UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. )

Filed

by the Registrant ☒

Filed by a Party other

than the Registrant ☐

Check

the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting

Material under §240.14a-12

WEC

Energy Group, Inc.

(Name

of Registrant as Specified In Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check all boxes that apply):

☒ No

fee required.

☐ Fee

paid previously with preliminary materials.

☐ Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

This

Page Intentionally Left Blank

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-2 |

2024

Proxy Statement |

Dear

Fellow Stockholders

On

behalf of our Board of Directors, I cordially invite you to attend WEC Energy Group’s Annual Meeting of Stockholders. We look forward

to hosting this year’s meeting in virtual format.

Throughout

the year 2023, our Board of Directors and management team maintained a clear focus on the fundamentals of our business — delivering

an exceptional year on virtually every meaningful measure.

Below

are several highlights that demonstrate our commitment to grow long-term stockholder value, pursue a clean energy future, support our

employees and communities, and ensure the diversity and experience of our Board of Directors.

Financial

Performance

•Delivered

solid net income and earnings per share.

•Returned

more cash to stockholders than in any other year in company history.

•Declared

a 7 percent increase in our dividend in January of 2024 — the twenty-first consecutive year of dividend increases for our stockholders.

•Developed

the largest five-year capital investment plan in the Company’s history.

Environmental

Stewardship

•Announced

plan to eliminate coal as a fuel source three years earlier — by the end of 2032.

•Made

significant progress on the transition of our regulated fleet, including the addition of solar power, highly efficient natural gas generation

and liquefied natural gas storage.

•Began

leading a pilot project to test a new form of long-duration battery storage, incorporating environmentally friendly materials, in partnership

with EPRI and CMBlu Energy.

Social

Initiatives

•Achieved

record employee safety performance for days away, restricted or transferred (DART).

•Contributed

through our charitable organizations more than $20 million to worthy organizations across our service areas. Our major focus areas continue

to be: education, community and neighborhood development, arts and culture, and the environment.

•Named

one of America’s greatest workplaces for diversity – Five Star – by Newsweek magazine.

Responsible

Governance

•Finalized

a plan to transition the role of Executive Chairman to Non-Executive Chairman, effective after the Annual Meeting of Stockholders, and

to transfer executive management duties currently held by the Executive Chairman to the CEO.

•Added

a director with significant utility experience to the Board, making her the fifth new independent director in the past five years.

•Extended

our track record of strong linkage between pay and performance, with challenging financial, operational and social metrics in our compensation

program. Received 95.48 percent support from stockholders for our executive compensation program at the 2023 annual meeting, the highest

favorable result since this annual proposal began in 2011.

We

ask for your support of the proposals requiring a vote at this year’s meeting. And, as always, we welcome your engagement. Thank

you for your confidence in WEC Energy Group.

Gale

E. Klappa

Executive

Chairman

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-3 |

2024

Proxy Statement |

Notice

of 2024 Annual Meeting of Stockholders

|

|

|

|

|

|

|

|

|

|

|

|

|

Date

and Time

Thursday, May 9, 2024 at

1:30 p.m., Central time.

Location

WEC Energy Group will hold

a virtual annual stockholders meeting, held exclusively online at www.meetnow.global/M4ACHZT. Access to the meeting begins at 1:15

p.m., Central time.

Items

to be voted

1.Election

of 12 directors-terms expiring in 2025.

2.Ratification

of Deloitte & Touche LLP as independent auditors for 2024.

3.Advisory

vote to approve compensation of the named executive officers.

4.Amendment

of our Restated Articles of Incorporation to increase the number of authorized shares of common stock.

5.Stockholder

proposal regarding simple majority vote.

In addition, we will consider

and act upon any other business as may properly come before the Annual Meeting or any adjournment or postponement thereof.

How

to attend the 2024 Annual Meeting

This year’s Annual

Meeting will take place entirely online. If you would like to participate in the meeting, including voting, submitting a question, or

examining our list of stockholders, you will need to visit our meeting site, located at www.meetnow.global/M4ACHZT, and enter your

control number. Consistent with our prior virtual meetings, we will offer stockholder rights and participation opportunities.

Registered

Stockholders. If your

shares are registered in your name, your 15-digit control number was included on your Notice of Internet Availability of Proxy Materials,

your proxy card or on the instructions that accompanied your proxy materials.

Beneficial

Owners. If you own shares

in “street name” (that is, through a broker, bank or other nominee), you must register in advance to obtain a control number.

For more information, see Annual Meeting Attendance and Voting Information, which begins on P-78.

Your

vote is very important to us. We

urge you to review the proxy statement carefully and exercise your right to vote. Even if you plan to attend the Annual Meeting, please

vote your shares as soon as possible using one of the voting methods outlined in this notice. If you vote in advance, you are still entitled

to vote at the Annual Meeting, which would have the effect of revoking any prior votes. |

|

Voting

methods |

|

|

|

|

|

Use

the Internet

Vote

shares online.

See

page P-79.

Mobile

Device

Scan

this QR code.

Call

Toll-Free

In

the U.S. or Canada call 1-800-652-8683.

Mail

your Proxy Card

Follow

the instructions on your voting form. |

|

Record Date

Stockholders of record

as of close of business on March 11, 2024 (Record Date), will be entitled to vote. Each share of common stock is entitled to one vote

for each director position and one vote for each of the other proposals.

On or about March 28, 2024,

the Proxy Statement and 2023 Annual Report are being mailed or made available online to stockholders.

Important Notice Regarding

the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 9, 2024: The

Proxy Statement and 2023 Annual Report are available at www.envisionreports.com/WEC. |

Margaret

C. Kelsey

Executive

Vice President, General Counsel and Corporate Secretary

March

28, 2024

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-4 |

2024

Proxy Statement |

Table

of Contents

Forward-Looking

Statements P-6

Proxy

Summary P-6

|

|

|

|

Proposal 1

P-12 |

|

Election of 12

Directors-Terms Expiring in 2025 |

Board

Composition P-13

Succession

Planning/Director Nomination Process P-16

2024

Director Nominees for Election P-18

Governance P-24

Primary

Role and Responsibilities of our Board P-24

Our

Environmental, Social and Governance

Commitment P-27

Stockholder

Engagement P-29

Board

Leadership Structure P-30

Board

and Committee Practices P-30

Board

Evaluation Process P-31

Board

Committees P-32

Compensation

Committee Interlocks and

Insider Participation P-34

Additional

Governance Matters P-34

Communications

with the Board P-35

Where

to Find More Information on Governance P-35

Director

Compensation P-36

|

|

|

|

Proposal 2

P-38 |

|

Ratification

of Deloitte & Touche LLP as Independent Auditors for 2024 |

Independent

Auditors' Fees and Services P-39

Audit

and Oversight Committee Report P-40

|

|

|

|

Proposal 3

P-41 |

|

Advisory

Vote to Approve Compensation of the Named Executive Officers |

Compensation

Discussion and Analysis P-42

Executive

Summary P-42

Components

of Our Executive Compensation

Program P-44

Determination

of Market Median P-46

Annual

Base Salary P-46

Annual

Cash Incentive Compensation P-46

Long-Term

Incentive Compensation P-49

Compensation

Recoupment Policy P-53

Stock

Ownership Guidelines P-54

Prohibition

on Hedging and Pledging P-54

Limited

Trading Windows P-54

Retirement

Programs P-54

Other

Benefits, Including Perquisites P-54

Tax

Gross-Up Policy P-55

Severance

Benefits and Change in Control P-55

Impact

of Prior Compensation P-56

Tax

and Accounting Considerations P-56

Compensation

Committee Report P-56

Executive

Compensation Tables P-56

Summary

Compensation Table P-56

Grants

of Plan-Based Awards for Fiscal Year 2023 P-58

Outstanding

Equity Awards at Fiscal Year-End 2023 P-59

Option

Exercises and Stock Vested for

Fiscal Year 2023 P-60

Pension

Benefits at Fiscal Year-End 2023 P-61

Retirement

Plans P-61

Nonqualified

Deferred Compensation for

Fiscal Year 2023 P-64

Potential

Payments Upon Termination or

Change in Control P-66

Pay

Ratio Disclosure P-68

Risk

Analysis of Compensation Policies and Practices P-69

Pay

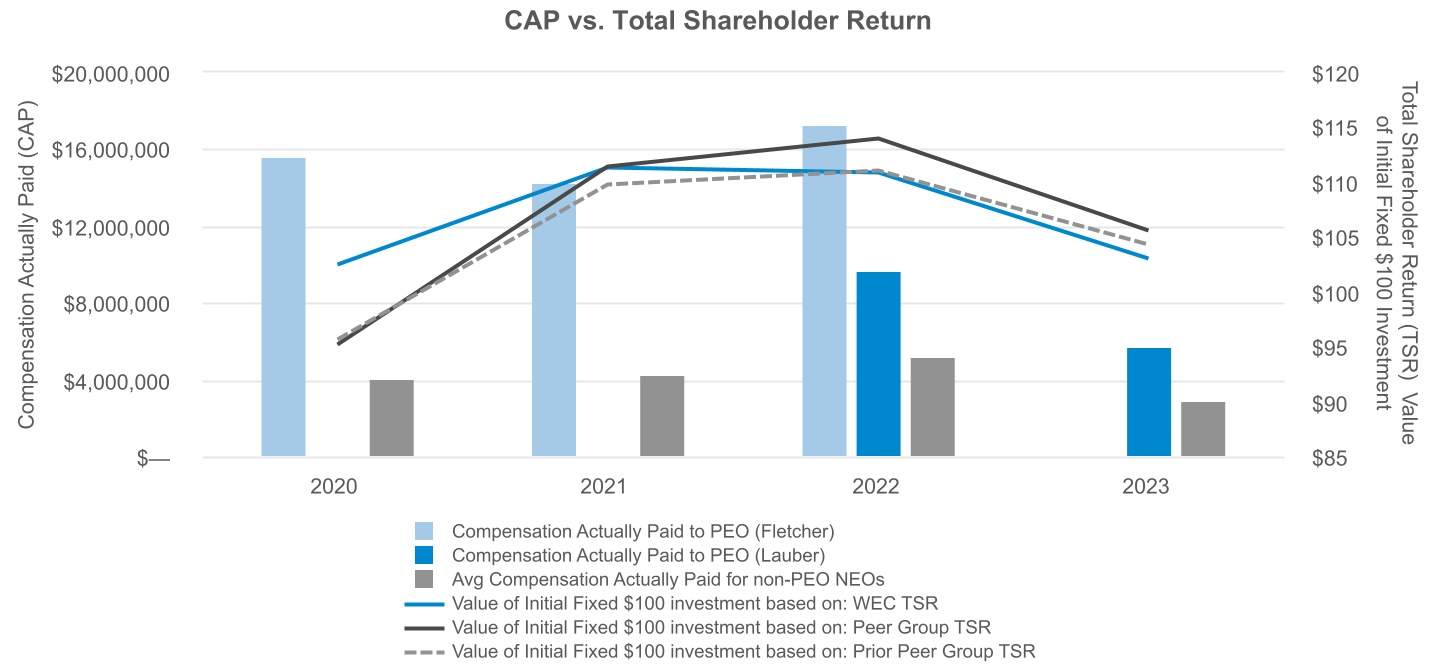

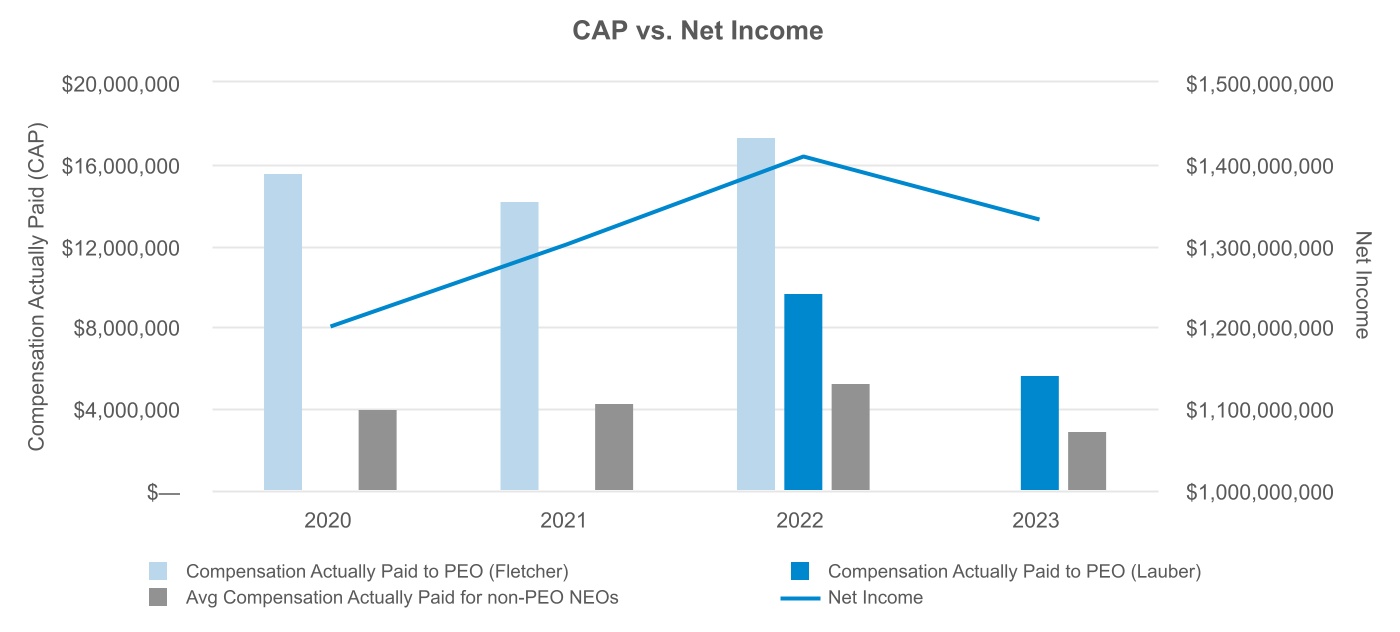

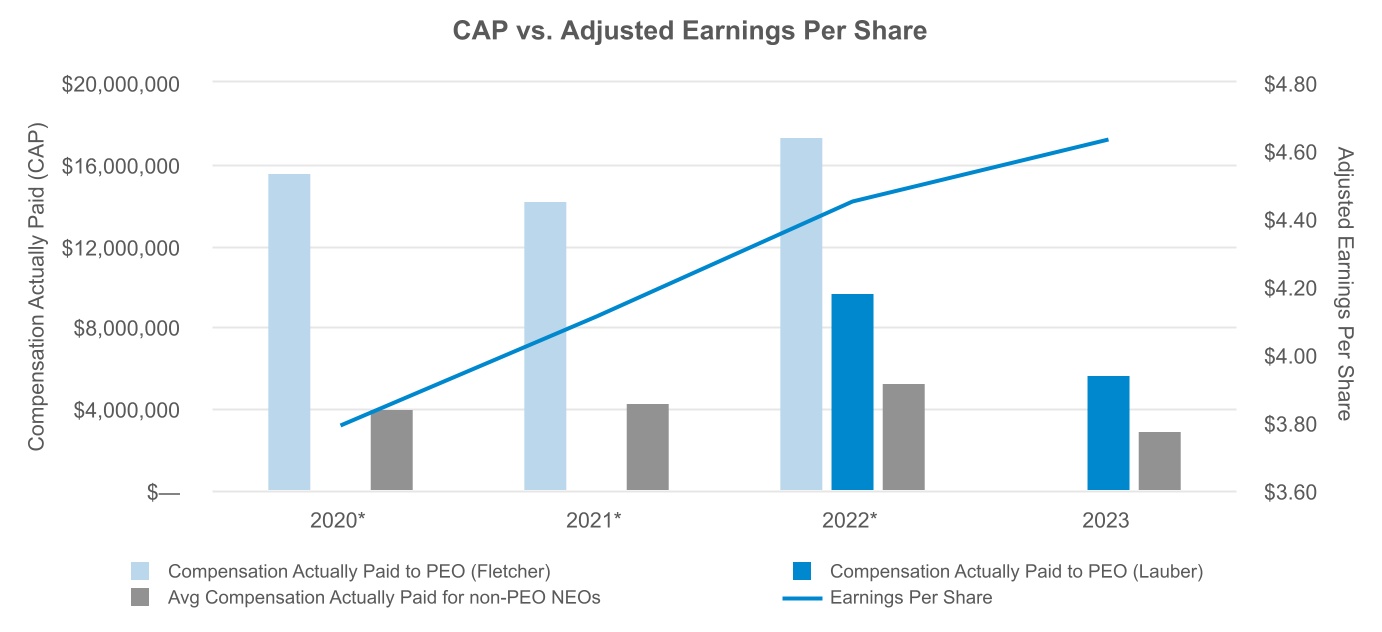

versus Performance Disclosure P-69

WEC

Energy Group Common Stock

Ownership P-73

|

|

|

|

Proposal 4

P-75 |

|

Amendment

of our Restated Articles of Incorporation to increase the number of authorized shares of common stock |

|

|

|

|

Proposal 5

P-77 |

|

Stockholder

Proposal Regarding Simple Majority Vote |

Annual Meeting Attendance

and Voting

Information P-78

Business

of the 2024 Annual Meeting of Stockholders P-78

Voting

Information P-78

Access

to Proxy Materials P-80

Annual

Meeting Attendance P-80

Stockholder

Nominees and Proposals P-81

Availability

of Form 10-K P-82

Appendix

A P-83

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-5 |

2024

Proxy Statement |

Forward-Looking

Statements

The statements contained

in this proxy statement about our future performance, including, without limitation, future financial and operational results, strategic

initiatives, execution of our capital plan, emissions reduction goals and all other statements that are not purely historical, are "forward-looking

statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934.

There are a number of risks and uncertainties that could cause actual results to differ materially from any forward-looking statements

made herein. A discussion of some of these risks and uncertainties is contained in our Annual Report on Form 10-K for the year ended December

31, 2023, and subsequent filings with the Securities and Exchange Commission ("SEC"). These reports address in further detail

our business, industry issues and other factors that could cause actual results to differ materially from those indicated in this proxy

statement. Except as may be required by law, we disclaim any obligation to publicly update or revise any forward-looking statements.

Other

reports and website references.

In this proxy statement we identify certain reports, including our climate reports, and materials that are available on or through our

website or those of our subsidiaries. These reports and the information contained on, or available through WEC Energy Group's website

and the websites of its subsidiaries, are not "soliciting material," are not deemed filed with the SEC, and are not, nor shall

they be deemed to be, incorporated by reference.

Proxy Summary

This summary highlights

selected information related to items to be voted on at the annual meeting of stockholders. This summary does not contain all of the information

that you should consider when deciding how to vote. Please read the entire proxy statement before voting. Additional information regarding

WEC Energy Group, Inc.'s (the "Company" or "WEC Energy Group") 2023 performance can be found in our Annual Report on Form

10-K for the year ended December 31, 2023.

The 2024 Annual Meeting

of Stockholders will be a virtual-only meeting via live webcast. There will not be a physical meeting location. Stockholders are encouraged

to participate online by logging into www.meetnow.global/M4ACHZT where you will be able to listen to the meeting live, submit questions

and vote your shares. Please see page P-78 for more information.

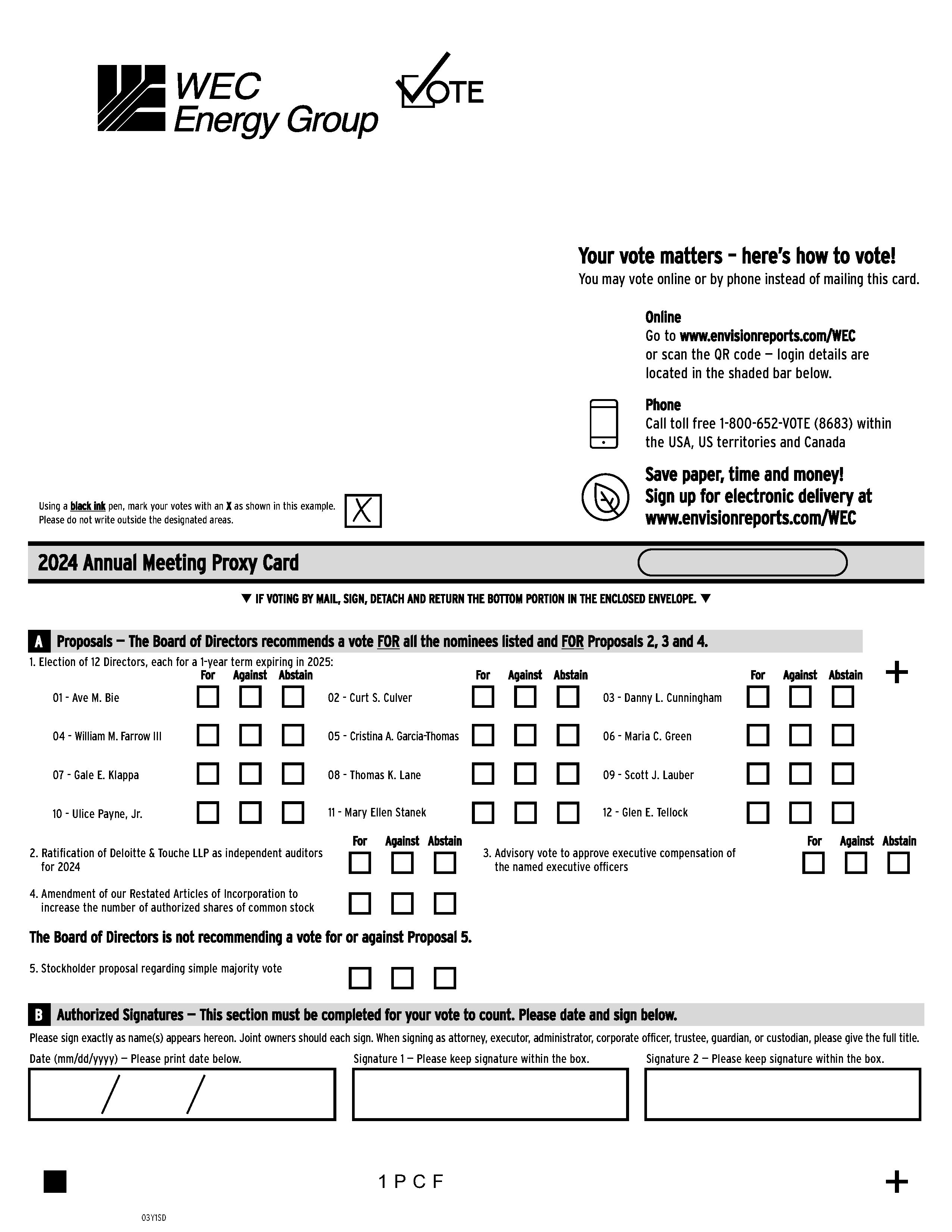

Voting

Matters and Recommendations

The

following proposals are scheduled to be presented at our upcoming 2024 Annual Meeting of Stockholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

to be Voted on |

Board’s

recommendation |

Page |

| Proposal

1 |

Election

of 12 Directors-terms expiring in 2025 |

FOR

each nominee |

P-12 |

| Proposal

2 |

Ratification

of Deloitte & Touche LLP as independent auditors for 2024 |

FOR |

P-38 |

|

Proposal

3 |

Advisory

vote to approve executive compensation of the named executive officers |

FOR |

P-41 |

|

Proposal

4 |

Amendment

of our Restated Articles of Incorporation to increase the number of authorized shares of common stock |

FOR |

P-75 |

|

Proposal

5 |

Stockholder

proposal regarding simple majority vote |

None |

P-77 |

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-6 |

2024

Proxy Statement |

An

Energy Industry Leader

WEC Energy Group is a

leading Midwest electric and natural gas holding company with subsidiaries serving 4.7 million customers in Wisconsin, Illinois, Michigan

and Minnesota. We also maintain majority ownership in American Transmission Company LLC, a for-profit electric transmission company regulated

by FERC and certain state regulatory commissions. In addition, as part of our non-utility energy infrastructure segment, we own majority

interests in a growing fleet of renewable generation facilities outside our regulated footprint. Our 7,000 employees are focused on providing

affordable, reliable and clean energy for a sustainable future.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-7 |

2024

Proxy Statement |

Our

2023 Performance Highlights

Throughout 2023, the Company

remained steadfast in executing its fundamentals — safety, reliability, customer satisfaction, financial discipline and environmental

stewardship. It ended the year having achieved solid financial and operational results, while delivering continued long-term value for

stockholders and customers.

|

|

|

|

|

|

| Business

Highlights / Awards and Recognition |

Financial Highlights

|

|

|

|

Announced

plans to eliminate coal as an energy source by the end of 2032 — three years earlier than the Company’s original goal.

Made

significant progress on the clean energy transition and the capital plan.

•Badger

Hollow Solar Park’s second phase went into service, completing the largest solar project in Wisconsin history. Together, We Energies

and Wisconsin Public Service own a total of 200 megawatts of solar capacity from this project.

•Work

continued on projects to support reliable service, including liquefied natural gas (LNG) storage facilities and highly efficient natural

gas generation using reciprocating internal combustion engines (RICE).

•The

Company brought 128 megawatts of new RICE generation online at its existing Weston power plant site and completed construction of the

Bluff Creek LNG storage facility in Wisconsin.

•As

part of an innovative pilot program, renewable natural gas entered the Company’s distribution system in Wisconsin. Dairy farms are

supplying methane that would otherwise have gone to waste, replacing a portion of conventional natural gas and reducing the environmental

impact of agricultural activity.

•Began

leading a pilot project to test a new form of long-duration energy storage, incorporating environmentally friendly materials, in partnership

with the Electric Power Research Institute ("EPRI") and CMBlu Energy.

Spent

a record $333.7 million with certified minority-, women-, veteran- or service-disabled-owned businesses.

Included

as a constituent of FTSE Russell’s FTSE4Good Index Series, which is made up of companies that reflect strong environmental, social

and governance practices.

Honored

by the Wisconsin Department of Workforce Development with the Vets Ready Employer Initiative award for supporting veterans in the workforce

and the community.

Named

among “America’s Greatest Workplaces” and “America’s Greatest Workplaces for Diversity” by Newsweek.

Presented

with the inaugural Paving the Pathway award by M3, a collaboration between Milwaukee Public Schools, Milwaukee Area Technical College

and University of Wisconsin-Milwaukee, in recognition of We Energies’ “commitment to strengthening Wisconsin’s future

workforce through work-based learning.”

Recognized

by the Minnesota Safety Council with the Outstanding Achievement Award for Minnesota Energy Resources’ occupational safety performance.

Presented

with the Regents Business Partnership Award for the Company’s longstanding support of University of Wisconsin-Milwaukee and its

students.

Recognized

by the Chicago Minority Supplier Development Council, which named Peoples Gas and North Shore Gas its 2023 Corporation of the Year.

Ranked

first among investor-owned utilities in the 2023 E Source Large Business Customer Satisfaction Study.

|

$4.63

earnings per share, on

an adjusted basis

___________________________

7%

dividend growth

___________________________

$984

million

cash

returned to stockholders

___________________________

20

consecutive years raising

the dividend (2004-2023)

___________________________

81

consecutive years of

delivering quarterly dividends (1942-2023) |

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-8 |

2024

Proxy Statement |

How

our Compensation Program Supports our Business Strategy

An

important aspect of the Board’s oversight responsibilities is to hold the executive management team accountable to achieving the

Company’s goals and objectives, and reward them appropriately when they do. This includes oversight of executive compensation.

Since

2004, our executive compensation program has included metrics that link a substantial portion of executive pay to achieving financial,

operational and social targets tied to our business fundamentals. These targets are linked to key objectives that underpin the company’s

sustainability.

Social

Matters

Incentive

targets associated with operational and social goals are tied to strategic priorities, which include, among other things, a focus on employee

safety, customer satisfaction, and workforce and supplier diversity.

Environmental

Matters

Delivering

a cleaner energy future to our customers while maintaining affordability and reliability, is one of our core responsibilities and a major

focus of our capital plan. The Compensation Committee assesses management’s performance against environmental goals through the

execution of its capital plan. Management annually refreshes the capital plan, discusses it with the Board, including a preview of anticipated

capital spending over five years, and then publicly discloses its plan during the fourth quarter each year.

The

Company’s ability to fund its substantial capital plan, which it was able to do without issuing equity through 2023, has been directly

linked with the Company’s ability to consistently deliver on its financial plan, including meeting the targets associated with the

financial metrics used in the Company’s compensation program. These financial metrics are key performance indicators underlying

our executives’ incentive compensation. During the remainder of 2024, the Compensation Committee will continue ongoing discussions

with its independent compensation consultant and management about the potential integration of the Company's environmental goals, including

emissions reduction targets, goals and other climate-related measures, into future performance metrics used in the Company's executive

compensation program.

Our

Efficiency, Sustainability and Growth Progress Plan

The Company’s 2024-2028

capital plan, referred to as our

ESG Progress Plan, details planned significant investments in low- and no-carbon generation and modernization

of the Company’s electric and natural gas infrastructure aimed at helping to reduce the emission of greenhouse gases (carbon and

methane). These investments are the building blocks for the Company’s carbon dioxide emission reduction goals from our electric

generation — 60% below 2005 levels by the end of 2025, 80% below 2005 levels by the end of 2030, and net carbon neutral by 2050.

The plan also supports the Company’s goal to achieve net-zero methane emissions from natural gas distribution lines in its network

by the end of 2030.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-9 |

2024

Proxy Statement |

Accountability

to our stockholders is critical to our long-term success. We routinely evaluate and enhance our governance practices to maintain alignment

with evolving best practices. Highlights of our governance framework and matters with which the Board was involved during 2023 are noted

below.

|

|

|

|

|

|

|

|

|

|

Governance Framework

Board

Independence/Composition

•10

of 12 director nominees are independent

•Independent

Lead Director with defined duties, elected by other independent directors

•Independent

Audit, Compensation, Finance and Governance Committees

•Opportunity

for executive sessions at every board and committee meeting

•50%

of Board nominees are diverse by gender or race/ethnicity

Board

Oversight

•Short-

and long-term strategy and major strategic initiatives

•Leadership

succession planning

•Code

of Business Conduct

•Corporate

sustainability, including risks and opportunities created by climate change

•Regular

reporting from Board committees on specific risk oversight responsibilities

Board

and Committee Practices

•Separate

Chairman and CEO

•Ongoing

Board refreshment

•Annual

Board and committee evaluations

•Strategy

and risk oversight discussion at every regular Board meeting

•Ongoing

education programs by internal and third-party experts

•Stock

ownership requirements for directors and executives

•Recoupment

(“clawback”) policies for incentive-based compensation to executives and officers

•Responsible

overboarding restrictions

Stockholder

Rights

•Annual

election of all directors

•Majority

voting standard for uncontested elections

•One-share,

one-vote standard

•Proxy

access and special meeting provisions in bylaws

•Annual

“say-on-pay” advisory vote |

|

Oversight

of 2023 Strategic Initiatives

The

Board is actively engaged in the oversight of the Company’s strategy, providing advice and counsel as warranted and holding management

accountable for making sound decisions in executing important matters affecting its stakeholders. Examples during 2023 included:

•ESG

Progress Plan, updated to reflect the Company’s anticipated capital expenditures over 2024-2028, allocated across strategies aimed

at delivering efficiency, sustainability and growth, while providing transparency to investors.

•Announced

plan to eliminate coal as an energy source by end of 2032 rather than 2035, three years earlier than previously planned.

•Capital

projects, investments and research tied to the execution of the Company’s ESG Progress Plan, including completion of a pilot program

to test hydrogen as a fuel source for power generation, and the continued mitigation of the effects of supply chain disruptions on renewable

energy project timelines and costs.

•Mitigation

of the continued impact of macro-economic and other trends on the utility sector.

•Regulatory

matters, including rate case reviews across all state jurisdictions.

2023

Governance Highlights

The

Board is committed to ensuring the Company conducts its business with the highest standards of ethics, integrity and transparency. Governance

highlights from 2023, which occurred at the Board’s direction, include:

•Developed

leadership succession plans, including the upcoming transition of the current Executive Chairman, Gale E. Klappa, to the role of Non-Executive

Chairman following the 2024 annual meeting of stockholders, subject to annual Board nomination and shareholder approval.

•Added

5 new independent directors from 2019 through 2023.

•Adopted

revisions to all committee charters, except for the Executive Committee, to reflect best practices and expanding risk oversight responsibilities.

•Updated

governance practices and disclosures to reflect new SEC rules, including those related to universal proxy provisions, insider trading

policies, clawback of incentive-based executive compensation, and cybersecurity incidents.

•Updated

the Corporate Governance Guidelines to reflect non-management director retirement age of 75, with the exception of any such directors

who, as of October 19, 2023, had accumulated more than ten years of service on the Board.

•Approved

updates to the Code of Business Conduct.

•Established

independent board director fees consistent with market, as recommended by outside advisor.

•Focused

on expanding and enhancing public disclosures of interest to stakeholders:

◦Issued

new position statements to address the social and economic elements of the low-carbon transition and our commitment to human rights.

◦Published

the Company's electric utility energy mix and emission rates.

◦Issued

corporate responsibility report in alignment with the Sustainability Accounting Standards Board ("SASB") industry standards.

◦Published

the Company’s consolidated EEO-1 Report.

◦Enhanced

the public disclosure of the Company’s political activities, corporate political donations and lobbying, including the Company’s

first Trade Association and Climate Engagement Report. |

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-10 |

2024

Proxy Statement |

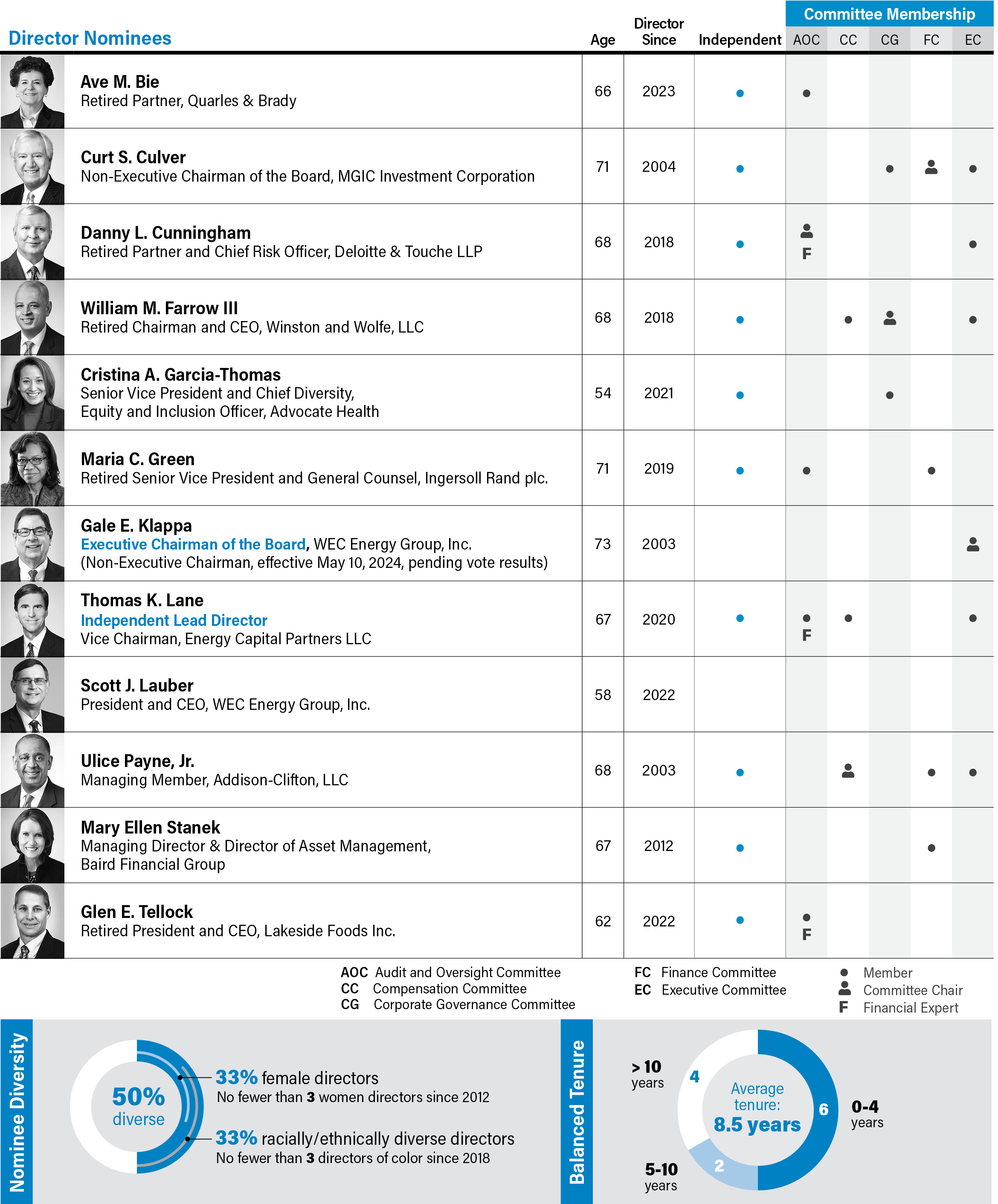

The

Director Nominees at a Glance

The following table provides

an overview of the director nominees, current as of January 18, 2024. All of the director nominees were elected at the 2023 Annual Meeting

of Stockholders. Additional information regarding our director nominees, including a detailed skills matrix, begins on P-12.

See P-14 for diversity characteristics self-identified by each director.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-11 |

2024

Proxy Statement |

|

|

|

|

|

|

|

|

|

|

PROPOSAL

1: ELECTION OF DIRECTORS

– TERMS EXPIRING IN 2025 |

|

|

|

|

What

am I voting on?

Stockholders are being

asked to elect 12 director nominees each for a one-year term. |

|

Voting

Recommendation:

✓

FOR the election of each Director Nominee.

The

Board of Directors and Corporate Governance Committee believe the 12 director nominees possess the experience and qualifications necessary

to provide effective oversight of the Company and the long-term interests of its stockholders. |

WEC Energy Group’s

bylaws require each director to be elected annually

to hold office for a

one-year term. Acting on the recommendation of the Corporate Governance Committee, the Board is recommending the following 12 nominees

for election as directors at our annual meeting. Each nominee, if elected, will serve until the 2025 Annual Meeting of Stockholders, or

until a successor is duly elected and qualified.

|

|

|

|

|

|

|

|

|

| 1.

Ave M. Bie |

5.

Cristina A. Garcia-Thomas |

9.

Scott J. Lauber |

| 2.

Curt S. Culver |

6.

Maria C. Green |

10.

Ulice Payne, Jr. |

| 3.

Danny L. Cunningham |

7.

Gale E. Klappa |

11.

Mary Ellen Stanek |

| 4.

William M. Farrow III |

8.

Thomas K. Lane |

12.

Glen E. Tellock |

•All

director nominees currently serve as directors on our Board. All nominees were elected by our stockholders at our 2023 Annual Meeting

of Stockholders, each having received at least 91.73% of the votes cast.

•All

director nominees are independent with the exception of Directors Klappa and Lauber, who are employees of the Company. If elected, Director

Klappa will transition from Executive Chairman to Non-Executive Chairman of the Board following the Company's annual stockholder meeting.

While Director Klappa will no longer be an employee of the company, he will remain non-independent due to his prior service as an executive

officer.

•Each

nominee has consented to being nominated and to serve if elected. In the unlikely event that any nominee becomes unable to serve for any

reason, the proxies will be voted for a substitute nominee selected by the Board upon the recommendation of the Corporate Governance Committee.

•This

is an uncontested election; therefore, our majority vote standard for election of directors will apply. Under this standard, each

director nominee will be elected only if the number of votes cast favoring such nominee’s election exceeds the number of votes cast

opposing that nominee’s election, as long as a quorum is present. Therefore, presuming a quorum is present, shares not voted, whether

by broker non-vote, abstention, or otherwise, have no effect on the election of directors. Proxies may not be voted for more than 12 persons

in the election of directors.

The process through which

the Board arrived at these director nominees is the result of the Board’s regular assessment of its composition and its focused

attention to ongoing succession planning, as described in the following pages.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-12 |

2024

Proxy Statement |

BOARD

COMPOSITION

The

Corporate Governance Committee and the Board evaluate director nominees in light of the Board’s current members, with the goal of

recommending nominees with diverse backgrounds and experiences who, together with the current directors, can best perpetuate the success

of WEC Energy Group’s business and represent stockholder interests. Director nominees are evaluated on the basis of certain key

attributes, core competencies, diversity, age/tenure, existing time commitments and independence. By following this process, the Board

is able to ensure that its director candidates bring a broad range of perspectives and experiences, will effectively contribute to the

Board, and will complement the other directors.

The Corporate Governance

Committee and the Board determined that the director nominees' complementary breadth of characteristics are suited to executing the duties

of the Board and, when taken together, embody the personal qualities, qualifications, skills, and diversity of background that best serve

our Company and its stockholders.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ———————————————— |

2024

BOARD OF DIRECTORS — 12

NOMINEES |

————————————————–– |

|

Gender

diversity |

Racial/Ethnic

diversity |

Average

age |

Average

tenure |

Independence |

| 33% |

33% |

66

years |

8.5

years |

83% |

Key

Attributes Required of All Directors

The

Corporate Governance Committee routinely evaluates the expertise and needs of the Board to determine its proper membership and size. As

described in the Corporate Governance Guidelines, The Board believes that all directors must demonstrate certain key attributes, as noted

below.

|

|

|

|

|

|

|

|

|

|

|

•Proven

integrity

•Ability

to appraise problems objectively

•Relevant

technological, civic, economic, and or social cultural experience

•Familiarity

with domestic and international issues affecting the Company's business

•Vision

and imagination |

•Mature

and independent judgment

•Ability

to evaluate strategic options and risks

•Social

consciousness

•Contribution

to the Board's desired collective diversity |

•Willingness

to dedicate sufficient time to board service

•Sound

business experience/acumen

•Achievement

of prominence in career

•Availability

to serve for five years before reaching retirement age |

|

|

|

Core

Competencies

The

Board regularly evaluates director qualifications and core competencies in the context of the Board’s oversight of strategic initiatives,

financial and operational performance objectives, and material risks. To that end, the Board seeks directors whose collective knowledge,

experience and skills provide a broad range of perspectives and leadership expertise in domains particularly relevant to our business

including: highly complex and regulated industries, strategic planning, financial strategy, utility/energy industry, technology

and security, audit oversight and financial controls, human capital management, corporate governance, sustainability matters (including

those associated with climate strategy), public policy, and other areas important to executing the Company’s strategy.

With

that in mind, the Corporate Governance Committee and Board have determined that the Board’s composition should consist of candidates

that collectively possess a specific set of core competencies, as listed below, in alphabetical order, in order to effectively carry out

its oversight function.

|

|

|

|

|

|

|

|

|

|

|

•Audit

Oversight/Financial Reporting

•Senior

Leadership/CEO Expirence

•Corporate

Governance

•Financial

Strategy/Investment Management/Investor Relations |

•Government/Public

Policy

•Human

Capital Management/Exec Comp

•Regulated

Industry Knowledge

•Risk

Management and Oversight |

•Strategic

Planning

•Sustainability

Matters

•Technology

and Security

•Utility/Energy

Industry Experience |

|

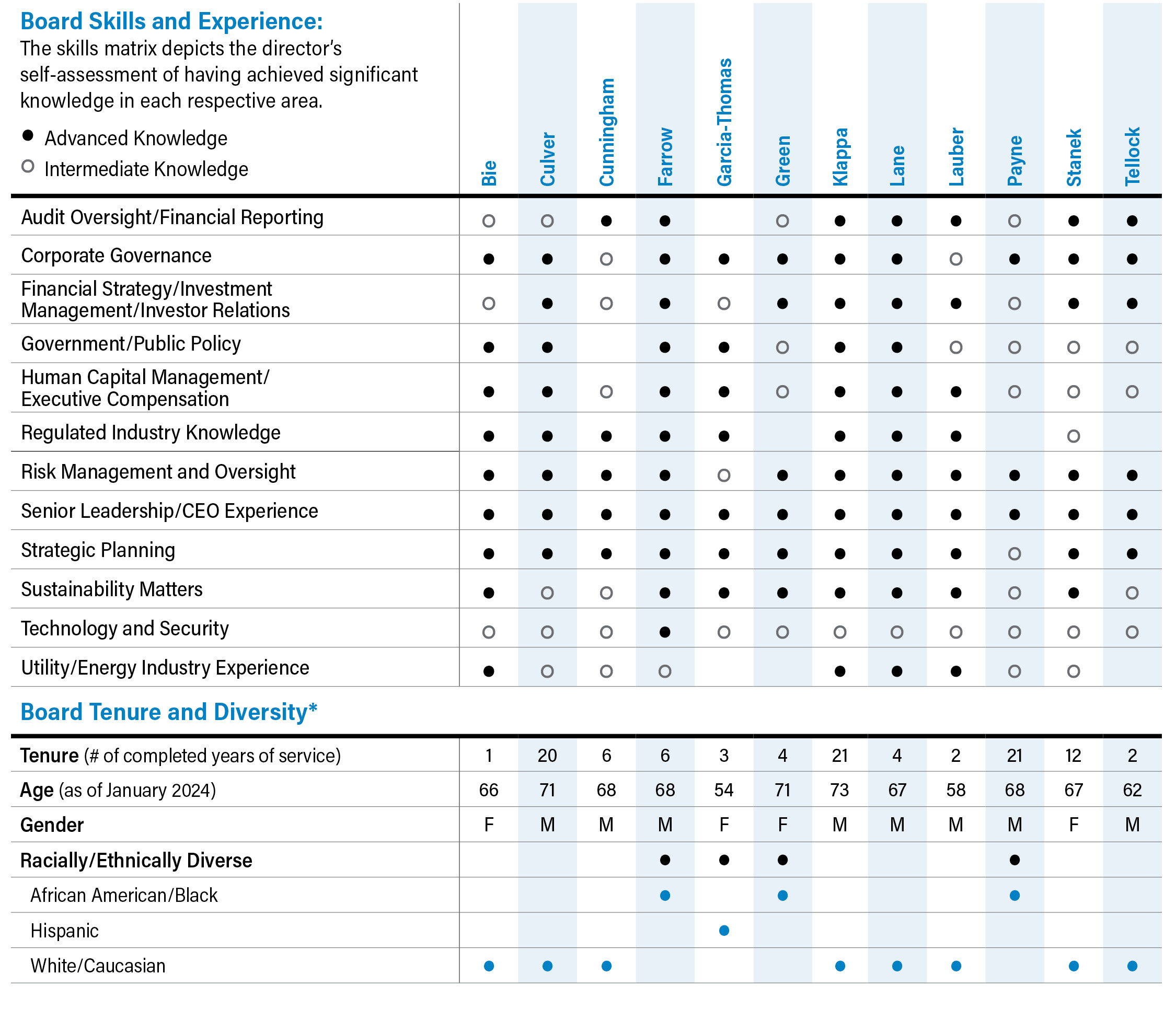

During the fourth quarter

of 2023, the Corporate Governance Committee and Board evaluated and affirmed this set of competencies. Each director performed a self-assessment

of his/her level of knowledge in each skill area using the following 3-point scale: “1” Limited knowledge (e.g., no

direct experience, primary exposure comes from Board or Committee reports); “2” Intermediate knowledge (e.g., general

managerial/oversight experience or broad exposure as a Board or Committee member); “3” Advanced knowledge (e.g., direct

experience; subject matter expert). A summary of the Board’s level of knowledge with respect to each of the core competencies

is shown on the following page.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-13 |

2024

Proxy Statement |

*Diversity

characteristics based on information self-identified by each director.

|

|

|

|

Diversity

Diversity

has been a major focus of the Corporate Governance Committee for decades when identifying director nominees. It is committed to actively

seeking highly qualified individuals from underrepresented communities as it strives to cast a wide net and recommend candidates who bring

unique perspectives to the Board, which contributes to its collective diversity - diversity of knowledge, skills, experiences, thought,

gender, race/ethnicity, retirement age and tenure. We believe this diversity improves the overall effectiveness of the Board as it

carries out its oversight role. |

Age

and Tenure

Under the Corporate Governance

Guidelines, a non-management director shall not be nominated for election to the Board after attaining the age of 75, unless nominated

by the Board for special circumstances. The foregoing shall not apply to current non-management directors who, as of October 19, 2023,

had accumulated more than ten years of service on the Board; such individuals shall not be nominated for election to the Board after

attaining the age of 72, unless nominated by the Board for special circumstances. Director nominees Culver, Payne and Stanek are subject

to this age-72 restriction.

The Board does not believe

it is appropriate or necessary to limit the number of terms a director may serve. The Board values the participation and insight of directors

who have developed an increased understanding of the Company and the specific issues it faces doing business in a complex, regulated industry,

as well as those directors who bring fresh and varied perspectives, resulting in a Board with a balanced tenure.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-14 |

2024

Proxy Statement |

Time

Commitment

Our

Corporate Governance Committee recommends and the Board nominates candidates whom they believe are capable of devoting the time necessary

to carefully fulfill their fiduciary duties. The Corporate Governance Committee regularly reviews stockholders’ views on the appropriate

number of public company boards on which directors may serve, which the Board takes into consideration each year as it reviews its Corporate

Governance Guidelines.

The Corporate Governance

Guidelines limit the maximum number of public company boards on which a WEC Energy Group director may serve to four public companies (including

our Board), and specify that any public company chief executive officer who serves as a director on our Board may not serve on more than

two public company boards (including our Board). Limited exceptions may be made with Corporate Governance Committee approval.

Independence

Our

Corporate Governance Guidelines state that to be independent, the Board should consist of at least a two-thirds majority of independent

directors. In order to be deemed independent, the individual must have no material relationship with the Company that would interfere

with the exercise of good judgment in carrying out his or her responsibilities as a director.

The

independence standards found in our Corporate Governance Guidelines are not only in compliance with the listing standards of the New York

Stock Exchange (“NYSE”), but are actually more stringent than the NYSE rules. Our director independence guidelines are located

in Appendix A of our Corporate Governance Guidelines, which are available on the Corporate Governance section of the Company’s website

at www.wecenergygroup.com/govern/governance.htm.

Prior

to initial and annual election, all directors complete a detailed questionnaire that elicits information that is used to ensure compliance

with the Board’s and the NYSE’s standards of independence. The Corporate Governance Committee also reviews potential conflicts

of interest, including related-party transactions, interlocking directorships, and substantial business, civic and/or social relationships

with other members of the Board that could impair the prospective Board member’s ability to act independently from the other Board

members and management. The Board also considers whether a director’s immediate family members meet the independence criteria outlined

in the Corporate Governance Guidelines, as well as whether a director has certain relationships with WEC Energy Group’s affiliates,

when determining the director’s independence.

The Board has affirmatively

determined that Directors Bie, Culver, Cunningham, Farrow, Garcia-Thomas, Green, Lane, Payne, Stanek, and Tellock are independent. Directors

Klappa and Lauber are not independent due to their employment with the Company as previously described on page P-12.

Director

Stanek

Since 2005, WEC Energy

Group has engaged Baird Financial Group ("Baird") primarily to provide consulting services for investments held in the Company’s

various benefit plan trusts. Baird also provides certain related administrative services. The Board reviewed the terms of this engagement,

including the $883,519

in

fees paid to Baird in 2023 (which are less than one-tenth of 1% of Baird’s total revenue), and

Director Stanek’s position at Baird, and concluded that such engagement is not material and did not impact Director Stanek’s

independence. Director Stanek is not involved with and does not consult on the contract with or recommendations made by Baird and receives

no direct financial benefit from these services. WEC Energy Group management evaluates Baird’s services against market standards

for overall quality and value on a regular basis. Neither the Board nor Director Stanek plays a role in the retention of Baird for these

services or any related negotiation of commercial terms. In addition, WEC Energy Group’s pension trusts and other benefit accounts

do not hold any investments in Baird funds.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-15 |

2024

Proxy Statement |

SUCCESSION

PLANNING AND DIRECTOR NOMINATION PROCESS

Board

Succession Planning

Our Board is regularly

engaged in rigorous discussions about the Board’s plans for ongoing succession, taking into consideration matters such as: current

inventory of director skills and qualifications; diversity, including gender, race/ethnicity, retirement age and tenure; and

future competencies needed to support appropriate oversight of the Company's long-term strategy and related risks and opportunities. These

discussions are co-facilitated by the Executive Chairman and Independent Lead Director during the Board’s executive sessions.

Guided by the Board’s

succession planning discussions, the Corporate Governance Committee, comprised entirely of independent directors, is responsible for identifying

and recommending director candidates to our Board for nomination.

Director

Nomination Process

The Corporate Governance

Committee is responsible for recommending a slate of nominees to the Board for election at each Annual Meeting of Stockholders using the

formal process detailed below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 1 |

Board

Succession Planning |

|

2 |

Identify

Candidates |

|

3 |

Evaluate

Candidate Recommendations |

|

4 |

Meet

with

Candidates |

|

5 |

Recommend

Candidate Nomination |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Develop

list of skills and qualifications sought in new directors and evaluate current Board composition |

|

Proposed

by stockholders, directors, and/or others |

|

Screen

qualifications, assess impact on Board composition, and review independence |

|

Multiple meetings scheduled

with the Executive Chairman and Independent Lead Director, members of Corporate Governance Committee, and other members of the Board |

|

Corporate

Governance Committee considers feedback and makes recommendation to the Board |

1.Board

succession planning.

The Corporate Governance

Committee facilitates the director recruitment and nomination process through the lens of the Board’s ongoing director succession

planning process, as described above. The Corporate Governance Committee seeks to fulfill its duty to stockholders to consistently maintain

a Board that is comprised of directors who each embody key attributes, and who, as a group, have the skills and experiences to effectively

oversee management's strategy for operating in a complex industry while performing their fiduciary obligations.

2.

Identify candidates.

Candidates for director nomination may be proposed in a number of ways, including by stockholders, the Corporate Governance Committee,

and other members of the Board. The Corporate Governance Committee may retain a third party to identify qualified candidates. No such

firm was engaged with respect to the nominees listed in this proxy statement.

The

Corporate Governance Committee will consider director candidates recommended by stockholders provided that the stockholders comply with

the requirements and procedures set forth in our bylaws. Stockholders may also nominate or recommend director candidates by following

the procedures outlined on page P-81. No formal stockholder nominations or recommendations for director candidates were received in connection

with the 2024 Annual Meeting of Stockholders.

3.

Evaluate candidate recommendations.

The Committee follows an established process for evaluating all director candidates whether recommended by directors, stockholders or

others. During this process, the Corporate Governance Committee reviews publicly available information regarding each identified candidate

to assess whether that person should be considered further. The Corporate Governance Committee considers whether each individual embodies

the key attributes listed above, as well as the person's qualifications, experience, skills, outside affiliations, age, gender, race and

ethnicity. The Committee will utilize third parties if and as needed to assist with these activities.

As

part of the evaluation process, the Corporate Governance Committee takes steps to ensure that the pool of director nominees contains the

attributes, skills and experiences identified during Board succession planning discussions. If the Corporate Governance Committee determines

that a candidate warrants further consideration, the Executive Chairman or another member of the Board of Directors contacts the prospective

director.

Generally,

if a recommended candidate expresses a willingness to be considered and to serve on the Board, the Corporate Governance Committee will

seek the Board’s concurrence in moving the candidate forward to the interview stage of the nomination process. Further, it will

instruct management to solicit from the candidate information used to review the candidate’s independence as well as assess any

potential conflicts of interest or reputational risk.

4.

Meet with candidates. Candidates

initially meet with the Executive Chairman, Independent Lead Director and members of the Corporate Governance Committee. Upon agreement

that a candidate has the attributes, skills and other identified factors the Board is seeking for its desired composition, all Board members

are provided an opportunity to meet with the candidate and provide feedback to the Corporate Governance Committee.

5.

Recommend candidate nomination.

The Corporate Governance Committee will review feedback received from the meetings with the candidates and engage in constructive dialogue,

following which it will make a recommendation regarding nomination for the Board's discussion and final determination.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-16 |

2024

Proxy Statement |

|

|

|

|

|

|

|

|

RESULTS

è |

Board

Refreshment

2019

- 2023 added 5 independent

directors |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

——

ADDITIONS —— |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oct.

2019

Maria

C. Green |

|

Jan.

2020

Thomas

K. Lane |

|

Jan.

2021

Cristina

A. Garcia-Thomas |

|

Jan.

2022

Glen

E. Tellock |

|

Jan.

2023

Ave

M. Bie |

|

|

|

|

|

|

|

|

|

|

All

have advanced levels

of competency in

•

Senior Leadership

•

Strategic Planning

•

Corporate Governance |

|

Areas

and/or attributes of particular focus during recruitment included:

✓ Diverse Board composition

✓ Technology and cybersecurity

knowledge

✓ Experience with sustainability

matters, including risks and opportunities of climate change

✓ Human capital management

✓ Audit / financial

/ risk oversight expertise

✓ Regulated and utility

industry background |

Included in each director

nominee’s biography that follows are career highlights and other public directorships, along with the key qualifications, skills

and expertise that we believe each director contributes to the Board. Our Board considered all of these factors,

as well as the results

of our annual Board evaluation, when deciding to re-nominate these directors.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-17 |

2024

Proxy Statement |

2024

DIRECTOR NOMINEES FOR ELECTION

The following 12 individuals

have been nominated for election to the Board of Directors at the 2024 Annual Meeting of Stockholders. Biographical information for each

director nominee is set forth below. Ages are as of January 18, 2024, the date each person was designated as a nominee of the Board

for election at the Meeting.

|

|

|

|

|

|

|

|

Age:

66

Director

Since: 2023

Board

Committee: Audit

and Oversight

|

Professional

Experience

Quarles & Brady LLP

– Retired Partner, 2005 to 2022. Quarles is a law firm serving a diverse list of domestic and international clients of all sizes,

in both large industrial sectors and small entrepreneurial settings.

Other

Public Directorships

None

Director

Qualifications

A retired business law,

utilities and energy attorney who spent her legal career counseling utilities and independent power producers, Director Bie brings to

our Board of Directors extensive industry experience across all aspects of the utility industry, from government relations and permitting

to counseling on infrastructure and long-range planning. At the time of her retirement in 2022, she was a partner at the Quarles law firm,

where, for over 20 years she focused on developing regulatory strategies to address critical infrastructure and renewable portfolio standards.

While at Quarles, she developed the firm’s corporate and social responsibility initiatives, leading the firm's efforts for five

years. Prior to joining Quarles, Director Bie served for seven years as the Chair of the Public Service Commission of Wisconsin, addressing

both transmission and generation infrastructure issues, including the review and approval of utility projects. The Board also greatly

benefits from the insights Director Bie has gained as a member of (and past Chair and Vice Chair) of the board of the New York Independent

System Operator, which operates the New York state bulk electricity grid and administers competitive wholesale markets, conducts comprehensive

long-term planning and advances the technological and security infrastructure of the electric system serving New York. As a member of

our Audit and Oversight Committee, Director Bie applies these experiences, along with her 25+ years of leadership roles in utility and

regulatory trade groups, to the committee’s risk oversight responsibilities, including those matters pertaining to legal and regulatory

risks and compliance, as well as data privacy and cybersecurity.

|

|

|

|

|

|

| Curt

S. Culver |

Independent |

|

|

|

|

|

|

|

|

Age:

71

Director

Since: 2004

Board

Committees: Corporate

Governance; Executive; Finance (Chair)

|

Professional

Experience

MGIC Investment Corporation

and Mortgage Guaranty Insurance Corporation - Non-Executive Chairman of the Board since 2015. MGIC Investment Corporation is the parent

company of Mortgage Guaranty Insurance Corporation, a private mortgage insurance company.

Other

Public Directorships

Director

of MGIC Investment Corporation since 1999.

Director

Qualifications

Having served for 15 years

as the CEO of Mortgage Guaranty Insurance Corporation and its parent company, MGIC Investment Corporation, Director Culver brings to our

Board of Directors a strong working knowledge of the strategic, operational, financial, and public policy issues facing a large, regulated,

publicly-held company headquartered in Milwaukee Wisconsin. His expertise in risk management and oversight is particularly valuable in

his service as chair of the Finance Committee, while his insurance industry experience puts him in a position to lead the Committee’s

evaluation of the Company's overall financial risk management program. Director Culver's broad corporate governance experience, developed

from his extensive past and present service on the MGIC boards, as well as those of several highly-visible Milwaukee-area non-profit entities

and two private for-profit organizations, is of great value to the Board as it carries out its oversight responsibilities, including the

duties of the Corporate Governance Committee, of which he is a member.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-18 |

2024

Proxy Statement |

|

|

|

|

|

|

| Danny

L. Cunningham |

Independent |

|

|

|

|

|

|

|

|

Age: 68

Director Since: 2018

Board Committees: Audit

and Oversight (Chair); Executive |

Professional Experience

Deloitte & Touche LLP

- Retired Partner and Chief Risk Officer. Served as Partner, 2002 to 2015, and as Chief Risk Officer, 2012 to January 2016. Deloitte &

Touche is an industry-leading audit, consulting, tax, and advisory firm.

Other

Public Directorships

Director of Enerpac Tool

Group Corp. since 2016.

Director

Qualifications

Director Cunningham brings

to our Board of Directors more than 30 years of experience serving public audit clients in a broad array of industries, including manufacturing

and financial services, as well as a deep understanding of the business, economic, compliance, and regulatory environment in which the

Company and many of its major customers operate. Director Cunningham applies his strong expertise in financial reporting, accounting,

internal controls, and audit functions to his responsibilities as WEC Energy Group’s Audit and Oversight Committee Chair. This experience

also contributes great value to the Board as it fulfills its responsibility for oversight of the Company's accurate preparation of financial

statements and disclosures, and compliance with legal and regulatory requirements. Having served as chief risk officer at Deloitte &

Touche, Director Cunningham gained insights into the complexities of risk management, and applies this expertise in assessing the effectiveness

of the Company's practices and policies to mitigate enterprise-wide risks. Director Cunningham’s multi-national experience brings

the added diversity of a global perspective to the Board as it evaluates its strategic objectives.

|

|

|

|

|

|

| William

M. Farrow III |

Independent

|

|

|

|

|

|

|

|

|

Age:

68

Director

Since: 2018

Board

Committees: Compensation;

Corporate Governance (Chair); Executive |

Professional Experience

Winston

and Wolfe, LLC - Retired Chairman and Chief Executive Officer, 2010 to 2023. Winston and Wolfe was a privately held technology development

and advisory company.

Other

Public Directorships

Director

of CBOE Global Markets Inc. since 2016; Lead Director

May

2023 to September 2023 and Non-Executive Chairman since September 2023.

Director of Echo Global

Logistics Inc., May 2017 to November 2021.

Director

Qualifications

In serving as Chair of

the Corporate Governance Committee, Director Farrow brings to our Board of Directors over 40 years of senior leadership experience in

managing business operations, technology development, enterprise risk, and strategy. His extensive professional experience in the highly

regulated banking and financial markets, accompanied by knowledge acquired from his service on the boards of CBOE Global Markets and the

Federal Reserve Bank of Chicago, enable him to add significant value to our Board’s oversight of the Company’s financial management

strategy. His firsthand experience and perspectives in addressing advances in information technology, coupled with the experience he has

gained serving as the non-executive chairman for CBOE Global Markets, is particularly valuable to the Board as WEC Energy Group companies

address complex risks, including those associated with protecting operating systems and assets against physical and cyber threats. Having

spent his career in Chicago, Director Farrow is able to provide the Board with economic, social, and public policy insight to conducting

business in Chicago, which is further enhanced by the strong relationships he has developed with key leaders while serving on the boards

of several highly visible Chicago-area private, not-for-profit and community organizations.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-19 |

2024

Proxy Statement |

|

|

|

|

|

|

| Cristina

A. Garcia-Thomas |

Independent

|

|

|

|

|

|

|

|

|

Age:

54

Director

Since: 2021

Board

Committee: Corporate

Governance |

Professional

Experience

Advocate

Health (formerly Advocate Aurora Health) - Senior Vice President and Chief Diversity, Equity and Inclusion Officer since December 2022;

Chief External Affairs Officer, April 2018 to December 2022. Advocate Health, the fifth-largest non-profit integrated health system in

the nation, operates across Alabama, Georgia, Illinois, North Carolina, South Carolina and Wisconsin.

Advocate

National Center for Health Equity, President since December 2022. Advocate National Center for Health Equity is a non-profit center innovating

strategies for equitable health and health care for all.

Other

Public Directorships

None

Director

Qualifications

Director Garcia-Thomas

brings to our Board of Directors significant leadership experience, particularly in the areas of customer and community relations, and

diversity, equity and inclusion. Since joining Advocate Health - the largest employer in the Milwaukee region - in 2011, she has successfully

addressed complex business issues in a highly regulated environment. As the Chief External Affairs Officer from 2018 to December 2022,

Director Garcia-Thomas was responsible for shaping the overall experience for patients, employees and community partners. She held oversight

responsibility for diversity, equity and inclusion, community relations, community health, community programs and the charitable foundation,

through which she has utilized and expanded her deep understanding of public policy, social priorities and challenges, and corporate governance.

Through her executive and civic leadership, Director Garcia-Thomas has established a strong network in the Company’s Wisconsin and

Illinois service areas, giving her keen insights into the needs of our customers. She contributes her experience in these areas to her

service on our Corporate Governance Committee, and to the Board’s oversight responsibilities and strategic discussions on sustainable

value creation, customer care and human capital management.

|

|

|

|

|

|

| Maria

C. Green |

Independent

|

|

|

|

|

|

|

|

|

Age:

71

Director

Since: 2019

Board

Committees: Audit

and Oversight; Finance

|

Professional

Experience

Ingersoll Rand plc - Retired

Senior Vice President and General Counsel, 2015 to June 2019. Ingersoll Rand is a diversified industrial manufacturer with market-leading

brands serving customers in global commercial, industrial and residential markets.

Other

Public Directorships

Director

of Tennant Co. since 2019.

Director

of Littelfuse Inc. since 2020.

Director of Fathom Digital

Manufacturing Corporation since

2021.

Director

Qualifications

Director Green brings to

our Board of Directors senior leadership experience accumulated during her 35-year career in law and business, including extensive public

company experience in strategic planning, acquisitions, enterprise risk management and shareholder relations, from which she provides

valuable insights in her service as a member of both our Finance and Audit and Oversight Committees. Director Green has substantial experience

with respect to corporate sustainability matters, including oversight responsibility for environmental compliance and corporate responsibility

reporting, as well as engagement with investors on these matters. Having served in the role of corporate secretary for several public

companies, Director Green’s deep corporate governance experience is of tremendous value to our Board as it carries out its evolving

oversight responsibilities. Director Green also contributes valuable insights into the economic, educational and social matters impacting

the greater Chicago community, where the Company has two utility subsidiaries. In particular, these insights come from having served for

18 years at Illinois Tool Works, a Fortune 200 global diversified manufacturing company headquartered in the northern suburbs of Chicago,

and as a member (and past chairman) of the Chicago Urban League executive committee.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-20 |

2024

Proxy Statement |

|

|

|

|

|

|

| Gale

E. Klappa |

Executive

Chairman |

|

|

|

|

|

|

|

|

Age:

73

Director

Since: 2003

Board

Committee: Executive

(Chair)

|

Professional Experience

WEC

Energy Group, Inc. - Executive Chairman since February 2019; Chairman of the Board and CEO, 2004 to May 2016 and October 2017 to February

2019; Non-Executive Chairman of the Board, May 2016 to October 2017; President, 2003 to August 2013.

Wisconsin

Electric Power Company (subsidiary of WEC Energy Group) - Chairman of the Board, 2004 to May 2016 and January 2018 to February 2019;

CEO, 2003 to May 2016 and January 2018 to February 2019; President, 2003 to June 2015.

Director

of Wisconsin Electric Power Company, 2003 to May 2016 and January 2018 to April 2024 (planned).

Chairman

Klappa also serves (until May 2024) as a director of several other major subsidiaries of WEC Energy Group.

Other

Public Directorships

Director

of Associated Banc-Corp since 2016.

Director

of Badger Meter, Inc. 2010 to April 2023.

Director

Qualifications

Chairman Klappa has more

than 45 years of experience working in the public utility industry, including more than 30 at a senior executive level. He first retired

as the Company's CEO in May 2016, at which time he assumed the role of Non-Executive Chairman of the Board. Chairman Klappa again served

as the Company's CEO between October 2017 and February 2019. Prior to joining the Company in 2003, Chairman Klappa served in various executive

leadership roles at The Southern Company, a public utility holding company headquartered in the southeastern United States. Under his

leadership, WEC Energy Group successfully completed its 2015 acquisition of Integrys Energy Group, which nearly doubled the employee and

customer population, and increased the Company’s geographic footprint to four states. With his extensive experience in the business

operations and C-suite leadership of publicly regulated utilities, his service as a board member for several other public companies, and

his contributions to significant economic development initiatives in southeastern Wisconsin, Chairman Klappa has led our Board with a

deep understanding of the financial, operational, and investment decisions and public policy issues facing large public companies. His

deep knowledge of the Company’s industry, customers, stockholders, and management team is of great value to our Board. If elected,

Director Klappa will transition from Executive Chairman to Non-Executive Chairman of the Board following the Company's Annual Meeting

of Stockholders.

|

|

|

|

|

|

| Thomas

K. Lane |

Independent

Lead Director |

|

|

|

|

|

|

|

|

Age:

67

Director

Since: 2020

Board

Committees: Audit

and Oversight; Compensation; Executive

|

Professional Experience

Energy Capital Partners

LLC - Vice Chairman since 2017; Partner, 2005 to 2017. Energy Capital Partners is a private equity firm that focuses on investing

in power generation, midstream gas, electric transmission and energy and environmental services sectors of North America's energy infrastructure.

Other

Public Directorships

Director

of Summit Midstream Partners, LP, 2009 to May 2020.

Director

of USD Partners, LP, 2014 to April 2020.

Director

Qualifications

In serving as WEC Energy

Group's Independent Lead Director, Director Lane brings to our Board of Directors more than 30 years of broad financial experience focused

within the energy sector, which provides him with a deep understanding of the complexities inherent to delivering strong financial performance

in a regulated industry. His experience in this area includes 17 years in the Investment Banking Division at Goldman Sachs where he held

senior-level coverage responsibility for electric and gas utilities, independent power companies and midstream energy companies throughout

the United States. Director Lane has significant experience in assessing the individual components of a company’s financial performance

and how it relates to a company’s compensation program, experience he gained over the course of his career, which has been focused

within the energy sector, and which is very valuable to his service as a member of our Compensation Committee. Since 2017, Director Lane

has served as Vice Chairman of Energy Capital Partners, following 12 years as a partner of the firm. During this tenure, he has held responsibility

for establishing and executing the firm’s investment strategies, which include projects encompassing power generation and renewables,

as well as midstream and environmental infrastructure. This experience enables him to add significant value to the Board’s oversight

of the Company’s long-term growth strategy, as does his substantial experience planning and executing merger and acquisition strategies.

Having testified before the House Energy Subcommittee on energy-related matters, Director Lane also brings to our Board an understanding

of the formulation of energy policy at the federal government level. His strong financial reporting experience within a regulated industry,

combined with his broad understanding of the risks facing the utility sector, provide tremendous value in his service as a member of our

Audit and Oversight Committee.

|

|

|

|

|

|

|

|

|

| WEC

Energy Group |

P-21 |

2024

Proxy Statement |

|

|

|

|

|

|

| Scott

J. Lauber |

President

and CEO |

|

|

|

|

|

|

|

|

Age:

58

Director

Since: 2022

Board

Committee: None |

Professional Experience

WEC

Energy Group - President and CEO since February 2022; Senior Executive Vice President and Chief Operating Officer from June 2020 to

January 2022; Senior Executive Vice President and CFO from October 2019 to June 2020; Senior Executive Vice President, CFO and

Treasurer from February 2019 to October 2019; Executive Vice President, CFO and Treasurer from October 2018 to February 2019;

Executive Vice President and CFO from April 2016 to October 2018.

Wisconsin

Electric Power Company (wholly owned subsidiary of WEC Energy Group) - Chairman of the Board and CEO since February 2022; President

since January 2022; Executive Vice President from June 2020 to December 2021; Executive Vice President and CFO from April 2016

to October 2018 and from October 2019 to June 2020; Executive Vice President, CFO and Treasurer from October 2018 to October 2019.

Director

of Wisconsin Electric Power Company since April 2016.

Director

Lauber also serves as an executive officer and/or director of several other major subsidiaries of WEC Energy Group.

Other

Public Directorships

None

Director

Qualifications

Director Lauber has more

than 30 years of experience working at WEC Energy Group and/or its subsidiaries and has held senior leadership levels for the past

12 years. A certified public accountant, Director Lauber first joined the Company in 1990 and held positions of increasing responsibility

in the areas of financial planning and management, accounting, and internal controls. In April 2016, he was named Executive Vice President

and Chief Financial Officer for WEC Energy Group, and added the Treasurer responsibilities in October 2018. From there, he advanced through

multiple executive leadership positions, including as Executive Vice President and Chief Operating Officer, a position that included oversight

responsibility for Information Technology, Enterprise Risk Management, Major Projects, Power Generation, Supply Chain, Supplier Diversity,

and WEC Infrastructure and Fuels. Effective February 2022, Director Lauber was named President and Chief Executive Officer of WEC Energy

Group and appointed to the Board of Directors. As President and Chief Executive Officer of WEC Energy Group’s major utilities in

Wisconsin, Michigan and Minnesota, Director Lauber is directly responsible for business operations in those jurisdictions. With his deep

expertise in financial and investment matters, in addition to his extensive knowledge and experience in the broad scope of the Company's

business operations critical to its continuing success as a leading Midwest public utility holding company, Director Lauber contributes

substantive insight into the Company’s strategies, objectives, risks and opportunities.

|

|

|

|

|

|

| Ulice

Payne, Jr. |

Independent

|

|

|

|

|

|

|

|

|

Age:

68

Director