false

0001126956

DEF 14A

0001126956

2022-10-01

2023-09-30

0001126956

2021-10-01

2022-09-30

0001126956

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:MsSitherwoodMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:MsSitherwoodMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

sr:MsSitherwoodMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:MessrsRascheMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:MessrsRascheMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:MessrsRascheMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:LindseyMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:LindseyMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:LindseyMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:DarrellMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:DarrellMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:DarrellMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:GeiselhartMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:GeiselhartMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:GeiselhartMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:DeductionForChangeInPensionValuesReportedInTheSCTMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:DeductionForChangeInPensionValuesReportedInTheSCTMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

sr:DeductionForChangeInPensionValuesReportedInTheSCTMember

2022-10-01

2023-09-30

0001126956

ecd:PeoMember

sr:IncreaseForServiceCostForPensionPlansMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:IncreaseForServiceCostForPensionPlansMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

sr:IncreaseForServiceCostForPensionPlansMember

2022-10-01

2023-09-30

0001126956

ecd:PeoMember

sr:IncreaseForPriorServiceCostForPensionPlansMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:IncreaseForPriorServiceCostForPensionPlansMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

sr:IncreaseForPriorServiceCostForPensionPlansMember

2022-10-01

2023-09-30

0001126956

ecd:PeoMember

sr:DeductionForStockAwardsAmountsReportedInTheSCTMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:DeductionForStockAwardsAmountsReportedInTheSCTMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

sr:DeductionForStockAwardsAmountsReportedInTheSCTMember

2022-10-01

2023-09-30

0001126956

ecd:PeoMember

sr:FairValueOfCurrentYearEquityAwardsAtYearEndMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:FairValueOfCurrentYearEquityAwardsAtYearEndMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

sr:FairValueOfCurrentYearEquityAwardsAtYearEndMember

2022-10-01

2023-09-30

0001126956

ecd:PeoMember

sr:ChangeInValueOfPriorYearsAwardsUnvestedAtYearEndMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:ChangeInValueOfPriorYearsAwardsUnvestedAtYearEndMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

sr:ChangeInValueOfPriorYearsAwardsUnvestedAtYearEndMember

2022-10-01

2023-09-30

0001126956

ecd:PeoMember

sr:ChangeInValueOfPriorYearsAwardsThatVestedDuringCurrentYearMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:ChangeInValueOfPriorYearsAwardsThatVestedDuringCurrentYearMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

sr:ChangeInValueOfPriorYearsAwardsThatVestedDuringCurrentYearMember

2022-10-01

2023-09-30

0001126956

ecd:PeoMember

sr:DeductionOfValueOfPriorYearsAwardsThatWereForfeitedDuringYearMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

sr:DeductionOfValueOfPriorYearsAwardsThatWereForfeitedDuringYearMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

sr:DeductionOfValueOfPriorYearsAwardsThatWereForfeitedDuringYearMember

2022-10-01

2023-09-30

0001126956

ecd:PeoMember

2020-10-01

2021-09-30

0001126956

ecd:PeoMember

2021-10-01

2022-09-30

0001126956

ecd:PeoMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:DeductionForChangeInPensionValuesReportedInTheSCTMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:DeductionForChangeInPensionValuesReportedInTheSCTMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:DeductionForChangeInPensionValuesReportedInTheSCTMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:IncreaseForServiceCostForPensionPlansMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:IncreaseForServiceCostForPensionPlansMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:IncreaseForServiceCostForPensionPlansMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:IncreaseForPriorServiceCostForPensionPlansMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:IncreaseForPriorServiceCostForPensionPlansMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:IncreaseForPriorServiceCostForPensionPlansMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:DeductionForStockAwardsAmountsReportedInTheSCTMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:DeductionForStockAwardsAmountsReportedInTheSCTMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:DeductionForStockAwardsAmountsReportedInTheSCTMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:FairValueOfCurrentYearEquityAwardsAtYearEndMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:FairValueOfCurrentYearEquityAwardsAtYearEndMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:FairValueOfCurrentYearEquityAwardsAtYearEndMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:ChangeInValueOfPriorYearsAwardsUnvestedAtYearEndMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:ChangeInValueOfPriorYearsAwardsUnvestedAtYearEndMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:ChangeInValueOfPriorYearsAwardsUnvestedAtYearEndMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:ChangeInValueOfPriorYearsAwardsThatVestedDuringCurrentYearMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:ChangeInValueOfPriorYearsAwardsThatVestedDuringCurrentYearMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:ChangeInValueOfPriorYearsAwardsThatVestedDuringCurrentYearMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

sr:DeductionOfValueOfPriorYearsAwardsThatWereForfeitedDuringYearMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

sr:DeductionOfValueOfPriorYearsAwardsThatWereForfeitedDuringYearMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

sr:DeductionOfValueOfPriorYearsAwardsThatWereForfeitedDuringYearMember

2022-10-01

2023-09-30

0001126956

ecd:NonPeoNeoMember

2020-10-01

2021-09-30

0001126956

ecd:NonPeoNeoMember

2021-10-01

2022-09-30

0001126956

ecd:NonPeoNeoMember

2022-10-01

2023-09-30

0001126956

1

2022-10-01

2023-09-30

0001126956

2

2022-10-01

2023-09-30

0001126956

3

2022-10-01

2023-09-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

PROXY STATEMENT PURSUANT TO SECTION 14(a)

OF THE SECURITIES EXCHANGE ACT OF 1934

(Amendment No. )

|

Filed by the Registrant |

|

Filed by a Party other than the Registrant |

| Check the appropriate box: |

|

Preliminary Proxy Statement |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14A-6(E)(2)) |

|

Definitive Proxy Statement |

|

Definitive Additional Materials |

|

Soliciting Material under §240.14a-12 |

SPIRE INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

| Payment of Filing Fee (Check all boxes that apply): |

|

No fee required. |

|

Fee paid previously with preliminary materials. |

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

Table of contents

| What’s

new? |

Each year, we strive to improve our proxy disclosures to provide a broader and deeper understanding

of Spire and how we think about governance, compensation and sustainability, as well as other topics of importance to our shareholders.

We believe these disclosures will be beneficial as you vote this year. Inside, you’ll find updates on the following, among

other topics:

• A new director skills table, to improve transparency about the skills and

experience of our Board of Directors

• The new “pay versus performance” disclosure, which provides

a new way of viewing the compensation of our named executive officers

• Discussions of director and management succession planning, which were important

to the appointment of a new president and chief executive officer, as well as two new independent directors and replacements for

the chief compliance and legal officer

|

Dear

fellow shareholders,

We are pleased to invite you to attend Spire’s

2024 Annual Shareholder Meeting, which is scheduled for Thursday, January 25, 2024, at 8:30 a.m., Central Standard Time. This year’s

meeting will be held virtually and the accompanying proxy information outlines how to participate in the meeting as well as the matters

that will be voted on at the meeting.

On behalf of the Board of Directors, thank you for

your investment in Spire. It is our privilege to serve you, and we appreciate the responsibility and trust you place in us to help grow

and guide the Company for continued success in the future. In fiscal year 2023, Spire’s management team remained focused on executing

our business strategy through organic growth, investing in infrastructure and advancing through innovation to ensure we continue to provide

value to our shareholders.

This past fiscal year once again brought challenges

and change, both at Spire and within the energy industry. We navigated these challenges to deliver value for our shareholders, achieving

basic net economic earnings of $4.06 per share. We also increased our annual dividend by 4.9%, making 2024 the 21st year in

a row we have increased our dividend.

During fiscal year 2023, Spire’s president and

chief executive officer, Suzanne Sitherwood, announced her retirement, effective January 1, 2024. Following this announcement, the Board

engaged an executive recruitment firm to assist the Board in conducting a thoughtful and comprehensive search for successors, including

both internal and external candidates. The Board considered a number of well-qualified candidates and ultimately named Steven L. Lindsey

Spire’s president and chief executive officer and appointed him to Spire’s Board of Directors, effective October 1, 2023.

Mr. Lindsey served as Spire’s executive vice president, chief operating officer prior to becoming president and chief executive

officer. Ms. Sitherwood remains on the leadership team as executive vice president, senior advisor, through her retirement date to assist

in a smooth transition of leadership. The Board believes that Mr. Lindsey’s leadership and expertise will continue to support Spire’s

vision and build upon the Company’s long-term strategy for success.

In addition to management succession planning, the

Board remains focused on its oversight responsibilities, with an emphasis on identification and mitigation of material risks, while further

developing and overseeing implementation of the Company’s growth strategy. The Board remains committed to ensuring the Board is

made up of directors who are independent, committed, capable, diverse, experienced and accountable to our shareholders. Accordingly, we

added two new directors to the Board in fiscal year 2023, each of whom brings skills and experience in areas that the Board identified

as priorities prior to the director search process.

Spire is committed to engaging with investors to determine

what information is most important to them, enhancing disclosures and making environmental, social and governance information even more

accessible. Our 2022 Sustainability Report, released in June 2023, describes the progress the Company has made in achieving its sustainability

goals and targets as well as our strategies to continue delivering on these goals. We invite you to review that report, which can be found

on our website at SpireEnergy.com/Sustainability, for more information about these efforts.

Natural gas is a vital part of America’s energy

future, so on behalf of the Board of Directors, thank you for your investment in Spire and for your continued support.

Sincerely,

Edward L. Glotzbach

Chair of the Board

Spire Inc. |

|

Spire Inc. | 2023 Proxy Statement  |

1 |

This page intentionally left blank

Notice of

Annual Meeting

of Shareholders

January 25, 2024

8:30 a.m. Central Standard Time (CST)

This year’s meeting is a virtual shareholder

meeting at www.virtualshareholdermeeting.com/SR2024

Proxy voting

Your vote is important. To ensure your representation

at the annual meeting, please vote your shares as promptly as possible over the internet at www.proxyvote.com or by telephone at 800-690-6903.

Alternatively, you may request a paper proxy card, which you may complete, sign and return by mail. If your shares are held by a broker,

bank or nominee, please follow their voting instructions for your vote to count.

Attending the meeting

We invite you to attend the annual meeting virtually.

There will not be a physical meeting. You will be able to vote your shares electronically and submit your questions during the meeting.

You will need the 16-digit control number included in your Notice of Internet Availability of Proxy Materials, on your proxy card or on

the instructions that accompany your proxy materials.

You do not need to attend the meeting online to vote

if you submit your vote via proxy in advance of the meeting. A replay of the meeting will be available on virtualshareholdermeeting.com.

To the shareholders of Spire Inc.:

The annual meeting of shareholders of Spire Inc. (“Spire”

or the “Company”) will be held on Thursday, January 25, 2024, at 8:30 a.m. CST, online at www.virtualshareholdermeeting.com/SR2024,

for the following purposes:

| 1. |

To elect three members of the Board of Directors. |

| 2. |

To provide an advisory vote to approve the compensation of our named executive officers. |

| 3. |

To ratify the appointment of Deloitte & Touche LLP as our independent registered public accountant for the 2024 fiscal year. |

| 4. |

To transact such other business as may properly come before the meeting and any adjournment or postponement thereof. |

You can vote if you were a common shareholder of record

on November 30, 2023.

During this virtual meeting, you may ask questions

and will be able to vote your shares electronically. The Company will respond to as many inquiries at the meeting as time allows.

The meeting will begin promptly at 8:30 a.m. CST. Online

check-in will begin at 8:15 a.m. CST.

By Order of the Board of Directors,

Courtney Vomund

Vice President,

Chief Compliance Officer and Corporate Secretary

December 13, 2023

| |

Spire Inc. | 2023 Proxy

Statement  |

3 |

Proxy statement summary

This summary highlights information contained elsewhere

in this proxy statement. This summary does not contain all of the information you should consider, and you should read the entire proxy

statement carefully before voting.

Who we are

At Spire, we believe energy exists to help people.

To warm homes, grow businesses and move communities forward. Every day, we’re inspired by our vision to make the breakthroughs today

that will energize tomorrow.

As one of the largest publicly traded natural gas distribution

companies in the country, we have the privilege of serving 1.7 million homes and businesses, as well as natural gas buyers, producers and industrial

customers through our gas-related businesses. This commitment to serve is reflected in our mission to answer every challenge, advance

every community and enrich every life through the strength of our energy. To live this mission, we hold strongly to our four values:

| Safety |

|

|

Drive |

|

|

Inclusion |

|

|

Integrity |

| |

|

|

|

|

|

|

|

|

|

| We keep our people, company, customers and communities safe. |

|

|

We lean into change, showing the courage and grit to make it happen. |

|

|

We embrace and celebrate our differences to better understand each other

and the world around us. |

|

|

We do what’s right, every time. |

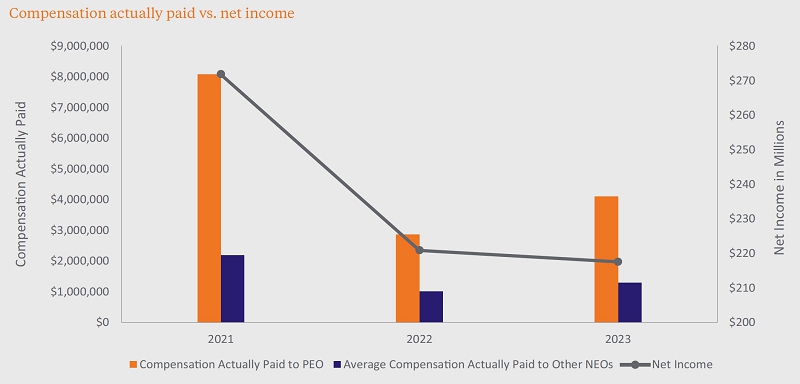

Spire’s fiscal year 2023 corporate performance

The following table provides information on the Company’s

performance in the last two fiscal years, which was a critical consideration in the Company’s determination of appropriate executive

compensation. For the fiscal year ended September 30, 2023, the Company reported consolidated net income of $217.5 million ($3.85 per

diluted share), compared with $220.8 million ($3.95 per diluted share) in fiscal year 2022. The $3.3 million decrease was driven by higher

interest and other corporate costs. Net income and earnings per share are determined in accordance with accounting principles generally

accepted in the United States of America (“GAAP”).

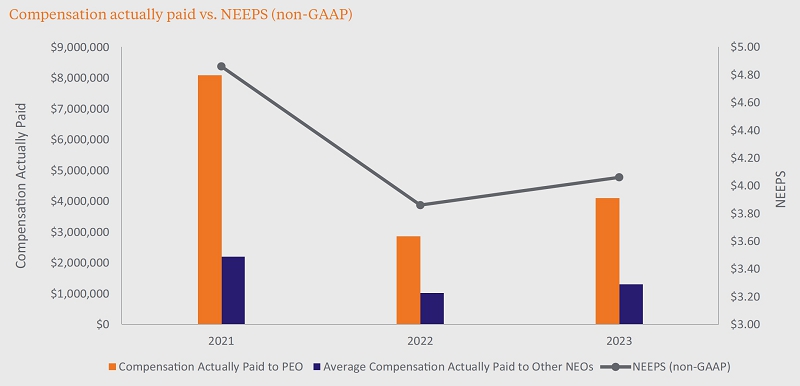

Management also uses the non-GAAP measure of net economic

earnings (“NEE”) and NEE per share when internally evaluating and reporting results of operations as discussed on page 29

of the Company’s Annual Report on Form 10-K for the year ended September 30, 2023. NEE for fiscal year 2023 was $228.1 million ($4.05

per diluted share), up from $216.3 million ($3.86 per diluted share) for fiscal year 2022. The incremental $11.8 million was driven by

increases in our Gas Marketing and Midstream segments, partially offset by unfavorable changes for the Gas Utility segment and other corporate

costs. The results are discussed further beginning on page 30 of the 2023 Annual Report on Form 10-K.

| www.SpireEnergy.com |

Spire Inc. | 2023 Proxy Statement  |

4 |

| In millions, except per share amounts | |

Gas Utility | |

Gas

Marketing | |

Midstream | |

Other | |

Consolidated | |

Per diluted

share** |

| Year Ended September 30, 2023 | |

| | |

| | |

| | |

| | |

| | |

| |

| Net income (loss) [GAAP] | |

$ | 200.5 | | |

$ | 39.1 | | |

$ | 12.0 | | |

$ | (34.1 | ) | |

$ | 217.5 | | |

$ | 3.85 | |

| Adjustments, pre-tax: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fair value and timing adjustments | |

| — | | |

| 11.4 | | |

| — | | |

| — | | |

| 11.4 | | |

| 0.21 | |

| Acquisition activities | |

| — | | |

| — | | |

| 2.5 | | |

| — | | |

| 2.5 | | |

| 0.05 | |

| Income tax effect of adjustments* | |

| — | | |

| (2.9 | ) | |

| (0.4 | ) | |

| — | | |

| (3.3 | ) | |

| (0.06 | ) |

| Net economic earnings (loss) [non-GAAP] | |

$ | 200.5 | | |

$ | 47.6 | | |

$ | 14.1 | | |

$ | (34.1 | ) | |

$ | 228.1 | | |

$ | 4.05 | |

| Year Ended September 30, 2022 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income (loss) [GAAP] | |

$ | 198.6 | | |

$ | 35.6 | | |

$ | 11.1 | | |

$ | (24.5 | ) | |

$ | 220.8 | | |

$ | 3.95 | |

| Adjustments, pre-tax: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Fair value and timing adjustments | |

| — | | |

| (11.4 | ) | |

| — | | |

| — | | |

| (11.4 | ) | |

| (0.22 | ) |

| Income tax effect of adjustments* | |

| 4.1 | | |

| 2.8 | | |

| — | | |

| — | | |

| 6.9 | | |

| 0.13 | |

| Net economic earnings (loss) [non-GAAP] | |

$ | 202.7 | | |

$ | 27.0 | | |

$ | 11.1 | | |

$ | (24.5 | ) | |

$ | 216.3 | | |

$ | 3.86 | |

| * |

Income tax effect is calculated by applying federal, state and

local income tax rates applicable to ordinary income to the amounts of the pre-tax reconciling items and then adding any estimated

effects of enacted state or local income tax laws for periods before the related effective date and, in the case of fiscal year

2022, includes a Spire Missouri regulatory adjustment. |

| ** |

Net economic earnings per share is calculated by replacing consolidated

net income with consolidated net economic earnings in the GAAP diluted earnings per share calculation, which includes reductions

for cumulative preferred dividends and participating shares. |

Our 2023 results

| Net Income |

Net Economic

Earnings (NEE) |

|

|

Diluted Earnings

per Share |

Basic NEE

per Share |

Diluted NEE

per Share |

|

|

Dividends Declared per

Common Share |

| $217.5M |

$228.1M |

|

|

$3.85 |

$4.06 |

$4.05 |

|

|

$2.88 |

GAAP

Down from

$220.8 million

for FY22

|

NON-GAAP

Up from

$216.3 million

for FY22

|

|

|

GAAP

Down from

$3.95 for FY22

|

NON-GAAP

Up from

$3.87 for FY22

|

NON-GAAP

Up from

$3.86 for FY22

|

|

|

Up from

$2.74 for FY22 |

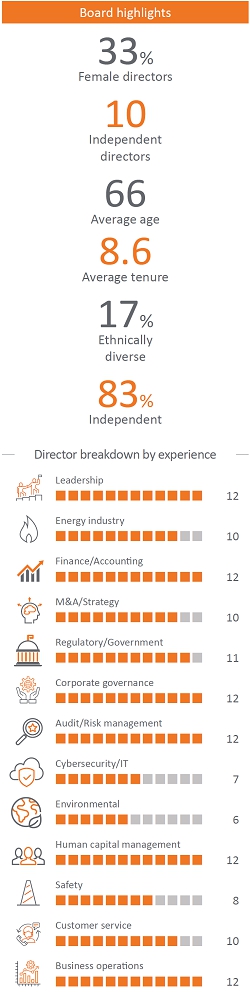

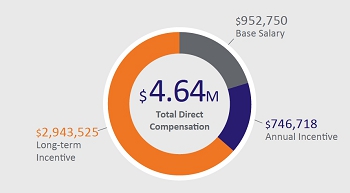

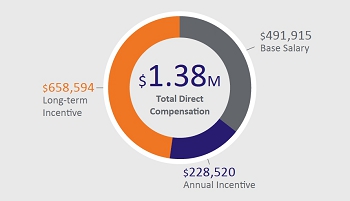

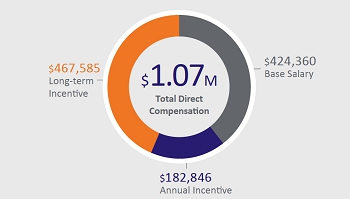

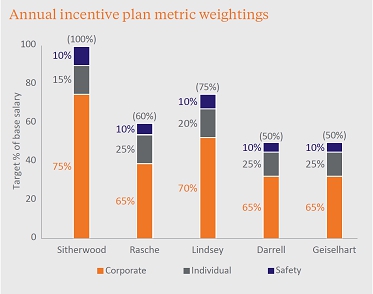

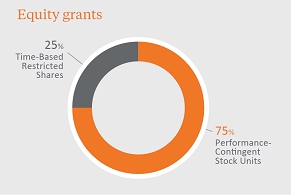

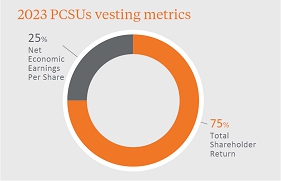

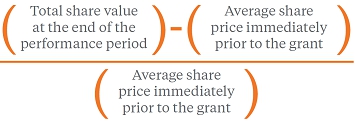

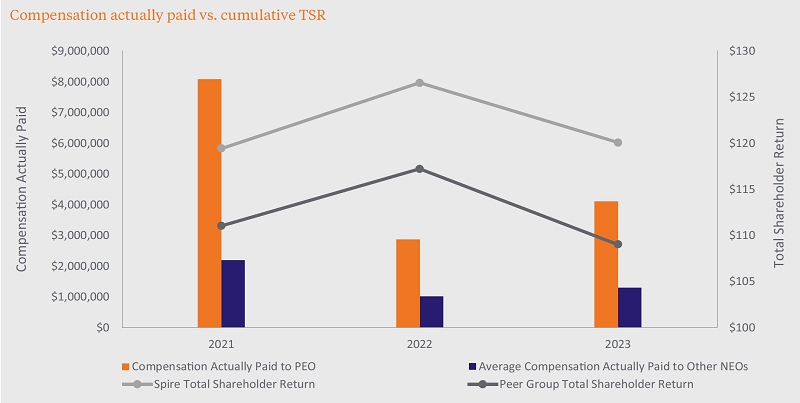

Executive compensation

The Company is committed to its pay-for-performance

philosophy, which we believe is closely aligned with shareholder interests by linking executive compensation to Company performance. The

key metric used to determine funding under our annual incentive plan is adjusted operating income, and the metrics used to determine vesting

under our long-term incentive plan are average net economic earnings per share and relative total shareholder return. The Company also

emphasizes pay-for-performance by placing a majority of the executives’

target total direct compensation (“TTDC”) at risk through the annual and long-term incentive plans. TTDC includes the current

base salary, the 2023 target annual incentive plan opportunity and the fair market value of the equity awards made during fiscal year

2023. Further, the value of the equity incentive award, the largest portion of incentive pay, is based on long-term performance.

Sustainability

We issued our fifth annual Sustainability Report in

June 2023, which continued to expand our disclosures on environmental, social and governance topics. We included reporting under the Sustainability

Accounting Standards Board (SASB) standards and increased disclosures aligned with the Task Force on Climate-Related Financial

Disclosures (TCFD) recommendations. We held an investor sustainability call to discuss highlights from the report and give investors the

opportunity to ask questions about our sustainability efforts. We remain committed to enhancing

Spire Inc. | 2023 Proxy Statement  |

5 |

and expanding our disclosures to create an even more

robust and transparent view of our overall sustainability strategy and plans.

In fiscal year 2023, the various committees of the

Board of Directors continued formal oversight of management’s sustainability efforts in the areas of environmental; diversity, equity

and inclusion; supplier diversity; and governance to ensure progress is being made on our

sustainability commitments. The corporate governance committee remains responsible for overseeing and approving the Sustainability Report.

The current Sustainability Report can be found on our website at SpireEnergy.com/Sustainability.

Annual meeting of shareholders

|

|

|

| Time

and date |

Place |

Record

date |

8:30 a.m. CST

on Thursday, January 25, 2024

Check-in beginning 8:15 a.m. CST |

Virtually at

www.virtualshareholdermeeting.com/SR2024 |

November 30, 2023 |

How to vote

Shareholders as of the record date are entitled to

vote. Each share of common stock is entitled to one vote for each director nominee and one vote for each of the proposals.

|

|

|

|

| By

internet |

By

telephone |

By

mail |

At

the meeting |

| www.proxyvote.com |

800-690-6903 |

Mark your proxy card or

voting instruction card, date

and sign it, and return it in the

postage-paid envelope provided. |

If you decide to attend the virtual

meeting, you will need your 16-digit

control number and follow the

instructions on the screen. |

Voting matters

| Proposal | |

Board vote

recommendation | |

Page reference

(for more detail) |

| Election of three directors | |

| FOR | | |

9 |

| Provide advisory vote to approve the compensation of our named

executive officers | |

| FOR | | |

32 |

| Ratification of Deloitte & Touche LLP (“Deloitte”) as our independent

registered public accountant for fiscal year 2024 | |

| FOR | | |

66 |

| www.SpireEnergy.com |

Spire Inc. | 2023 Proxy Statement  |

6 |

Nominees for election (page 9)

The following chart includes summary bios and key

aspects of our Board of Directors, including directors who are nominees this year. We believe the competencies currently possessed

by our directors represent a solid mix of backgrounds and experiences for the Company.

|

|

|

|

|

|

|

| Mark A. Borer |

|

Vinny J. Ferrari |

|

Maria V. Fogarty |

|

Edward L. Glotzbach* |

|

Nominee

Retired Chief Executive Officer

and Board Member

DCP Midstream Partners LP

Age: 69

Director since: 2014

Committees:

|

|

Retired Chief Administrative

Officer/Chief Operating Officer

Edward D. Jones & Co., LP

Age: 63

Director since: 2023

Committees:

|

|

Nominee

Retired Senior Vice President,

Internal Audit and Compliance

NextEra Energy, Inc.

Age: 64

Director since: 2014

Committees:

|

|

Retired Vice Chairman, Mergers and

Acquisitions

Information Services Group

Age: 75

Director since: 2005

Committees:

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Carrie J. Hightman |

|

Rob L. Jones |

|

Paul D. Koonce |

|

Steven L. Lindsey |

|

Retired Executive Vice President

and Chief Legal Officer

NiSource Inc.

Age: 66

Director since: 2021

Committees:

|

|

Retired Co-Head

Bank of America

Merrill Lynch Commodities, Inc.

Age: 65

Director since: 2016

Committees:

|

|

Retired Executive Vice President

and Chief Executive Officer, Power Generation Group

Dominion Energy, Inc.

Age: 63

Director since: 2023

Committees:

|

|

Nominee

President and Chief Executive

Officer

Spire Inc.

Age: 57

Director since: 2023

Committees:

|

| |

|

|

|

|

|

Ï |

|

|

|

|

|

|

|

| Brenda D. Newberry |

|

Stephen S. Schwartz** |

|

Suzanne

Sitherwood*** |

|

John P. Stupp Jr. |

|

Retired Chairman of the Board

The Newberry Group

Age: 70

Director since: 2007

Committees:

|

|

President and Chief Executive

Officer

Azenta, Inc.

Age: 64

Director since: 2018

Committees:

|

|

Executive Vice President, Senior

Advisor

Spire Inc.

Age: 63

Director since: 2011

Committees:

|

|

Chairman, President

and Chief Executive

Officer

Stupp Bros., Inc.

Age: 73

Director since: 2005

Committees:

|

Chair

Chair  Audit

Audit  Compensation and

Human Resources

Compensation and

Human Resources  Corporate

Governance

Corporate

Governance  Strategy

Strategy

| * |

In accordance with our director retirement policy set forth in

the Company’s Corporate Governance Guidelines, Mr. Glotzbach, who is 75, announced on November 8, 2023, that he would

be retiring from the Board on the same day as the 2024 annual meeting. |

| ** |

Dr. Schwartz announced on November 8, 2023, that he would be resigning from the Board

on January 25, 2024 on the same day as the 2024 annual meeting. This resignation was not the result of any disagreement with

management or the Board over the Company’s operations, policies or practices. |

| *** |

Ms. Sitherwood has announced her resignation from the Board effective January 1,

2024, due to her retirement from the Company. |

| |

Spire Inc. | 2023 Proxy Statement  |

7 |

Advisory vote to approve the compensation of our

named executive officers (page 32)

As we do every year, we are again seeking shareholder

advisory approval of the compensation of our named executive officers as disclosed in this proxy statement. Although the vote on

this proposal is advisory and nonbinding, the compensation and human resources committee and Board will review the results of the

vote and consider the collective views of our shareholders in future determinations concerning our executive compensation program.

Ratification of appointment of independent registered

public accountant (page 66)

We are asking shareholders to ratify the selection

of Deloitte as our independent registered public accountant for fiscal year 2024. The table contains summary information with respect

to Deloitte’s fees for services provided in fiscal years 2023 and 2022.

| | |

2023 |

| |

2022 |

|

| Audit fees | |

$ | 2,612,000 | | |

$ | 2,500,000 | |

| Audit-related fees | |

| 330,000 | | |

| 243,000 | |

| Tax fees | |

| 41,462 | | |

| 37,654 | |

| All other fees | |

| 1,895 | | |

| 1,895 | |

| Total | |

$ | 2,985,357 | | |

$ | 2,782,549 | |

| www.SpireEnergy.com |

Spire Inc. | 2023 Proxy Statement  |

8 |

Proposal 1: Election of directors

The Board of Directors is divided into three classes.

Directors Borer, Fogarty and Lindsey, whose terms will expire upon the election of directors at the meeting on January 25, 2024,

have been nominated to stand for reelection for terms expiring upon the election of their successors in January 2027 or their earlier

removal or resignation from office. The persons named as proxies intend to vote FOR the election of the three nominees.

If any nominee becomes unavailable to serve for

any reason before the meeting, which is not anticipated, the proxies will vote the shares indicated for that nominee for a person

to be selected by our Board of Directors.

Information about the nominees and directors

Nominees for term expiring in 2027

| Mark A. Borer |

|

Age: 69

Director since: 2014

Independent

Committees:

|

|

Mr. Borer served as chief executive officer as well

as a member of the board of directors of DCP Midstream Partners, LP from November 2006 through his retirement in December 2012.

DCP Midstream Partners, LP is a public midstream master limited partnership that is engaged in all stages of the midstream business

for both natural gas and natural gas liquids.

Skills relevant to Spire:

Mr.

Borer’s experience in the midstream natural gas business gives him hands-on knowledge of the industry. His service

as a chief executive officer and member of the board of a public entity that grew significantly under his leadership

provides him with experience in the operations of an energy company and the capital markets, and he

possesses business and leadership expertise that assists the Board as it evaluates the Company’s financial and operational

risks and strategy.

Other public directorships: Mr.

Borer previously served on the board of directors of Texas Eastern Products Pipeline Company,

LLC and DCP Midstream Partners, LP. Most recently, he served on the board of directors of Altus Midstream

Company from 2017 to 2022, where he was a member of the audit committee. |

| Maria V. Fogarty |

|

Age: 64

Director since: 2014

Independent

Committees:

|

|

Ms. Fogarty served as the senior vice

president of internal audit and compliance at NextEra Energy, Inc. from 2011 through her retirement

in June 2014. She previously served as vice president of internal audit at that company from 2005

to 2010 and director of internal audit from April 1993 through 2004. NextEra Energy, Inc. is a leading clean energy company

and the parent company of Florida Power & Light, the largest rate-regulated electric utility in Florida.

Skills relevant to Spire:

Ms. Fogarty’s prior experience

leading the audit function at a public energy company bolsters her knowledge of the audit and

Sarbanes-Oxley requirements facing public companies today. Her industry experience at a company that grew

significantly during her tenure benefits the Board, as she can provide insights into the risks, opportunities and challenges

created by growth.

Other public directorships: None |

Chair

Chair  Audit

Audit  Compensation

and Human Resources

Compensation

and Human Resources  Corporate Governance

Corporate Governance  Strategy

Strategy

| |

Spire Inc. | 2023 Proxy Statement  |

9 |

| Steven L. Lindsey |

|

Age: 57

Director since: 2023

Management

Committees:

|

|

Mr. Lindsey has served as the Company’s president

and chief executive officer since October 1, 2023.

Skills relevant to Spire:

Prior to being named president and

chief executive officer, Mr. Lindsey spent 11 years at Spire, most recently as the Company’s

executive vice president, chief operating officer. In that role, he was responsible for the operations of all Gas Utilities,

as well as Spire Marketing and Spire Midstream. Prior to Mr. Lindsey’s time at Spire, he spent 23 years in the natural

gas utility business at AGL Resources, most recently serving as president of Atlanta Gas Light, Chattanooga Gas and

Florida City Gas and as senior vice president of southern operations. Mr. Lindsey has also served as the chair of the Southern

Gas Association and is a member of the executive council of the American Gas Association. Mr. Lindsey will use

his extensive experience in the natural gas industry to continue to shape the future strategy of the Company, both in

his capacity as chief executive officer and as a member of the Board.

Other public directorships: None |

|

Your Board of Directors recommends a vote “FOR” election of the above nominees as directors. |

Directors with terms expiring in 2025

| Carrie J. Hightman |

|

Age: 66

Director since: 2021

Independent

Committees:

|

|

Ms. Hightman retired in January 2021

after having served as executive vice president and chief legal officer of NiSource Inc., which

is a $10B market cap, $5B revenue gas and electric utility holding company listed on the New York

Stock Exchange. She also served as president and chief executive officer of Columbia Gas of Massachusetts, one

of the largest natural gas utilities in the commonwealth, until its sale by NiSource Inc. in October 2020. Prior

to joining NiSource in 2007, Ms. Hightman served as president of AT&T Illinois and led the Energy, Telecommunications

and Public Utilities practice group at Schiff Hardin LLP, a national law firm.

Skills relevant to Spire:

Ms. Hightman’s broad range of

experience during her more than three-decades-long business career, including gas operations,

regulatory strategy, federal government affairs, ethics, corporate communications, environmental, safety,

data privacy and human resources, adds depth and breadth to the Board. Her specific focus on regulated industries,

crisis management and ESG, as well as her experience as a lawyer, add a new dimension and fresh perspective

to the Board.

Other public directorships: None |

| |

|

|

| Paul D. Koonce |

|

Age: 63

Director since: 2023

Independent

Committees:

|

|

Mr. Koonce retired in February 2020

as executive vice president and president and chief executive officer of the Power Generation

Group of Dominion Energy, Inc., which is a $33B market cap, $17B revenue gas and electric utility holding company

listed on the New York Stock Exchange. He spent 20 years at Dominion in various roles, including chief executive

officer of the Gas Infrastructure Group and chief executive officer of the Power Delivery Group. Prior to joining

Dominion, Mr. Koonce spent more than 15 years at other companies in the energy sector.

Skills relevant to Spire:

Mr. Koonce’s 38-year career in

the energy industry adds expertise in strategic planning, operations planning, regulatory strategy,

mergers and acquisitions, customer service, environmental, safety, risk management and human resources.

His recent and extensive experience working in the utility industry brings a strong ability to assist the Board in

understanding utility operations and strategic decisions.

Other public directorships: None |

Chair

Chair  Audit

Audit  Compensation

and Human Resources

Compensation

and Human Resources  Corporate Governance

Corporate Governance  Strategy

Strategy

| www.SpireEnergy.com |

Spire Inc. | 2023 Proxy Statement  |

10 |

| Brenda D. Newberry |

|

Age: 70

Director since: 2007

Independent

Committees:

|

|

Ms. Newberry retired in May 2010 as

chairman of the board of The Newberry Group, a provider of information technology consulting

services on a global basis, specializing in information systems, technology infrastructure, data and

network security, and project management services. Ms. Newberry founded The Newberry Group in 1996 following a

career in technology starting in the U.S. Air Force, McDonnell Douglas, and MasterCard International where she was vice

president of MasterCom, a global profit and loss business unit.

Skills relevant to Spire:

Ms. Newberry provides insight into

the Company’s information technology strategy and related risks and exposures. Her experience

in creating and building her own businesses assists the Company as it considers growth opportunities, and

her government contractor experience provides insight into conducting business in a highly regulated industry. She

has obtained the NACD Directorship Certification, as well as the CERT Certificate in Cyber-Risk Oversight.

Other public directorships: None |

| Suzanne Sitherwood* |

|

Age: 63

Director since: 2011

Management

Committee:

|

|

Ms. Sitherwood served as the Company’s

president since September 1, 2011 and chief executive officer since February 1, 2012. As of

October 1, 2023, she became executive vice president, senior advisor. She will retire from the Company and the

Board effective January 1, 2024.

Skills relevant to Spire:

Ms. Sitherwood has more than 40 years

of experience in the natural gas industry and has overseen significant growth at the Company.

During the course of her career, Ms. Sitherwood has gained extensive management and operational experience

and has demonstrated a strong track record of leadership, strategic vision and business acumen. In her long tenure

as the Company’s chief executive officer and member of the Board, she utilizes her knowledge of the energy markets

in overseeing the development of the Company’s long-term strategy.

Other public directorships: None |

| * |

Ms. Sitherwood has announced her resignation from the Board effective January 1,

2024, due to her retirement from the Company. |

Directors with terms expiring in 2026

| Vinny J. Ferrari |

|

Age: 63

Director since: 2023

Independent

Committees:

|

|

Mr. Ferrari retired in December 2020

from Edward Jones, where he served in various leadership roles, including general partner,

chief information officer, and most recently, chief operating officer/chief administrative officer. He served

on the firm’s executive committee and management committee. Prior to working at Edward Jones, Mr. Ferrari

worked on Wall Street for 22 years with Morgan Stanley, JJ Kenny and the Chase Manhattan Bank. He was the

chair of the board of trustees and a member of the board of directors of the Securities Industry Institute.

Skills relevant to Spire:

Mr. Ferrari’s experience in technology

and the financial industry brings a unique and important skillset to the Board. He is able

to provide insight to the Board on cybersecurity and potential risks in that area. As a former executive at a

large private company, he also brings to the Board experience with operations, strategic planning, organizational optimization

and crisis management.

Other public directorships: None |

Chair

Chair  Audit

Audit  Compensation

and Human Resources

Compensation

and Human Resources  Corporate Governance

Corporate Governance  Strategy

Strategy

| |

Spire Inc. | 2023 Proxy Statement  |

11 |

| Edward L. Glotzbach* |

|

Age: 75

Director since: 2005

Independent

Committees:

|

|

Mr. Glotzbach served as vice chairman,

mergers and acquisitions, of Information Services Group from November 2007, when it acquired

Technology Partners International, Inc., until his retirement in March 2012. From December

2004 to November 2007, he served as president and chief executive officer of Technology Partners

International, Inc., an organization that assists clients with the evaluation, negotiation, implementation and

management of information technology and business process sourcing initiatives. From October 2003 to December

2004, he served as vice president and chief financial officer of the firm. From 1970 to September 2003, he

served in many positions with SBC Communications, with his most recent position there being executive vice president

and chief information officer for six years.

Skills relevant to Spire:

Mr. Glotzbach brings to the Board business

and leadership experience as an executive of a public company, regulated utility experience

as a former executive of a telephone utility regulated by the Missouri Public Service Commission, financial

expertise having served as a chief financial officer at other companies, and information technology expertise given

his experience at Information Services Group and his chief information officer experience at a major telephone company.

He also provides insight to the Company as to potential exposures and risks in those areas.

Other public directorships: None |

| * |

Mr. Glotzbach, who will be 75 years old prior to the 2024 annual

meeting, announced on November 8, 2023, his resignation from the Board on the day of the 2024 annual meeting in accordance

with the director retirement policy set forth in the Company’s Corporate Governance Guidelines. At such time, the Board

intends to decrease the size of the Board and the number of directors in the class with a term expiring 2026. |

| Rob L. Jones |

|

Age: 65

Director since: 2016

Independent

Committees:

|

|

Mr. Jones served as co-head of Bank

of America Merrill Lynch Commodities, Inc. (MLC) from 2007 until his retirement in March 2012.

MLC is a global commodities trading business and a wholly owned subsidiary of Bank of America.

Prior to taking leadership of MLC, he served as head of Merrill Lynch’s Global Energy and Power Investment Banking

Group. An investment banker with Merrill Lynch and The First Boston Corporation for over 20 years, Mr.

Jones worked extensively with a variety of energy and power clients, with a particular focus on the natural gas

and utility sectors. He has also served as an Executive in Residence at the McCombs School of Business at the University

of Texas at Austin with a focus on energy finance.

Skills relevant to Spire:

Mr. Jones’ experience in financial

roles in the energy banking industry, with a particular focus on the natural gas and utility

sectors, as well as his experience as a lead independent director of a publicly traded partnership, add a unique dimension

to the Board and provide insight into the capital markets and financial risks and strategies.

Other public directorships: Since

2014, he has served on the board of directors of Shell Midstream Partners GP LLC, which is

the general partner of Shell Midstream Partners, LP. He chaired its audit committee and served on the conflicts

committee until the partnership was acquired by Shell in 2022. |

| John P. Stupp Jr. |

|

Age: 73

Director since: 2005

Independent

Committees:

|

|

Mr. Stupp has been president of Stupp

Bros., Inc. since March 2004, chairman and chief executive officer since March 2014 and chief

executive officer of Stupp Corporation since August 1995. Through its subsidiaries, Stupp Bros., Inc.

fabricates steel highway and railroad bridges, provides broadband fiber service, and offers general, steel and industrial

construction services. Mr. Stupp serves as a director of Stupp Bros., Inc.

Skills relevant to Spire:

As chairman, chief executive officer

and president of Stupp Bros., Inc., one of the Company’s largest shareholders with a

long-term investment relationship with the Company, Mr. Stupp has historic institutional knowledge of the Company

and directly represents shareholder interests. Further, his experience with the various subsidiaries and investments

of Stupp Bros., Inc. provides insight into the pipeline and other infrastructure industries on a national basis

as well as insight into the regional economy.

Other public directorships: Mr.

Stupp joined the Atrion Corp. board in 1985, where he chairs the compensation committee and serves on the audit committee. |

Chair

Chair  Audit

Audit  Compensation

and Human Resources

Compensation

and Human Resources  Corporate Governance

Corporate Governance  Strategy

Strategy

| www.SpireEnergy.com |

Spire Inc. | 2023 Proxy Statement  |

12 |

Directors not standing for election

| |

|

|

| Stephen S. Schwartz* |

|

Age: 64

Director since: 2018

Independent

Committees:

|

|

Dr. Schwartz joined Brooks Automation,

Inc. in April 2010 as president and continued to serve in that role until August 2013. He was

re-appointed president in May 2016, and on October 1, 2010, he became chief executive officer. In 2022, Brooks

Automation, Inc. separated its business into two different public companies, and Dr. Schwartz continues as president

and chief executive officer of one of those companies, Azenta, Inc.

Skills relevant to Spire:

Dr. Schwartz has extensive leadership,

operational, strategic and financial management and reporting experience as chief executive

officer of a successful public company and brings to the Board a unique perspective with regard to innovation

and technology based on his experience in the automation manufacturing space.

Other public directorships: Since

2010, Dr. Schwartz served on the board of Brooks Automation, Inc. After the company split in

2022, Dr. Schwartz no longer serves on the board of Brooks Automation, Inc. and instead serves on the board of Azenta,

Inc. |

| * |

Dr. Schwartz announced

on November 8, 2023, that he would be resigning from the Board effective as of the date of the 2024 annual meeting. This resignation

was not the result of any disagreement with management or the board over the Company’s operations, policies or practices. |

Chair

Chair  Audit

Audit  Compensation

and Human Resources

Compensation

and Human Resources  Corporate Governance

Corporate Governance  Strategy

Strategy

Qualifications required of all directors

The Board requires that each director be a person

of high integrity with a proven record of success in his or her field and have the ability to devote the time and effort necessary

to fulfill his or her responsibilities to the Company. Generally, the Board looks for persons who possess characteristics of the

highest personal and professional ethics, integrity and values; an inquiring and independent mind; practical wisdom and mature

judgment; and expertise that is useful to the Company and complementary to the background and experience of other Board members.

In addition, the Board conducts interviews of potential

director candidates to assess intangible qualities, including the individual’s ability to ask difficult questions and to

work collegially and collaboratively. The Board considers diversity of race, ethnicity, gender, age, cultural background and professional

experience in evaluating candidates for Board membership. Diversity is important because the Board believes that a variety of perspectives

contribute to a more effective decision-making process.

When recommending director nominees for election

by shareholders, the Board and the corporate governance committee focus on how the experience and skill set of each director nominee

complements those of fellow directors to create a balanced Board with diverse viewpoints and deep expertise.

| |

Spire Inc. | 2023 Proxy Statement  |

13 |

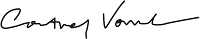

Board skills and composition matrix

The following matrix sets forth, for each director,

the skills they bring to the Board; their age and Board tenure; their independence; and other qualities and experiences that contribute

to a diverse Board of Directors.

Skills, qualifications, and experience

signifies

expert or highly proficient signifies

expert or highly proficient

signifies

significant knowledge/experience signifies

significant knowledge/experience

through employment or board service

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Leadership

Leadership experience as CEO or other senior executive

role guiding an organization, formulating and implementing corporate strategy and long-term planning

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Energy Industry

Experience in utility, energy and/or nuclear operations,

including oil and gas marketing and midstream operations

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance/Accounting

Experience in accounting, finance and capital management,

including understanding financial statements and operating results

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

M&A/Strategy

Experience with developing and implementing business

growth strategies, evaluating transactions and understanding integration plans

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Regulatory/Government

Experience in regulatory affairs, public policy or government,

including highly regulated industries and their governing bodies

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate Governance

Experience with governance and compliance practices,

board management and succession planning, management accountability, and protecting shareholder and stakeholder interests

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Audit/Risk

Management

Experience with identifying,

overseeing and controlling business and financial risks, especially those risks that may impact

operations and shareholder value |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cybersecurity/IT

Experience managing cybersecurity and information security

risks, and understanding the cybersecurity threat landscape

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Environmental

Experience overseeing or advising on environmental,

climate or environmental sustainability practices, understanding and managing environmental policies and risks

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Human Capital Management/Executive Compensation

Experience in building and retaining talent in a competitive

workforce, including exposure to compensation and benefits, and succession planning programs

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Safety

Experience monitoring and overseeing safety and physical

security measures necessary to keep employees and the public safe

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Customer Service

Experience in a customer-facing industry, with an understanding

of customer expectations and customer experience

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Business Operations

Experience with operational oversight of a business

and the administrative and financial oversight that accompanies such a role

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| www.SpireEnergy.com |

Spire Inc. | 2023 Proxy Statement  |

14 |

Spire Inc. | 2023 Proxy Statement  |

15 |

Governance

Corporate governance at a glance

| Board independence |

|

• Our Board chair is independent*

• 10 out of our 12 directors are independent*

• Our CEO and former CEO are the only non-independent

directors

• Among other duties, our chair leads quarterly

executive sessions of the independent directors to discuss certain matters without management present

|

| Board composition and diversity |

|

• The Board consists of 12 directors*

• The Board includes four women and eight

men*; two of our directors are racially diverse

• The Board regularly assesses its performance

through Board and committee self-evaluations, as well as peer reviews of individual directors

• The corporate governance committee regularly

leads the full Board in considering Board competencies and alignment with Company strategy

• The Board is actively engaged in Board

succession planning and has adopted the Board of Directors Succession Planning and Diversity Policy

• Directors are required to retire from

the Board at the annual meeting after reaching age 75

|

| Board committees |

|

• We have four Board committees –

audit, compensation and human resources, corporate governance and strategy; audit and corporate governance committees are chaired

by female directors

• All committees (except for the strategy

committee on which our CEO and former CEO serve) are composed entirely of independent directors

• The Board periodically rotates committee

chairs and members

|

| Leadership structure |

|

• Our Board chair is independent*

• The Board members elect our chair annually

• Two of our committee chairs are female

directors

|

| Risk oversight |

|

• Our full Board is responsible for risk

oversight and has designated specific committees to lead the oversight efforts with regard to certain key risks

• Our Board oversees management as it fulfills

its responsibilities for the assessment and management of risks

|

| Sustainability oversight |

|

• The Board has assumed formal oversight of sustainability issues, and has assigned specific

oversight duties to the Board committees (environmental and supplier diversity are overseen by the strategy committee; diversity,

equity and inclusion is overseen by the compensation and human resources committee; and governance is overseen by the corporate governance

committee) |

| Management succession planning |

|

• The Board actively monitors our succession planning and personnel development and receives

regular updates on employee engagement matters |

| Open communication |

|

• We encourage open communication and strong

working relationships among the chair, the CEO and the other directors

• Our directors have access to management

and employees

|

| Director stock ownership |

|

• Our directors are required to own shares of our common stock equal in value to at least

six times their annual cash retainer, or $600,000 ($630,000 beginning in 2024); they may not dispose of shares until they reach this

level |

| Accountability to shareholders |

|

• We use majority voting in director elections

(plurality voting in contested elections)

• We actively reach out to our shareholders

through our engagement program

• Shareholders can contact our Board, Board

chair or management by regular mail

|

| * |

This information does not reflect the retirement of Ms. Sitherwood on January 1, 2024, or the resignations of Mr. Glotzbach and Dr. Schwartz on the date of the 2024 annual meeting. |

Board and committee structure

Our Board currently consists of 12 directors, 10 of

whom are independent. As discussed above, Ms. Sitherwood has announced her retirement from the Company and the Board effective January

1, 2024, Mr. Glotzbach has announced his retirement from the Board on the date of the 2024 annual meeting in accordance with our director retirement policy, and Dr. Schwartz has announced his

resignation from the Board on the date of the 2024 annual meeting. Under our Corporate Governance Guidelines, the chair may be an officer

or may be an independent member of the Board, at the discretion of the Board. The Board believes it should be free to use

| www.SpireEnergy.com |

Spire Inc. | 2023 Proxy Statement  |

16 |

its business judgment to determine what is best for

the Company in light of all the circumstances. Mr. Glotzbach is currently chair of the Board. A new Board chair will be elected at the

January Board meeting in connection with Mr. Glotzbach’s retirement.

As chair, Mr. Glotzbach leads the Board in the performance

of its duties by working with the chief executive officer to establish meeting agendas and content, engaging with the leadership team

between meetings and providing overall guidance as to the Board’s views and perspective.

Mr. Lindsey, as chief executive officer effective October

1, 2023, focuses on setting the strategy for the Company, overseeing daily operations, developing our leaders and promoting employee engagement

throughout the Company.

During fiscal year 2023, there were 13 meetings of

our Board of Directors. All directors attended 75% or more of the aggregate number of meetings of the Board and applicable committee meetings,

except as follows. Messrs. Ferrari and Koonce were not appointed to the Board until July 2023, and were not appointed to committees until

August 2023. Mr. Borer attended nine out of 13 Board meetings during fiscal year 2023. The four meetings he missed all took place over

a one-week period. Mr. Borer’s absence was due to a personal medical issue which is not anticipated to affect his attendance at

future meetings. All directors attended the last annual meeting of shareholders other than Messrs. Ferrari and Koonce, who were not yet

on the Board.

The standing committees of the Board of Directors include

the audit, compensation and human resources, corporate governance and strategy committees.

Board evaluation process

How we evaluate our Board, committee and individual

director performance

|

| Conversations |

|

Feedback

shared |

|

Feedback

incorporated |

| In fiscal year 2023, Mr. Glotzbach, the Board chair, conducted individual conference calls with each director during which they discussed the performance of: (1) the Board, (2) each committee on which the director serves, and (3) each of the other individual directors. Mr. Glotzbach and each director also discussed what skills and attributes the Board should seek in future directors. |

|

Mr. Glotzbach compiled and summarized the results of the conversations. He shared feedback with each committee chair regarding the performance of the respective committees, and he met with each director privately to discuss the input he received regarding their individual performance. The entire Board, including Ms. Sitherwood and Mr. Lindsey, discussed the feedback regarding the Board and the committees. |

|

The corporate governance committee used the feedback about each director as a starting point for its conversation regarding which directors to nominate for reelection at the annual meeting.

The directors agreed that this evaluation process allowed them to share their thoughts and input directly and transparently. |

How we determine whether the Board has the right skills

and experience

The corporate governance committee supports the Board

in its development and maintenance of the Board succession plan. Each year, the corporate governance committee leads the Board in discussions

regarding whether the Board possesses the appropriate mix of experiences, skills, attributes and tenure it needs to provide oversight

and direction in light of the Company’s current and future business environment and strategic direction, all with the objective

of recommending a group of directors that can best continue our success and represent our shareholders’ interests.

Through this process, the Board identified two candidates

in fiscal year 2023 with skills that were deemed to be critical to the Board performing its oversight role, and these candidates were

appointed to the Board. Vinny J. Ferrari and Paul D. Koonce were appointed to the Board in July 2023, and these new directors bring valuable

expertise in cybersecurity, gas utility industry strategy, and executive and operating experience. The corporate governance committee

and Board are committed to developing a diverse pool of potential candidates for future Board service and maintaining a diverse and well-rounded

Board.

Spire Inc. | 2023 Proxy Statement  |

17 |

Director onboarding and continuing education

In an effort to ensure the directors possess the necessary

and appropriate skills and knowledge, all incoming directors participate in the Company’s orientation for new directors, which involves

meetings between the new directors and leaders of various functional areas of the Company. The corporate governance committee also identifies

educational programs on topics appropriate for public company board members, which the directors are encouraged to attend. Additionally,

management arranges for speakers during Board and committee meetings to address timely topics, such as new legal and regulatory requirements

that apply to the Company and industry updates. During the Board’s strategy sessions, directors hear presentations from, and engage

in discussions with, speakers on numerous strategic and educational topics.

The Board, under the guidance of Mr. Glotzbach, has

continued to develop a long-term Board succession plan that encompasses Board structure, mandatory and potential director and senior officer

retirements, the evolving strategy of the Company, and the current and future skills and attributes required for the Board to effectively

perform its oversight role.

Board committees and their membership

The following chart shows the fiscal year 2023 membership

of our Board committees, committee meetings and committee member attendance while serving on the committee.

| |

|

Audit |

|

Compensation and human

resources |

|

Corporate

governance |

|

Strategy |

| Number of meetings held |

|

4 |

|

5 |

|

4 |

|

4 |

| Borer* |

|

— |

|

80% |

|

— |

|

75% |

| Ferrari*** |

|

— |

|

— |

|

— |

|

— |

| Fogarty |

|

100% |

|

40%** |

|

100% |

|

— |

| Glotzbach |

|

100% |

|

100% |

|

— |

|

100% |

| Hightman |

|

100% |

|

— |

|

50%** |

|

100% |

| Jones |

|

50%** |

|

— |

|

50%** |

|

100% |

| Koonce*** |

|

— |

|

— |

|

— |

|

— |

| Lindsey**** |

|

— |

|

— |

|

— |

|

— |

| Newberry |

|

100% |

|

— |

|

100% |

|

— |

| Schwartz |

|

50%** |

|

— |

|

50%** |

|

100% |

| Sitherwood |

|

— |

|

— |

|

— |

|

100% |

| Stupp |

|

— |

|

100% |

|

100% |

|

— |

| * |

Mr. Borer’s absence was due to a personal medical issue which is not anticipated to affect his attendance at future meetings. |

| ** |

Committee assignments were changed effective February 1, 2023, so certain directors were only on committees for part of the fiscal year. |

| *** |

Messrs. Ferrari and Koonce were appointed to the Board in July 2023 but were not appointed to committees until August 2023, and no committee meetings were held in fiscal year 2023 following their committee appointments. |

| **** |

Mr. Lindsey was not a member of the Board during fiscal year 2023. His appointment was effective October 1, 2023. |

Our Board has delegated certain of its responsibilities

to committees to provide for more efficient Board operations and allow directors to engage in deeper analysis and oversight in specific

areas. The members and committee chairs are appointed by the Board on recommendations from the corporate governance committee. The chair

of each committee helps develop the agenda for that committee and updates the Board after each regular committee meeting and otherwise

as appropriate. Each committee reviews its charter annually. The primary responsibilities and membership of each committee are below.

| www.SpireEnergy.com |

Spire Inc. | 2023 Proxy Statement  |

18 |

| Audit

committee |

|

|

|

Members:

Ms. Fogarty (Chair)

Mr. Ferrari

Mr. Glotzbach

Ms. Hightman

Ms. Newberry

Dr. Schwartz

Meetings in fiscal 2023: 4

|

|

Key responsibilities:

The audit committee:

• Assists the Board in fulfilling the Board’s

oversight responsibilities with respect to the quality and integrity of the financial statements, financial reporting process and systems

of internal controls;

• Assists the Board in monitoring the independence

and performance of the independent registered public accountant and the internal audit department; and

• Assists the Board in overseeing the operation

of the Company’s ethics and compliance programs.

|

| |

All audit committee members were determined by the

Board to be independent and financially literate in accordance with New York Stock Exchange requirements. Ms. Fogarty has been determined

to be the financial expert for the audit committee.

The audit committee report is included on page 66.

|

Compensation and human resources committee

|

Members:

Mr. Borer (Chair)

Mr. Ferrari

Ms. Fogarty

Mr. Glotzbach

Mr. Stupp

Meetings in fiscal 2023: 5

|

|

Key responsibilities:

The compensation and human resources committee:

• Assists the Board in the discharge of its responsibilities

relative to the compensation of the Company’s executives;

• Reviews and makes recommendations to the Board

relative to the Company’s short-term and long-term incentive plans;

• Reviews management’s risk assessment

of the Company’s compensation practices and programs;

• Assists the Board in the oversight of succession

planning for executive officers;

• Oversees the Company’s diversity, equity

and inclusion initiatives;

• Oversees the investments of the qualified defined

benefit pension plans; and

• Reviews and provides feedback to management

on key aspects of the Company’s human resources policies and programs, including employee

recruitment, retention and development.

|

| |

|

All compensation and human resources committee members

were determined by the Board to be independent in accordance with the New York Stock Exchange requirements. The committee engaged Semler

Brossy Consulting Group LLC (“Semler Brossy”) as its independent compensation consultant for fiscal year 2023.

Compensation committee interlocks and

insider participation: There are no compensation and human resources committee interlocks and no insiders

are members of the committee.

The compensation and human resources committee report

is included on page 50.

|

Corporate governance committee

|

Members:

Ms. Newberry (Chair)

Ms. Fogarty

Ms. Hightman

Mr. Jones

Mr. Koonce

Mr. Stupp

Meetings in fiscal 2023: 4

|

|

Key responsibilities:

The corporate governance committee:

• Considers and makes recommendations to the

Board relative to corporate governance and its Corporate Governance Guidelines;

• Assists the Board in annually assessing what

skills would be beneficial to the Company for the Board to possess and whether those skills are represented sufficiently by the existing

members and identifying individuals qualified to become Board members;

• Makes recommendations to the Board regarding

director compensation, with input from Semler Brossy and Total Rewards Strategies;

• Assists the Board in identifying appropriate

educational opportunities for Board members and encouraging periodic attendance;

• Periodically arranges for Board education sessions

addressing timely governance topics;

• Reviews and approves any related-party transactions;

• Recommends committee chair and member appointments

to the full Board;

• Oversees periodic outreach to institutional

shareholders to obtain feedback on various governance topics; and

• Oversees the development of the Sustainability

Report.

|

| |

All corporate governance committee members were determined by the Board to be independent in accordance with New York Stock Exchange requirements. |

Spire Inc. | 2023 Proxy Statement  |

19 |

Strategy committee

|

Members:

Mr. Jones (Chair)

Mr. Borer

Mr. Glotzbach

Ms. Hightman

Mr. Koonce

Mr. Lindsey

Dr. Schwartz

Ms. Sitherwood

Meetings in fiscal 2023: 4

|

|