Athelney Trust PLC Net Asset Value(s) (6651V)

04 Dicembre 2019 - 12:05PM

UK Regulatory

TIDMATY

RNS Number : 6651V

Athelney Trust PLC

04 December 2019

Athelney Trust PLC

Legal Entity Identifier:

213800ON67TJC7F4DL05

The unaudited net asset value of Athelney Trust was 254p at 30

November 2019.

Fund Manager's comment for November 2019

Minutes from the recent FOMC meeting indicated the Fed is

content to remain on the side lines for the rest of this year as

the looser financial conditions resulting from rate cuts at three

consecutive meetings feed through to the economy. This sentiment is

echoed by other Central banks with the Bank of England and the

Reserve Bank of Australia opting to keep their official Bank Rate

at 0.75%. Global markets continued their upward trend in November

as consumer confidence in the US remained high on the back of low

interest rates, low gasoline prices and a stock market near record

highs.

Politics continues to dominate the equity markets. In the U.K. a

series of recent election polls continue to show Boris Johnson's

Conservative Party has a significant lead over the opposition

Labour Party. The current margin of support points to a

parliamentary majority for the Conservatives which will allow them

to execute their Brexit plan. However, much can still change before

the election on 12 December 2019. In Germany, Chancellor Angela

Merkel's coalition is on a knife edge and in spite of the release

of recent data showing a slight rebound in business confidence,

economic growth is likely to be sluggish.

After falling by 3.7% in October, energy commodity prices

increased by 5.3% in November resulting in a year to date increase

of 2.7%. Non energy commodities did not perform quite as well,

increasing by 2.3% and are currently up by 1.9% year to date.

The major world markets as represented by the MSCI World Index

and the S&P 500 continued their upward trend in November with

these indices up by 2.63% and 3.40% respectively. The UK, European

and Asian markets were also stronger. In the UK, the FTSE increased

by 1.35% in local currency terms with the Small Cap Index up by

3.03%. The AIM All Share Index was the best performing of the UK

indices, increasing by 3.25% while the Fledgling Index increased by

only 1.0%.

Our portfolio of investments performed much better than the

market, increasing by 5.64% during the month which, after allowing

for expenses resulted in a 5.44% improvement in the NAV. We

utilised some of our surplus cash, adding to our position in Close

Brothers, XP Power and LXI Reit during the month. Cash held

currently comprises 3.9% of the portfolio.

Fact Sheet

An accompanying fact sheet which includes the information above

as well as wider details on the portfolio can be found on the

Fund's website www.athelneytrust.co.uk under "Portfolio

Details".

Background Information

Dr. Emmanuel (Manny) Pohl

Manny is Chairman and Chief Investment Officer of E C Pohl &

Co ("ECP"), an investment management company and has been a major

shareholder in Athelney trust for many years.

E C Pohl & co is licensed by the Australian Financial

services (licence no.421704).

www.ecpohl.com

www.ecpam.com

Manny Pohl and the ECP group has over AU$1000m under its

management including four listed investment companies, three listed

in Australia and one in the UK:

-- Flagship Investments (ASX code:FSI)

AUD56m https://flagshipinvestments.com.au

-- Barrack St Investments (ASX code: BST)

AUD25m www.barrackst.com

-- Global Masters Fund Limited (ASX code: GFL)

AUD27m www.globalmastersfund.com.au

-- Athelney Trust plc (LSE code: ATY)

GBP5m www.athelneytrust.co.uk

Athelney Trust plc Investment Policy

The investment objective of the Trust is to provide shareholders

with prospects of long-term capital growth with the risks inherent

in small cap investment minimised through a spread of holdings in

quality small cap companies that operate in various industries and

sectors. The Fund Manager also considers that it is important to

maintain a progressive dividend record.

The assets of the Trust are allocated predominantly to companies

with either a full listing on the London Stock Exchange or a

trading facility on AIM or ISDX. The assets of the Trust have been

allocated in two main ways: first, to the shares of those companies

which have grown steadily over the years in terms of profits and

dividends but, despite this progress, the market rating is

favourable when compared to future earnings and dividends; second,

to those companies whose shares are standing at a favourable level

compared with the value of land, buildings or cash in the balance

sheet.

Athelney Trust was founded in 1994. In 1996 it was one of the

ten pioneer members of the Alternative Investment Market ("AIM").

In 2008 the shares became fully listed on the main market of the

London Stock Exchange. Athelney Trust has a successful progressive

dividend growth record and the dividend has grown every year since

2004. According to the Association of Investment Companies (AIC)

Athelney Trust is one of only "22 investment companies that have

increased their dividend every year between 10 and 20 years - the

next generation of dividend heroes" (as at 20/03/2018). See

link

www.theaic.co.uk/aic/news/press-releases/next-generation-of-dividend-heroes

Website

www.athelneytrust.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

NAVBBBDDUGGBGCS

(END) Dow Jones Newswires

December 04, 2019 06:05 ET (11:05 GMT)

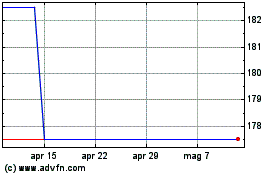

Grafico Azioni Athelney (LSE:ATY)

Storico

Da Mar 2024 a Apr 2024

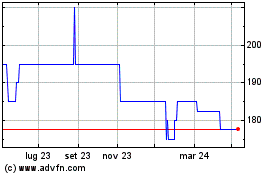

Grafico Azioni Athelney (LSE:ATY)

Storico

Da Apr 2023 a Apr 2024