Canadian General Investments, Limited Reports Audited 2011 Financial Results

15 Febbraio 2012 - 9:41PM

Marketwired

Canadian General Investment, Limited's (CGI)

(TSX:CGI)(TSX:CGI.PR.B)(TSX:CGI.PR.C)(LSE:CGI) net asset value at

December 31, 2011 was $426,413,000, representing a 15.0% decrease

from the $501,548,000 at the end of 2010. CGI's net asset value per

share (NAV) at December 31, 2011 was $20.44, down from $24.04 at

year end 2010. The NAV return, with dividends reinvested, for the

year ended December 31, 2011 was -11.7%, compared with a -8.7%

total return for the benchmark S&P/TSX Composite Index.

Equity markets had shown promise in the early stages of 2011 by

building on their gains of the prior year, but they reversed course

in April and remained firmly in a downtrend for the remainder of

the year. Macroeconomic issues seemed to carry the greatest

influence on the markets and the effects of these were magnified as

all of news, speculation and rumour had a heightened sway on

investors' behaviour in a very nervous market. The Eurozone debt

crisis dominated the headlines as the consequences of various

possible outcomes were debated and analyzed. As well, a slowdown in

some of the emerging economies such as China and Brazil became

evident and provided unwelcome news as these areas had been a

source of global economic growth during the most recent period when

developed economies such as the United States had softened.

A loss of confidence in equities was apparent as almost all

global market indices had double digit losses for the year, the

major exception being the U.S. where the S&P500 was flat and

the Dow Jones Industrial Average was up about six percent. This

anomaly could have been partly due to the desire of obtaining

relative safety in U.S. dollar denominated assets. Although the

S&P/TSX fared slightly better than the indices of most other

global markets, the high correlation between markets around the

world was a significant influence on the downside.

A bias to perceived lower-risk assets was illustrated not only

by the general downtrend experienced by the S&P/TSX, but also

by the dispersion of returns in the sub-sectors. Four of the ten

groups in the index, including Energy, Consumer Discretionary,

Information Technology and Materials underperformed the average,

and they would be considered to have the highest sensitivity to

deteriorating economic conditions. Outperformers tended to have

stable, often regulated businesses, with good cash flows and

supportive dividend yields. Many of these companies were in the

Telecommunication Services, Consumer Staples and Utilities

sectors.

CGI's portfolio diversity has always been maintained to provide

investors with a broad exposure to all of the sectors in the

Canadian market and so relative returns result from the overall

mix. The leverage provided by CGI's preference shares served to

magnify negative portfolio returns.

In addition to the payment of four regular quarterly dividends

of $0.06 per common share, CGI paid a year-end special capital

gains distribution of $0.56 per common share on December 28, 2011.

Based on the year-end common share price of $16.00, total dividend

payments during 2011 represented a yield of 5.0%.

CGI is a closed-end equity fund, focused on medium to long-term

investments in primarily Canadian corporations. Its objective is to

provide better than average returns to investors through prudent

security selection, timely recognition of capital gains/losses and

appropriate income generating instruments.

FINANCIAL HIGHLIGHTS

(in thousands of dollars, except per share amounts)

For the Year Ended

--------------------------

December 31, December 31,

2011 2010

--------------------------

Net investment loss (1,899) (1,415)

Net gain/(loss) on investments (58,631) 121,801

--------------------------

Increase/(decrease) in net assets resulting from

operations (60,530) 120,386

Increase/(decrease) in net assets resulting from

operations per share (2.90) 5.77

As at

--------------------------

December 31, December 31,

2011 2010

--------------------------

Selected data(1)

Net asset value 426,413 501,548

Net asset value per share 20.44 24.04

Selected data according to GAAP(1)

Net assets 424,875 500,049

Net assets per share 20.37 23.97

(1) The Company calculates the net asset value and net asset

value per share on the basis of the valuation principles set out in

its annual information form. These valuation principles differ from

the requirements of Canadian generally accepted accounting

principles (GAAP), with the main difference relating to securities

that are listed on a public stock exchange. While the Company

values such securities based on the latest sale price, GAAP

requires the use of the closing bid price. Accordingly, bid prices

are used in determining net assets and net assets per share for

purposes of the interim and annual financial statements.

In the United Kingdom, copies of the Company's financial reports

will be made available at the U.K. branch transfer agent,

Computershare Investor Services PLC, P.O. Box 82, The Pavilions,

Bridgwater Road, Bristol, BS99 6ZY. Phone 0870-702-0000.

Contacts: Canadian General Investments, Limited Jonathan A.

Morgan President & CEO (416) 366-2931 (416) 366-2729

(FAX)cgifund@mmainvestments.com www.mmainvestments.com

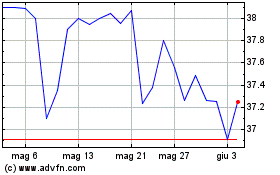

Grafico Azioni Canadian General Investm... (TSX:CGI)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Canadian General Investm... (TSX:CGI)

Storico

Da Gen 2024 a Gen 2025