Pitney Bowes Provides Update on Accelerated Progress of Cost Rationalization Program and Increases Savings Targets

01 Luglio 2024 - 2:00PM

Business Wire

Management has Expeditiously Implemented

~$70 Million in Cost Reductions Over the Past Month and Identified

New Opportunities for Strengthening Pitney Bowes

The Cost Rationalization Program’s Increased

Savings Target is $120 Million to $160 Million, Up from $60 Million

to $100 Million

Pitney Bowes Inc. (NYSE: PBI) (“Pitney Bowes” or the “Company”),

a global shipping and mailing company that provides technology,

logistics and financial services, today announced an update on the

first phase of the Company’s cost rationalization initiative, which

was previously announced in late May 2024.

The Company has identified and initiated approximately $70

million in cost savings, the majority of which has already been

eliminated in the second quarter. Approximately $25 million of

non-recurring charges associated with these efforts are expected to

be recorded in the second quarter. The cost reductions announced

today are anticipated to be largely reflected in the Company’s

second half of 2024 pre-tax earnings and fully reflected in

2025.

The savings primarily come from general corporate cost

reductions and include certain SendTech and Presort expense

reductions. These savings do not include prospective savings from

changes in the Global Ecommerce segment, where the Company is in

the final stages of an expedited strategic review of alternatives

to eliminate ongoing operating losses.

Further, management has identified additional opportunities for

achieving new efficiencies in the coming months and has increased

its anticipated savings from an initial target of $60 million to

$100 million to between $120 million to $160 million The Company

anticipates that a meaningful portion of these incremental savings

will be realized over the remainder of 2024, while some initiatives

will require efforts into 2025.

Lance Rosenzweig, Interim Chief Executive Officer and a member

of the Board of Directors, commented:

“Since announcing our strategic initiatives in late May, new

leadership has been operating with intensity and urgency to

accelerate the turnaround of Pitney Bowes. Our ability to implement

approximately $70 million in long-term savings in just over a month

reflects the significant value creation opportunities at hand. It

also reflects the dedication and hard work that our leadership

teams are putting into the Company’s transformation. Looking ahead,

we will continue to leave no stone unturned when it comes to

improving the Company’s profitability, focus and overall financial

strength. By making thoughtful decisions and laying the right

foundation now, we can position Pitney Bowes to generate enhanced

value from its tremendous assets and businesses in 2025 and beyond.

I look forward to delivering further detail on our upsized cost

rationalization program and other important initiatives on Pitney

Bowes’ second quarter earnings call.”

Mr. Rosenzweig added:

“We acknowledge that certain necessary decisions impacted our

workforce and valued employees. I want to express my sincere and

heartfelt appreciation to these individuals who have been impacted.

Some of the non-recurring charges have been dedicated to severance,

outplacement and other resources intended to guide a smooth

transition for those that have been so instrumental in shaping our

Company.”

As previously disclosed, Pitney Bowes is also continuing to

focus on other strategic initiatives that include an accelerated

Global Ecommerce strategic review, cash optimization and balance

sheet deleveraging. A full overview of these initiatives can be

found in the Company’s May 22, 2024 announcement.

About Pitney Bowes

Pitney Bowes is a global shipping and mailing company that

provides technology, logistics and financial services to more than

90 percent of the Fortune 500. Small business, retail, enterprise

and government clients around the world rely on Pitney Bowes to

remove the complexity of sending mail and parcels. For the latest

announcements and financial results, visit

https://www.pitneybowes.com/us/newsroom.html. For additional

information, visit Pitney Bowes at www.pitneybowes.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240701315736/en/

For Media:

Kathleen Raymond, 203.351.7233 kathleen.raymond@pb.com

or

pitneybowes@longacresquare.com

For Investors:

Alex Brown, 203.351.7639 investorrelations@pb.com

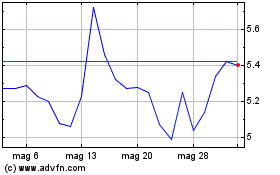

Grafico Azioni Pitney Bowes (NYSE:PBI)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Pitney Bowes (NYSE:PBI)

Storico

Da Nov 2023 a Nov 2024