Caesars Sues Insurance Carriers, Saying They Declined to Cover $2 Billion-Plus of Losses

22 Marzo 2021 - 10:51PM

Dow Jones News

By Dave Sebastian

Caesars Entertainment Inc. sued a group of insurance carriers,

accusing them of declining to cover an estimated loss of more than

$2 billion because of the Covid-19 pandemic.

The casino and hotel company alleges in the lawsuit that it had

purchased property insurance coverage to protect against "all risk

of physical loss or damage" and resulting business interruption.

Most of the policies don't exclude loss or damage caused by a virus

or pandemic, Caesars said in the lawsuit filed Friday in the Eighth

Judicial District Court of Clark County, Nev.

The company said it has paid more than $25 million in premiums

to secure the all-risk policy portfolio providing more than $3.4

billion in coverage limits. Caesars, which was formed as a result

of Eldorado Resort Inc.'s combination with Caesars Entertainment

Corp. last year, swung to a loss of $1.76 billion in 2020.

The suit is the latest case of a company trying to recover lost

business during the pandemic through insurance. The insurers have

had the upper hand so far. Of the more than 200 rulings in suits

pitting businesses against insurers, more than 80% have been in

favor of insurers, according to a Covid-19 litigation-tracking

effort at the University of Pennsylvania Carey Law School.

The corporate-insurance arm of Allianz SE, which was one of the

firms named as a defendant, said it wouldn't comment on individual

situations, though it has been evaluating claims during the

pandemic case-by-case to determine coverage.

"We will certainly honor Covid-19-related claims where they are

part of our policies and cover is clear," Allianz said. "However,

many businesses will not have purchased cover that will enable them

to claim on their insurance for Covid-19 pandemic losses."

The insurance carriers in the suit include select subsidiaries

of Chubb Ltd., Markel Corp. and Aspen Insurance Holdings Ltd. as

well as certain underwriters at Lloyd's of London. Chubb, Markel

and Aspen declined to comment. Lloyd's, an insurance marketplace,

said it isn't authorized to comment on any litigation.

Caesars, like other casino owners, shut down its properties in

March 2020 as Covid-19 lockdowns began, the start of what Chief

Executive Officer Thomas Reeg would later call "the most

challenging year that we've had operationally and personally to

date." Its properties now operate with local restrictions.

A cavalcade of restaurants, retailers and others hurt by

pandemic restrictions have sued to force their insurers to cover

billions of dollars in business losses. Millions of businesses

across the U.S. have "business interruption" insurance.

Insurance companies have largely refused to pay claims under

that coverage, citing a standard requirement for physical damage.

That is a legacy of its origins in the early 1900s as part of

property insurance protecting manufacturers from broken boilers or

other failing equipment that closed factories. The insurance is

also known as "business income" coverage.

The point of dispute in Caesars' suit is whether business

disruption caused by the pandemic constitutes physical damage, a

key component in an insurance claim. Caesars said the pandemic led

to physical loss or damage, including losses from closures and

capacity restrictions. But courts have ruled that the loss of an

intended use of a property doesn't constitute physical loss or

damage the same way a fire obliterates a building, said Michael

Menapace, an insurance lawyer at Wiggin and Dana LLP.

"The virus itself does not physically damage property," said Mr.

Menapace, who is also a nonresident scholar at the Insurance

Information Institute, a trade group for insurance carriers.

In a win for insurance policyholders, the U.K. Supreme Court

ruled in January that insurers must pay out disputed claims related

to the coronavirus to a range of businesses. Rulings from courts

outside the U.S. don't normally have an impact on

insurance-coverage disputes in American courts, where judges rely

on individual state laws, said industry executives and

academics.

Write to Dave Sebastian at dave.sebastian@wsj.com

(END) Dow Jones Newswires

March 22, 2021 17:36 ET (21:36 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

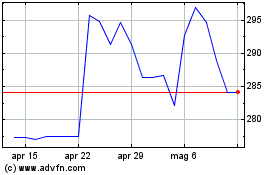

Grafico Azioni Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Storico

Da Gen 2024 a Gen 2025