Champion Homes, Inc. (NYSE: SKY) (“Champion Homes”) today

announced financial results for its third quarter ended December

28, 2024 (“fiscal 2025”).

Third Quarter Fiscal 2025 Highlights (compared to Third

Quarter Fiscal 2024)

- Net sales increased 15.3% to $644.9 million

- U.S. homes sold increased 14.1% to 6,437

- Backlog increased 7.6% compared to December 2023 and decreased

26.9% to $313 million from the sequential second quarter

- Average selling price (“ASP”) per U.S. home sold increased 2.8%

to $94,900

- Gross profit margin expanded by 280 basis points to 28.1%

- Net income increased by 31.0% to $61.5 million

- Earnings per diluted share (“EPS”) increased 30.9% to

$1.06

- Adjusted EBITDA increased 25.7% to $83.3 million

- Adjusted EBITDA margin expanded by 110 basis points to

12.9%

- Net cash generated by operating activities of $50.4 million

during the quarter

- Repurchased $20.0 million of shares under the share repurchase

program

“Champion’s strong performance this quarter reflects our ability

to earn new customers and deliver profitable growth across our

family of brands,” said Tim Larson, President and Chief Executive

Officer of Champion Homes. “Since stepping into the role, I’ve been

actively engaging with our employees, customers, partners, and

shareholders to solicit feedback and identify opportunities to

build on our strengths and drive long-term growth. I remain

confident in the effectiveness of our strategy, including the

expansion of our retail and digital presence, and strategic

investments supporting the growth of community owners, independent

retailers, and builder developers. As we respond to the evolving

housing environment, we will continue to remain nimble and execute

our differentiated strategy – including investing in technology and

accelerating product innovation – while delivering sustained value

for all our stakeholders."

Third Quarter Fiscal 2025 Results

Net sales for the third quarter fiscal 2025 increased 15.3% to

$644.9 million compared to the prior-year period. The number of

U.S. homes sold in the third quarter fiscal 2025 increased 14.1% to

6,437 driven by an increase in demand across all sales channels.

The ASP per U.S. home sold increased 2.8% to $94,900 due to an

increase in the number of units sold through company-owned retail

sales centers during the quarter. The number of Canadian

factory-built homes sold in the quarter decreased to 209 homes

compared to 249 homes in the prior-year period due to softening

demand in certain markets.

Gross profit increased by 28.1% to $181.0 million in the third

quarter fiscal 2025 compared to the prior-year period. Gross profit

margin was 28.1% of net sales, a 280-basis point expansion compared

to 25.3% in the third quarter fiscal 2024. Gross margin expansion

reflects higher ASPs on new homes sold through company-owned retail

sales centers which also generated a greater percentage of total

revenue in addition to lower input costs and acquisition synergy

capture when compared to the prior-year period.

Selling, general, and administrative expenses (“SG&A”) in

the third quarter fiscal 2025 increased to $108.2 million from

$85.1 million in the same period last year. SG&A during the

quarter increased due to higher variable compensation from higher

sales volumes and profitability as well as investments in people

and information systems to support future growth. SG&A as a

percentage of net sales was 16.8%, compared to 15.2% in the prior

year period.

Net income increased by 31.0% to $61.5 million for the third

quarter fiscal 2025 compared to the prior-year period. The increase

in net income was driven by higher sales and gross profit partially

offset by higher SG&A in the quarter.

Adjusted EBITDA for the third quarter fiscal 2025 increased by

25.7% to $83.3 million compared to the third quarter fiscal 2024.

Adjusted EBITDA margin for the quarter was 12.9%, compared to 11.8%

in the prior-year period.

As of December 28, 2024, Champion Homes had $581.8 million of

cash and cash equivalents, an increase of $11.5 million in the

current quarter. The Company repurchased and retired $20 million of

its common stock during the third quarter under the previously

announced repurchase program. On January 30, 2025, the Board of

Directors refreshed the share repurchase authorization to provide

for $100 million of potential future repurchases.

Conference Call and Webcast Information:

Champion Homes’ management will host a conference call tomorrow,

February 5, 2025, at 8:00 a.m. Eastern Time, to discuss Champion

Homes’ financial results and an update on current operations.

Investors and other interested parties can listen to a webcast

of the live conference call by logging onto the Investor Relations

section of Champion Homes’ website at ir.championhomes.com. The

online replay will be available on the same website immediately

following the call.

The conference call can also be accessed by dialing (877)

407-4018 (domestic) or (201) 689-8471 (international). A telephonic

replay will be available approximately three hours after the call

by dialing (844) 512-2921, or for international callers, (412)

317-6671. The passcode for the live call and the replay is

13750900. The replay will be available until 11:59 P.M. Eastern

Time on February 19, 2025.

About Champion Homes, Inc.:

Champion Homes, Inc. (NYSE: SKY) is a leading producer of

factory-built housing in North America and employs approximately

9,000 people. With more than 70 years of homebuilding experience

and 48 manufacturing facilities throughout the United States and

western Canada, Champion Homes is well positioned with an

innovative portfolio of manufactured and modular homes, ADUs,

park-models and modular buildings for the single-family,

multi-family, and hospitality sectors.

In addition to its core home building business, Champion Homes

provides construction services to install and set-up factory-built

homes, operates a factory-direct retail business with 72 retail

locations across the United States, and operates Star Fleet

Trucking, providing transportation services to the manufactured

housing and other industries from several dispatch locations across

the United States.

Champion Homes builds homes under some of the most well-known

brand names in the factory-built housing industry including Skyline

Homes, Champion Homes, Genesis Homes, Regional Homes, Athens Park

Models, Dutch Housing, Atlantic Homes, Excel Homes, Homes of Merit,

New Era, Redman Homes, ScotBilt Homes, Shore Park, Silvercrest,

Titan Homes in the U.S. and Moduline and SRI Homes in western

Canada.

Presentation of Non-GAAP Financial Measures

In addition to the results provided in accordance with U.S.

generally accepted accounting principles (“U.S. GAAP”) throughout

this press release, Champion Homes has provided Non-GAAP financial

measures, Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net

Income, and Adjusted EPS, (collectively the “Non-GAAP Financial

Measures”) which present operating results on a basis adjusted for

certain items. Champion Homes uses these Non-GAAP Financial

Measures for business planning purposes and in measuring its

performance relative to that of its competitors. Champion Homes

believes that these Non-GAAP Financial Measures are useful

financial metrics to assess its operating performance from

period-to-period by excluding certain items that Champion Homes

believes are not representative of its core business. These

Non-GAAP Financial Measures are not intended to replace, and should

not be considered superior to, the presentation of Champion Homes’

financial results in accordance with U.S. GAAP.

Champion Homes defines Adjusted EBITDA as net income or loss

attributable to Champion Homes, Inc. plus expenses or minus income,

(a) the provision for income taxes, (b) interest income or expense,

net, (c) depreciation and amortization, (d) gain or loss from

discontinued operations, (e) non-cash restructuring charges and

impairment of assets, (f) equity in net earnings or losses of ECN,

(g) charges related to the remediation of the water intrusion

product liability claims; and (h) other non-operating income and

costs, including but not limited to those costs for the acquisition

and integration or disposition of businesses, including the change

in fair value of contingent consideration, and idle facilities.

Adjusted EBITDA Margin is calculated as Adjusted EBITDA divided by

net sales reported in the income statements.

Champion Homes defines Adjusted Net Income as net income or loss

attributable to Champion Homes, Inc. plus expenses or minus income

(net of tax where applicable), (a) gain or loss from discontinued

operations, (b) non-cash restructuring charges and impairment of

assets, (c) equity in net earnings or losses of ECN, (d) charges

related to the remediation of estimated water intrusion product

liability, and (e) other non-operating income or expense including,

but not limited to those costs for the acquisition and integration

or disposition of businesses, including the change in fair value of

contingent consideration, and idle facilities. Champion Homes

defines Adjusted EPS as Adjusted Net Income divided by shares

outstanding.

Adjusted EBITDA, Adjusted EBITDA Margin, Adjusted Net Income and

Adjusted EPS are not measures of earnings calculated in accordance

with U.S. GAAP, and should not be considered an alternative to, or

more meaningful than, net income or loss, net sales, operating

income or earnings per share prepared on a U.S. GAAP basis. These

Non-GAAP Financial Measures do not purport to represent cash flow

provided by, or used in, operating activities as defined by U.S.

GAAP. Champion Homes believes that similar Non-GAAP Financial

Measures are commonly used by investors to evaluate its performance

and that of its competitors. However, Champion Homes use of

Non-GAAP Financial Measures may vary from that of others in its

industry. The Non-GAAP Financial Measures are reconciled from the

respective measure under U.S. GAAP in the tables below.

Forward-Looking Statements

Statements in this press release, including certain statements

regarding Champion Homes’ strategic initiatives, and future market

demand are intended to be covered by the safe harbor for

"forward-looking statements" provided by the Private Securities

Litigation Reform Act of 1995. These forward-looking statements

generally can be identified by use of words such as "believe,"

"expect," "future," "anticipate," "intend," "plan," "foresee,"

"may," "could," "should," "will," "potential," "continue," or other

similar words or phrases. Similarly, statements that describe

objectives, plans, or goals also are forward-looking statements.

Such forward-looking statements involve inherent risks and

uncertainties, many of which are difficult to predict and are

generally beyond the control of Champion Homes. We caution readers

that a number of important factors could cause actual results to

differ materially from those expressed in, implied, or projected by

such forward-looking statements. Risks and uncertainties include

regional, national and international economic, financial, public

health and labor conditions, and the following: supply-related

issues, including prices and availability of materials;

labor-related issues; inflationary pressures in the North American

economy; the cyclicality and seasonality of the housing industry

and its sensitivity to changes in general economic or other

business conditions; demand fluctuations in the housing industry,

including as a result of actual or anticipated increases in

homeowner borrowing rates; the possible unavailability of

additional capital when needed; competition and competitive

pressures; changes in consumer preferences for our products or our

failure to gauge those preferences; quality problems, including the

quality of parts sourced from suppliers and related liability and

reputational issues; data security breaches, cybersecurity attacks,

and other information technology disruptions; the potential

disruption of operations caused by the conversion to new

information systems; the extensive regulation affecting the

production and sale of factory-built housing and the effects of

possible changes in laws with which we must comply; the potential

impact of natural disasters on sales and raw material costs; the

risks associated with mergers and acquisitions, including

integration of operations and information systems; periodic

inventory adjustments by, and changes to relationships with,

independent retailers; changes in interest and foreign exchange

rates; insurance coverage and cost issues; the possibility that all

or part of our intangible assets, including goodwill, might become

impaired; the possibility that all or part of our investment in ECN

Capital Corp. ("ECN") might become impaired; the possibility that

our risk management practices may leave us exposed to unidentified

or unanticipated risks; the potential disruption to our business

caused by public health issues, such as an epidemic or pandemic,

and resulting government actions; the possibility our share

repurchase program will not enhance long-term stockholder value,

could increase the volatility of our stock price, and diminish our

cash reserves; and other risks set forth in the “Risk Factors”

section, the “Legal Proceedings” section, the “Management's

Discussion and Analysis of Financial Condition and Results of

Operations” section, and other sections, as applicable, in our

Annual Reports on Form 10-K, including our Annual Report on Form

10-K for the fiscal year ended March 30, 2024 previously filed with

the Securities and Exchange Commission (“SEC”), as well as in our

Quarterly Reports on Form 10-Q, and Current Reports on Form 8-K,

filed with or furnished to the SEC.

If any of these risks or uncertainties materializes or if any of

the assumptions underlying such forward-looking statements proves

to be incorrect, then the developments and future events concerning

Champion Homes set forth in this press release may differ

materially from those expressed or implied by these forward-looking

statements. You are cautioned not to place undue reliance on these

statements, which speak only as of the date of this release. We

anticipate that subsequent events and developments will cause our

expectations and beliefs to change. Champion Homes assumes no

obligation to update such forward-looking statements to reflect

events or circumstances after the date of this document or to

reflect the occurrence of unanticipated events, unless obligated to

do so under the federal securities laws.

CHAMPION HOMES, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Dollars in thousands)

December 28, 2024

(unaudited)

March 30, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

581,753

$

495,063

Trade accounts receivable, net

68,441

64,632

Inventories, net

336,766

318,737

Other current assets

33,721

39,870

Total current assets

1,020,681

918,302

Long-term assets:

Property, plant, and equipment, net

304,166

290,930

Goodwill

357,973

357,973

Amortizable intangible assets, net

67,601

76,369

Deferred tax assets

29,644

26,878

Other noncurrent assets

257,404

252,889

Total assets

$

2,037,469

$

1,923,341

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Floorplan payable

$

88,198

$

91,286

Accounts payable

44,695

50,820

Other current liabilities

261,269

247,495

Total current liabilities

394,162

389,601

Long-term liabilities:

Long-term debt

24,696

24,669

Deferred tax liabilities

7,088

6,905

Other liabilities

83,224

79,796

Total long-term liabilities

115,008

111,370

Stockholders' Equity:

Common stock

1,587

1,605

Additional paid-in capital

582,673

568,203

Retained earnings

965,008

866,485

Accumulated other comprehensive loss

(20,969

)

(13,923

)

Total stockholders’ equity

1,528,299

1,422,370

Total liabilities and stockholders’

equity

$

2,037,469

$

1,923,341

CHAMPION HOMES, INC.

CONDENSED CONSOLIDATED INCOME

STATEMENTS

(Unaudited, dollars in thousands,

except per share amounts)

Three months ended

Nine months ended

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Net sales

$

644,925

$

559,455

$

1,889,581

$

1,488,460

Cost of sales

463,903

418,183

1,378,011

1,101,026

Gross profit

181,022

141,272

511,570

387,434

Selling, general, and administrative

expenses

108,214

85,091

316,696

219,984

Operating income

72,808

56,181

194,874

167,450

Interest (income), net

(3,991

)

(4,309

)

(12,977

)

(24,090

)

Other (income) expense

(2,158

)

756

(3,363

)

2,821

Income before income taxes

78,957

59,734

211,214

188,719

Income tax expense

16,698

12,764

45,809

44,811

Net income before equity in net loss of

affiliates

62,259

46,970

165,405

143,908

Equity in net (income) loss of

affiliates

(568

)

—

1,466

—

Net income

62,827

46,970

163,939

143,908

Net (income) attributable to

non-controlling interest

(1,290

)

—

(1,874

)

—

Net income attributable to Champion Homes,

Inc

$

61,537

$

46,970

$

162,065

$

143,908

Net income per share:

Basic

$

1.07

$

0.81

$

2.81

$

2.51

Diluted

$

1.06

$

0.81

$

2.79

$

2.49

CHAMPION HOMES, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited, dollars in

thousand)

Nine months ended

December 28, 2024

December 30, 2023

Cash flows from operating

activities

Net income

$

163,939

$

143,908

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

30,796

24,017

Amortization of deferred financing

fees

280

255

Equity-based compensation

14,184

15,231

Deferred taxes

(2,464

)

(3,115

)

Loss on disposal of property, plant, and

equipment

128

145

Foreign currency transaction loss

(gain)

1,436

(184

)

Equity in net loss of affiliates

1,466

217

Dividends from equity method

investment

1,011

—

Change in fair value of contingent

consideration

7,912

—

Change in assets and liabilities:

Accounts receivable

(3,858

)

39,340

Floor plan receivables

(16,874

)

(4,978

)

Inventories

(18,902

)

47,696

Other assets

8,045

(10,756

)

Accounts payable

(4,762

)

(15,309

)

Accrued expenses and other liabilities

12,515

(17,850

)

Net cash provided by operating

activities

194,852

218,617

Cash flows from investing

activities

Additions to property, plant, and

equipment

(37,971

)

(40,986

)

Cash paid for equity method investment

—

(2,250

)

Cash paid for investment in ECN common

stock

—

(78,858

)

Cash paid for investment in ECN preferred

stock

—

(64,520

)

Investment in floor plan loans

—

(18,466

)

Proceeds from floor plan loans

2,737

14,646

Acquisitions, net of cash acquired

—

(284,545

)

Proceeds from disposal of property, plant,

and equipment

222

556

Net cash (used) in investing

activities

(35,012

)

(474,423

)

Cash flows from financing

activities

Changes in floor plan financing, net

(3,089

)

4,474

Payments on long term debt

(20

)

(67

)

Payments on repurchase of common stock

(59,999

)

—

Stock option exercises

285

506

Tax payments for equity-based

compensation

(3,031

)

(983

)

Net cash (used in) provided by financing

activities

(65,854

)

3,930

Effect of exchange rate changes on cash

and cash equivalents

(7,296

)

2,330

Net increase (decrease) in cash and cash

equivalents

86,690

(249,546

)

Cash and cash equivalents at beginning of

period

495,063

747,453

Cash and cash equivalents at end of

period

$

581,753

$

497,907

CHAMPION HOMES, INC.

RECONCILIATION OF NET INCOME

TO ADJUSTED EBITDA

(Unaudited, dollars in

thousand)

Three months ended

Nine months ended

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Net income attributable to Champion

Homes, Inc.

$

61,537

$

46,970

$

162,065

$

143,908

Income tax expense

16,698

12,764

45,809

44,811

Interest (income), net

(3,991

)

(4,309

)

(12,977

)

(24,090

)

Depreciation and amortization

10,673

9,639

30,796

24,017

EBITDA

84,917

65,064

225,693

188,646

Equity in net (income) of ECN

(656

)

—

(135

)

—

Change in fair value of contingent

consideration

—

—

7,912

—

Transaction costs

—

1,188

—

3,253

Other

(1,000

)

—

(1,000

)

—

Adjusted EBITDA

$

83,261

$

66,252

$

232,470

$

191,899

CHAMPION HOMES, INC.

RECONCILIATION OF NET INCOME

TO ADJUSTED NET INCOME AND ADJUSTED EARNINGS PER SHARE

(Unaudited, dollars and shares in

thousands, except per share amounts)

(Certain amounts shown net of

tax, as applicable)

Three months ended

Nine months ended

December 28, 2024

December 30, 2023

December 28, 2024

December 30, 2023

Net income attributable to Champion Homes,

Inc.

$

61,537

$

46,970

$

162,065

$

143,908

Adjustments:

Equity in net (income) loss of ECN

(656

)

—

(135

)

—

Change in fair value of contingent

consideration

—

—

6,088

—

Transaction costs

—

934

—

2,481

Other

(753

)

—

(753

)

—

Adjusted net income attributable to

Champion Homes, Inc.

$

60,128

$

47,904

$

167,265

$

146,389

Adjusted basic net income per share

$

1.05

$

0.83

$

2.90

$

2.55

Adjusted diluted net income per share

$

1.04

$

0.82

$

2.88

$

2.53

Average basic shares outstanding

57,407

57,644

57,640

57,364

Average diluted shares outstanding

58,021

58,136

58,177

57,842

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203029609/en/

Investor: Name: Jason Blair Email:

jablair@championhomes.com Phone: (248) 614-8211

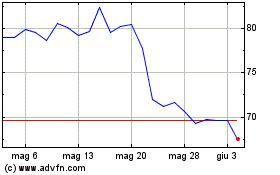

Grafico Azioni Champion Homes (NYSE:SKY)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Champion Homes (NYSE:SKY)

Storico

Da Feb 2024 a Feb 2025