TIDMBLT

RNS Number : 9569U

BHP Billiton PLC

17 July 2018

Release Time IMMEDIATE

Date 18 July 2018

Release Number 10/18

BHP OPERATIONAL REVIEW

FOR THE YEARED 30 JUNE 2018

-- Met or exceeded full year production guidance for petroleum,

copper, iron ore and energy coal. Met revised guidance for

metallurgical coal.

-- Group copper equivalent production increased by 8% in the

2018 financial year, with annual production records at Western

Australia Iron Ore (WAIO), Queensland Coal and Spence.

-- We expect to achieve full year unit cost guidance at our

major assets (based on 2018 financial year guidance exchange rates

of AUD/USD 0.75 and USD/CLP 663).

-- Group copper equivalent production for the 2019 financial

year is expected to be broadly in line with the 2018 financial

year(1) .

-- The exit process for Onshore US is progressing to plan. Bids

have been received and we aim to announce one or more transactions

within the coming months, targeting completion of any transactions

by the end of the 2018 calendar year.

-- In Petroleum, the Victoria-1 exploration well in Trinidad and Tobago encountered gas and the

Samurai-2 well in the US Gulf of Mexico encountered hydrocarbons

in multiple horizons.

-- The South Flank sustaining iron ore project was approved during the June 2018 quarter.

-- We expect the financial results for the second half of the

2018 financial year to reflect certain items as summarised in the

table on page two.

FY18 Jun Q18

Production (vs FY17) (vs Mar Q18) Jun Q18 commentary

Petroleum (MMboe) 192 49 Improved well performance and positive trial results in Onshore US offset by natural field

decline.

(-8%) (+9%)

Copper (kt) 1,753 463 Higher volumes at Escondida supported by the ramp-up of the Los Colorados Extension project.

(+32%) (+1%)

Iron ore(2) (Mt) 238 64 Record annualised production rate of 289 Mtpa (100% basis) reflects increased productivity

across the supply chain following completion of the rail reliability project and improved

car dumper performance. Production records at Jimblebar and Newman.

(+3%) (+10%)

Metallurgical coal(2) (Mt) 43 12 Record quarterly production at Queensland Coal following improved performance at Blackwater

and Broadmeadow, and higher feed rates at Caval Ridge. Production records at South Walker

Creek and Poitrel.

(+7%) (+16%)

Energy coal(2) (Mt) 29 9 Record production at New South Wales Energy Coal underpinned by improved stripping fleet performance.

(0%) (+48%)

BHP Chief Executive Officer, Andrew Mackenzie, said: "We have

delivered a strong finish to the 2018 financial year with an eight

per cent increase in annual production and record output at Western

Australia Iron Ore, Queensland Coal and at our Spence copper mine

in Chile. We further simplified the portfolio with the announced

divestment of Cerro Colorado in Chile and Gregory Crinum in

Australia and our investment in South Flank supports our ability to

supply low cost, high quality products into Asia.

Good prices and our culture of continuous improvement give us

positive momentum into the 2019 financial year."

1

Summary

Operational performance

Production for the 2018 financial year and guidance for the 2019

financial year are summarised in the table below.

Jun FY18 Jun Q18 Jun Q18

2018 vs vs vs FY19 FY19e

Production FY18 Qtr FY17 Jun Q17 Mar Q18 guidance vs FY18

---------------------------- ----- ----- ----- -------- -------- ------------------- -----------

Petroleum (MMboe) 192 49 (8%) (6%) 9%

Onshore US (MMboe) 72 20 (10%) 3% 20% Refer footnote(iii)

Conventional (MMboe) 120 29 (6%) (11%) 3% 113 - 118 (6%) - (2%)

Copper (kt) 1,753 463 32% 20% 1% 1,675 - 1,770 (4%) - 1%

Escondida (kt) 1,213 316 57% 40% 1% 1,120 - 1,180 (8%) - (3%)

Other copper(i) (kt) 540 147 (3%) (9%) 3% 555 - 590 3% - 9%

Iron ore(ii) (Mt) 238 64 3% 6% 10% 241 - 250 1% - 5%

WAIO (100% basis) (Mt) 275 72 3% 3% 8% 273 - 283 (1%) - 3%

Metallurgical coal(ii) (Mt) 43 12 7% 41% 16% 43 - 46 1% - 8%

Energy coal(ii) (Mt) 29 9 0% 10% 48% 28 - 29 (4%) - (1%)

(i) Other copper comprises Pampa Norte (including Cerro Colorado

production for the first half of the 2019 financial year), Olympic

Dam and Antamina.

(ii) Excludes production from Samarco, Haju (IndoMet Coal) and New Mexico Coal.

(iii) Given our intention to exit Onshore US, no annual guidance

for the 2019 financial year for these assets will be provided;

however, until completion, we expect a production run rate broadly

consistent with the second half of the 2018 financial year.

Summary of disclosures

BHP expects its financial results for the second half of the

2018 financial year to reflect certain items as summarised in the

table below. The table does not provide a comprehensive list of all

items impacting the period. The financial statements are the

subject of ongoing work that will not be finalised until the

release of the financial results on 21 August 2018. Accordingly the

information is subject to update.

H2 FY18

impact

Description US$M(i) Classification(ii)

------------------------------------------------------------------------------- ------------ -----------------------

Non-cash fair value adjustment related to the Angostura (Trinidad and Tobago) 60 Operating costs

gas sale embedded

derivative

Exploration expense (including petroleum and minerals exploration programs) 448 Exploration expense

The Group's adjusted effective tax rate for the full year is expected to be - Income tax expense

within the guidance

range of 30 to 35 per cent

Non-cash fair value adjustments related to interest rate and exchange rate Under review Net debt

movements (weaker

US dollar in the period) are expected to reduce net debt in the June 2018 half

year

Dividends paid to non-controlling interests 650 Financing cash outflow

Financial impact on BHP Billiton Brasil of the Samarco Dam failure 440(iii) Exceptional item charge

(i) Numbers are not tax effected.

(ii) There will be a corresponding balance sheet, cash flow

and/or income statement impact as relevant.

(iii) The total financial impact on BHP Billiton Brasil of the

Samarco Dam failure is expected to be US$650 million in the 2018

financial year (H1 US$210 million and H2 US$440 million).

2

Average realised prices

The average realised prices achieved for our major commodities

are summarised below.

FY18 Jun H18 Jun H18

vs vs vs

Average realised prices(i) Jun H18 Dec H17 FY18 FY17 FY17 Jun H17 Dec H17

------------------------------------- ------- ------- ------ ------ ----- -------- --------

Oil (crude and condensate) (US$/bbl) 67.07 53.76 60.12 47.61 26% 35% 25%

Natural gas (US$/Mscf)(ii) 3.71 3.54 3.62 3.34 8% 7% 5%

US natural gas (US$/Mscf) 2.77 2.84 2.80 2.88 (3%) (7%) (2%)

LNG (US$/Mscf) 8.65 7.48 8.07 6.84 18% 17% 16%

Copper (US$/lb) 3.05 3.20 3.12 2.54 23% 13% (5%)

Iron ore (US$/wmt, FOB) 56.86 56.54 56.71 58.42 (3%) (8%) 1%

Metallurgical coal (US$/t) 189.66 164.22 177.22 163.30 9% 16% 15%

Hard coking coal (US$/t)(iii) 205.80 182.29 194.59 179.83 8% 14% 13%

Weak coking coal (US$/t)(iii) 143.40 120.99 131.70 121.32 9% 19% 19%

Thermal coal (US$/t)(iv) 86.47 87.49 86.94 74.67 16% 15% (1%)

Nickel metal (US$/t) 13,974 11,083 12,591 10,184 24% 43% 26%

(i) Based on provisional, unaudited estimates. Prices exclude

sales from equity accounted investments, third party product and

internal sales, and represent the weighted average of various sales

terms (for example: FOB, CIF and CFR), unless otherwise noted.

Includes the impact of provisional pricing and finalisation

adjustments.

(ii) Includes internal sales.

(iii) Hard coking coal (HCC) refers generally to those

metallurgical coals with a Coke Strength after Reaction (CSR) of 35

and above, which includes coals across the spectrum from Premium

Coking to Semi Hard Coking coals, while weak coking coal (WCC)

refers generally to those metallurgical coals with a CSR below

35.

(iv) Export sales only; excludes Cerrejón. Includes thermal coal

sales from metallurgical coal mines.

The majority of iron ore shipments were linked to the index

price for the month of shipment, with price differentials

predominantly a reflection of product quality and market

fundamentals. The majority of metallurgical coal and energy coal

exports were linked to the index price for the month of shipment or

sold on the spot market at fixed or index-linked prices, with price

differentials reflecting product quality.

At 30 June 2018, the Group had 364 kt of outstanding copper

sales that were revalued at a weighted average price of US$3.01 per

pound. The final price of these sales will be determined in the

2019 financial year. In addition, 254 kt of copper sales from the

2017 financial year were subject to a finalisation adjustment in

the current period. The provisional pricing and finalisation

adjustments will increase Underlying EBITDA(3) by US$2 million in

the 2018 financial year and is included in the average realised

copper price in the above table.

Major development projects

During the June 2018 quarter, the BHP Board approved US$2.9

billion (BHP share; US$3.4 billion 100 per cent) in capital

expenditure for the South Flank sustaining iron ore project in

Western Australia. A US$122 million increase in the budget of the

Jansen project to US$2.7 billion has been incorporated to fund

support services at the site as work continues on completion of the

shafts. The forecast for the North West Shelf Greater Western

Flank-B project has been reduced by US$98 million to US$216 million

as the project is tracking ahead of schedule.

At the end of the 2018 financial year, BHP had five major

projects under development in petroleum, copper, iron ore and

potash, with a combined budget of US$10.6 billion over the life of

the projects.

3

Corporate update

On 25 June 2018, Samarco, Vale and BHP, together with the

Federal Government of Brazil, the states of Espirito Santo and

Minas Gerais and the Public Prosecutors agreed an arrangement which

settles the BRL20 billion Civil Claim, enhances community

participation in decisions related to the remediation and

compensation programs, and establishes a process to renegotiate

those programs and to progress settlement of the BRL155 billion

Civil Claim (Governance Agreement). The Governance Agreement is

conditional on the Federal Government of Brazil signing the

Agreement and ratification by the 12th Federal Court of Minas

Gerais.

On 29 June 2018, BHP announced a total of US$211 million in

further financial support for the Renova Foundation and Samarco

until 31 December 2018. This comprises US$158 million to fund the

Renova Foundation which will be offset against the Group's

provision for the Samarco dam failure and a short-term facility of

up to US$53 million to be made available to Samarco.

Unrelated to the new Governance Agreement, BHP expects to

recognise an income statement charge in the second half of the 2018

financial year of US$440 million in respect of the Samarco dam

failure. This charge largely reflects updated assumptions relating

to the continuation of the fishing ban, the number of eligible

claimants, and the timeline and technical scope for resettlement of

the communities.

The US$440 million income statement charge will be recognised as

an exceptional item in the June 2018 half year.

The net increase in the provision is approximately US$250

million due to the offsetting impact of payments to the Renova

Foundation to fund remediation and compensation Programs under the

Framework Agreement.

Petroleum

Production

Jun FY18 Jun Q18 Jun Q18

2018 vs vs vs

FY18 Qtr FY17 Jun Q17 Mar Q18

----- ------ ------ --------- ---------

Crude oil, condensate and natural gas liquids (MMboe) 86 22 (11%) (10%) 8%

Natural gas (bcf) 636 163 (5%) (2%) 11%

Total petroleum production (MMboe) 192 49 (8%) (6%) 9%

Petroleum - Total petroleum production for the 2018 financial

year decreased by eight per cent to 192 MMboe.

In our Conventional business, volumes are expected to decrease

to between 113 and 118 MMboe in the 2019 financial year as a result

of additional downtime from planned dry dock maintenance at

Pyrenees and natural field decline across the portfolio. Given our

intention to exit Onshore US, no annual guidance for the 2019

financial year for these assets will be provided, however until

completion, which we are targeting by the end of the 2018 calendar

year, we expect a production run rate broadly consistent with the

second half of the 2018 financial year.

Production breakdown FY18 vs FY17

------------------------------------ ------- -----------

Crude oil, condensate and natural gas liquids (MMboe)

Conventional 57 (8%) Hurricane Harvey and Hurricane Nate in the Gulf of

Mexico and natural field decline across

the portfolio.

Onshore US 29 (16%) Hurricane Harvey and natural field decline, which more

than offset improved recoveries and

additional wells in the Black Hawk and Permian.

Total 86 (11%)

Natural gas (bcf)

Conventional 377 (4%) Maintenance at Bass Strait and Macedon.

Onshore US 259 (6%) Hurricane Harvey and natural field decline, partially

offset by additional wells in the Eagle

Ford, Permian and Haynesville.

Total 636 (5%)

4

In the June 2018 quarter, BHP agreed to sell its 90 per cent

interest in the Minerva Gas Plant in Victoria to the Casino Henry

Joint Venture. The agreement provides for the transfer of the plant

and associated land after the cessation of current operations

processing gas from the offshore Minerva gas field, and remains

conditional on completion of regulatory approvals and

assignments.

Projects

Project and Capital expenditure Initial production

ownership (US$m) target date Capacity Progress

---------------------- ---------------------- ---------------------- ---------------------- ----------------------

North West Shelf 216 CY19 To maintain LNG plant Ahead of schedule and

Greater Western throughput from the budget. The overall

Flank-B North West Shelf project is 87%

(Australia) operations. complete.

16.67% (non-operator)

Mad Dog Phase 2 2,154 CY22 New floating On schedule and

(US Gulf of Mexico) production facility budget. The overall

23.9% (non-operator) with the capacity to project is 23%

produce up to 140,000 complete.

gross barrels

of crude oil per day.

Petroleum capital expenditure for the 2018 financial year

increased by five per cent to US$1.6 billion.

Onshore US development activity

Onshore US drilling and development expenditure for 2018

financial year was US$0.9 billion. Our operated rig count declined

from seven to five during the June 2018 quarter.

FY18 Liquids focused areas Gas focused areas

------------------------------ --------------------------

(FY17) Eagle Ford Permian Haynesville Fayetteville Total

--------------------------- -------------- --------------- ------------- ----------- ------------- -------------

Capital expenditure(i) US$ billion 0.3 (0.3) 0.4 (0.2) 0.2 (0.1) 0.0 (0.0) 0.9 (0.6)

Rig allocation At period end 2 (1) 2 (1) 1 (3) 0 (0) 5 (5)

Net wells drilled and

completed(ii) Period total 36 (51) 29 (21) 20 (5) 0 (2) 85 (79)

Net productive wells At period end 958 (963) 155 (126) 393 (394) 1,042 (1,044) 2,548 (2,527)

(i) Includes land acquisition, site preparation, drilling,

completions, well site facilities, mid-stream infrastructure and

pipelines.

(ii) Can vary between periods based on changes in rig activity

and the inventory of wells drilled but not yet completed at period

end.

The exit process for our Onshore US assets is progressing to

plan. Bids have been received and we aim to announce one or more

transactions within the coming months, targeting completion of any

transactions by the end of the 2018 calendar year.

Petroleum exploration

Exploration and appraisal wells drilled during the June 2018

quarter are summarised below.

Total

Well Location Target BHP equity Spud date Water well Status

depth depth

----------- -------------------------- ------- ------------------ ------------- ------- ------- -------------------------

Hydrocarbons encountered,

Samurai-2 US Gulf of Mexico GC432 Oil 50% 16 April 2018 1,088 m 8,615 m drilling ahead

(Murphy Operator)

Hydrocarbons encountered,

Victoria-1 Trinidad & Tobago Block 5 Gas 65% 12 June 2018 1,828 m 2,545 m drilling ahead

(BHP Operator)

In the US Gulf of Mexico, we increased our equity interest in

the Murphy operated Samurai prospect (GC432 and GC476), the

northern extension of the Wildling sub-basin, from 33.33 to 50 per

cent. The Samurai-2 exploration well was spud on 16 April 2018 and

encountered hydrocarbons in multiple horizons not previously

observed by the Wildling-2 exploration well. As reported in the

March 2018 Operational Review, we were the apparent high bidder on

three blocks, EB914 and EB699 in the western Gulf of Mexico and

GC823 to the west of the Mad Dog field, which we co-own with BP and

Chevron. All three leases were awarded by the Regulator during the

June 2018 quarter.

5

In Trinidad and Tobago, following the gas discovery at LeClerc,

we commenced Phase 2 of our deepwater exploration drilling campaign

to further assess the commercial potential of the Magellan play.

The Victoria-1 exploration well was spud on 12 June 2018 and

encountered gas. Following completion of the Victoria-1 well, we

expect the Deepwater Invictus to drill the Bongos prospect in

Northern Trinidad and Tobago.

In Mexico, we expect to begin drilling the first appraisal well

at Trion in the December 2018 quarter.

In Australia, the fast track of the Exmouth sub-basin 3D seismic

data has been received. The final processed data will be delivered

during the September 2018 quarter.

Petroleum exploration expenditure for the 2018 financial year

was US$709 million, of which US$516 million was expensed.

Copper

Production

Jun FY18 Jun Q18 Jun Q18

2018 vs vs vs

FY18 Qtr FY17 Jun Q17 Mar Q18

------- ------ ----- -------- --------

Copper (kt) 1,753 463 32% 20% 1%

Zinc (t) 119,800 35,983 37% 24% 41%

Uranium oxide concentrate (t) 3,364 1,123 (8%) 52% 0%

Copper - Total copper production for the 2018 financial year

increased by 32 per cent to 1,753 kt. Total copper production of

between 1,675 and 1,770 kt is expected in the 2019 financial

year.

Escondida copper production for the 2018 financial year

increased by 57 per cent to 1,213 kt, reflecting a full year of

production following the industrial action in the previous year and

supported by the start-up of the Los Colorados Extension project on

10 September 2017. Production of between 1,120 and 1,180 kt is

forecast in the 2019 financial year, as higher expected throughput

is offset by a significant decrease in average concentrator head

grade consistent with the mine plan. The existing agreement with

Union Ndeg1 will expire on 1 August 2018 and negotiations for a new

agreement are in progress. The Escondida Water Supply Extension

(EWSE) is in execution phase and will deliver first water

production in the 2020 financial year.

Pampa Norte copper production increased by four per cent to 264

kt supported by record production at Spence of 200 kt reflecting

better recoveries and higher utilisation of the solvent extraction

and electrowinning plants. On 19 June 2018, BHP entered into an

agreement to sell Cerro Colorado to EMR Capital(4) . The

transaction is expected to close during the December 2018 quarter,

subject to financing and customary closing conditions. Production

at Spence is expected to be between 185 and 200 kt in the 2019

financial year, with volumes weighted to the second half as planned

maintenance in May and June 2018 resulted in a lower stacking rate.

During the period, we successfully completed the advanced

negotiation with Spence Union Ndeg1 (operators and maintenance)

with the new agreement effective from 1 June 2018 for 36 months. An

agreement was also reached with the Cerro Colorado Union Ndeg2

(supervisors and staff) on the terms and conditions for a new

collective agreement, effective for 36 months from 1 July 2018.

Olympic Dam copper production decreased by 18 per cent to 137 kt

as a result of the planned major smelter maintenance campaign in

the first half of the 2018 financial year and a slower than planned

ramp-up. The operation returned to full capacity during the June

2018 quarter. Production is expected to increase to between 200 and

220 kt in the 2019 financial year reflecting improved operational

stability and higher ore grades from the Southern Mine Area.

Antamina copper production increased by four per cent to 140 kt

and zinc production increased 37 per cent to 120 kt due to higher

head grades as mining continued through a zinc-rich ore zone.

Copper production is expected to remain at similar levels in the

2019 financial year at approximately 135 kt, while zinc production

is expected to be approximately 85 kt, consistent with the mine

plan.

6

Projects

Initial

Capital production

Project and expenditure target

ownership (US$m) date Capacity Progress

--------------------- ----------- ---------- --------------------------------------------------------------------------------------------------- --------------------------------------

Spence Growth Option 2,460 FY21 New 95 ktpd concentrator is expected to increase Spence's payable copper in concentrate production On schedule and budget. The overall p

by approximately 185 ktpa in the first 10 years of operation and extend the mining operations roject is 14% complete.

by more than 50 years.

(Chile)

100%

Iron Ore

Production

Jun FY18 Jun Q18 Jun Q18

2018 vs vs vs

FY18 Qtr FY17 Jun Q17 Mar Q18

------- ------ ----- -------- --------

Iron ore (kt) 238,421 63,586 3% 6% 10%

Iron ore - Total iron ore production for the 2018 financial year

increased by three per cent to a record 238 Mt (275 Mt on a 100 per

cent basis). WAIO production of between 241 and 250 Mt, or between

273 and 283 Mt on a 100 per cent basis, is expected in the 2019

financial year. A program of work to optimise maintenance schedules

across our supply chain and improve port reliability and

performance is planned for the September 2018 quarter, with a

corresponding impact expected on production and unit costs.

At WAIO, increased production was supported by improved

productivity and stability across the supply chain, including both

rail and port, which has enabled record production at Jimblebar and

Mining Area C. This was partially offset by the impact of lower

opening stockpile levels following the Mt Whaleback fire in June

2017 and unplanned car dumper maintenance in the March 2018

quarter. WAIO produced at record annualised rates of 289 Mtpa (100

per cent basis) in the June 2018 quarter.

On 14 June 2018, the BHP Board approved US$2.9 billion (BHP

share; US$3.4 billion 100 per cent) in capital expenditure for the

South Flank project. The South Flank project will fully replace

production from the 80 Mtpa (100 per cent basis) Yandi mine, with

first ore targeted in the 2021 calendar year. South Flank will

contribute to an increase in WAIO's average iron grade from 61 per

cent to 62 per cent, and the overall proportion of lump from 25 per

cent to approximately 35 per cent.

Mining and processing operations at Samarco remain suspended

following the failure of the Fundão tailings dam and Santarém water

dam on 5 November 2015.

Projects

Initial

Capital production

Project and expenditure target

ownership (US$m) date Capacity Progress

-------------- ----------- ---------- ------------------------------------------------------------------------------------------- ----------------------------------

South Flank 3,061(i) CY21 Sustaining iron ore mine to replace production from the 80 Mtpa (100 per cent basis) Yandi Project approved on 14 June 2018.

mine.

(Australia)

85%

(i) Includes initial funding of US$184 million announced on 26 June 2017.

7

Coal

Production

Jun FY18 Jun Q18 Jun Q18

2018 vs vs vs

FY18 Qtr FY17 Jun Q17 Mar Q18

------ ------ ----- -------- --------

Metallurgical coal (kt) 42,640 12,009 7% 41% 16%

Energy coal (kt) 29,158 9,023 0% 10% 48%

Metallurgical coal - Metallurgical coal production for the 2018

financial year increased by seven per cent to a record 43 Mt.

Production is expected to increase to between 43 and 46 Mt in the

2019 financial year, with volumes weighted to the second half of

the year. An extensive maintenance program is planned for the first

half of the 2019 financial year, with a corresponding impact

expected on production and unit costs.

At Queensland Coal, record production for the 2018 financial

year was supported by record stripping performance, increased truck

hours and higher wash-plant utilisation from low-cost

debottlenecking activities. Production records were achieved at

Peak Downs, Saraji, Caval Ridge, South Walker Creek and Poitrel. In

the June 2018 quarter production increased by 16 per cent from the

previous quarter following improved operational conditions at

Blackwater (geotechnical issues) and Broadmeadow (challenging roof

conditions), increased feed rates at the Caval Ridge wash-plant,

and utilisation of additional wash-plant capacity at Poitrel

following the purchase of the remaining 50 per cent of the Red

Mountain processing facility.

On 30 May 2018, BHP announced it has entered into an arrangement

to sell the Gregory Crinum mine, which was placed into care and

maintenance in January 2016, to Sojitz Corporation(5) . Completion

of the sale is subject to the fulfilment of conditions precedent

including customary regulatory approvals, which could take several

months.

On the Central Queensland Coal Network, where Aurizon is the

rail track provider, we continue to engage with stakeholders and

encourage Aurizon to ensure infrastructure productivity is

maximised while they await the Queensland Competition Authority's

final decision in respect of Access Undertaking 5 (UT5).

The Caval Ridge Southern Circuit project is progressing

according to plan, and is expected to ramp-up early in the 2019

financial year. A longwall move at Broadmeadow is scheduled for the

December 2018 quarter.

Energy coal - Energy coal production for the 2018 financial year

was flat at 29 Mt. Production is expected to remain broadly

unchanged at approximately 28 to 29 Mt in the 2019 financial

year.

New South Wales Energy Coal production increased by two per

cent, supported by record production and sales volumes during the

June 2018 quarter from improved stripping performance, utilisation

of raw coal inventory build from the prior quarter and additional

bypass coal. Increasing stripping requirements in the September

2018 quarter are expected to result in lower production rates for

the quarter compared to the remainder of the 2019 financial year.

This was offset by a three per cent decline in Cerrejón production

due to unfavourable weather impacts on mine sequencing, equipment

availability and higher strip ratio areas being mined.

Other

Nickel production

Jun FY18 Jun Q18 Jun Q18

2018 vs vs vs

FY18 Qtr FY17 Jun Q17 Mar Q18

----- ----- ----- -------- --------

Nickel (kt) 90.6 24.9 6% (1%) 21%

Nickel - Nickel West production for the 2018 financial year

increased by six per cent to 91 kt, with increased production at

the Mt Keith and Leinster operations supporting record metal

production. Nickel production for the 2019 financial year is

expected to remain broadly unchanged from the 2018 financial

year.

8

Potash project

Project and Investment

ownership (US$m) Scope Progress

------------- ---------- ------------------------------------------------------------------------------------- -------------------------------------------------------------------------------------------

Jansen Potash 2,700 Investment to finish the excavation and lining of the production and service shafts, Budget revised to fund support services at the site as work continues on completion of the

and to shafts. The project is 79% complete.

continue the installation of essential surface infrastructure and utilities.

(Canada)

100%

Minerals exploration

Minerals exploration expenditure for the 2018 financial year was

US$165 million, of which US$124 million was expensed. Greenfield

minerals exploration is predominantly focused on advancing copper

targets within Chile, Ecuador, Peru, Canada, South Australia and

the South-West United States.

Variance analysis relates to the relative performance of BHP

and/or its operations during the 2018 financial year compared with

the 2017 financial year, unless otherwise noted. Production

volumes, sales volumes and capital and exploration expenditure from

subsidiaries are reported on a 100 per cent basis; production and

sales volumes from equity accounted investments and other

operations are reported on a proportionate consolidation basis.

Copper equivalent production based on 2017 financial year average

realised prices.

The following footnotes apply to this Operational Review:

(1) Excludes production from Onshore US and Cerro Colorado.

(2) Excludes production from Samarco, Haju (IndoMet Coal) and New Mexico Coal.

(3) Underlying EBIT and Underlying EBITDA are used to reflect

the underlying performance of BHP. Underlying EBIT is earnings

before net finance costs, taxation and any exceptional items.

Underlying EBITDA is Underlying EBIT before depreciation,

amortisation and impairment.

(4) On 19 June 2018, BHP announced it has entered into an

agreement to sell the Cerro Colorado copper mine in Chile to EMR

Capital. The total cash consideration consist of US$230 million to

be paid to BHP after the closing of the transaction, plus

approximately US$40 million in proceeds from the post-closing sale

of certain copper inventory, and a contingent payment of up to

US$50 million to be paid in the future, depending upon copper price

performance.

(5) On 30 May 2018, BHP Billiton Mitsubishi Alliance (BMA)

announced it has entered into an agreement to sell the Gregory

Crinum coal mine in central Queensland to Sojitz Corporation for

A$100 million (100 per cent basis). In addition to the sale of the

mine to Sojitz, BHP will be providing appropriate funding for

rehabilitation of existing areas of disturbance at the site, with

all rehabilitation liabilities transferred to Sojitz on

completion.

The following abbreviations may have been used throughout this

report: barrels (bbl); billion cubic feet (bcf); cost and freight

(CFR); cost, insurance and freight (CIF); dry metric tonne unit

(dmtu); free on board (FOB); grams per tonne (g/t); kilograms per

tonne (kg/t); kilometre (km); metre (m); million barrels of oil

equivalent (MMboe); million cubic feet per day (MMcf/d); million

tonnes (Mt); million tonnes per annum (Mtpa); ounces (oz); pounds

(lb); thousand barrels of oil equivalent (Mboe); thousand ounces

(koz); thousand standard cubic feet (Mscf); thousand tonnes (kt);

thousand tonnes per annum (ktpa); thousand tonnes per day (ktpd);

tonnes (t); and wet metric tonnes (wmt).

In this release, the terms 'BHP', 'Group', 'BHP Group', 'we',

'us', 'our' and ourselves' are used to refer to BHP Billiton

Limited, BHP Billiton Plc and, except where the context otherwise

requires, their respective subsidiaries as defined in note 28

'Subsidiaries' in section 5.1 of BHP's 30 June 2017 Annual Report

on Form 20-F and in note 13 'Related undertaking of the Group' in

section 5.2 of BHP's 30 June 2017 Annual Report on Form 20-F.

Notwithstanding that this release may include production and other

data from non-operated assets, non-operated assets are not included

in the BHP Group.

9

Further information on BHP can be found at: bhp.com

Media Relations Investor Relations

Email: media.relations@bhpbilliton.com Email: investor.relations@bhpbilliton.com

Australia and Asia Australia and Asia

Ben Pratt Tara Dines

Tel: +61 3 9609 3672 Mobile: +61 Tel: +61 3 9609 2222 Mobile:

419 968 734 +61 499 249 005

United Kingdom and South Africa United Kingdom and South Africa

Neil Burrows Elisa Morniroli

Tel: +44 20 7802 7484 Mobile: Tel: +44 20 7802 7611 Mobile:

+44 7786 661 683 +44 7825 926 646

North America Americas

Judy Dane James Wear

Tel: +1 713 961 8283 Mobile: +1 Tel: +1 713 993 3737 Mobile:

713 299 5342 +1 347 882 3011

BHP Billiton Limited ABN 49 004 BHP Billiton Plc Registration

028 077 number 3196209

LEI WZE1WSENV6JSZFK0JC28 LEI 549300C116EOWV835768

Registered in Australia Registered in England and Wales

Registered Office: Level 18, 171 Registered Office: Nova South,

Collins Street 160 Victoria Street

Melbourne Victoria 3000 Australia London SW1E 5LB United Kingdom

Tel +61 1300 55 4757 Fax +61 3 Tel +44 20 7802 4000 Fax +44

9609 3015 20 7802 4111

Members of BHP which is

headquartered in Australia

Follow us on social media

10

Production summary

Quarter ended Year to date

-------------------------------------------- ------------------

BHP Jun Sep Dec Mar Jun Jun Jun

interest 2017 2017 2017 2018 2018 2018 2017

------- ------- ------- ------- -------- -------- --------

Petroleum (1)

Petroleum

Crude oil, condensate

and NGL (Mboe)

Onshore US 8,501 7,079 7,423 6,256 8,266 29,024 34,371

Conventional 15,612 15,090 14,869 13,960 13,486 57,405 62,708

Total 24,113 22,169 22,292 20,216 21,752 86,429 97,079

Natural gas (bcf)

Onshore US 67.2 61.4 60.5 64.1 72.5 258.5 275.0

Conventional 99.5 107.3 96.1 82.9 90.7 377.0 392.8

Total 166.7 168.7 156.6 147.0 163.2 635.5 667.8

Total petroleum production

(MMboe) 51.9 50.3 48.4 44.7 49.0 192.4 208.4

Copper (2)

Copper

Payable metal in concentrate

(kt)

Escondida (3) 57.5% 162.4 196.3 238.5 244.9 246.1 925.8 539.6

Antamina 33.8% 38.5 35.9 33.8 35.2 34.6 139.5 133.8

Total 200.9 232.2 272.3 280.1 280.7 1,065.3 673.4

Cathode (kt)

Escondida (3) 57.5% 62.8 71.9 76.1 69.4 70.1 287.5 232.0

Pampa Norte (4) 100% 72.3 58.0 68.4 66.8 70.6 263.8 254.3

Olympic Dam 100% 51.4 42.0 12.2 40.5 42.0 136.7 166.3

Total 186.5 171.9 156.7 176.7 182.7 688.0 652.6

Total copper (kt) 387.4 404.1 429.0 456.8 463.4 1,753.3 1,326.0

Lead

Payable metal in concentrate

(t)

Antamina 33.8% 1,799 1,415 1,009 464 546 3,434 5,473

Total 1,799 1,415 1,009 464 546 3,434 5,473

Zinc

Payable metal in concentrate

(t)

Antamina 33.8% 29,076 29,201 29,054 25,562 35,983 119,800 87,502

Total 29,076 29,201 29,054 25,562 35,983 119,800 87,502

Gold

Payable metal in concentrate

(troy oz)

Escondida (3) 57.5% 33,941 50,525 50,279 59,953 68,345 229,102 110,858

Olympic Dam (refined

gold) 100% 28,188 13,101 15,969 28,989 33,497 91,556 104,146

Total 62,129 63,626 66,248 88,942 101,842 320,658 215,004

Silver

Payable metal in concentrate

(troy koz)

Escondida (3) 57.5% 1,234 1,737 2,193 2,339 2,527 8,796 4,326

Antamina 33.8% 1,691 1,596 1,331 1,189 1,321 5,437 5,783

Olympic Dam (refined

silver) 100% 243 131 135 248 278 792 768

Total 3,168 3,464 3,659 3,776 4,126 15,025 10,877

12

Quarter ended Year to date

------------------------------------------- ------------------

BHP Jun Sep Dec Mar Jun Jun Jun

interest 2017 2017 2017 2018 2018 2018 2017

------- ------- ------- ------- ------- -------- --------

Uranium

Payable metal in concentrate

(t)

Olympic Dam 100% 737 880 243 1,118 1,123 3,364 3,661

Total 737 880 243 1,118 1,123 3,364 3,661

Molybdenum

Payable metal in concentrate

(t)

Antamina 33.8% 328 402 579 420 261 1,662 1,144

Total 328 402 579 420 261 1,662 1,144

Iron Ore

Iron Ore

Production (kt) (5)

Newman 85% 16,241 13,842 18,317 16,412 18,500 67,071 68,283

Area C Joint Venture 85% 13,016 13,099 13,575 12,802 12,041 51,517 48,744

Yandi Joint Venture 85% 17,415 14,559 16,348 15,802 17,339 64,048 65,355

Jimblebar (6) 85% 5,891 6,283 4,583 4,669 15,092 30,627 21,950

Wheelarra 85% 7,578 7,804 8,734 8,006 614 25,158 27,020

Samarco 50% - - - - - - -

Total 60,141 55,587 61,557 57,691 63,586 238,421 231,352

Coal

Metallurgical coal

Production (kt) (7)

BMA 50% 6,394 8,296 7,394 7,983 9,220 32,893 31,458

BHP Mitsui Coal (8) 80% 2,100 2,271 2,291 2,396 2,789 9,747 8,312

Haju (9) 75% - - - - - - 129

Total 8,494 10,567 9,685 10,379 12,009 42,640 39,899

Energy coal

Production (kt)

USA 100% - - - - - - 451

Australia 100% 5,711 4,235 4,383 3,662 6,261 18,541 18,176

Colombia 33.3% 2,475 2,497 2,914 2,444 2,762 10,617 10,959

Total 8,186 6,732 7,297 6,106 9,023 29,158 29,586

Other

Nickel

Saleable production

(kt)

Nickel West 100% 25.2 22.8 22.4 20.5 24.9 90.6 85.1

Total 25.2 22.8 22.4 20.5 24.9 90.6 85.1

13

(1) LPG and ethane are reported as natural gas liquids (NGL).

Product-specific conversions are made and NGL is reported in

barrels of oil equivalent (boe). Total boe conversions are based on

6 bcf of natural gas equals 1 MMboe.

(2) Metal production is reported on the basis of payable metal.

(3) Shown on a 100% basis. BHP interest in saleable production is 57.5%.

(4) Includes Cerro Colorado and Spence.

(5) Iron ore production is reported on a wet tonnes basis.

(6) Shown on a 100% basis. BHP interest in saleable production is 85%.

(7) Metallurgical coal production is reported on the basis of

saleable product. Production figures include some thermal coal.

(8) Shown on a 100% basis. BHP interest in saleable production is 80%.

(9) Shown on a 100% basis. BHP interest in saleable production is 75%.

Throughout this report figures in italics indicate that this

figure has been adjusted since it was previously reported.

14

Production and sales report

Quarter ended Year to date

-------------------------------------- ----------------

Jun Sep Dec Mar Jun Jun Jun

2017 2017 2017 2018 2018 2018 2017

------ ------ ------ ------ ------ ------- -------

Petroleum (1)

Bass Strait

Crude oil and condensate (Mboe) 1,552 1,815 1,513 1,126 1,361 5,815 6,599

NGL (Mboe) 1,661 1,950 1,584 1,170 1,428 6,132 6,459

Natural gas (bcf) 37.4 42.6 32.9 20.5 29.9 125.9 139.3

Total petroleum products (MMboe) 9.4 10.9 8.6 5.7 7.8 32.9 36.3

North West Shelf

Crude oil and condensate (Mboe) 1,314 1,474 1,442 1,377 1,267 5,560 5,507

NGL (Mboe) 209 227 200 210 186 823 964

Natural gas (bcf) 32.5 36.2 36.2 35.8 34.2 142.4 140.3

Total petroleum products (MMboe) 6.9 7.7 7.7 7.6 7.2 30.1 29.9

Pyrenees

Crude oil and condensate (Mboe) 1,606 1,510 1,210 1,250 1,168 5,138 6,517

Total petroleum products (MMboe) 1.6 1.5 1.2 1.3 1.2 5.1 6.5

Other Australia (2)

Crude oil and condensate (Mboe) 9 9 8 8 7 32 35

Natural gas (bcf) 16.3 16.1 13.3 13.4 13.9 56.7 66.1

Total petroleum products (MMboe) 2.7 2.7 2.2 2.2 2.3 9.5 11.1

Atlantis (3)

Crude oil and condensate (Mboe) 3,637 3,022 3,377 3,459 3,471 13,329 13,835

NGL (Mboe) 213 218 195 248 217 878 923

Natural gas (bcf) 1.9 1.6 1.8 1.8 1.5 6.7 7.1

Total petroleum products (MMboe) 4.2 3.5 3.9 4.0 3.9 15.3 15.9

Mad Dog (3)

Crude oil and condensate (Mboe) 1,167 1,020 1,231 1,140 581 3,972 4,472

NGL (Mboe) 68 44 72 55 27 198 215

Natural gas (bcf) 0.2 0.1 0.2 0.2 0.1 0.6 0.7

Total petroleum products (MMboe) 1.3 1.1 1.3 1.2 0.6 4.3 4.8

Shenzi (3)

Crude oil and condensate (Mboe) 2,588 2,291 2,513 2,323 2,110 9,237 10,587

NGL (Mboe) 179 141 184 140 151 616 565

Natural gas (bcf) 0.6 0.4 0.5 0.4 0.4 1.7 2.1

Total petroleum products (MMboe) 2.9 2.5 2.8 2.5 2.3 10.1 11.5

Eagle Ford (4)

Crude oil and condensate (Mboe) 4,278 3,457 3,720 2,838 3,826 13,841 17,608

NGL (Mboe) 2,240 1,856 2,100 1,555 1,767 7,278 9,021

Natural gas (bcf) 15.1 13.8 14.4 12.6 13.9 54.7 63.8

Total petroleum products (MMboe) 9.0 7.6 8.2 6.5 7.9 30.2 37.3

15

Quarter ended Year to date

-------------------------------------- ---------------

Jun Sep Dec Mar Jun Jun Jun

2017 2017 2017 2018 2018 2018 2017

------ ------ ------ ------ ------ ------- ------

Permian (4)

Crude oil and condensate (Mboe) 1,336 1,179 1,142 1,398 1,903 5,622 5,331

NGL (Mboe) 646 587 460 465 770 2,282 2,388

Natural gas (bcf) 6.2 4.5 3.6 4.1 6.4 18.6 19.0

Total petroleum products (MMboe) 3.0 2.5 2.2 2.5 3.7 11.0 10.9

Haynesville (4)

Crude oil and condensate (Mboe) 1 - 1 - - 1 5

NGL (Mboe) - - - - - - 18

Natural gas (bcf) 21.4 21.5 22.0 28.7 33.1 105.3 95.6

Total petroleum products (MMboe) 3.6 3.6 3.7 4.8 5.5 17.6 16.0

Fayetteville (4)

Natural gas (bcf) 24.5 21.6 20.5 18.7 19.1 79.9 96.6

Total petroleum products (MMboe) 4.1 3.6 3.4 3.1 3.2 13.3 16.1

16

Production and sales report

Quarter ended Year to date

------------------------------------------- ------------------

Jun Sep Dec Mar Jun Jun Jun

2017 2017 2017 2018 2018 2018 2017

------- ------- ------- ------- ------- -------- --------

Petroleum (1) (continued)

Trinidad/Tobago

Crude oil and condensate (Mboe) 139 118 135 232 233 718 562

Natural gas (bcf) 9.4 9.7 10.5 10.0 9.8 40.0 32.6

Total petroleum products (MMboe) 1.7 1.7 1.9 1.9 1.9 7.4 6.0

Other Americas (3)

(5)

Crude oil and condensate (Mboe) 238 229 207 189 313 938 1,039

NGL (Mboe) 10 5 3 3 22 33 22

Natural gas (bcf) 0.1 0.1 0.1 - 0.3 0.5 0.4

Total petroleum products (MMboe) 0.3 0.3 0.2 0.2 0.4 1.1 1.1

UK

Crude oil and condensate (Mboe) 64 40 22 43 38 143 268

NGL (Mboe) 16 39 13 18 18 88 119

Natural gas (bcf) 1.1 0.5 0.6 0.8 0.6 2.5 4.2

Total petroleum products (MMboe) 0.3 0.2 0.1 0.2 0.2 0.6 1.1

Algeria

Crude oil and condensate (Mboe) 942 938 960 969 888 3,755 4,020

Total petroleum products (MMboe) 0.9 0.9 1.0 1.0 0.9 3.8 4.0

BHP Petroleum

Crude oil and condensate

Onshore US (Mboe) 5,615 4,636 4,863 4,236 5,729 19,464 22,944

Conventional (Mboe) 13,256 12,466 12,618 12,116 11,437 48,637 53,441

Total (Mboe) 18,871 17,102 17,481 16,352 17,166 68,101 76,385

NGL

Onshore US (Mboe) 2,886 2,443 2,560 2,020 2,537 9,560 11,427

Conventional (Mboe) 2,356 2,624 2,251 1,844 2,049 8,768 9,267

Total (Mboe) 5,242 5,067 4,811 3,864 4,586 18,328 20,694

Natural gas

Onshore US (bcf) 67.2 61.4 60.5 64.1 72.5 258.5 275.0

Conventional (bcf) 99.5 107.3 96.1 82.9 90.7 377.0 392.8

Total (bcf) 166.7 168.7 156.6 147.0 163.2 635.5 667.8

Total petroleum products

Onshore US (Mboe) 19,701 17,312 17,506 16,939 20,349 72,107 80,204

Conventional (Mboe) 32,195 32,973 30,886 27,777 28,603 120,238 128,175

Total (Mboe) 51,896 50,286 48,392 44,716 48,952 192,346 208,379

(1) Total boe conversions are based on 6 bcf of natural gas

equals 1 MMboe. Negative production figures represent finalisation

adjustments.

(2) Other Australia includes Minerva and Macedon.

(3) Gulf of Mexico volumes are net of royalties.

(4) Onshore US volumes are net of mineral holder royalties.

(5) Other Americas includes Neptune, Genesis and Overriding

Royalty Interest.

17

Production and sales report

Quarter ended Year to date

----------------------------------------------- ------------------

Jun Sep Dec Mar Jun Jun Jun

2017 2017 2017 2018 2018 2018 2017

------- -------- -------- -------- -------- -------- --------

Copper

Metals production is payable metal

unless otherwise stated.

Escondida, Chile (1)

Material mined (kt) 93,389 104,867 101,371 103,385 106,788 416,411 316,801

Sulphide ore milled (kt) 18,777 24,080 30,260 32,203 31,732 118,275 67,484

Average concentrator

head grade (%) 1.07% 1.06% 0.98% 0.96% 0.96% 0.99% 0.99%

Production ex mill (kt) 167.0 204.2 245.7 252.6 253.6 956.1 557.5

Production

Payable copper (kt) 162.4 196.3 238.5 244.9 246.1 925.8 539.6

Copper cathode (EW) (kt) 62.8 71.9 76.1 69.4 70.1 287.5 232.0

- Oxide leach (kt) 20.3 22.4 27.4 24.5 27.1 101.4 80.4

- Sulphide leach (kt) 42.5 49.5 48.7 44.9 43.0 186.1 151.6

Total copper (kt) 225.2 268.2 314.6 314.3 316.2 1,213.3 771.6

(troy

Payable gold concentrate oz) 33,941 50,525 50,279 59,953 68,345 229,102 110,858

(troy

Payable silver concentrate koz) 1,234 1,737 2,193 2,339 2,527 8,796 4,326

Sales

Payable copper (kt) 163.3 195.1 236.7 228.3 260.3 920.4 534.6

Copper cathode (EW) (kt) 56.0 61.6 84.1 61.7 80.9 288.3 232.8

(troy

Payable gold concentrate oz) 33,941 50,525 50,279 59,953 68,345 229,102 110,858

(troy

Payable silver concentrate koz) 1,234 1,737 2,193 2,339 2,527 8,796 4,326

(1) Shown on a 100% basis. BHP interest in saleable production

is 57.5%.

Pampa Norte, Chile

Cerro Colorado

Material mined (kt) 15,760 21,381 20,191 17,766 17,918 77,256 58,235

Ore milled (kt) 4,411 3,951 4,611 4,905 4,833 18,300 15,173

Average copper grade (%) 0.53% 0.62% 0.59% 0.58% 0.58% 0.59% 0.60%

Production

Copper cathode (EW) (kt) 18.8 13.3 17.4 13.6 19.0 63.3 64.7

Sales

Copper cathode (EW) (kt) 19.8 12.3 17.7 13.7 20.9 64.6 65.5

Spence

Material mined (kt) 24,230 22,314 23,096 21,463 23,103 89,976 93,442

Ore milled (kt) 4,968 5,375 4,919 5,144 4,009 19,447 20,093

Average copper grade (%) 1.13% 1.21% 1.18% 1.03% 1.11% 1.13% 1.14%

Production

Copper cathode (EW) (kt) 53.5 44.7 51.0 53.2 51.6 200.5 189.6

Sales

Copper cathode (EW) (kt) 55.7 43.0 52.2 49.8 57.1 202.1 187.4

18

Production and sales report

Quarter ended Year to date

------------------------------------------------ -----------------

Jun Sep Dec Mar Jun Jun Jun

2017 2017 2017 2018 2018 2018 2017

------- ------ --------- -------- ---------- ------- --------

Copper (continued)

Metals production is payable

metal unless otherwise stated.

Antamina, Peru

Material mined (100%) (kt) 62,254 59,216 59,125 58,085 59,002 235,428 244,491

Sulphide ore milled

(100%) (kt) 13,229 12,822 13,098 12,166 12,973 51,059 52,105

Average head grades

- Copper (%) 1.00% 0.94% 0.89% 1.01% 0.91% 0.94% 0.89%

- Zinc (%) 0.95% 0.99% 0.93% 1.01% 1.19% 1.03% 0.80%

Production

Payable copper (kt) 38.5 35.9 33.8 35.2 34.6 139.5 133.8

Payable zinc (t) 29,076 29,201 29,054 25,562 35,983 119,800 87,502

(troy

Payable silver koz) 1,691 1,596 1,331 1,189 1,321 5,437 5,783

Payable lead (t) 1,799 1,415 1,009 464 546 3,434 5,473

Payable molybdenum (t) 328 402 579 420 261 1,662 1,144

Sales

Payable copper (kt) 36.9 31.9 37.0 32.1 36.6 137.6 132.9

Payable zinc (t) 27,936 25,224 30,340 26,456 33,088 115,108 89,982

(troy

Payable silver koz) 1,513 1,475 1,470 1,052 1,311 5,308 5,482

Payable lead (t) 1,493 1,624 972 859 595 4,050 4,835

Payable molybdenum (t) - 168 693 500 388 1,749 1,124

Olympic Dam, Australia

Material mined (1) (kt) 1,974 1,851 1,391 2,056 2,201 7,499 8,008

Ore milled (kt) 2,097 2,302 554 2,188 2,171 7,215 8,604

Average copper grade (%) 2.30% 2.10% 2.22% 2.36% 2.12% 2.19% 2.08%

Average uranium grade (kg/t) 0.58 0.55 0.58 0.71 0.69 0.64 0.62

Production

Copper cathode (ER

and EW) (kt) 51.4 42.0 12.2 40.5 42.0 136.7 166.3

Uranium oxide concentrate (t) 737 880 243 1,118 1,123 3,364 3,661

(troy

Refined gold oz) 28,188 13,101 15,969 28,989 33,497 91,556 104,146

(troy

Refined silver koz) 243 131 135 248 278 792 768

Sales

Copper cathode (ER

and EW) (kt) 51.5 31.6 24.3 36.8 46.0 138.7 163.7

Uranium oxide concentrate (t) 1,298 680 338 509 1,230 2,757 4,105

(troy

Refined gold oz) 24,726 22,435 17,999 20,715 35,714 96,863 97,194

(troy

Refined silver koz) 251 219 118 202 307 846 746

(1) Material mined refers to run of mine ore mined and

hoisted.

19

Production and sales report

Quarter ended Year to date

------------------------------------------- ------------------

Jun Sep Dec Mar Jun Jun Jun

2017 2017 2017 2018 2018 2018 2017

------- ------- ------- ------- ------- -------- --------

Iron Ore

Iron ore production and sales are

reported on a wet tonnes basis.

Pilbara, Australia

Production

Newman (kt) 16,241 13,842 18,317 16,412 18,500 67,071 68,283

Area C Joint Venture (kt) 13,016 13,099 13,575 12,802 12,041 51,517 48,744

Yandi Joint Venture (kt) 17,415 14,559 16,348 15,802 17,339 64,048 65,355

Jimblebar (1) (kt) 5,891 6,283 4,583 4,669 15,092 30,627 21,950

Wheelarra (kt) 7,578 7,804 8,734 8,006 614 25,158 27,020

Total production (kt) 60,141 55,587 61,557 57,691 63,586 238,421 231,352

Total production (100%) (kt) 69,714 64,287 71,611 67,048 72,145 275,091 268,302

Sales

Lump (kt) 15,104 13,896 15,145 13,993 15,173 58,207 56,191

Fines (kt) 46,249 40,733 45,769 44,332 47,730 178,564 175,017

Total (kt) 61,353 54,629 60,914 58,325 62,903 236,771 231,208

Total sales (100%) (kt) 71,149 63,322 70,733 67,799 71,385 273,239 268,226

(1) Shown on a 100% basis. BHP interest in saleable production

is 85%.

Samarco, Brazil (1)

Production (kt) -- - - - - -

Sales (kt) --14 25 -39 47

(1) Mining and processing operations remain suspended following

the failure of the Fundão tailings dam and Santarém water dam on 5

November 2015.

20

Production and sales report

Quarter ended Year to date

----------------------------------------- ----------------

Jun Sep Dec Mar Jun Jun Jun

2017 2017 2017 2018 2018 2018 2017

------ ------- ------ ------- ------- ------- -------

Coal

Coal production is reported on the basis of saleable product.

Queensland Coal

Production (1)

BMA

Blackwater (kt) 1,766 1,985 1,470 1,384 1,849 6,688 7,296

Goonyella (kt) 1,157 1,639 1,369 2,314 2,639 7,961 7,355

Peak Downs (kt) 1,238 1,602 1,367 1,723 1,658 6,350 6,055

Saraji (kt) 913 1,414 1,198 1,240 1,201 5,053 4,734

Daunia (kt) 560 662 718 547 629 2,556 2,560

Caval Ridge (kt) 760 994 1,272 775 1,244 4,285 3,458

Total BMA (kt) 6,394 8,296 7,394 7,983 9,220 32,893 31,458

BHP Mitsui Coal (2)

South Walker Creek (kt) 1,348 1,400 1,524 1,490 1,615 6,029 5,123

Poitrel (kt) 752 871 767 906 1,174 3,718 3,189

Total BHP Mitsui Coal (kt) 2,100 2,271 2,291 2,396 2,789 9,747 8,312

Total Queensland Coal (kt) 8,494 10,567 9,685 10,379 12,009 42,640 39,770

Sales

Coking coal (kt) 5,496 7,934 6,341 7,177 8,489 29,941 27,527

Weak coking coal (kt) 2,502 3,150 2,816 2,598 2,866 11,430 10,721

Thermal coal (kt) 142 102 173 168 85 528 598

Total (kt) 8,140 11,186 9,330 9,943 11,440 41,899 38,846

(1) Production figures include some thermal coal.

(2) Shown on a 100% basis. BHP interest in saleable production

is 80%.

Haju, Indonesia (1)

Production (kt) ------129

Sales - export (kt) ------117

(1) Shown on 100% basis. BHP interest in saleable production is

75%. BHP completed the sale of IndoMet Coal on 14 October 2016.

New Mexico, USA

Production

Navajo Coal (1) (kt) - - - - - - 451

Total (kt) - - - - - - 451

Sales thermal coal

- local utility - - - - - - 105

(1) The divestment of Navajo Coal was completed on 29 July 2016,

with no further production reported by BHP.

Management of Navajo Coal was transferred to Navajo Transitional

Energy Company on 31 December 2016.

21

NSW Energy Coal, Australia

Production (kt) 5,711 4,235 4,383 3,662 6,261 18,541 18,176

Sales

Export thermal coal (kt) 4,913 3,622 4,048 3,181 5,795 16,646 16,499

Inland thermal coal (kt) 327 405 411 400 160 1,376 1,400

Total (kt) 5,240 4,027 4,459 3,581 5,955 18,022 17,899

Cerrejón, Colombia

Production (kt) 2,475 2,497 2,914 2,444 2,762 10,617 10,959

Sales thermal coal

- export (kt) 2,803 2,518 2,619 2,480 2,763 10,380 11,043

Production and sales report

Quarter ended Year to date

-------------------------------------- ---------------

Jun Sep Dec Mar Jun Jun Jun

2017 2017 2017 2018 2018 2018 2017

------ ------ ------ ------ ------ ------- ------

Other

Nickel production is reported

on the basis of saleable product

Nickel West, Australia

Production

Nickel contained in

concentrate (kt) - - - - - - 0.7

Nickel contained in

finished matte (kt) 5.3 6.8 4.6 1.3 6.4 19.1 13.5

Nickel metal (kt) 19.9 16.0 17.8 19.2 18.5 71.5 70.9

Total nickel production (kt) 25.2 22.8 22.4 20.5 24.9 90.6 85.1

Sales

Nickel contained in

concentrate (kt) - - - - - - 0.7

Nickel contained in

finished matte (kt) 4.9 4.6 6.4 2.1 5.9 19.0 13.0

Nickel metal (kt) 18.1 16.6 17.9 19.7 17.8 72.0 69.3

Total nickel sales (kt) 23.0 21.2 24.3 21.8 23.7 91.0 83.0

22

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

DRLDBGDRDUBBGIR

(END) Dow Jones Newswires

July 18, 2018 02:00 ET (06:00 GMT)

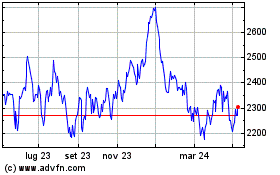

Grafico Azioni Bhp (LSE:BHP)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Bhp (LSE:BHP)

Storico

Da Mag 2023 a Mag 2024