Treasury Metals Announces Bought Deal, Unit and Flow-Through Private Placement

12 Settembre 2012 - 10:50PM

PR Newswire (Canada)

/NOT FOR DISSEMINATION IN THE UNITED STATES OR TO U.S. NEWSWIRE

SERVICES/ TORONTO, Sept. 12, 2012 /CNW/ - ("Treasury Metals" or the

"Company") is pleased to announce that it has entered into an

agreement with Canaccord Genuity Corp. ("Canaccord"), pursuant to

which a syndicate of underwriters led by Canaccord (the

"Underwriters") will purchase, in any combination, units of the

Company ("Units") at a price of $0.75 per Unit and a minimum of

$2.0 million in flow-through common shares of the Company

("Flow-Through Shares") at a price of $0.80 per Flow-Through Share

to raise aggregate gross proceeds of $3.0 million (the

"Underwritten Offering"). Each Unit shall consist of one common

share in the Company and one half of one common share purchase

warrant of the Company exercisable for a period of 24 months from

the closing date. Each whole warrant shall be exercisable into one

common share of the Company at $1.00 per share. In addition, the

Company will grant the Underwriter an option to sell additional

units (the "Over-Allotment Units") or flow-through common shares

(the "Over-Allotment Flow-Through Shares") of the Company, in any

combination of Over-Allotment Units or Over-Allotment Flow-Through

Shares (and together with the Units and Flow-Through Shares, the

"Offered Securities"), to raise additional gross proceeds of up to

$2.0 million (the "Over-Allotment Option" and together with the

Underwritten Offering, the "Offering"). The net proceeds raised

through the Offering will be for the advancement of the Company's

assets and for general working capital purposes. Closing of the

Offering is anticipated to occur on or about September 21, 2012

(the "Closing Date"). Closing of the Offering is subject to receipt

of regulatory approvals, including the acceptance of the Offering

by the Toronto Stock Exchange. The Offered Securities will be

subject to a four month hold period under applicable securities

laws in Canada. In consideration of the Underwriters' services, the

Company has agreed to pay the Underwriters a cash commission of

6.0% of the gross proceeds raised under the Offering. The

Underwriters will also receive broker warrants (the "Broker

Warrants") exercisable at any time from the Closing Date to the day

prior to the date that is 24 months from the Closing Date to

acquire that number of common shares of the Company which is equal

to 6.0% of the aggregate number of Offered Securities issued

pursuant to the Offering. This news release does not constitute an

offer to sell or a solicitation of an offer to buy the securities

described herein in the United States. The securities described

herein have not been and will not be registered under the United

States Securities Act of 1933, as amended, and may not be offered

or sold in the United States or to the account or benefit of a U.S.

person absent an exemption from the registration requirements of

such Act. Forward Looking Statements This press release contains

forward-looking statements such as the expected use of the net

proceeds from the private placement, our future financial

condition, business plans and objectives, results of operations and

business. Such statements are based on operations, estimates,

forecasts and projections. They are not guarantees of future

performance or events and involve risks and uncertainties that are

difficult to predict and may be beyond Treasury Metals' control. A

number of important factors could cause actual outcomes and results

to differ materially from those expressed in forward-looking

statements, including those set forth herein and in other public

filings. In addition, such statements relate to the date on which

they are made. Consequently, undue reliance should not be placed on

such forward-looking statements. Treasury Metals disclaims any

intention or obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, save and except as may be required by applicable

securities laws. Treasury Metals Inc. CONTACT: To learn more about

Treasury Metals, please visit the Company'swebsiteat

www.treasurymetals.com.Greg FerronVice President, Corporate

DevelopmentT: 1.416.214.4654greg@treasurymetals.comMartin

WalterPresident and CEOT: 1.416.214.4654martin@treasurymetals.com

Copyright

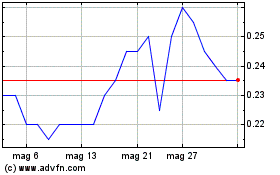

Grafico Azioni Treasury Metals (TSX:TML)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Treasury Metals (TSX:TML)

Storico

Da Lug 2023 a Lug 2024