Kincora Announces Fiscal Year Results and Provides Corporate Update

29 Aprile 2013 - 11:30PM

Marketwired Canada

Kincora Copper Limited (the "Company", "Kincora") (TSX VENTURE:KCC) has today

filed its annual operational and financial results for the year ended December

31st, 2012. The Company's audited Consolidated Financial Statements and

Management's Discussion and Analysis has been filed with SEDAR, and is available

on the Company website at www.kincoracopper.com.

John Rickus, President and CEO commented, "The year 2012 was dominated by global

economic contractions with the junior resource industry impacted particularly

hard. Despite significant progress delivering on our stated exploration,

development and acquisition strategy a series of adverse external and Mongolia

specific uncertainties over this period, and emerging into 2013, have adversely

affected our share price performance in particular and as well as that of most

Mongolian asset classes which are trading at or near 52 week lows (or

significantly longer). As such we have taken measures to strengthen the Company,

align our strategy with current market conditions and I thank our shareholders

for their ongoing support.

"While the Bronze Fox license remains our flagship project, with field season

activities in 2012 confirming and significantly advancing a number of copper

porphyry targets at the West Kasulu prospect, I am pleased to confirm that

recent correspondence with MRAM confirms all our licenses are in good standing.

Uncertainty relating to our lower priority two Golden Grouse licenses has

undoubtedly impacted our share price and led to Kincora trading at a clear

discount to its listed Mongolian copper exploration peers.

"Kincora continues to closely monitor key events and political developments in

respect to mining and foreign investment laws. In particularly the expected

resolution of current issues facing Oyu Tolgoi, the largest proposed project

financing in the mining industry and achievement of Stage 1 commercial

production by the end of June, is likely to be a very positive catalyst

favourably impacting investor sentiment to Mongolia. This event is scheduled to

occur at a time when Presidential elections will conclude (June 26th), which

will bring to a close a highly uncertain two year political cycle following

Parliamentary elections and the subsequent change in Government last year."

John Rickus further noted, "Finally, I would like to thank our Director of

Exploration, Yawen Cao, and his Mongolian team for their continued hard work

particularly as we shortly resume exploration activities. To reach this stage of

exploration and development activities at Bronze Fox is a very commendable

achievement particularly bearing in mind our licenses are only in their fourth

year.

"Despite the significant uncertainties that have emerged since mid last year we

see recent external events as potential catalysts for an improvement in market

sentiment towards Mongolia and especially Kincora. We note that the Mongolian

Parliament has already supported an amendment to the Foreign Investment Law

(SEFIL) and a proposed amendment to the securities market law. Similarly Erdene

Resource Development Corp.'s strategic alliance with Teck Resources Limited is a

sign of strategic investors continued interest in Mongolia, in particular,

copper exploration. Kincora remains comfortably funded with planned exploration

activities expected to significantly advance our asset portfolio. "

Highlights for the year ended December 31st, 2012 and subsequent developments

through March 31st, 2013 include:

-- Large-scale exploration targets advanced: Over 15000 metres of drilling

during 2012 confirmed and significantly progressed a number of copper

porphyry targets at the West Kasulu prospect (in Bronze Fox) for both

bulk lower grade and deeper higher-grade copper mineralisation. Scout

drilling activities coupled with IP analysis supports a mesothermal

predominately gold target to the approximately 4-5 km south, south-east

of the West Kasulu copper porphyry target and establishment of an

epithermal predominately gold target at the Tourmaline Hill

prospect/neighbouring license.

-- Anomaly extends target zones and adds substance to further geophysics:

In late 2012 two previously untested anomalies at Bronze Fox, which were

identified from the first phase 3D Induced Polarisation ('IP') programme

earlier in the year, were drilled. Whilst not encountering economic

mineralisation, both holes were technical successes, returning

significant alteration warranting further exploration activities.

Furthermore mineralisation encountered reconciles to the geophysics

target profile, adding substance to further IP analysis and supporting a

substantial new target zone of over 2kms at West Kasulu.

-- Analysis of potential oxide development project commenced: A first phase

oxide development project, if viable, could provide cash flow to be

reinvested into further exploration and conversion to a mining license.

Following initial infill drilling and metallurgical analysis a decision

to move to pre-feasibility studies for a shallow, small scale open pit

mine to produce cathode copper by heap leaching is subject to further

drilling, metallurgical analysis, desktop reviews and clarity on the

proposed new Government Minerals Policy.

-- Executive management team strengthened: Two senior executives have been

appointed bringing valuable technical, commercial and financial markets

experience with them to the Company's existing operations and business

development strategy.

-- Regional consolidation and corporate opportunities advanced: Two

commercial agreements have been completed, further opportunities being

evaluated and discussions with potential strategic investors regarding

technical and financial synergies ongoing.

-- Successful capital raisings: Two capital raising in the second half of

2012, with notable support from the Company's largest shareholder and a

new significant scale Hong Kong based institution, provides Kincora a

number of options and flexibility to resume optimal exploration

activities in 2013. The Company's cash balance as at April 23rd, 2013 is

$2,604,782 supporting board approved activities until 2014 with the

management also focusing on further reducing overhead and administrative

costs.

-- Planned resumption of field activities and confirmation of licenses

standing: Despite recent speculation driven by an ongoing Mongolian

court case, Kincora has had confirmation from the Mineral Resources

Authority of Mongolia ("MRAM") that all its licenses remain in good

order. A staged systematic exploration programme is planned with field

season activities expected to recommence within the next month.

The core focus of these activities is to refine exploration data and

specify target generation of the copper porphyry targets at the West

Kasulu prospect in light of the positive results at depth (eg hole F62)

and other shallower zones of bulk and higher grade porphyry

mineralisation (eg holes F82, F92 and F72) encountered late 2012. Also

this will potentially enable Kincora to undertake a deep IP programme

and possibly further drilling at identified high priority targets in the

second half of the year which, if successful, could to lead to a

significant exploration target range. Further details on Kincora's

planned exploration activities are provided in our 2012 Annual Report.

About Kincora Copper Limited

Kincora Copper Limited is a mining exploration and development company based in

Vancouver and listed on the TSX Venture Exchange that was formed in mid 2011.

Kincora's ambition is to be the leading listed independent copper exploration

and development company in the highly prospective and proven Oyu Tolgoi South

Gobi porphyry copper belt in southeast Mongolia. The Company is currently

exploring its wholly owned Bronze Fox, Tourmaline Hills and North Fox projects

which host an extremely large and strategically located mineralised footprint

covering over 40km2.

The projects are situated only 250km from the Chinese border and within 140km of

two large scale greenfield copper construction projects: Oyu Tolgoi, invested

capital to date approximately US$6.6 billion and target production of up to

160,000t/ day; and, Tsagaan Suvarga, estimated capex US$1b and target production

of 40,000t/ day. Other significant mines and associated infrastructure are being

developed in this immediate region.

FOR FURTHER INFORMATION PLEASE CONTACT:

Kincora Copper Limited

Sam Spring

VP Corporate Development

+61431 329 345

sam.spring@kincoracopper.com

Kincora Copper Limited

www.kincoracopper.com

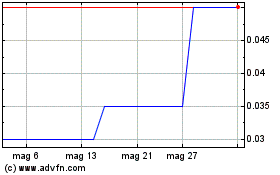

Grafico Azioni Kincora Copper (TSXV:KCC)

Storico

Da Lug 2024 a Ago 2024

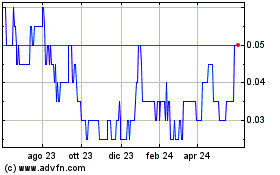

Grafico Azioni Kincora Copper (TSXV:KCC)

Storico

Da Ago 2023 a Ago 2024