SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities

Exchange Act of 1934 (Amendment No. )

Filed by

the Registrant ☒

Filed by

a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

|

Preliminary Proxy Statement |

| ☐ |

|

Confidential, for the use of the Commission only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

|

Definitive Proxy Statement |

| ☐ |

|

Definitive Additional Materials |

| ☐ |

|

Soliciting Material Pursuant to §240.14a-12 |

iQSTEL INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ |

|

No fee required. |

| ☐ |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

|

(1) |

|

Title of each class of securities to which transaction applies: |

| |

|

|

|

|

| |

|

(2) |

|

Aggregate number of securities to which transaction applies: |

| |

|

|

|

|

| |

|

(3) |

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| |

|

|

|

|

| |

|

(4) |

|

Proposed maximum aggregate value of transaction: |

| |

|

|

|

|

| |

|

(5) |

|

Total fee paid: |

| |

|

|

|

|

| ☐ |

|

Fee paid previously with preliminary materials. |

| ☐ |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-1l (a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

|

(1) |

|

Amount Previously Paid: |

| |

|

|

|

|

| |

|

(2) |

|

Form, Schedule or Registration Statement No.: |

| |

|

|

|

|

| |

|

(3) |

|

Filing Party: |

| |

|

|

|

|

| |

|

(4) |

|

Date Filed: |

| |

|

|

|

|

Notice of Annual Meeting of Stockholders

| |

Date and Time

Tuesday, January 31, 2024 at 10:00 a.m. (EDT)

|

YOUR

VOTE IS IMPORTANT |

|

| |

Meeting Access |

|

|

| |

|

Wether or not you attend

the meeting, we urge you to vote promptly by: |

|

| |

Live

Webcast: |

|

|

| |

www.virtualshareholdermeeting.com/IQST2024 |

visiting

www.iqstel.com/proxyvote visiting

www.iqstel.com/proxyvote |

|

| |

|

|

|

| |

Record Date |

Mailing

your signed proxy card or voting instructions form Mailing

your signed proxy card or voting instructions form |

|

| |

December 22, 2023 |

|

|

| |

|

|

|

Items of Business

• Proposal

1: Election of five directors, as described in the accompanying proxy statement.

• Proposal

2: Ratification of Urish Popeck & Co., LLC as the company’s independent registered public accounting firm for the 2023 fiscal

year.

• Consideration

of any other business properly brought before the annual meeting.

The annual meeting will be a virtual meeting conducted via live

webcast. The annual meeting format will be a live audio webcast where you can view presentation materials made available online.

There will be no physical in-person meeting. Additional information regarding attending the annual meeting, voting your shares

and submitting questions in advance of the annual meeting can be found in the proxy statement.

Eligibility to Vote

Only stockholders of record as of the close of business on December

22, 2023 are entitled to notice of and to vote at the annual meeting and any postponements or adjournments thereof.

This Notice of Annual Meeting of Stockholders, the proxy statement,

form of proxy and the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 are being distributed

and made available to our stockholders on or about January 5, 2024.

Your vote is important. Whether or not you attend the meeting,

we urge you to vote promptly.

| |

|

By Order of the Board of Directors |

| |

|

|

| |

|

/s/ Leandro Iglesias |

| |

|

Leandro Iglesias |

| Coral Gables |

|

Chairperson |

| December 28, 2023 |

|

|

This Notice of Annual Meeting of Stockholders, the proxy statement

and the Company’s Annual Report on Form 10-K for the year ended December 31, 2022 are available at www.iqstel.com/investors/shareholdersmeeting.

TABLE OF CONTENTS

PROXY STATEMENT SUMMARY

This summary highlights information contained elsewhere in this proxy

statement. It does not contain all of the information you should consider, and you should read the entire proxy statement carefully before

voting. References in this proxy statement to the “Company,” “iQSTEL,” “we,” “us,” and

“our” refer to iQSTEL Inc., a Nevada company. This proxy statement, form of proxy and the Company’s Annual Report on

Form 10-K for the year ended December 31, 2022 are being distributed and made available to our stockholders on or about January

5, 2024. Our principal executive offices are located at 300 Aragon Avenue, Suite 375, Coral Gables, FL 33134.

Annual Meeting Information

| Date and Time: |

Wednesday, January 31, 2024 at 10:00 a.m., Eastern Daylight Time |

| Meeting Access: |

Live Webcast: www.virtualshareholdermeeting.com/IQST2024 |

| Record Date: |

December 22, 2023 |

| Voting: |

Common stockholders have one vote per share on all matters presented

at the annual meeting.

Series A Preferred stockholders are entitled to vote together with

the holders of our common stockholders on all matters submitted to stockholders at a rate of 51% of the total vote of stockholders.

|

The

annual meeting will be a virtual meeting conducted via live webcast. You will be able to attend the annual meeting and vote your shares

electronically during the meeting by visiting www.virtualshareholdermeeting.com/IQST2024.

The annual meeting format will be a live audio webcast where you can view presentation materials made available online. There will be

no physical in-person meeting. You may submit questions in advance of the meeting by sending an email to investors@iqstel.com.

You can submit a question up to 11:59 p.m. EDT on January 30, 2024. Please see “Questions and Answers About the Annual Meeting”

for more information regarding the annual meeting.

Even if you plan to attend the virtual annual meeting, please

vote in advance so that your vote will be counted if you later decide not to attend the virtual annual meeting.

Voting Matters and the Board’s Recommendation

| Agenda Item |

Board Vote Recommendation |

Page

Reference |

| Election of five directors |

FOR each Director Nominee |

8 |

| Ratification of Urish Popeck & Co., LLC as the company’s independent registered public accounting firm for the 2023 fiscal year |

FOR |

18 |

In addition to these matters, stockholders may be asked to vote on

such other business as may properly come before the annual meeting.

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING

Why did I receive these proxy materials?

This proxy statement, form of proxy and the Company’s Annual

Report on Form 10-K for the year ended December 31, 2022 are being distributed and made available to our stockholders starting

on or about January 5, 2024. We are providing these proxy materials in connection with the solicitation by the Board of proxies to be

voted at our 2023 Annual Meeting of Stockholders and at any adjournment or postponement of the meeting.

When and where will the annual meeting be held?

| Date |

Wednesday, January 31, 2024 |

| Time |

10:00 a.m. (EDT) |

| Location |

Live Webcast at: www.virtualshareholdermeeting.com/IQST2024 |

Who is entitled to vote at the annual meeting?

Holders of the company’s common stock and Series A Preferred

Stock at the close of business on December 22, 2023, are entitled to receive the Notice of Annual Meeting and proxy statement and to vote

their shares at the annual meeting. As of that date, there were 171,529,630 shares of the Company’s common stock outstanding

and entitled to vote. Each share of common stock is entitled to one vote on each matter properly brought before the annual meeting. Also

on the record date, there were 10,000 shares of the Company’s Series A Preferred Stock outstanding and entitled to vote. Holders

of Series A Preferred Stock are entitled to vote together with the holders of our common stock on all matters submitted to stockholders

at a rate of 51% of the total vote of stockholders.

What constitutes a quorum for the annual meeting?

The holders of at least a majority of the voting power of the Company’s

capital stock, present in person or by proxy (regardless of whether the proxy has authority to vote on any matter), shall constitute a

quorum. Abstentions and broker non-votes are counted for purposes determining whether there is a quorum.

How can I attend and participate in the annual meeting?

To

attend and participate in the annual meeting, visit www.virtualshareholdermeeting.com/IQST2024.

The virtual annual meeting will begin promptly at 10:00 a.m. (EDT) on Wednesday, January 31, 2024. You may log in beginning

at 9:50 a.m. (EDT).

We encourage you to access the virtual annual meeting prior

to the start time leaving ample time to confirm that your Internet or Wi-Fi connection is sufficient to access the features of the

virtual annual meeting, and to allow sufficient time to check in. The virtual meeting platform is supported across browsers

(Edge, Internet Explorer, Firefox, Chrome, and Safari) and devices (desktops, laptops, tablets, and mobile phones) that have the

most updated version of applicable software and plugins installed. You should ensure that you have a strong Wi-Fi connection wherever

you intend to participate in the annual meeting. While there is no fee to attend the virtual annual meeting, you may incur data or other

fees imposed by your Internet or wireless carrier.

The recording, reproduction or distribution of the virtual annual

meeting, or any portion thereof, is strictly prohibited.

What if I am having technical difficulties?

Technicians will be ready to assist you with any technical difficulties

you may have accessing the virtual annual meeting. Technical support will be available on the virtual annual meeting platform beginning

at 9:30 a.m. (EDT) on the day of the annual meeting by calling the numbers posted on the log in page.

How do I submit a question for the annual meeting?

You may submit questions in advance of the meeting by sending an email

to investors@iqstel.com. You can submit a question up to 11:59 p.m. EDT on January 30, 2024.

How do I vote if I am a stockholder of record?

How do I vote if I am a beneficial owner of shares?

If you are a “beneficial owner,” also known as a “street

name” holder (meaning that you hold your shares of our common stock through a broker, bank or other financial institution), your

broker, bank or financial institution will ask you how you wish to have your shares voted. In addition, you will receive instructions

as part of your proxy materials provided by your broker, bank or other financial institution on how to access the virtual annual meeting

and participate and vote at the annual meeting (including, if your broker, bank or other financial institution elects to do so, instructions

on how to vote via telephone or the Internet). You must follow those instructions in order to be able to access the virtual annual meeting

and have your shares voted. You may also be able to obtain a proxy from your broker, bank or other financial institution by contacting

them directly. Your broker is not permitted to vote on your behalf on the election of directors and other matters to be considered at

the annual meeting (except on the ratification of the appointment of Urish Popeck & Co., LLC as auditors for 2023) unless you provide

specific instructions. Accordingly, your shares will only be voted if you give instructions to your broker, bank or financial institution.

Can I revoke my proxy or change my vote after I vote by proxy?

If you are a stockholder of record, you can revoke your proxy before

it is exercised by:

• giving

written notice to our Corporate Secretary;

• delivering

a valid, later-dated proxy, or a later-dated vote by email (investors@iqstel.com), in a timely manner; or

• voting during the live webcast of

the annual meeting

If you are a beneficial owner of shares, you may submit new voting

instructions by contacting your broker, bank or other holder of record and following their instructions for how to do so.

What vote is needed to approve each proposal? How do abstentions

or broker non-votes affect the voting results?

The following table summarizes the vote threshold required for approval

of each proposal and the effect on the outcome of the vote of abstentions and uninstructed shares held by brokers (referred to as

broker non-votes). When a beneficial owner does not provide voting instructions to the institution that holds the shares in street name,

brokers may not vote those shares in matters deemed non-routine. Only Proposal 2 is a routine matter.

| PROPOSAL |

ITEM |

VOTE REQUIRED FOR APPROVAL |

EFFECT OF ABSTENTIONS (OR THE WITHHOLDING OF AUTHORITY) |

EFFECT OF BROKER

NON-VOTES |

| 1 |

Election of five directors |

Plurality—the five director nominees who receive the most “FOR” votes will be elected to serve on the Board |

No effect |

No effect |

| 2 |

Ratification of the appointment of independent auditor |

Number of votes cast in favor exceeds number of votes cast in opposition |

No effect |

No broker non-votes; shares are voted by brokers in their discretion |

Your shares will be voted in accordance with your instructions. If

you are a stockholder of record and sign, date and return a proxy card but do not indicate how you wish to vote your shares, the appointed

proxies named on the proxy card will vote your shares “for” each of the nominees with respect to Proposal 1 and “for”

Proposal 2, and in the discretion of the appointed proxies named on the proxy card with respect to any other business properly brought

before the annual meeting.

Who will pay for the cost of this proxy solicitation?

We will pay all expenses incurred in connection with the solicitation

of proxies. In addition to solicitation by mail, our officers, directors and regular employees, who will receive no additional compensation

for their services, may solicit proxies in person or by telephone, facsimile, email or the Internet. We have requested that brokers, banks

and other nominees who hold stock in their names furnish this proxy material to their customers; we will reimburse these brokers, banks

and nominees for their out-of-pocket and reasonable expenses.

Could other matters be decided at the annual meeting?

We are not aware of any other matters that will be presented and voted

upon at the annual meeting. If you return your signed and completed proxy card or vote by telephone or on the Internet and other matters

are properly presented at the annual meeting for consideration, the persons named in the accompanying proxy card will have the discretion

to vote for you on such matters and intend to vote the proxies in accordance with their best judgment.

PROPOSAL NO. 1

ELECTION OF DIRECTORS

Our bylaws provide that our business shall be managed by or under

the direction of a board of directors. The Board currently consists of five directors.

There are five nominees for election to the Board at the annual meeting.

Each of the five nominees, if elected, will hold office for a term that expires at the next annual stockholders’ meeting. Each director

shall hold office for the term for which he or she was elected and until his or her successor is elected and qualified or until his or

her earlier death, resignation, or removal. Proxies solicited by the Board will, unless otherwise directed, be voted to elect the five

nominees named below to constitute the entire Board.

The Board has nominated each of the following individuals for election

as a director at the annual meeting: Leandro Iglesias, Alvaro Quintana Cardona, Italo Segnini, Raul Perez and Jose Antonio Barreto. Each

nomination for director was based upon the recommendation of our board of directors and each nominee for director is a current member

of the board. All nominees have consented to be named and have indicated their intent to serve if elected. In the event any of the nominees

shall be unable or unwilling to serve as a director, the persons named in the proxy intend to vote “FOR” the election of any

person as may be nominated by the board in substitution. The Company has no reason to believe that any of the nominees named below will

be unable to serve as a director if elected.

The following table sets forth certain information, as of the date

of this proxy statement, as to each nominee for the office of director:

| Name |

|

Age |

|

Position |

|

Director Since |

| Leandro Iglesias |

|

58 |

|

President, Chairman, Chief Executive Officer and Director |

|

06/28/2018 |

| Alvaro Quintana Cardona |

|

52 |

|

Chief Operating Officer, Chief Financial Officer and Director |

|

06/28/2018 |

| Italo Segnini |

|

58 |

|

Director |

|

06/28/2021 |

| Raul Perez |

|

72 |

|

Director |

|

06/28/2021 |

| Jose Antonio Barreto |

|

65 |

|

Director |

|

06/28/2021 |

The following information about our directors is based, in part, upon

information supplied by them.

Leandro Iglesias

Before founding Etelix in year 2008, where he has

acted as President and CEO, Mr. Iglesias was the International Business Manager at CANTV/Movilnet (the Venezuelan biggest telecommunications

services provider). He held this position between January 2003 and July 2008, while the company was under the control of Verizon. Previous

to his position in Cantv/Movilnet Mr. Iglesias was Executive Vice President and responsible of the Latin America marketing division of

American Internet Communications (August 1998 – December 2002). Leandro Iglesias has developed a career for more than 20 years in

the telecommunications industry with a particular emphasis in the international long-distance traffic business, submarine cables, satellite

communications and international roaming services. He is Electronic Engineer graduate from Universidad Simon Bolivar and graduated from

the Management Program at IESA Business School. He also holds an MBA from Universidad Nororiental Gran Mariscal de Ayacucho.

Aside from that provided above, Mr. Iglesias does

not hold and has not held over the past five years any other directorships in any company with a class of securities registered pursuant

to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an

investment company under the Investment Company Act of 1940.

We believe that Mr. Iglesias is qualified to serve

on our Board of Directors because of his wealth of experience in the telecom industry.

Alvaro Quintana Cardona

Alvaro Quintana has developed a career of more

than twenty years of experience in the telecommunication industry with particular focus on regulatory affairs, strategic planning, value

added services and international interconnection agreements. Before joining Etelix in year 2013 as Chief Operation Officer and Chief Financial

Officer, Mr. Quintana acted between June 2004 and May 2013 as Interconnection and Value-Added Services Manager at Digitel (a mobile service

provider in Venezuela, formerly a Telecom Italia Mobile subsidiary). He holds a Bachelor Degree in Business Administration and a Specialist

Degree in Economics, both from the Universidad Catolica Andres Bello. He also holds a Master in Telecommunications from the EOI Business

School in Spain.

Aside from that provided above, Mr. Cardona does

not hold and has not held over the past five years any other directorships in any company with a class of securities registered pursuant

to Section 12 of the Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an

investment company under the Investment Company Act of 1940.

We believe that Mr. Quintana is qualified to serve

on our Board of Directors because of his wealth of experience in the telecom industry.

Italo R. Segnini

From March 2020 to the present,

Mr. Segnini has been serving as Global Carrier Partnership Director of Sierra Wireless. From June 2019 to February 2020, he served as

an Independent Telecom Consultant. From 2017 to 2019, he served as Director of International Carrier Business for Televisa Telecom. From

2012 to 2019, he served as Director International Carrier Business for Millicom.

Mr. Segnini is a long time Telecommunicaction industry

professional who has had high level positions at Global Tier Ones for more than 20 years, Telefonica, Millicon and Televisa, Sierra Wireless

to mention a few. Mr. Segnini has extensive executive experience in the Telecom areas like Voice, A2P, SMS, Data, Roaming, Mobility Services,

B2B, MNO, MVNO, IoT, Interconnection, etc., and a solid business performance record spanning multiple functions including International

commercial negotiations, management, sales, business development, sales, regulatory and operations. Italo R. Segnini holds a Juris Doctor

degree from the Andres Bello Catholic University, a Telecommunication Masters Degree from Madrid Pontificia Comillas University and an

MBA from IESA Business School.

Raul A Perez

From December 1, 2014 to present, Mr. Perez serves

as CFO of Deerbrook Family Dentistry, PC, Dental Practice in Humble, Texas. From November 1, 2017 to January 31, 2019, he served as Senior

Accountant to Principrin School, PC, Day Care in Houston, Texas.

Mr. Perez has been in finance for more than 40

years, starting in 1970 as analyst in treasury and finance departments and progressively assuming different positions up to corporate

treasurer for large corporations. He served for Sudamtex of Venezuela, C.A for 5 years and Polar Brewery in Caracas, Venezuela for 10

year. Beginning in 2000, he accepted a position as a Director of the Security and Exchange Commission of Venezuela to have the surveillance

of Venezuelan stock market participants. Also, in 2004 he completed the requirements and received his certification as a Venezuelan Investment

Advisor. Later, as an independent contractor for three years, he was selected as the Corporate Compliance Officer for an especially important

stock market broker dealer in Venezuela, Activalores Casa de Bolsa, in which he developed the Compliance Unit and manuals required by

local and international anti money laundering laws. He also taught Advanced Institute of Finance (IAF) in Caracas being a professor of

Corporate Finance and Managerial Accounting for 5 years.

Mr. Perez has a Bachelor’s degree in accounting

(1976), and MBA Finance (1982), gave me the overall knowledge of finance and how to plan, start up, run, and control a business.

We have selected Mr. Perez to serve as an independent

director because of his education, skills and experience in finance and his regulatory history.

Jose Antonio Barreto

From 2006 to the present,

Mr. Barreto has been Chief Business Development Officer of Xpectra Remote Management / Mexico. There he was in charge of directing all

aspects of account development and sales effort to close specific private and government opportunities and developing strategic accounts

in Mexico and the LATAM region. From 2020 to present, he has been an advisor to our Board of Directors.

Mr. Barreto has more than

30 years of experience working in telecommunications and technology companies. He has been directly responsible of leading the business

development and operational in several telecommunication and technology companies’ acquisition activity, with the responsibility

of leading the technical, operation and financial analysis. Over the last 14 years, Jose Antonio has been the North and Central American

leader, spanning from Mexico to Panama, in the development of commercial processes in the technology security field, artificial intelligence,

Internet of Things (IoT) platforms, as well as cutting edge technology solutions and software systems.

He studied Electronic Engineering

at the Universidad Simón Bolivar followed by a Master of Science Degree in Electrical and Computer Engineering at Rice University.

He also completed the Master in Telecommunications Management offered by Universidad Simon Bolivar and the Telecom SudParis Institute.

We have selected Mr. Barreto to serve as an independent

director because of his education, skills and experience in technology companies.

THE BOARD RECOMMENDS A VOTE “FOR”

EACH OF THE NOMINEES.

CORPORATE GOVERNANCE

Family Relationships

There are no family relationships between or

among the directors, executive officers or persons nominated or chosen by us to become directors or executive officers.

Arrangements between Officers and Directors

To our knowledge, there is no arrangement or

understanding between any of our officers and any other person, including directors, pursuant to which the officer was selected to serve

as an officer.

Involvement in Certain Legal Proceedings

We are not aware of any of our directors or officers

being involved in any legal proceedings in the past ten years relating to any matters in bankruptcy, insolvency, criminal proceedings

(other than traffic and other minor offenses), or being subject to any of the items set forth under Item 401(f) of Regulation S-K.

Board Meetings

The board met on 12 occasions during the fiscal

year ended December 31, 2022. Each of the members of the board attended at least 75% of the meetings held by the board during the

time such directors served as a member of the board.

Although we do not have a formal policy regarding

attendance by members of our board of directors at annual meetings of stockholders, we strongly encourage our directors to attend.

Committees of the Board

Our full board serves the functions that would normally

be served by a separately-designated nominating committee. Each of Messrs. Perez, Barreto and Segnini have been determined by the Board

to be an independent director within the meaning of NASDAQ Rule 5605.

Our company has an Audit Committee with a financial

expert on the Committee. The committee is comprised of Messrs., Barreto and Segnini, with Perez as Chairperson. The Audit Committee’s

responsibilities, which are discussed in detail in its Charter, include the following:

| • | Be directly responsible for the appointment, compensation,

retention and oversight of the work of the Company’s independent auditors; |

| • | Pre-approve all audit and permitted non-audit services to

be provided by the independent auditors; |

| • | Discuss with management and the independent auditors significant

financial reporting issues and judgments made in connection with the preparation of the Company’s financial statements; |

| • | Review with the independent auditors the matters required

to be discussed by the applicable auditing standards adopted by the PCAOB and approved by the SEC from time to time; |

| • | Review and discuss the Company’s annual and quarterly

financial statements with management and the independent auditors; |

| • | Review and discuss with management the Company’s earnings

press releases; |

| • | Discuss Company policies and practices with respect to risk

assessment and risk management; |

| • | Establish procedures for (i) the receipt, retention and treatment

of complaints received by the Company regarding accounting, internal accounting controls or auditing matters, and (ii) the confidential,

anonymous submission by Company employees of concerns regarding questionable accounting or auditing matters; and |

| • | Review related party transactions |

On November 17, 2022, we authorized the creation of

a Compensation Committee. The Compensation Committee’s responsibilities, which are discussed in detail in its Charter, include the

following:

| • | In consultation with our senior management, establish our

general compensation philosophy and oversee the development and implementation of our compensation programs; |

| • | Recommend the base salary, incentive compensation and any

other compensation for our Chief Executive Officer to the Board of Directors and review and approve the Chief Executive Officer’s

recommendations for the compensation of all other officers of our company and its subsidiary; |

| • | Administer our incentive and stock-based compensation plans,

and discharge the duties imposed on the Compensation Committee by the terms of those plans; |

| • | Review and approve any severance or termination payments

proposed to be made to any current or former officer of our company; and |

| • | Perform other functions or duties deemed appropriate by the

Board of Directors. |

The Committee is comprised of, Raul Perez, Jose Antonio

Barreto, and Italo Segnini, with Mr. Segnini serving as Chairperson.

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16(a) of the Exchange Act requires our directors

and executive officers and persons who beneficially own more than ten percent of a registered class of the Company’s equity securities

to file with the SEC initial reports of ownership and reports of changes in ownership of common stock and other equity securities of the

Company. Officers, directors and greater than ten percent beneficial stockholders are required by SEC regulations to furnish us with copies

of all Section 16(a) forms they file. To the best of our knowledge based solely on a review of Forms 3, 4, and 5 (and any amendments thereof)

received by us, no persons have failed to file, on a timely basis, the identified reports required by Section 16(a) of the Exchange Act

during fiscal year ended December 31, 2022.

Code of Ethics

On October 31, 2022, our Board of Directors approved and adopted a

Code of Business Conduct and Ethics (the “Code of Ethics”). The Code of Ethics is applicable to all directors, officers and

employees of our company, our company’s subsidiaries and any subsidiaries that may be formed in the future. The Code of Ethics addresses

such individuals’ conduct with respect to, among other things, conflicts of interests; compliance with applicable laws, rules, and

regulations; full, fair, accurate, timely, and understandable disclosure; competition and fair dealing; corporate opportunities; confidentiality;

insider trading; protection and proper use of our assets; fair treatment; and reporting suspected illegal or unethical behavior.

DIRECTOR COMPENSATION

All Directors shall receive reimbursement for reasonable

travel expenses incurred to attend Board and committee meetings.

Effective on July 1, 2021 and thereafter, all Directors

shall be compensated monthly up to 4,000 shares of common stock cash of $1,000 for their service as Directors. The Chairman and Secretary

of the Board shall receive an additional $2,000 per month in addition to the Director compensation.

In lieu of the cash compensation set forth above,

each Director may elect to receive shares of the Corporation's Common Stock equal to the total cash compensation divided by the average

market value of the Company's Common Stock during the last 10 trading days and applying a discount of 25%.

EXECUTIVE OFFICERS

The following information sets forth, as of the date of this proxy

statement, the names, ages, and positions of our current executive officers.

| Name |

|

Age |

|

Positions and Offices Held |

| Leandro Iglesias |

|

58 |

|

President, Chairman, Chief Executive Officer and Director |

| Alvaro Quintana Cardona |

|

52 |

|

Chief Operating Officer, Chief Financial Officer and Director |

| Juan Carlos Lopez Silva |

|

55 |

|

Chief Commercial Officer |

The following information about Juan Carlos Lopez Silva is based,

in part, upon information supplied by him. Information about Messrs. Iglesias and Cardona are included above.

Juan Carlos Lopez Silva

Juan Carlos Lopez Silva is an Engineer graduated

from Universidad de Los Andes, with a Master degree in Project Management from the Pontificia Universidad Javeriana; and MBA from EADA

Business School; with more than 20 years of experience in project management, negotiation, business development and management on international

companies. Previous to joining Etelix in August 2011 as Chief Commercial Officer, Juan Carlos was International Carrier Relations Manager

at Colombia Telecomunicaciones S.A. Esp. a subsidiary of Telefonica of Spain, between September 2003 and June 2011.

Aside from that provided above, Mr. Silva does not hold and has not

held over the past five years any other directorships in any company with a class of securities registered pursuant to Section 12 of the

Exchange Act or subject to the requirements of Section 15(d) of the Exchange Act or any company registered as an investment company under

the Investment Company Act of 1940.

See “Proposal No. 1 Election of Directors” for a

description of the backgrounds and business experience of Leandro Iglesias and Alvaro Quintana Cardona.

EXECUTIVE COMPENSATION

The table below summarizes all compensation awarded

to, earned by, or paid to our former or current executive officers for the fiscal years ended December 31, 2022 and 2021.

|

Name and principal

Position |

Year |

Salary ($) |

Bonus

($) |

Stock

Awards

($) |

Option

Awards

($) |

All Other

Compensation

($) (1)(2) |

Total

($) |

|

Leandro Iglesias

President, CEO and Director |

2022

2021 |

204,000

174,000 |

-

419,024 |

-

- |

-

- |

-

- |

204,000

593,024 |

|

Alvaro Quintana

Treasury, Secretary and Director |

2022

2021 |

144,000

159,088 |

-

337,674 |

-

- |

-

- |

-

- |

144,000

496,762 |

|

Juan Carlos López

Chief Commercial Officer |

2022

2021 |

120,000

80,000 |

-

244,050 |

-

- |

-

- |

-

- |

120,000

324,050 |

On May 2, 2019, the Company entered into Employment

Agreements with the following persons: (i) Leandro Iglesias as President, CEO and Chairperson of the Company’s Board of Directors

with an annual salary of $168,000 with an annual bonus of 3% of our net income; (ii) Juan Carlos Lopez Silva as Chief Commercial Officer

with an annual salary of $120,000 with an annual bonus of 3% of our net income; and

Alvaro Quintana Cardona as Chief Operating Officer

and Chief Financial Officer with an annual salary of $144,000 with an annual bonus of 3% of our net income. The Employment Agreements

have a term of 36 months, are renewable automatically for 24-month periods, unless the Company gives written notice at least 90 days prior

to termination of the initial 36-month term. The Company shall have the right to terminate any of the employment agreements at any time

without prior notice, but in that event, the Company shall pay these persons salaries and other benefits they are entitled to receive

under their respective agreements for three years. The above executive officers agreed to two year non-compete and non-solicit restrictive

covenants with the Company. If any of the executive officers are terminated for cause they shall forfeit any rights to severance.

On November 1, 2020, our board of directors approved

amended employments in favor of our Chief Executive Officer, Leandro Iglesias, our Chief Financial Officer, Alvaro Quintana, and our Chief

Commercial Officer, Juan Carlos Lopez Silva.

The amended employment agreement in favor of Mr.

Iglesias extended the term of employment from 36 months to 60 months. The now five year employment agreement with Mr. Iglesias provides

that we will compensate him with a salary of $17,000 monthly and he is eligible for quarterly bonus of 250,000 shares of our common stock.

If we do not have the cash available, the agreement provides that Mr. Iglesias may convert his accrued salary/bonus into shares of our

common stock or newly created Series A Preferred Stock. For common shares, the amount of accrued salary to be converted into shares must

be determined by considering the average price per share of the Company’s common stock on the OTC Markets during the last 10 days

and applying a discount of 25%.” For Series A Preferred Shares, the amount of accrued salary to be converted into shares is the

per share conversion price for common shares multiplied by ten US Dollars ($10). Mr. Iglesias has a further right to convert any common

shares under his control into Series A Preferred shares at any time at a rate of ten (10) common shares for each Series A Preferred share.

The amended employment agreement in favor of Mr.

Quintana extended the term of employment from 36 months to 60 months. The now five year employment agreement with Mr. Quintana provides

that he is eligible for quarterly bonus of 200,000 shares of our common stock. If we do not have the cash available, the agreement provides

that Mr. Quintana may convert his accrued salary/bonus into shares of our common stock or newly created Series A Preferred Stock. For

common shares, the amount of accrued salary to be converted into shares must be determined by considering the average price per share

of the Company’s common stock on the OTC Markets during the last 10 days and applying a discount of 25%.” For Series A Preferred

Shares, the amount of accrued salary to be converted into shares is the per share conversion price for common shares multiplied by ten

US Dollars ($10). Mr. Quintana has a further right to convert any common shares under his control into Series A Preferred shares at any

time at a rate of ten (10) common shares for each Series A Preferred share.

The amended employment agreement in favor of Mr.

Silva extended the term of employment from 36 months to 60 months. Mr. Silva is eligible for quarterly bonuses of 150,000 shares of our

common stock. If we do not have the cash available, the agreement provides that Mr. Iglesias may convert his accrued salary/bonus into

shares of our common stock at the average price of our common stock during the last 10 days after applying a discount of 25%.

Option Grants

We have not granted any options or stock appreciation

rights to our named executive officers or directors since inception. We do not have any stock option plans.

Pension, Retirement or Similar Benefit Plans

There are no arrangements or plans in which we

provide pension, retirement or similar benefits to our directors or executive officers. We have no material bonus or profit sharing plans

pursuant to which cash or non-cash compensation is or may be paid to our directors or executive officers, except that stock options may

be granted at the discretion of the board of directors or a committee thereof.

Compensation Committee

The Company have a compensation committee of the

board of directors. This committee is constituted by independent members of the Board and participates in the consideration of executive

officer and director compensation.

Indebtedness of Directors, Senior Officers,

Executive Officers and Other Management

None of our directors or executive officers or

any associate or affiliate of our company during the last two fiscal years is or has been indebted to our company by way of guarantee,

support agreement, letter of credit or other similar agreement or understanding currently outstanding.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Other than described below or the transactions

described under the heading “Executive Compensation” (or with respect to which such information is omitted in accordance with

SEC regulations), there have not been, and there is not currently proposed, any transaction or series of similar transactions to which

we were or will be a participant in which the amount involved exceeded or will exceed the lesser of $120,000 or one percent of the average

of our total assets at year-end for the last two completed fiscal years, and in which any director, executive officer, holder of 5% or

more of any class of our capital stock or any member of the immediate family of any of the foregoing persons had or will have a direct

or indirect material interest.

Due from related party

During

the years ended December 31, 2022 and 2021, the Company loaned $1,000 and $220,674 to a related party and collected $700 and

$226, respectively.

As

of December 31, 2022 and 2021, the Company had due from related parties of $326,324 and $424,086, respectively. The loans are unsecured,

non-interest bearing and due on demand.

Due to related parties

During

the years ended December 31, 2022 and 2021, the Company repaid $0 and $90,787, respectively, to the CEO and CFO of the Company.

As

of December 31, 2022 and 2021, the Company had amounts due to related parties of $26,613. The amounts are unsecured, non-interest

bearing and due on demand.

Dept to Equity Swap

During the year ended December

31, 2021 the Company recorded a debt-to-equity swap to a related party of $1,647,150 as additional paid in capital.

INFORMATION REGARDING SECURITY

HOLDERS

The following table sets forth, as of December

22, 2023, certain information as to shares of our voting stock owned by (i) each person known by us to beneficially own more than 5% of

our outstanding voting stock, (ii) each of our directors, and (iii) all of our executive officers and directors as a group.

Unless otherwise indicated below, to our knowledge,

all persons listed below have sole voting and investment power with respect to their shares of voting stock, except to the extent authority

is shared by spouses under applicable law. Unless otherwise indicated below, each entity or person listed below maintains an address of 300

Aragon Avenue, Suite 375, Coral Gables, FL 33134.

The number of shares beneficially owned by each

stockholder is determined under rules promulgated by the SEC. The information is not necessarily indicative of beneficial ownership for

any other purpose. Under these rules, beneficial ownership includes any shares as to which the individual or entity has sole or shared

voting or investment power and any shares as to which the individual or entity has the right to acquire beneficial ownership within 60 days

through the exercise of any stock option, warrant or other right. The inclusion in the following table of those shares, however, does

not constitute an admission that the named stockholder is a direct or indirect beneficial owner.

| |

|

Common Stock |

| Name of Beneficial Owner |

|

Number of Shares Owned

(1) |

|

Percent of Class

(2) |

| Leandro Iglesias |

|

|

542,932 |

|

|

|

0.317 |

% |

| Alvaro Quintana Cardona |

|

|

1,121,842 |

|

|

|

0.654 |

% |

| Juan Carlos Lopez Silva |

|

|

925,497 |

|

|

|

0.539 |

% |

| Raul Perez |

|

|

8,000 |

|

|

|

0.005 |

% |

| Jose Antonio Barreto |

|

|

8,000 |

|

|

|

0.005 |

% |

| Italo Segnini |

|

|

8,000 |

|

|

|

0.005 |

% |

| All Directors and Executive Officers as a Group (6 persons) |

|

|

2,614,271 |

|

|

|

1.525 |

% |

| |

|

Series A Preferred Stock(4) |

| Name of Beneficial Owner |

|

Number of Shares Owned

(1) |

|

Percent of Class

(3) |

| Leandro Iglesias |

|

|

7,000 |

|

|

|

70.00 |

% |

| Alvaro Quintana Cardona |

|

|

3,000 |

|

|

|

30.00 |

% |

| Juan Carlos Lopez Silva |

|

|

— |

|

|

|

— |

|

| Raul Perez |

|

|

— |

|

|

|

— |

|

| Jose Antonio Barreto |

|

|

— |

|

|

|

— |

|

| Italo Segnini |

|

|

— |

|

|

|

— |

|

| All Directors and Executive Officers as a Group (6 persons) |

|

|

10,000 |

|

|

|

100.00 |

% |

| |

|

|

Total Voting Power |

|

| Name of Beneficial Owner |

|

|

Number of Votes

(5) |

|

|

|

Percent of Vote

(5) |

|

| Leandro Iglesias |

|

|

125,514,520 |

|

|

|

35.86 |

% |

| Alvaro Quintana Cardona |

|

|

54,681,094 |

|

|

|

15.62 |

% |

| Juan Carlos Lopez Silva |

|

|

925,497 |

|

|

|

* |

|

| Raul Perez |

|

|

8,000 |

|

|

|

* |

|

| Jose Antonio Barreto |

|

|

8,000 |

|

|

|

* |

|

| Italo Segnini |

|

|

8,000 |

|

|

|

* |

|

| All Directors and Executive Officers as a Group (6 persons) |

|

|

181,145,110 |

|

|

|

51.75 |

% |

| |

|

|

|

|

|

|

|

|

| * Less than 1% |

|

|

|

|

|

|

|

|

(1) Unless otherwise

indicated, each person or entity named in the table has sole voting power and investment power (or shares that power with that person’s

spouse) with respect to all shares of voting stock listed as owned by that person or entity.

(2) Pursuant to Rules 13d-3

and 13d-5 of the Exchange Act, beneficial ownership includes any shares as to which a shareholder has sole or shared voting power or investment

power, and also any shares which the shareholder has the right to acquire within 60 days, including upon exercise of common shares purchase

options or warrants. The percent of class is based on 171,529,630 voting shares as of December 22, 2023

(3) Pursuant to Rules 13d-3

and 13d-5 of the Exchange Act, beneficial ownership includes any shares as to which a shareholder has sole or shared voting power or investment

power, and also any shares which the shareholder has the right to acquire within 60 days, including upon exercise of common shares purchase

options or warrants. The percent of class is based on 10,000 voting shares as of December 22, 2023.

(4) Under the Certificate

of Designation, holders of Series A Preferred Stock will participate on an equal basis per-share with holders of our common stock in any

distribution upon winding up, dissolution, or liquidation. Holders of Series A Preferred Stock are entitled to vote together with the

holders of our common stock on all matters submitted to shareholders at a rate of 51% of the total vote of shareholders.

(5) There are 171,529,630

total shares of common stock outstanding entitled to one vote per share. Holders of Series A Preferred Stock are entitled to vote together

with the holders of our common stock on all matters submitted to shareholders at a rate of 51% of the total vote of shareholders, including

the election of directors. Our common stock is entitled to one vote per share on all matters submitted to a vote of the stockholders,

including the election of directors. As a result of voting feature of the Series A Preferred Stock, there are 171,529,630 votes represented

by the common stock, which means that there are 178,530,839 votes available to the holders of the 10,000 shares of Series A Preferred

Stock for 51% of the total vote. Combining the common stock and the Series A Preferred Stock, there are a total of 350,060,469 votes that

may be cast.

PROPOSAL NO. 2

RATIFICATION OF Urish Popeck & Co., LLC AS INDEPENDENT REGISTERED PUBLIC ACCOUNTING

FIRM

Our independent registered public accounting firm for the fiscal year

ended December 31, 2022 was the firm of Urish Popeck & Co., LLC (“Urish”). Our Audit Committee has appointed Urish

as our independent registered public accounting firm for the fiscal year ending December 31, 2023. A representative of Urish is expected

to attend the annual meeting and to have the opportunity to make a statement, if he or she desires to do so, and is expected to be available

to respond to appropriate questions submitted by stockholders in advance of the annual meeting.

The Audit Committee, with the endorsement of the Board, recommends

that you ratify that appointment. Although ratification is not required by our bylaws or otherwise, we are submitting the selection of

Urish to you for ratification as a matter of good corporate practice. If the selection is not ratified by a majority of the votes cast

on this proposal at the annual meeting, our Audit Committee will consider whether it is appropriate to select another registered public

accounting firm. Even if the selection is ratified, our Audit Committee in its discretion may select a different registered public accounting

firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.

Independent Registered Public Accountant Fee Information

Below are tables of Audit Fees (amounts in US$) billed

by our auditors in connection with the audits of the Company’s annual financial statements for the years ended:

Financial Statements for the

Year Ended December 31 |

|

Audit Services |

|

Audit Related Fees |

|

Tax Fees |

|

Other Fees |

| 2022 |

|

|

$ |

180,710 |

|

|

$ |

1,717 |

|

|

$ |

0 |

|

|

$ |

0 |

|

| 2021 |

|

|

$ |

136,297 |

|

|

$ |

29,500 |

|

|

$ |

0 |

|

|

$ |

0 |

|

THE

BOARD RECOMMENDS A VOTE “FOR” THE

RATIFICATION OF THE APPOINTMENT OF Urish Popeck & Co., LLC AS THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR FISCAL 2023.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee reviews the Company’s financial reporting

processes on behalf of the Board. Management is responsible for the financial statements and the reporting processes, including the internal

control over financial reporting. The Company’s independent registered public accounting firm, Urish Popeck & Co., LLC, is responsible

for expressing an opinion on the conformity of the audited financial statements with U.S. generally accepted accounting principles. The

Audit Committee monitors these processes. The Audit Committee has reviewed and discussed the audited financial statements with management.

As required by the standards of the Public Company Accounting Oversight

Board (“PCAOB”), the Audit Committee has discussed with Urish Popeck & Co., LLC (i) the matters required to be discussed

by the applicable requirements of the PCAOB and the SEC, and (ii) the independence of Urish Popeck & Co., LLC from the Company

and management. Urish Popeck & Co., LLC has provided the Audit Committee the written disclosures and letters required by applicable

requirements of the PCAOB regarding the independent accountant communicating with the Audit Committee concerning independence.

Based upon the review and discussions referred to above, the Audit

Committee recommended to the Board, and the Board approved, the inclusion of the audited financial statements in the Company’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2022 for filing with the SEC.

The Audit Committee:

Raul Perez, Chair

Jose Antonio Barreto

Italo Segnini

STOCKHOLDER PROPOSALS

The table below summarizes the requirements for stockholders who wish

to submit proposals or director nominations for our 2024 Annual Meeting of Stockholders. Stockholders are encouraged to consult Rule 14a-8 of

the Exchange Act and our bylaws, as appropriate, to see all applicable requirements.

| |

|

Proposals for inclusion in

2023 Proxy Statement |

|

Other proposals/nominees

to be presented at the

2023 Annual Meeting* |

| Type of proposal |

|

SEC rules permit stockholders to submit proposals for inclusion in our 2023 proxy statement by satisfying the requirements set forth in Rule 14a-8 of the Exchange Act |

|

Stockholders may present proposals or director nominations directly at the 2023 Annual Meeting (and not for inclusion in our proxy materials) by satisfying the requirements set forth in Article II, Section 2.13 of our bylaws** |

| When proposal must be received by iQSTEL |

|

No later than March 10, 2024 |

|

Not earlier than the close of business on April 21, 2024 and not later than the close of business on May 21, 2024 |

| Where to send |

|

IQSTEL Inc., 300 Aragon Ave, Suite 375, Coral Gables, FL 33134 |

| What to include |

|

The information required by Rule 14a-8 |

|

The information required by our bylaws** |

* SEC

rules permit management to vote proxies in its discretion in certain cases if the stockholder does not comply with this deadline, and

in certain other cases notwithstanding the stockholder’s compliance with this deadline.

** Our bylaws

are available on our website located at www.iqstel.com under “Investor Relations—Governance.”

OTHER MATTERS

As of the date of this proxy statement, no other matter is known which

will be brought before the annual meeting. If any matter not described in this proxy statement is properly presented for a vote at the

meeting, the persons named in the accompanying proxy card will vote in accordance with their best judgment and discretion

HOUSEHOLDING

In accordance with notices previously sent to many stockholders who

hold their shares through a broker, bank or other holder of record (“street-name stockholders”) and share a single address,

only one annual report and proxy statement is being delivered to that address unless contrary instructions from any stockholder at that

address were received. This practice, known as “householding,” is intended to reduce our printing and postage costs. However,

any such street-name stockholder residing at the same address who wishes to receive a separate copy of this proxy statement or the

accompanying annual report on Form 10-K may request a copy by contacting the broker, bank or other holder of record. Alternatively,

we will promptly deliver a separate copy of either of such documents if a street-name stockholder contacts us either by calling (954)

951-8191 or by writing to IQSTEL Inc., 300 Aragon Avenue, Suite 375, Coral Gables, FL 33134 Attn:

Corporate Secretary.

Street-name stockholders who are currently receiving householded

materials may revoke their consent, and street-name stockholders who are not currently receiving householded materials may request

householding of our future materials, by contacting Broadridge Financial Services, Inc., either by calling toll free at (866) 540-7095 or

by writing to Broadridge, Householding Department, 51 Mercedes Way, Edgewood, New York 11717. If you revoke your consent, you will

be removed from the “householding” program within 30 days of Broadridge’s receipt of your revocation, and each

stockholder at your address will receive individual copies of our future materials.

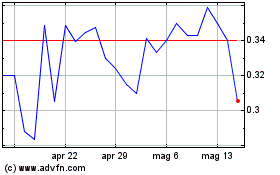

Grafico Azioni iQSTEL (QX) (USOTC:IQST)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni iQSTEL (QX) (USOTC:IQST)

Storico

Da Nov 2023 a Nov 2024