TIDMALNA

RNS Number : 1911K

Alina Holdings PLC

30 December 2020

FOR IMMEDIATE RELEASE.

30 December 2020

Alina Holdings PLC (the "Company")

Results for the six months ended 30 September 2020

Further to the Company's announcement dated 2 December 2020, the

directors of Alina Holdings PLC are pleased to announce the

Company's unaudited consolidated results for the six months ended

30 September 2020.

Enquiries:

Alina Holdings PLC

William A Heaney

Company Secretary

07712 868315

Management Report

Corporate Activity

During the period the directors reviewed the options open to the

Company for its future strategy, in tandem with the aim of

restoring trading in the Company's shares on the London Stock

Exchange. This culminated in the publication, and subsequent

approval by the Company's shareholders in September 2020, of

proposals for the Company's new investment strategy (summarised

above), in tandem with which the Company's largest shareholder at

that time, Thalassa Holdings Ltd, distributed the majority of its

shares in the Company to its own shareholders. This enabled the

Company to apply to the Financial Conduct Authority for the

restoration of trading in the Company's shares on the London Stock

Exchange, which took place on 19 November 2020.

In accordance with the new investment strategy adopted by its

shareholders, the Company changed its name to Alina Holdings PLC on

26 November 2020.

Economic Background & Market Conditions

Throughout the period reported on the Company operated under its

previous investment strategy as a UK REIT specialising in local

retail shopping assets. An element of the uncertainty that had

overhung the property market for much of 2019 had to some extent

been dissipated prior to the period reported on, following the

general election in December 2019. Nevertheless, concerns over the

potential impact of the UK's departure from the European Union and

uncertainty over its future trading relationship with the bloc

continued to influence property values and transaction volumes

throughout the period. This situation was greatly compounded by the

COVID-19 outbreak, confirmed as a global pandemic by the World

Health Organisation immediately prior to the period, which impacted

all owners and occupiers of commercial property. The effects of the

pandemic, and the measures taken by Government to contain it, have

been particularly severe in the retail and leisure segments.

However, even during the most severe lockdown restrictions, those

smaller local and convenience shops supplying essential items to

their localities could continue to trade.

Financial Results

The Group made an IFRS loss before tax for the six-months period

to 30 September 2020 of GBP0.652 million (or loss per share of

2.87p), compared with a profit of GBP0.026 million (or 0.03 pence

per share) for the equivalent period in 2019 and a loss of GBP0.06

million (or 0.26 pence per share) for the six months period to 31

March 2020 and a loss of GBP1.90 million (or 2.37 pence per share)

for the six-months period to 31 March 2019. The loss for the Group

reflected the loss of income resulting from the disposal of

property assets during the previous periods, the revaluation of the

residual portfolio and the effect of currency market fluctuations

on the Group's cash holdings.

Property Portfolio and Asset Management

At 30 September 2020 the Company's portfolio comprised six

properties, with an annual gross rental income, after deducting

head rent payments, of GBP0.45 million (30 September 2019: eight

properties, gross rental income GBP0.48 million). The portfolio

included 61 letting units (2019: 65 letting units). One of the

property assets was considered to be held for sale.

Asset management activities during the period focused on

maximising property occupancy and opportunities for rental growth,

as well as a number of repair and maintenance projects. Marketing

and letting activities continued, albeit with appropriate

precautions to address lockdown requirements.

Portfolio Valuation

The fair value of the property portfolio of six assets held at

30 September 2020 was GBP2.795 million (30 September 2019: eight

assets, GBP3.465 million; 31 March 2020: six assets, GBP3.120

million). The valuation was provided by Allsop LLP, a firm of

independent chartered surveyors. In line with the Company's

established valuation policy, two of the larger assets were subject

to full RICS valuations, with the remainder subject to desktop

updates of their previous full valuations provided by Allsop LLP in

July 2019. The holding value of the property assets in the

Company's accounts of the one remaining property considered to be

held for sale took account of agreed pricing and potential

transaction costs.

Cash

At 30 September 2020 the Company held GBP3.818 million in cash

(31 March 2020: GBP4.023 million; 30 September 2019: GBP3.566

million).

Net Asset Value

The Net Asset Value at 30 September 2020 was GBP6.281 million or

27.67p per share (31 March 2020: GBP6.933 million, 30.55p per

share; 30 September 2019: GBP6.992 million or 30.81p per share).

The reduction in Net Asset Value reflected the reduction in the

valuation of the Company's property portfolio, which in turn

reflected general trends in the UK property market, together with

the reduction in rental income as a result of property disposals in

previous periods and the effect of currency market fluctuations on

the Group's cash holdings.

Basis of Preparation of Financial Statements

The Company's financial statements at 31 March 2019 were

prepared on a break-up basis in view of the progress with the

property sales programme then in place. Following the decision of

the new directors to suspend the property disposal programme in

October 2019, the directors decided that it was appropriate for the

Company's financial statements for 30 September 2019 onwards should

be prepared on the going concern basis.

Financing

The Company did not utilise any external funding facilities

during the period.

Taxation

As a result of the share buy-back offer concluded in October

2019, the Company no longer fulfilled the conditions of the UK REIT

tax regime. It was subsequently agreed with HM Revenue &

Customs, that the Group would be considered to remain in the REIT

regime until 30 September 2020, at which time it would depart from

the REIT regime unless it had fulfilled the relevant conditions by

that date. However, in September 2020 the Company's shareholders

adopted a new investment strategy, including the re-listing of the

Company's shares on the Standard element of the Main Market of the

London Stock Exchange and, in consequence, to leave the UK REIT tax

regime. Under the UK REIT rules the Company is considered to have

exited the REIT regime for the entirety of its financial year

beginning 1 October 2018, being the beginning of the first tax year

of the Company during which it did not fulfil all the REIT

conditions. The Company is therefore deemed to be subject to

corporation tax in the usual way from that date. However, in the

light of the losses incurred during 2018-19, it is not anticipated

that any corporation tax liability has arisen in respect of that

year.

Dividend

In line with the Group's current dividend distribution policy no

interim dividend will be paid. The directors will continue to

review the dividend policy in line with progress with the Company's

new investment strategy.

Related Party

The Company has been internally managed since 24 November 2019,

when its previous fund management contract with Principal Real

Estate Limited terminated. During the period the Company had an

arrangement with Thalassa Holdings Ltd, its then largest

shareholder, for the provision of accountancy and registered office

services. The services were supplied to the Company at cost, which

was not considered to be material, and the directors did not

consider the arrangement to amount to a related party

transaction.

Principal Risks and Uncertainties for the Remaining Six Months

of the Financial Period

The risks facing the Group for the foreseeable future remain

consistent with those described in detail in the annual report for

the year to 30 September 2019 (available on the Group's website:

www.alina-holdings.com ) .

These centre on:

-- Changes in the macroeconomic environment, particularly those

arising from the COVID-19 epidemic

-- Higher than anticipated property maintenance costs

-- Changes to legal environment, planning law or local planning policy

-- Regulatory requirements in connection with the property portfolio

-- Information technology systems and data security

-- Non-payment of trade receivables by tenants, potentially exacerbated by the COVID-19 epidemic

-- Financial and property market conditions

-- Uncontrolled exit from the UK REIT regime

The potential impact of a number of these risk areas on the

Company is mitigated by the significant proportion of the Company's

assets held in cash.

The Board was satisfied that its approach to macroeconomic risks

supplied an appropriate response to the effects of the COVID-19

pandemic during the period.

The Group's exit from the UK REIT regime was the subject of

consultation with HM Revenue and Customs the Company's tax advisers

and was thus under control.

The Board will continue to review its risk management approach

to ensure that it reflects the risk profile of the revised

investment strategy recently approved by the Company's

shareholders.

The Group does not speculate in derivative financial

instruments.

The Group's exposure to the risk of non-payment of trade

receivables by its tenants was considered to have been heightened

during the period reported on as a direct result of the COVID-19

virus and the consequent lockdown imposed by the UK Government,

which restricted the ability of the Group's tenants to trade in

their properties. The lockdown has also impacted on the ability of

the Company to refurbish, market and let vacant properties. The

directors monitor the level of rent and service charge arrears, as

well as progress with letting void properties, on a continual

basis.

Auditors' Review

This interim financial report has been reviewed but not audited

by auditors pursuant to the Financial Reporting Council guidance on

Review of Interim Financial Information.

Responsibility Statement

We confirm that to the best of our knowledge that:

(a) the condensed set of financial statements has been prepared

in accordance with IAS 34 Interim Financial Reporting as adopted by

the EU: and

(b) the Interim Management Report includes a fair review of the

information required by:

DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the six

months of the financial period and their impact on the condensed

set of financial statements; and a description of the principal

risks and uncertainties for the remaining three months of the

financial period; and

DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the six months

of the current financial period and that have materially affected

the financial position or performance of the entity during that

period; and any changes in the related party transactions described

in the last annual report that could do so.

Signed on behalf of the Board who approved the interim

management report on 29 December 2020.

Duncan Soukup

Chairman

Condensed Consolidated Income Statement for the six months ended

30 September 2020

Unaudited Audited Unaudited Unaudited

Twelve Unaudited Unaudited Twelve Six Six

months Six months Six months months months months

ended ended ended ended ended ended

30 September 30 September 31 March 30 September 30 September 31 March

Note 2020 2020 2020 2019 2019 2019

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

Gross rental income 453 224 229 764 305 459

---------------------

Property operating

expenses 3 (133) (88) (45) (695) (23) (672)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Net rental income 320 136 184 69 282 (213)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Profit/Loss on

disposal

of investment

properties

held for sale 4 1 - 1 (148) (1) (147)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

(Loss)/Profit from

change in fair

value

of investment

properties 9 (325) (325) - (258) 37 (295)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Administrative

expenses

including

non-recurring

items 5 (428) (273) (155) (1,580) (319) (1,261)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Operating

(loss)/profit

before net

financing

costs (432) (462) 30 (1,917) (1) (1,916)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Financing income 6 3 - 3 49 29 20

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Financing expenses 6 (282) (190) (92) (6) (2) (4)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

(Loss)/profit before

tax (711) (652) (59) (1,874) 26 (1,900)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Taxation 7 - - - - -

--------------------- ----- -------------- ------------ -------------- -------------- ----------

(Loss)/profit for

the period from

continuing

operations (711) (652) (59) (1,874) 26 (1,900)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

(Loss)/profit for

the financial

period

attributable to

equity

holders of the

Company (711) (652) (59) (1,874) 26 (1,900)

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Basic and diluted

loss per share on

(loss)/profit for

the period 10 (3.13)p (2.87)p (0.26)p (2.34)p 0.03p (2.37)p

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Basic and diluted

(loss)/profit per

share on operations

for the period 10 (3.13)p (2.87)p (0.26)p (2.34)p 0.03p (2.37)p

--------------------- ----- -------------- ------------ -------------- -------------- ----------

Condensed Consolidated Statement of Comprehensive Income for the

six months ended 30 September 2020

Unaudited Audited Unaudited Unaudited

Twelve Unaudited Unaudited Twelve Six Six

months Six months Six months months months months

ended ended ended ended ended ended

30 September 30 September 31 March 30 September 30 September 31 March

2020 2020 2020 2020 2019 2019

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

------------------------ -------------- -------------- ------------ -------------- -------------- ----------

Loss for the financial

period (711) (652) (59) (1,874) 26 (1,900)

------------------------- -------------- -------------- ------------ -------------- -------------- ----------

Total comprehensive

loss for the period (711) (652) (59) (1,874) 26 (1,900)

------------------------- -------------- -------------- ------------ -------------- -------------- ----------

Attributable to:

------------------------ -------------- -------------- ------------ -------------- -------------- ----------

Equity holders of the

parent Company (711) (652) (59) (1,874) 26 (1,900)

------------------------- -------------- -------------- ------------ -------------- -------------- ----------

Condensed Consolidated Balance Sheet as at 30 September 2020

Unaudited Audited Unaudited

as at Unaudited as at 30 as at

30 September as at 31 September 31 March

Note 2020 March 2020 2019 2019

GBP000s GBP000s GBP000s GBP000s

----- -------------- ------------ ----------- ----------

Non-current assets

----- -------------- ------------ ----------- ----------

Investment properties 9 2,814 3,139 3,139 -

----- -------------- ------------ ----------- ----------

2,814 3,139 3,139 -

----- -------------- ------------ ----------- ----------

Current assets

----- -------------- ------------ ----------- ----------

Trade and other receivables 243 192 378 844

----- -------------- ------------ ----------- ----------

Investment properties held

for sale 9 330 330 677 3,656

----- -------------- ------------ ----------- ----------

Cash 3,818 4,023 3,566 22,755

----- -------------- ------------ ----------- ----------

4,391 4,545 4,621 27,255

----- -------------- ------------ ----------- ----------

Total assets 7,205 7,684 7,760 27,255

----- -------------- ------------ ----------- ----------

Non-current liabilities

----- -------------- ------------ ----------- ----------

Finance lease liabilities 9 (350) (350) (350) -

----- -------------- ------------ ----------- ----------

(350) (350) (350) -

----- -------------- ------------ ----------- ----------

Current liabilities

----- -------------- ------------ ----------- ----------

Trade and other payables (574) (401) (418) (1,402)

----- -------------- ------------ ----------- ----------

(574) (401) (418) (1,402)

----- -------------- ------------ ----------- ----------

Total liabilities (924) (751) (768) (1,402)

----- -------------- ------------ ----------- ----------

Net assets 6,281 6,933 6,992 25,853

----- -------------- ------------ ----------- ----------

Equity

----- -------------- ------------ ----------- ----------

Issued capital 2 319 319 319 18,334

----- -------------- ------------ ----------- ----------

Capital redemption reserve 2 598 598 598 1,764

----- -------------- ------------ ----------- ----------

Retained earnings 5,364 6,016 6,075 5,755

----- -------------- ------------ ----------- ----------

Total attributable to equity

holders of the Company 6,281 6,933 6,992 25,853

----- -------------- ------------ ----------- ----------

Condensed Consolidated Statement of Cash Flows for the six

months ended 30 September 2020

Unaudited Audited

Twelve Unaudited Unaudited Twelve Unaudited Unaudited

months Six months Six months months Six months Six months

ended ended ended ended ended ended

30 September 30 September 31 March 30 September 30 September 31 March

Note 2020 2020 2020 2019 2019 2019

GBP000s GBP000s GBP000s GBP000s GBP000s GBP000s

----- -------------- -------------- ------------ -------------- -------------- ------------

Operating

activities

----- -------------- -------------- ------------ -------------- -------------- ------------

(Loss)/Profit for

the period (711) (652) (59) (1,874) 26 (1,900)

----- -------------- -------------- ------------ -------------- -------------- ------------

Adjustments for:

----- -------------- -------------- ------------ -------------- -------------- ------------

Loss/(Profit) from

change in fair

value

of investment

properties 9 325 325 258 (37) 295

----- -------------- -------------- ------------ -------------- -------------- ------------

Net financing

loss/(income) 6 279 190 89 (43) (27) (16)

----- -------------- -------------- ------------ -------------- -------------- ------------

(Profit)/Loss on

disposal

of investment

properties (1) - (1) 148 1 147

----- -------------- -------------- ------------ -------------- -------------- ------------

Equity secured

share-based

payment expenses - 40 20 20

----- -------------- -------------- ------------ -------------- -------------- ------------

(108) (137) 29 (1,471) (17) (1,454)

----- -------------- -------------- ------------ -------------- -------------- ------------

Decrease/

(Increase)

in trade and

other

receivables 135 (51) 186 3,963 466 3,497

----- -------------- -------------- ------------ -------------- -------------- ------------

Decrease in trade

and other

payables 156 173 (17) (1,818) (1,003) (815)

----- -------------- -------------- ------------ -------------- -------------- ------------

183 (15) 198 674 (554) 1,228

----- -------------- -------------- ------------ -------------- -------------- ------------

Loss on foreign

exchange (282) (190) (92) - -

----- -------------- -------------- ------------ -------------- -------------- ------------

Loan arrangement

fees

paid - - - (6) (2) (4)

----- -------------- -------------- ------------ -------------- -------------- ------------

Interest received 3 - 3 49 29 20

----- -------------- -------------- ------------ -------------- -------------- ------------

Net cash

(outflow)/inflow

from operating

activities (96) (205) 109 717 (527) 1,244

----- -------------- -------------- ------------ -------------- -------------- ------------

Investing

activities

----- -------------- -------------- ------------ -------------- -------------- ------------

Net proceeds from

sale of

investment

properties 348 - 348 18,468 246 18,222

----- -------------- -------------- ------------ -------------- -------------- ------------

Acquisition and

improvements

to investment

properties 9 - - (4) (1) (3)

----- -------------- -------------- ------------ -------------- -------------- ------------

Cash flows from

investing

activities 348 - 348 18,464 245 18,219

----- -------------- -------------- ------------ -------------- -------------- ------------

Net cash flows

from

operating

activities

and investing

activities 252 (205) 457 19,181 (282) 19,463

----- -------------- -------------- ------------ -------------- -------------- ------------

Financing

activities

----- -------------- -------------- ------------ -------------- -------------- ------------

Repayment of - - - - - -

borrowings

----- -------------- -------------- ------------ -------------- -------------- ------------

Reduction in share

capital - (18,907) (18,907) -

----- -------------- -------------- ------------ -------------- -------------- ------------

Cash flows from

financing

activities - (18,907) (18,907) -

----- -------------- -------------- ------------ -------------- -------------- ------------

Net decrease in

cash 252 (205) 457 274 (19,189) 19,463

----- -------------- -------------- ------------ -------------- -------------- ------------

Cash at beginning

of period 3,566 4,023 3,566 3,292 22,755 3,292

----- -------------- -------------- ------------ -------------- -------------- ------------

Cash at end of

period 3,818 3,818 4,023 3,566 3,566 22,755

----- -------------- -------------- ------------ -------------- -------------- ------------

Condensed Consolidated Statement of Changes in Equity for the

six months ended 30 September 2020

Capital

--------------------------------

Share redemption Retained

--------------------------------

capital Reserves reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000

-------------------------------- --------- --------- ----------- --------- ---------

At 30 September 2018 18,334 3,773 1,764 3,862 27,733

--------- --------- ----------- --------- ---------

Total comprehensive expense

--------- --------- ----------- --------- ---------

for the period

--------- --------- ----------- --------- ---------

Loss for the period - - - (1,900) (1,900)

--------- --------- ----------- --------- ---------

Transactions with owners,

--------- --------- ----------- --------- ---------

recorded directly in

equity

--------- --------- ----------- --------- ---------

Dividends - - - - -

--------- --------- ----------- --------- ---------

Share based payments - - - 20 20

--------- --------- ----------- --------- ---------

Total contributions by - - - - -

and

--------- --------- ----------- --------- ---------

distributions to owners

--------- --------- ----------- --------- ---------

Release of Gilfin acquisition

reserve to distributable

reserve - (3,773) - 3,773 -

--------- --------- ----------- --------- ---------

At 31 March 2019 18,334 - 1,764 5,755 25,853

--------- --------- ----------- --------- ---------

Total comprehensive loss

for the period

--------- --------- ----------- --------- ---------

Profit for the period - - - 26 26

--------- --------- ----------- --------- ---------

Transactions with owners

recorded directly in

equity

--------- --------- ----------- --------- ---------

Dividends - - - - -

--------- --------- ----------- --------- ---------

Share based payments - - - 20 20

--------- --------- ----------- --------- ---------

Total contributions by - - - - -

and distributions to

owners

--------- --------- ----------- --------- ---------

Capital reduction (Note

a)

--------- --------- ----------- --------- ---------

(17,417) - - 17,417 -

--------- --------- ----------- --------- ---------

Transfer capital reserves

to revenue (Note b) - - (1,764) 1,764 -

--------- --------- ----------- --------- ---------

Cost of own shares acquired

(note c) (598) - - (18,309) (18,907)

--------- --------- ----------- --------- ---------

Creation of Capital Redemption

Reserve (note d) - - 598 (598) -

--------- --------- ----------- --------- ---------

At 30 September 2019 319 - 598 6,075 6,992

--------- --------- ----------- --------- ---------

Total comprehensive profit

--------- --------- ----------- --------- ---------

for the period

--------- --------- ----------- --------- ---------

Loss for the period - - - (59) (59)

--------- --------- ----------- --------- ---------

Transactions with owners,

--------- --------- ----------- --------- ---------

recorded directly in

equity

--------- --------- ----------- --------- ---------

Dividends - - - - -

--------- --------- ----------- --------- ---------

Share based payments - - - - -

--------- --------- ----------- --------- ---------

Total contributions by - - - - -

and

--------- --------- ----------- --------- ---------

distributions to owners

--------- --------- ----------- --------- ---------

At 31 March 2020 319 - 598 6,016 6,933

--------- --------- ----------- --------- ---------

During the six months period to 30 September 2019 the Company

successfully applied to the High Court to undertake a capital

restructuring in order to facilitate a share buy-back tender offer.

Under this restructuring and buy-back:

(a) The nominal value of each Ordinary Share was reduced from

20p to 1p, resulting in GBP17.417m being released to retained

earnings.

(b) The capital redemption reserves and other reserves were

transferred to retained earnings as part of the Court approved

capital restructuring.

(c) 59,808,456 ordinary 1p shares were purchased, representing

72.5% of total share capital at the time, at a price of 31.33p each

and then cancelled, the total cost comprising:

GBP000s

59,808,456 shares 1p nominal value

purchased at of each share 598

------------------------------- -------------------

plus premium

30.33p on each

share 18,140

------------------------------- ----------------------------- -------------------

18.738

------------------------------------------------------------- -------------------

legal costs

of restructuring

and buy back 169

------------------------------- ----------------------------- -------------------

18,907

------------------------------------------------------------- -------------------

(d) A new capital redemption reserve of GBP0.598m was created to

replace the nominal value of shares bought.

Notes to the interim report for the six months ended 30

September 2020

1. Accounting policies

Basis of preparation

The condensed unaudited set of financial statements has

been prepared in accordance with IAS 34 "Interim Financial

Reporting" as adopted by the EU.

The annual financial statements of the Group are prepared

in accordance with International Financial Reporting Standards

(IFRSs) as adopted by the EU. As required by the Disclosure

and Transparency Rules of the Financial Services Authority,

the condensed set of financial statements has been prepared

applying the accounting policies and presentation that

were applied in the preparation of the Company's published

consolidated financial statements for the year ended 30

September 2019 (with which they should be read in conjunction).

The independent auditor's report on the 2019 financial

statements was not qualified.

The Group adopted IFRS 15 Revenue from Contracts with

Customers, IFRS 9 Financial Instruments and IFRS 16 Leases

from 1 January 2019. None of these standards has a material

effect on the Group's financial statements.

The financial statements are prepared on a going concern

basis, as were the financial statements for the year ended

30 September 2019. The financial statements for the six

months ended 31 March 2019 were prepared on a break-up

basis.

2. Segmental reporting

IFRS 8 requires operating segments to be identified on

the basis of internal reports that are regularly reported

to the chief operating decision maker to allocate resources

to the segments and to assess their performance.

The Group has identified one operation and one reporting

segment which is reported to the Board on a quarterly

basis. The Board of directors is considered to be the

chief operating decision maker.

3. Property Operating Expenses

Unaudited Unaudited Audited Unaudited

Twelve Six Unaudited Twelve Six

months months Six months months Unaudited

ended ended months ended ended Six months

30 30 ended 30 30 ended

September September 31 March September September 31 March

2020 2020 2020 2019 2019 2019

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------- ---------- ---------- ---------- -----------

Bad debt

charge 13 4 9 108 134 (26)

---------- ---------- ---------- ---------- ---------- -----------

Head rent

payments (21) (13) (8) (11) (8) (3)

--------------- ---------- ---------- ---------- ---------- -----------

Repairs (25) (13) (12) (211) (2) (209)

--------------- ---------- ---------- ---------- ---------- -----------

Business rates

and

council tax (24) (10) (14) (25) (23) (2)

--------------- ---------- ---------- ---------- ---------- -----------

Irrecoverable

service

charge 3 (5) 8 (39) 2 (41)

--------------- ---------- ---------- ---------- ---------- -----------

Utilities 9 3 6 (109) (15) (94)

--------------- ---------- ---------- ---------- ---------- -----------

Insurance (12) (5) (7) (36) (25) (11)

--------------- ---------- ---------- ---------- ---------- -----------

Managing agent

fees (32) (14) (18) (123) (24) (99)

--------------- ---------- ---------- ---------- ---------- -----------

Letting and

review

fees - - - (36) (4) (32)

--------------- ---------- ---------- ---------- ---------- -----------

Legal &

professional (28) (22) (6) (113) (39) (74)

--------------- ---------- ---------- ---------- ---------- -----------

EPC

amortisation,

Abortives,

and Misc (16) (13) (3) (100) (19) (81)

--------------- ---------- ---------- ---------- ---------- -----------

Total property

operating

expenses (133) (88) (45) (695) (23) (672)

--------------- ---------- ---------- ---------- ---------- -----------

In common with many property organisations, the Company's

portfolio is a mix of residential, opted and non-opted properties

for VAT. In the above table the applicable VAT which is not

recovered has been included directly in the cost.

During the period the rate of rent collection improved, enabling

a reduction in the bad debt provision.

4. Property disposals

Unaudited Audited

Twelve Unaudited Twelve Unaudited

months Six months Unaudited months Six months Unaudited

ended ended Six months ended ended Six months

30 30 ended 30 30 ended

September September 31 March September September 31 March

2020 2020 2020 2019 2019 2019

Number Number Number Number Number Number

Number of sales 2 - 2 66 1 65

---------------- ----------- ----------- ----------- ----------- ------------------

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ----------- ----------- ----------- ----------- ------------------

Average value 177 177 287 260 288

---------------- =========== =========== =========== =========== =========== ==================

Sales

---------------- ----------- ----------- ----------- ----------- ------------------

Total sales 355 - 355 18,955 260 18,695

---------------- ----------- ----------- ----------- ----------- ------------------

Carrying value (347) - (347) (18,616) (247) (18,369)

---------------- ----------- ----------- ----------- ----------- ------------------

Profit/(Loss)

on disposals

before

transaction

costs 8 - 8 339 13 326

================ =========== =========== =========== =========== =========== ==================

Transaction

costs

---------------- ----------- ----------- ----------- ----------- ------------------

Legal fees (4) - (4) (210) (9) (201)

---------------- ----------- ----------- ----------- ----------- ------------------

Agent fees,

marketing

and brochure

costs (3) - (3) (240) (2) (238)

---------------- ----------- ----------- ----------- ----------- ------------------

Disbursements - - - (8) (2) (6)

---------------- ----------- ----------- ----------- ----------- ------------------

Non recoverable

VAT (on

non-opted and

residential

elements) - - - (29) (1) (28)

---------------- ----------- ----------- ----------- ----------- ------------------

Total

transaction

costs (7) - (7) (487) (14) (473)

================ =========== =========== =========== =========== =========== ==================

Profit/(Loss)

on disposals

after

transaction

costs 1 - 1 (148) (1) (147)

---------------- ----------- ----------- ----------- ----------- ------------------

Transaction

costs as

percentage of

sales value 2.0% 0.0% 2.0% 2.6% 5.4% 2.5%

---------------- ----------- ----------- ----------- ----------- ------------------

5. Administrative expenses

Unaudited Unaudited Audited Unaudited

Twelve Six Unaudited Twelve Six Unaudited

months months Six months months Six

ended ended months ended ended months

30 30 ended 30 30 ended

September September 31 March September September 31 March

2020 2020 2020 2019 2019 2019

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ---------- ---------- ---------- ---------- ----------

Investment

manager

fees (9) (1) (8) (320) (88) (232)

---------------- ---------- ---------- ---------- ---------- ----------

Legal and

professional (167) (147) (20) (1,177) (292) (885)

---------------- ---------- ---------- ---------- ---------- ----------

Tax and audit (66) (29) (37) (96) (47) (49)

---------------- ---------- ---------- ---------- ---------- ----------

Remuneration

Costs* (138) (77) (61) (134) (65) (69)

---------------- ---------- ---------- ---------- ---------- ----------

Other (20) (13) (7) 14 (15) 29

---------------- ---------- ---------- ---------- ---------- ----------

Irrecoverable

VAT on

Administration

expenses ** (28) (6) (22) (92) (37) (55)

---------------- ---------- ---------- ---------- ---------- ----------

Provision for

liquidators'

fees - - - 225 225 -

---------------- ---------- ---------- ---------- ---------- ----------

Total

administrative

expenses (428) (273) (155) (1,580) (319) (1,261)

---------------- ---------- ---------- ---------- ---------- ----------

* Remuneration costs for the each of the two six months periods to

30 September 2020 include GBPnil (six months to 30 September 2019:

GBP20,000; six months to 31 March 2019 GBP20,000) in respect of the

expensing of employee share options which were capable of vesting

in 2018 onwards. This amount has a corresponding entry in equity and

has no impact on the Company's net assets now or in the future.

** The Company's portfolio contains residential elements and commercial

properties not opted for VAT. Accordingly, VAT on overheads is not

fully recoverable.

6. Net financing (loss)/income

Unaudited Unaudited Audited Unaudited

Twelve Six Unaudited Twelve Six Unaudited

months months Six months months Six

ended ended months ended ended months

30 30 ended 30 30 ended

September September 31 March September September 31 March

2020 2020 2020 2019 2019 2019

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------- ---------- ---------- ---------- ----------- ----------

Interest

receivable 3 - 3 49 29 20

---------- ---------- ---------- ---------- ----------- ----------

Financing

income 3 - 3 49 29 20

---------- ---------- ---------- ---------- ----------- ----------

Bank facility

fees - - (6) (2) (4)

---------- ---------- ---------- ---------- ----------- ----------

Loss on

foreign

exchange (282) (190) (92)

---------- ---------- ---------- ---------- ----------- ----------

Financing

expenses (282) (190) (92) (6) (2) (4)

---------- ---------- ---------- ---------- ----------- ----------

Net financing

(loss)/income (279) (190) (89) 43 27 16

---------- ---------- ---------- ---------- ----------- ----------

Funds held in non-sterling accounts are revalued at the prevailing

exchange rate at each period end. These revaluation gains and losses

and those which have crystalised in the period are reflected in the

Income Statement.

At 30 September 2020 the Company held $US4.248m (GBP3.300m). At 31

March 2020 the Company held EUR3.948m (GBP3.509m).

7. Taxation

From 11 May 2007, the Group elected to join the UK REIT tax regime.

As a result, the Group was exempt from corporation tax on the profits

and gains from its investment business from this date, provided it

met certain conditions. Non-qualifying profits and gains of the Group

(the residual business) continued to be subject to corporation tax.

The directors consider that all the rental income post 11 May 2007

originates from the Group's tax-exempt business whilst it participated

in the UK REIT tax regime.

From the first closing date of the Company's share buy-back offer

on 16 September 2019, the Group no longer fulfilled certain of the

REIT tax regime conditions, principally owing to the proportion of

the Company's issued share capital that had thereby come to be held

by Thalassa Holdings Ltd. As a consequence of this and the Company's

adoption of its new investment policy in September 2020, it is considered

that the Group had exited the REIT regime with effect from 1 October

2018 and is from that date fully subject to corporation tax. However,

the Board believes that the Group's activities since then and the

availability of tax losses means that the Company's activities are

unlikely to have generated any material corporation tax liability

for periods since 1 October 2018 and no provision for corporation

tax has been made in these financial statements.

8. Dividends

No dividends have been paid since December 2012.

9. Investment properties

Allsop LLP, a firm of independent chartered surveyors valued the

Group's property portfolio at 30 September 2018 and 31 March 2019.

On each of these dates Allsop LLP performed a full valuation of 25%

of the Group's properties (including site inspections) and a

desktop valuation of the remainder, such that all properties owned

by the Group are inspected and valued over the two-year period. The

valuations, using assumptions regarding yield rates, void levels

and comparable market transactions, were undertaken in accordance

with the Royal Institute of Chartered Surveyors Appraisal and

Valuation Standards on the basis of market value. Market value is

defined as the estimated amount for which a property should

exchange on the date of valuation between a willing buyer and a

willing seller in an arm's length transaction, after proper

marketing wherein the parties had each acted knowledgeably,

prudently and without compulsion.

In July 2019 Allsop LLP provided a full valuation (including

site visits) on all the properties then held by the Group. In the

light of that valuation, for the 30 September 2019 financial

statements the Company had desktop valuations prepared by Allsop

LLP for all the properties in the portfolio at that date, except

for three properties which were considered to be held for sale and

were therefore valued at their expected sale price less sales

costs.

During the six months' period to 31 March 2020 sales were

completed on two properties considered at 30 September 2019 to be

held for sale.

In view of the market uncertainty and the operational

restrictions arising from the COVID-19 outbreak, the directors did

not consider it appropriate to carry out a fresh valuation of the

property portfolio at 31 March 2020. The six properties contained

in the portfolio therefore continued to be recognised at 31 March

2020 in the financial statements at their holding value in the

Company's accounts at 30 September 2019.

The six property assets held at 30 September 2020 were valued at

that date by Allsop LLP. In line with the Company's established

valuation policy, two of the larger assets were subject to full

RICS valuations, including site inspections, with the remainder

subject to desktop updates of their previous carrying values.

One property is considered to be held for sale and its holding

value in the Company's accounts therefore takes account of agreed

pricing and sales costs.

Material valuation uncertainty

The outbreak of the Coronavirus (COVID-19), declared by the

World Health Organization as a "Global Pandemic" on 11 March 2020,

significantly impacted the global economy, including the UK

property market. Given the unknown future impact that COVID-19

might have on the real estate market, less certainty should be

attached to the valuation than would normally be the case.

A reconciliation of the portfolio valuation at 30 September 2020

to the total value for investment properties given in the

Consolidated Balance Sheet is as follows:

30 September 31 March 30 September 31 March

2020 2020 2019 2019

GBP000s GBP000s GBP000s GBP000s

------------- --------- ------------- ---------

Portfolio valuation * 2,775 3,100 3,447 3,656

Investment properties

held for sale (330) (330) (677) (3,656)

Head leases treated as

investment properties

held under finance leases

in accordance with IFRS

16 369 369 369 -

Total per consolidated

Balance Sheet 2,814 3,139 3,139 -

* Revalued assets and held for sale at net realisable value

10. Earnings per share and basic earnings per share

The calculation of basic earnings per share was based on the

profit attributable to ordinary shareholders and a weighted average

number of ordinary shares outstanding, calculated as follows:

Unaudited Audited

Twelve Unaudited Unaudited Twelve Unaudited Unaudited

months Six months Six months months Six months Six months

ended ended ended ended ended ended

30 September 30 September 31 March 30 September 30 September 31 March

2020 2020 2020 2019 2019 2019

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

(Loss)/profit for

the period (GBP'000) (711) (652) (59) (1,874) 26 (1,900)

------------------------- -------------- ------------ -------------- -------------- ------------

Weighted average

number of shares

(000s) 31,861 31,861 31,861 31,861 31,861 91,670

------------------------- -------------- ------------ -------------- -------------- ------------

Treasury shares (000s) (9,164) (9,164) (9,164) (9,164) (9,164) (9,164)

------------------------- -------------- ------------ -------------- -------------- ------------

Effective weighted

average number of

shares (000s) 22,697 22,697 22,697 80,231 80,231 82,506

------------------------- -------------- ------------ -------------- -------------- ------------

Earnings/(loss) per

share (pence) (3.13) (2.87) (0.26) (2.34) 0.03 (2.30)

------------------------- -------------- ------------ -------------- -------------- ------------

Diluted earnings/(loss)

per share (pence) (3.13) (2.87) (0.26) (2.34) 0.03 (2.30)

------------------------- -------------- ------------ -------------- -------------- ------------

Note: The aggregate of the two six months periods to 30

September 2019 do not equal the total for the year owing to

different weighted average number of shares in each period. The

weighted aggregate number of shares in the six months period to

September 2020 is the same as the equivalent figure for the six

months period to 31 March 2020.

11. Net asset value (NAV)

30 September 31 March 30 September 31 March

2020 2020 2019 2019

GBP000s GBP000s GBP000s GBP000s

Number of shares in issue 31,861 31,861 31,861 91,670

Less: shares held in Treasury (9,164) (9,164) (9,164) (9,164)

------------------------------- --------- ------------- ---------

Weighted average number of 22,697 22,697 22,697 82,506

------------------------------- --------- ------------- ---------

30 September 31 March 30 September 31 March

2020 2020 2019 2019

GBP000s GBP000s GBP000s GBP000s

Net assets per Consolidated

Balance Sheet 6,281 6,933 6,992 25,853

Net asset value per share GBP0.28 GBP0.31 GBP0.31 GBP0.31

------------------------------- --------- ------------- ---------

12. Related parties

There have been no transactions with related parties which have

materially affected the financial position or performance of the

Group during the current or previous period nor have there been any

changes in related party transactions which could have a material

effect on the financial position or performance of the Company

during the six months of the current financial period. Following

the termination of the investment advisory agreement between the

Company and Principal Real Estate Europe Limited on 24 November

2019, including the period reported on, Thalassa Holdings Ltd, a

significant shareholder of the Company, has provided management

accounting and registered office facilities to the Company. Those

services have been supplied at cost, the value of which is not

regarded as material, and it is not considered that the arrangement

comprised a related party transaction.

13. Significant contracts

The management agreement between the Company and Principal Real

Estate Europe Limited ("Principal") was terminated on 24 November

2019. Under this agreement the Company had paid to Principal:

1. an annual management fee of 0.70% of the gross asset value of

the Company, subject to a minimum fee of GBP1m in each of the first

two years, GBP0.95m for the third year and GBP0.9m for the fourth

year. This minimum fell away in July 2018;

2. an annual performance fee of 20% of the recurring operating

profits above a pre-agreed target recurring profit;

3. fees for property sales, as follows:

up to GBP50m: nil

GBP50m - GBP150m: 0.5% of sales

over GBP150m: 1% of sales.

The Company paid no fees to Principal in respect of the six months

period to 30 September 2020. For the six months period to 31 March

2020 fees paid to Principal totalled GBP8,000 (6 months to 31 March

2019: GBP232,000; 12 months to 30 September 2020: GBP320,000).

ENDS

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014. Following the

publication of this announcement, this inside information is now

considered to be in the public domain.

LEI: 213800SOAIB9JVCV4D57

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR FLFEEFILIVII

(END) Dow Jones Newswires

December 30, 2020 10:54 ET (15:54 GMT)

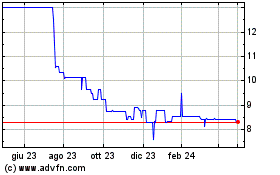

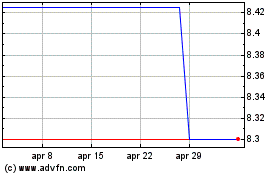

Grafico Azioni Alina (LSE:ALNA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Alina (LSE:ALNA)

Storico

Da Apr 2023 a Apr 2024