Treasury Metals Revises Private Placement Financing Plans

05 Novembre 2010 - 7:51PM

Marketwired Canada

Treasury Metals Inc. ("Treasury" or the "Company") (TSX:TML) announced today,

changes to its previously announced financing plans. The Company has elected to

withdraw from its previously announced brokered private placement of

flow-through shares and units for aggregate gross proceeds of up to $3,600,000,

and to terminate its related engagement of a syndicate of agents, led by MGI

Securities and including Casimir Capital L.P. and M Partners Inc. The Company is

currently exploring various financing alternatives, which may include completing

a private placement offering of securities on a non-brokered basis, either on

the same or modified terms as its previously announced non-brokered private

placement offering in connection with the brokered financing.

"The Company remains focused on advancing the Goliath Gold Project through

pre-feasibility including upgrading current resources through in-fill drilling,

building additional ounces through exploration drilling and implementing

recommendations from the recently completed Preliminary Economic Assessment.

This information will be used to deliver an updated mineral resource estimate

and economic model aimed at driving the Project forward to anticipated

production," said Scott Jobin-Bevans, President and Chief Executive Officer.

"The Company will continue to be disciplined as it considers available options

to raise the funds necessary to support these initiatives to ensure that it

executes on terms that are attractive to the Company," he added.

About Treasury Metals

Treasury Metals Inc. is a Canadian mining company that is focussed on expanding

the Company's gold resources and developing its 100% owned flagship Goliath Gold

Project located in the Kenora Gold District of northwestern Ontario. The NI

43-101 compliant gold resource contains non-diluted underground Indicated

Resources of 490,000 tonnes grading 5.7 g/t Au (90,000 ounces) and Inferred

Resources of 5,200,000 tonnes grading 4.4 g/t Au (740,000 ounces) and surface

Indicated Resources of 2,900,000 tonnes grading 1.9 g/t Au (180,000 ounces) and

Inferred Resources of 5,400,000 tonnes grading 1.1 g/t Au (190,000 ounces).

Treasury also receives revenue from a Net Smelter Royalty they hold on Goldgroup

Mining Inc.'s Cerro Colorado Mine located in Mexico.

Technical information in this press release has been reviewed and approved by

Scott Jobin-Bevans, Treasury's President and CEO, who is a qualified person

under the definitions established by National Instrument 43-101.

The Company has implemented a quality assurance and control (QA/QC) program to

ensure sampling and analysis of all exploration work is conducted in accordance

with the CIM Exploration Best Practices Guidelines. The drill core is sawn in

half with one half of the core samples shipped to Accurassay Laboratories in

Thunder Bay, Ontario. The other half of the core is retained for future assay

verification. Other QA/QC procedures include the insertion of blind blanks and

standards for every tenth sample in the sample stream. Blind quarter core

duplicates were assayed for 5% of the samples. The laboratory re-assays at least

10% of all samples (pulps and rejects) and additional checks may be run on

anomalous values. Gold analysis is conducted by lead collection, fire assay with

atomic absorption or gravimetric finish on a 30 gram sample. Check assays by a

secondary lab will be completed in the future.

For additional information on Treasury Metals and its projects, please visit the

Company's website at www.treasurymetals.com.

Forward-looking Statements

This press release contains forward-looking statements such as the closing of

any private placement and the expected use of proceeds from any such financing.

Such statements are based on operations, estimates, forecasts and projections.

They are not guarantees of future performance and involve risks and

uncertainties that are difficult to predict and may be beyond Treasury Metals'

control. A number of important factors could cause actual outcomes and results

to differ materially from those expressed in forward-looking statements,

including those set forth in other public filings. In addition, such statements

relate to the date on which they are made. Consequently, undue reliance should

not be placed on such forward-looking statements. Treasury disclaims any

intention or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise, save and

except as may be required by applicable securities laws.

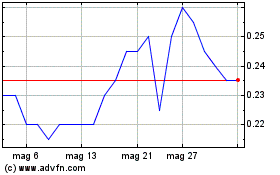

Grafico Azioni Treasury Metals (TSX:TML)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Treasury Metals (TSX:TML)

Storico

Da Lug 2023 a Lug 2024