IQST - iQSTEL Signs $10M Term Sheet with LDA Capital to Back Nasdaq Uplist Plan

13 Settembre 2023 - 4:03PM

InvestorsHub NewsWire

NEW YORK, NY -- September 13, 2023 -- InvestorsHub NewsWire

-- iQSTEL Inc. (OTC-QX:

IQST) today announced executing a term sheet with LDA

Capital for $10 million as part of iQSTEL’s plan to uplist onto the

Nasdaq Stock Market. iQSTEL is a high growth, enhanced

telecommunications company making ubiquitous access to

communications, news and general information, access to financial

services and clean mobility available to all regardless of race,

ethnicity, religion, socioeconomic status, or identity. The company

reported $93.2 million in revenue last year and is on

track to meet or exceed its $120

million 2023 revenue forecast.

LDA Capital is an alternative investment group

with expertise in complex, cross border transactions. The firm is

led by an energetic, collaborative core leadership team with a

proven track record that includes over 250 transactions in both

private and public markets. In conjunction with a new

partnership, LDA Capital recently launched a $2

billion fund to make regionally specific investments in

publicly listed and pre-IPO high-growth companies

(Forbes).

The term sheet is not binding on the parties and the investment

may only occur upon the execution of definitive documents, and

there is no guarantee that this will happen. As stated in the term

sheet, the $10 million investment is expected in two

tranches. In advance of a Nasdaq uplisting, the first $5

million is expected to be placed in exchange for a 24 month

bond. iQSTEL plans to utilize the $5 million to

expand its core telecommunications business by completing an

acquisition that is expected to add disruptive innovation and

positive financial fundamentals, to include revenue with positive

net income. The second $5 million is expected to be

placed in exchange for a second $5 million bond available

following a successful uplisting to Nasdaq.

Management believes the company is currently undervalued and

that the partnership with LDA Capital may bring new market wide

visibility that in turn has the potential to elevate iQSTEL's

market cap to be more in line with the company's underlying

value. If the investment is realized and an acquisition is

accomplished, iQSTEL management believes that its share price has

the potential to organically achieve the minimum price necessary to

uplist to Nasdaq.

"We greatly appreciate the confidence LDA Capital has shown for

iQSTEL's track record, management team, and business plan,"

said Leandro Iglesias, CEO of iQSTEL. "LDA Capital has an

impressive history of successful investments that demonstrate

extensive experience with international growth businesses. iQSTEL

management believes the caliber of the investment team is far more

important than the funds alone. We believe we could not ask

for a better fit for iQSTEL's investment needs than LDA

Capital. Together we are setting the table for a Nasdaq

uplisting."

iQSTEL and LDA Capital are beginning a 30 day due diligence

engagement as the first step toward an anticipated definitive

investment agreement. iQSTEL has agreed not to solicit any

competing offers during the due diligence period.

This press release does not constitute an offer of any

securities for sale.

About IQSTEL:

iQSTEL Inc. (OTC-QX: IQST) (www.iQSTEL.com) is a US-based, multinational publicly

listed company preparing for a Nasdaq up-listing with an

FY2023 $120 million revenue forecast. iQSTEL's mission is

to serve basic human needs in today's modern world by making the

necessary tools accessible regardless of race, ethnicity, religion,

socioeconomic status, or identity. iQSTEL recognizes that in

today's modern world, the pursuit of the human hierarchy of needs

(physiological, safety, relationship, esteem and

self-actualization) is marginalized without access to ubiquitous

communications, the freedom of virtual banking, clean affordable

mobility and information and content. iQSTEL has 4 Business

Divisions delivering accessibly to the necessary tools in today's

pursuit of basic human needs: Telecommunications, Fintech, Electric

Vehicles and Metaverse.

- The Enhanced Telecommunications Services Division

(Communications) includes VoIP, SMS, International

Fiber-Optic, Proprietary Internet of Things (IoT), and a

Proprietary Mobile Portability Blockchain Platform.

- The Fintech Division (Financial Freedom) includes

remittances services, top up services, Master Card Debit Card, a US

Bank Account (No SSN required), and a Mobile App.

- The Electric Vehicles (EV) Division (Mobility) offers Electric

Motorcycles and plans to launch a Mid Speed Cars.

- The Artificial Intelligence (AI)-Enhanced Metaverse

Division (information and content) includes an enriched and

immersive white label proprietary AI-Enhanced Metaverse platform to

access products, services, content, entertainment, information,

customer support, and more in a virtual 3D interface.

The company continues to grow and expand its suite of products

and services both organically and through mergers and

acquisitions. iQSTEL has completed 10 acquisitions

since June 2018 and continues to develop an active

pipeline of potential future acquisitions.

Safe Harbor Statement: Statements in this news release may be

"forward-looking statements". Forward-looking statements include,

but are not limited to, statements that express our intentions,

beliefs, expectations, strategies, predictions, or any other

information relating to our future activities or other future

events or conditions. These statements are based on current

expectations, estimates, and projections about our business based

partly on assumptions made by management. These statements are not

guarantees of future performance and involve risks, uncertainties,

and assumptions that are difficult to predict. Therefore, actual

outcomes and results may and are likely to differ materially from

what is expressed or forecasted in forward-looking statements due

to numerous factors. Any forward-looking statements speak only as

of the date of this news release, and iQSTEL Inc. undertakes no

obligation to update any forward-looking statement to reflect

events or circumstances after the date of this news release. This

press release does not constitute a public offer of any securities

for sale. Any securities offered privately will not be or have not

been registered under the Act and may not be offered or sold

in the United States absent registration or an applicable

exemption from registration requirements.

iQSTEL Inc.

IR US Phone: 646-740-0907

IR Email: investors@iqstel.com

Contact Details

iQSTEL Inc.

+1 646-740-0907

investors@iqstel.com

Company Website

www.iqstel.com

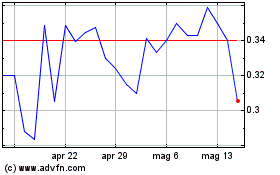

Grafico Azioni iQSTEL (QX) (USOTC:IQST)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni iQSTEL (QX) (USOTC:IQST)

Storico

Da Nov 2023 a Nov 2024