1,000,000 | $6,335.58 |

| Equity | Common stock, par value $1.00 per share | Rule 457(a) (2) | 3,000,000 (4) | $5.11 | $15,330,000 | $147.60 per $1,000,000 | $2,262.71 |

| Total Offering Amounts |

| $58,254,000 | | $8,598.29 |

| Total Fee Offsets |

|

| | — |

| Net Fee Due |

|

|

| $8,598.29 |

(1) Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement on Form S-8 shall also cover such indeterminate number of additional shares of common stock, par value $1.00 per share, of the Registrant (the “Common Stock”) as may become issuable to prevent dilution in the event of stock splits, stock dividends or similar transactions pursuant to the terms of the Pitney Bowes Inc. 2024 Stock Plan (the “Stock Plan”).

(2) Calculated solely for the purpose of determining the registration fee pursuant to Rules 457(c) and (h) of the Securities Act, and based on the average of the high and low sale prices of the Common Stock, as quoted on The New York Stock Exchange, on May 9, 2024.

(3) Represents 8,400,000 shares of Common Stock reserved for issuance under the Stock Plan.

(4) Represents an additional 3,000,000 shares of Common Stock reserved for issuance under the 1996 Pitney Bowes Employee Stock Purchase Plan.

Exhibit 5.1

May 9, 2024

Pitney Bowes Inc.

3001 Summer Street

Stamford, Connecticut 06926

Re: Pitney Bowes Inc. Registration Statement on Form S-8

Ladies and Gentlemen:

We have examined the Registration Statement on Form S-8 (the “Registration Statement”) of Pitney Bowes Inc., a Delaware corporation (the “Company”), to be filed with the Securities and Exchange Commission (the “Commission”) pursuant to the Securities Act of 1933, as amended (the “Securities Act”), in connection with the offering by the Company of up to (i) 8,400,000 shares of the Company’s common stock, par value $1.00 per share (the “Stock Plan Shares”), under the Pitney Bowes Inc. 2024 Stock Plan (the “Plan”) and (ii) 3,000,000 Shares under the 1996 Pitney Bowes Inc. Employee Stock Purchase Plan, as amended and restated (such shares, together with the Stock Plan Shares, the “Shares”).

We have examined the originals, or photostatic or certified copies, of such records of the Company and certificates of officers of the Company and of public officials and such other documents as we have deemed relevant and necessary as the basis for the opinion set forth below. We have also made such other investigations as we have deemed relevant and necessary or appropriate in connection with the opinion hereinafter set forth. In our examination, we have assumed the genuineness of all signatures, the legal capacity and competency of all natural persons, the authenticity of all documents submitted to us as originals and the conformity to original documents of all documents submitted to us as copies. We have also assumed that there are no agreements or understandings between or among the Company and any participants in the Plan that would expand, modify or otherwise affect the terms of such plans or the rights or obligations of the participants thereunder. Finally, we have assumed the accuracy of all other information provided to us by the Company during the course of our investigations, on which we have relied in issuing the opinion expressed below.

Based upon the foregoing examination and in reliance thereon, and subject to the assumptions stated here and in reliance on the statements of fact contained in the documents that we have examined, we are of the opinion that the Shares, when issued and sold in accordance with the terms set forth in the Plan and against payment therefor, and when the Registration Statement has become effective under the Securities Act, will be validly issued, fully paid and non-assessable.

We render no opinion herein as to matters involving the laws of any jurisdiction other than the Delaware General Corporation Law (the “DGCL”). We are not admitted to practice in the State of Delaware; however, we are generally familiar with the DGCL as currently in effect and have made such inquiries as we consider necessary to render the opinions above. This opinion is limited to the effect of the current state of the DGCL and the facts as they currently exist. We assume no obligation to revise or supplement this opinion in the event of future changes in such law or the interpretations thereof or such facts.

We consent to the filing of this opinion as an exhibit to the Registration Statement and we further consent to the use of our name in the Registration Statement and the prospectus that forms a part thereof. In giving these consents, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the Rules and Regulations of the Commission.

Very truly yours,

/s/ Gibson Dunn & Crutcher LLP

Gibson Dunn & Crutcher LLP

Exhibit 23.2

CONSENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We hereby consent to the incorporation by reference in the Registration Statement on Form S-8 of Pitney Bowes Inc. of our report dated February 20, 2024 relating to the financial statements, the financial statement schedule, and the effectiveness of internal control over financial reporting, which appears in Pitney Bowes Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023.

/s/ PricewaterhouseCoopers LLP

Stamford, Connecticut

May 10, 2024

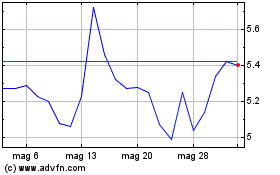

Grafico Azioni Pitney Bowes (NYSE:PBI)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Pitney Bowes (NYSE:PBI)

Storico

Da Nov 2023 a Nov 2024