Nestle Lifts 2022 Organic Sales Outlook; Sets Out 2025 Targets

29 Novembre 2022 - 8:19AM

Dow Jones News

By Giulia Petroni

Nestle SA has lifted its full-year organic sales-growth guidance

and outlined targets for 2025 ahead of its investor seminar on

Tuesday.

The Swiss packaged-foods giant said it now expects sales to grow

organically between 8% and 8.5% from previous expectations of

around 8%. The underlying trading operating profit margin is still

seen at around 17%.

By 2025, it expects to return to an underlying trading operating

profit margin in the range of 17.5% to 18.5%, following the margin

impact of cost inflation in 2021 and 2022.

Annual underlying earnings-per-share growth is seen between 6%

and 10% in constant currency over the 2022-25 period, Nestle said.

The company aims for free cash flow toward 12% of sales, and return

on invested capital of 15% by 2025.

In terms of portfolio management, it said it will explore

strategic options for peanut allergy treatment Palforzia, following

slower than expected adoption by patients and heathcare

professionals. The review should be completed in the first half of

next year.

Nestle said the health-science business will focus more on

consumer care and medical nutrition.

The company confirmed its program to repurchase 20 billion Swiss

francs ($21.14 billion) of its shares between 2022 and 2024 and

said it aims to keep increasing its dividend year on year.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

November 29, 2022 02:04 ET (07:04 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

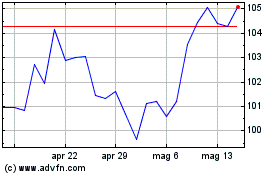

Grafico Azioni Nestle (PK) (USOTC:NSRGY)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Nestle (PK) (USOTC:NSRGY)

Storico

Da Nov 2023 a Nov 2024

Notizie in Tempo Reale relative a Nestle SA (PK) (OTCMarkets): 0 articoli recenti

Più Nestle SA (PK) Articoli Notizie