OMV Shares Fall As 4Q Results Miss Expectations

02 Febbraio 2023 - 11:59AM

Dow Jones News

By Giulia Petroni

OMV AG's shares plunged on Thursday on weaker-than-expected

results for the fourth quarter of last year, despite a higher

dividend.

The Austrian oil-and-gas player reported an adjusted net profit

of 700 million euros ($769.3 million) compared with EUR1.02 billion

in the previous year and roughly 4% below a company-compiled

consensus that had it at EUR727 million.

The clean CCS EBIT--operating earnings without one-off special

effects and adjusted by the current cost of supply--were EUR2.1

billion in the quarter, 10% below the company consensus.

At 1019GMT, shares trade 5% lower at EUR43.19.

"We expect the weaker results to weigh on the shares but this is

mitigated by the higher dividend," UBS analysts said in a research

note.

OMV proposed a dividend of EUR2.80 a share, up 22% compared to

the previous year, and a special dividend of EUR2.25. The dividend

is 5% above expectations, implying a 11.2% yield, according to UBS

analysts.

"The difference came from a higher base dividend, up 22%

year-on-year versus UBS expectations of 15%," they say.

Looking at the current year, OMV is guiding for capital

expenditure of around EUR3.7 billion. Total production is expected

to average around 360,000 barrels of oil equivalent a day, lower

compared to the previous year due to the exclusion of the Russian

volumes and a natural decline in particular in Norway and Romania,

the company said.

Write to Giulia Petroni at giulia.petroni@wsj.com

(END) Dow Jones Newswires

February 02, 2023 05:44 ET (10:44 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

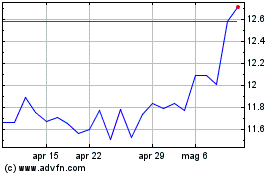

Grafico Azioni Omv Ag Bearer (PK) (USOTC:OMVKY)

Storico

Da Mag 2024 a Giu 2024

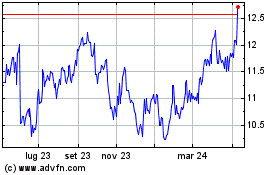

Grafico Azioni Omv Ag Bearer (PK) (USOTC:OMVKY)

Storico

Da Giu 2023 a Giu 2024