By Ryan Dezember | Photographs by Jeff Lautenberger for The Wall Street Journal

A bidding war broke out this winter at a new subdivision north

of Houston. But the prize this time was the entire subdivision, not

just a single suburban house, illustrating the rise of big

investors as a potent new force in the U.S. housing market.

D.R. Horton Inc. built 124 houses in Conroe, Texas, rented them

out and then put the whole community, Amber Pines at Fosters Ridge,

on the block. A Who's Who of investors and home-rental firms

flocked to the December sale. The winning $32 million bid came from

an online property-investing platform, Fundrise LLC, which manages

more than $1 billion on behalf of about 150,000 individuals.

The country's most prolific home builder booked roughly twice

what it typically makes selling houses to the middle class -- an

encouraging debut in the business of selling entire neighborhoods

to investors.

"We certainly wouldn't expect every single-family community we

sell to sell at a 50% gross margin," the builder's finance chief,

Bill Wheat, said at a recent investor conference.

From individuals with smartphones and a few thousand dollars to

pensions and private-equity firms with billions, yield-chasing

investors are snapping up single-family houses to rent out or flip.

They are competing for houses with ordinary Americans, who are

armed with the cheapest mortgage financing ever, and driving up

home prices.

"You now have permanent capital competing with a young couple

trying to buy a house," said John Burns, whose eponymous real

estate consulting firm estimates that in many of the nation's top

markets, roughly one in every five houses sold is bought by someone

who never moves in. "That's going to make U.S. housing permanently

more expensive," he said.

The consulting firm found Houston to be a favorite haunt of

investors who have lately accounted for 24% of home purchases

there. Investors' slice of the housing market grows -- as it does

in other boomtowns, such as Miami, Phoenix and Las Vegas -- among

properties priced below $300,000 and in decent school

districts.

"Limited housing supply, low rates, a global reach for yield,

and what we're calling the institutionalization of real-estate

investors has set the stage for another speculative investor-driven

home price bubble," the firm concluded.

The bubble has room to grow before it bursts, according to John

Burns Real Estate Consulting. But it is inflating fast. The firm

expects home prices to climb 12% this year -- on top of last year's

11% rise -- and increase at least 6% in 2022, a period of

appreciation reminiscent of 2004 and 2005.

That boom was different, fueled by loose lending that enabled

individuals to speculate on home prices by racking up mortgages

they could repay only if home prices kept climbing. The money party

ended a few years later when home prices stopped rising. The

ensuing crash wiped out $11 trillion in U.S. household wealth and

brought the global financial system to the brink of collapse.

Financiers stepped in starting in 2011 and gobbled up foreclosed

homes at steep discounts. They dispatched buyers to courthouse

auctions with duffel bags of cash. Smartphones and tablet computers

-- new then -- enabled them to orchestrate the land grab and manage

tens of thousands of far-flung properties thereafter.

They dominated the market for a few years, accounting for about

a third of sales in some markets and setting a floor for falling

prices. There wasn't much competition. Stung by losses, banks made

it harder for regular home buyers to get a mortgage. Millions of

Americans were underwater, owing more on their mortgages than their

homes were worth, and unable to move.

Home-rental firms, including Invitation Homes Inc. and American

Homes 4 Rent, thrived. Renting suburban homes proved so profitable

that landlords hit the open market and added properties at full

price once foreclosures dried up. Many now build houses explicitly

to rent.

The coronavirus pandemic sparked a race for home-office space

and yards. Occupancy rates reached records and rents are rising

with home prices. The ecosystem of companies that service, finance

and mimic the mega landlords is booming.

Burns counted more than 200 companies and investment firms in

the house hunt: computer-assisted flipper Opendoor Technologies

Inc., money managers including J.P. Morgan Asset Management and

BlackRock Inc., platforms such as Fundrise and Roofstock that buy

and arrange for the management of rentals on behalf of individuals

and builder LGI Homes Inc., which now reports wholesale home sales

to bulk buyers in its quarterly results.

Spring brought a fresh stampede of buyers.

PCCP LLC, which typically invests in apartment buildings and

office towers, said it bought rental-home communities in the

Southeast, the start of a $1 billion pact with Calstrs,

California's $286.9 billion teachers' retirement system.

Home builder Lennar Corp. announced a rental venture with

investment firms including Centerbridge Partners LP and Allianz SE

to which it and potentially other builders will supply more than $4

billion of houses.

Madison Realty Capital moved into rentals with clients that used

to focus on developing apartment buildings and owner-occupied

subdivisions. On Thursday, it closed a $110 million loan on a

project in Los Angeles, where 220 of the nearly 700 home sites are

being sold to investors. The original plans, derailed by the

housing crash, didn't envision any rentals.

"A lot of things that would have been for-sale housing are going

to be for-rent housing," said Josh Zegen, Madison's managing

principal.

Bruce McNeilage began building houses to rent out around

Nashville, Tenn., in 2005. After the housing crash, his Kinloch

Partners expanded into other Southeastern markets, flipping

occupied rentals to bigger investors.

Kinloch was financed mostly by community banks in the cities

where it rehabbed foreclosures and built rentals. These days

Kinloch can borrow far more from Walker & Dunlop Inc., a

commercial real estate lender forging into suburban rentals. Mr.

McNeilage's problem is that others are bidding up houses and

lots.

"I am boxed out," he said. "There's too many people chasing

things and they're willing to overpay. It's silly money right

now."

Write to Ryan Dezember at ryan.dezember@wsj.com

(END) Dow Jones Newswires

April 04, 2021 10:14 ET (14:14 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

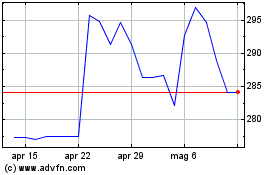

Grafico Azioni Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Storico

Da Gen 2024 a Gen 2025