Combination Would Establish Leading Residential

Mortgage REIT With Increased Scale and Operational Efficiencies

Transaction Expected to Drive Earnings

Accretion and Long-Term Growth

WMC Stockholders to Receive Cash Consideration

as Part of Merger

AG Mortgage Investment Trust, Inc. (NYSE: MITT) (“MITT”), a

publicly traded residential mortgage REIT managed by AG REIT

Management, LLC, an affiliate of Angelo, Gordon & Co., L.P.

(“Angelo Gordon”), a leading $73 billion alternative investment

firm, and Western Asset Mortgage Capital Corporation (NYSE: WMC)

(“WMC”), today announced that they have entered into a definitive

merger agreement, pursuant to which MITT will acquire WMC in a

fixed exchange ratio stock/cash transaction. WMC has terminated its

previously announced acquisition agreement with Terra Property

Trust, Inc. in accordance with the terms of such agreement.

MITT’s common stock closing price on the New York Stock Exchange

(the "NYSE") on August 7, 2023, implies a transaction value of

$11.23 per WMC common share, consisting of stock consideration of

$10.11 per share and cash consideration of $1.12 per share,

representing a 34% premium to WMC’s unaffected closing stock price

on the NYSE on July 12, 2023.

“We are very pleased to have reached an agreement to acquire WMC

in a combination that presents a compelling, value-maximizing

opportunity for both MITT and WMC stockholders,” said T.J. Durkin,

President, Chief Executive Officer, and board member of MITT. “We

are confident that combining these highly complementary portfolios

will help scale our platform, generate greater operational

efficiencies, cost synergies, and accretive earnings growth, and

benefit all stockholders. We look forward to moving swiftly to

complete this transaction.”

James W. Hirschmann III, Chairman of WMC’s Board of Directors,

stated, “After careful consideration, the Board, in consultation

with its outside legal counsel and financial advisors, unanimously

concluded that entering into the merger agreement with MITT is in

the best interest of WMC’s stockholders. This combination will

allow our stockholders to realize compelling value and we are

excited about what our companies can achieve together.”

Bonnie Wongtrakool, Chief Executive Officer of WMC, added, “The

merger of MITT and WMC delivers immediate cash value to WMC

stockholders as well as allows our stockholders to continue to

participate in the upside of the combined company. With the support

of Angelo Gordon’s deep credit expertise, resources, and proven

track record, we believe MITT is well-positioned to drive long-term

value for the combined company in the residential mortgage market.

We are committed to working closely with the MITT team to quickly

complete the acquisition and deliver substantial value for our

stockholders.”

Compelling Strategic Rationale for MITT and WMC

Stockholders

The merger of MITT and WMC is expected to create numerous

operational and financial benefits, including:

- Cash Consideration for Stockholders: WMC stockholders

will receive a portion of the merger consideration in cash,

consisting of a payment from Angelo Gordon, MITT’s external

manager, equal to the lesser of $7.0 million and approximately

9.99% of the aggregate per share merger consideration, or $6.9

million in total as of August 7, 2023. Any difference between $7.0

million and the 9.99% will be used to benefit the combined company

post-closing by offsetting reimbursable expenses that would

otherwise be payable to MITT’s external manager.

- Strong Financial Rationale: Expected accretion to

earnings within one year of closing and provide the combined

company with an attractive growth profile. The combined company

will have a reduced G&A expense ratio and an optimized capital

structure, with MITT’s preferred equity reduced to 42% (down from

49%).

- Increased Financial Strength and Flexibility: Strong

support and resources from MITT’s external manager, Angelo Gordon,

a leading alternative investment firm with $73 billion of assets

under management, which includes access to Angelo Gordon’s

proprietary, best-in-class securitization platform. The combined

company is also expected to benefit from an expanded investor base

and enhanced trading liquidity and volume. Notably, for the first

year following close, Angelo Gordon will waive $2.4 million of

management fees.

- Compelling Strategic Fit: Strategically aligned

investment strategies focused on securitizing residential mortgage

loans brings the combined company’s investment portfolio to $5.7

billion, consisting of approximately 86% of Non-Agency residential

mortgage loans, 5% of Agency RMBS, and 6% of other residential

investments. WMC’s legacy commercial investments will only

represent approximately 3% of the total investment portfolio on a

pro forma basis.

- Enhanced Operational Efficiencies: Significant operating

efficiencies of approximately $5-7 million on an annual basis are

expected to be realized in the transaction, which is before taking

into account the effective resetting of WMC’s management fee and

MITT’s external manager waiving $2.4 million in management

fees.

Transaction Overview

Each share of WMC common stock will be converted at closing into

the right to receive 1.5 shares of MITT common stock for a total of

9.2 million shares, pursuant to a fixed exchange ratio, subject to

adjustment based on the companies’ respective transaction

expenses,1 and a cash payment from Angelo Gordon equal to

approximately 9.99% of the aggregate per share merger consideration

(not to exceed $7 million in total). Upon the closing of the

transaction, MITT stockholders are expected to own approximately

69% of the combined company’s stock, while WMC stockholders are

expected to own approximately 31% of the combined company’s

stock.

Upon completion of the merger, MITT’s President and Chief

Executive Officer, T.J. Durkin, will serve as Chief Executive

Officer of the combined company, which will continue to operate as

“AG Mortgage Investment Trust, Inc.” and be managed by AG REIT

Management, LLC, an affiliate of Angelo Gordon. MITT’s Board of

Directors will be increased from six to eight directors to include

two WMC-designated directors. The combined company will be

headquartered in New York and will continue to trade on the NYSE

under MITT’s current ticker symbol.

Additional information on the transaction and the anticipated

benefits to MITT and WMC stockholders can be found in MITT’s

investor deck relating to the transaction posted on MITT’s website.

The investor deck is also being furnished by MITT in a Current

Report on Form 8-K being filed by MITT with the Securities and

Exchange Commission (the “SEC”) on the date hereof.

_____________________ 1 Exchange ratio is based on 6.150 million

outstanding shares of WMC common stock on a fully-diluted basis as

of June 30, 2023.

Timing and Approvals

The transaction has been unanimously approved by the Boards of

Directors of MITT and WMC and external managers of MITT and WMC.

The transaction is expected to close in the fourth quarter of 2023,

subject to the respective approvals by the stockholders of MITT and

WMC and other customary closing conditions set forth in the merger

agreement.

Advisors

Piper Sandler & Co. is acting as exclusive financial advisor

and Hunton Andrews Kurth LLP is acting as legal counsel to MITT.

BTIG, LLC and JMP Securities, a Citizens Company, are acting as

financial advisors, and Skadden, Arps, Slate, Meagher & Flom

LLP is acting as legal advisor to WMC.

About AG Mortgage Investment Trust, Inc.

AG Mortgage Investment Trust, Inc. is a residential mortgage

REIT with a focus on investing in a diversified risk-adjusted

portfolio of residential mortgage-related assets in the U.S.

mortgage market. AG Mortgage Investment Trust, Inc. is externally

managed and advised by AG REIT Management, LLC, a subsidiary of

Angelo, Gordon & Co., L.P., a leading alternative investment

firm focusing on credit and real estate strategies.

Additional information can be found on MITT’s website at

www.agmit.com.

About Angelo, Gordon & Co., L.P.

Angelo, Gordon & Co., L.P. is a leading alternative

investment firm founded in November 1988. The firm currently

manages approximately $73 billion* with a primary focus on credit

and real estate strategies. Angelo Gordon has over 650 employees,

including more than 200 investment professionals, and is

headquartered in New York, with associated offices elsewhere in the

U.S., Europe and Asia. For more information, visit

www.angelogordon.com.

*Angelo Gordon’s (the "firm") currently stated assets under

management (“AUM”) of approximately $73 billion as of December 31,

2022 reflects fund-level asset-related leverage. Prior to May 15,

2023, the firm calculated its AUM as net assets under management

excluding leverage, which resulted in firm AUM of approximately $53

billion as of December 31, 2022. The difference reflects a change

in the firm’s AUM calculation methodology and not any material

change to the firm’s investment advisory business. For a

description of the factors the firm considers when calculating AUM,

please see the disclosure at www.angelogordon.com/disclaimers/.

About Western Asset Mortgage Capital Corporation

WMC is a real estate investment trust that invests in, finances,

and manages a diverse portfolio of assets consisting of Residential

Whole Loans, Non-Agency RMBS, and to a lesser extent GSE Risk

Transfer Securities, Commercial Loans, Non-Agency CMBS, Agency

RMBS, Agency CMBS, and ABS. WMC is externally managed and advised

by Western Asset Management Company, LLC, an investment advisor

registered with the Securities and Exchange Commission and a

wholly-owned subsidiary of Franklin Resources, Inc.

Additional Information

This communication relates to the proposed merger (the “Merger”)

pursuant to the terms of a definitive agreement and plan of merger

(the “Merger Agreement”). In connection with the proposed Merger,

MITT expects to file with the SEC a registration statement on Form

S-4 that will include a prospectus of MITT and a joint proxy

statement of MITT and WMC. MITT and WMC also expect to file with

the SEC other documents regarding the Merger. The Merger will be

submitted to the stockholders of MITT and WMC for their

consideration. The definitive joint proxy statement/prospectus will

be sent to the stockholders of MITT and WMC, and will contain

important information about MITT, WMC, the proposed Merger and

related matters. This communication is not a substitute for any

proxy statement, registration statement, tender or exchange offer

statement, prospectus or other document MITT or WMC may file with

the SEC in connection with the proposed Merger and related matters.

INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ THE

REGISTRATION STATEMENT ON FORM S-4 AND THE RELATED JOINT PROXY

STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS

THERETO) AND OTHER RELEVANT DOCUMENTS FILED BY MITT AND WMC WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME

AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT

MITT, WMC AND THE PROPOSED MERGER. Investors and security

holders may obtain copies of these documents free of charge (if and

when they become available) through the website maintained by the

SEC at www.sec.gov. Copies of the documents filed by MITT with the

SEC are also available free of charge on MITT’s website at

www.agmit.com. Copies of the documents filed by WMC with the SEC

are also available free of charge on WMC’s website at

www.westernassetmcc.com.

Participants in the Solicitation Relating to the

Merger

MITT, WMC and certain of their respective directors and

executive officers and certain other affiliates of MITT and WMC may

be deemed to be participants in the solicitation of proxies from

the common stockholders of WMC and MITT in respect of the proposed

Merger. Information regarding WMC and its directors and executive

officers and their ownership of common stock of WMC can be found in

WMC’s Annual Report on Form 10-K for the fiscal year ended December

31, 2022, filed with the SEC on March 13, 2023, and in its

definitive proxy statement relating to its 2023 annual meeting of

stockholders, filed with the SEC on May 2, 2023. Information

regarding MITT and its directors and executive officers and their

ownership of common stock of MITT can be found in MITT’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2022,

filed with the SEC on February 27, 2023, and in its definitive

proxy statement relating to its 2023 annual meeting of

stockholders, filed with the SEC on March 22, 2023. Additional

information regarding the interests of such participants in the

Merger will be included in the proxy statement/prospectus and other

relevant documents relating to the proposed Merger when they are

filed with the SEC. These documents are available free of charge on

the SEC’s website and from MITT or WMC, as applicable, using the

sources indicated above.

No Offer or Solicitation

This communication and the information contained herein shall

not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act, as amended (the

“Securities Act”). This communication may be deemed to be

solicitation material in respect of the proposed Merger.

Forward-Looking Statements

This communication contains certain “forward-looking” statements

within the meaning of Section 27A of the Securities Act and Section

21E of the Exchange Act, as amended. MITT and WMC intend such

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and include this statement

for purposes of complying with the safe harbor provisions. Words

such as “expects,” “anticipates,” “intends,” “plans,” “believes,”

“seeks,” “estimates,” “will,” “should,” “may,” “projects,” “could,”

“estimates” or variations of such words and other similar

expressions are intended to identify such forward-looking

statements, which generally are not historical in nature, but not

all forward-looking statements include such identifying words.

Forward-looking statements regarding MITT and WMC include, but are

not limited to, statements related to the proposed Merger,

including the anticipated timing, benefits and financial and

operational impact thereof; other statements of management’s

belief, intentions or goals; and other statements that are not

historical facts. These forward-looking statements are based on

each of the companies’ current plans, objectives, estimates,

expectations and intentions and inherently involve significant

risks and uncertainties. Actual results and the timing of events

could differ materially from those anticipated in such

forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and

uncertainties associated with: MITT’s and WMC’s ability to complete

the proposed Merger on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to

securing the necessary stockholder approval from WMC’s and MITT’s

respective stockholders and satisfaction of other closing

conditions to consummate the proposed Merger; the occurrence of any

event, change or other circumstance that could give rise to the

termination of the Merger Agreement; risks related to diverting the

attention of MITT and WMC management from ongoing business

operations; failure to realize the expected benefits of the

proposed Merger; significant transaction costs and/or unknown or

inestimable liabilities; the risk of stockholder litigation in

connection with the proposed Merger, including resulting expense or

delay; the risk that MITT’s and WMC’s respective businesses will

not be integrated successfully or that such integration may be more

difficult, time-consuming or costly than expected; and effects

relating to the announcement of the proposed Merger or any further

announcements or the consummation of the proposed Merger on the

market price of MITT’s or WMC’s common stock. Additional risks and

uncertainties related to MITT’s and WMC’s business are included

under the headings “Forward-Looking Statements” and “Risk Factors”

in MITT’s and WMC’s Annual Report on Form 10-K for the year ended

December 31, 2022, and in other reports and documents filed by

either company with the SEC from time to time. Moreover, other

risks and uncertainties of which MITT or WMC are not currently

aware may also affect each of the companies’ forward-looking

statements and may cause actual results and the timing of events to

differ materially from those anticipated. The forward-looking

statements made in this communication are made only as of the date

hereof or as of the dates indicated in the forward-looking

statements, even if they are subsequently made available by MITT or

WMC on their respective websites or otherwise. Neither MITT nor WMC

undertakes any obligation to update or supplement any

forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other

circumstances that exist after the date as of which the

forward-looking statements were made, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230808322347/en/

Investors AG Mortgage Investment Trust, Inc. Investor

Relations (212) 692-2110 ir@agmit.com

Western Asset Mortgage Capital Corporation Larry Clark Financial

Profiles, Inc. (310) 622-8223 lclark@finprofiles.com

Media AG Mortgage Investment Trust, Inc. Jonathan

Gasthalter/Amanda Shpiner Gasthalter & Co. (212) 257-4170

Western Asset Mortgage Capital Corporation Tricia Ross Financial

Profiles, Inc. (310) 622-8226 tross@finprofiles.com

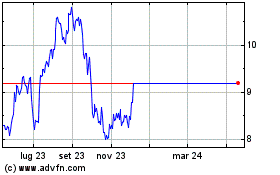

Grafico Azioni Western Asset Mortgage C... (NYSE:WMC)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Western Asset Mortgage C... (NYSE:WMC)

Storico

Da Dic 2023 a Dic 2024