Regulatory News:

Vivendi (Paris:VIV):

- Revenues increased 14.1% (up 5.6% on a constant basis) due

in particular to the very strong performance of Universal Music

Group (UMG)

- EBITA increased 18.5% (up 10.8% on a constant basis)

supported by:

- another record year for UMG

- the international growth at Canal+

- the strength of the Havas business model

- the success of the Editis integration

- Adjusted net income increased 50.5% to €1.7 billion

- Proposed dividend with respect to 2019 of €0.60 per share

(up 20%)

2019 KEY FIGURES

% change year-on-

year

% change year-on-

year at constant

currency and perimeter1

Revenues

€15,898 M

+14.1%

+5.6%

EBITA2,3

€1,526 M

+18.5%

+10.8%

EBIT3

€1,381 M

+16.9%

Earnings attributable to Vivendi SA

shareowners3

€1,583 M

x12.5

Adjusted net income2,3

€1,741 M

+50.5%

This press release contains audited consolidated financial

figures established under IFRS, which were approved by Vivendi’s

Management Board on February 10, 2020, reviewed by the Vivendi

Audit Committee on February 11, 2020, and by Vivendi’s Supervisory

Board on February 13, 2020 under the chairmanship of Yannick

Bolloré.

________________________

1 Constant perimeter notably reflects the impacts of the

acquisition of M7 by Canal+ Group (September 12, 2019), the

acquisition of the remaining interest in Ingrooves Music Group,

which has been consolidated by Universal Music Group (March 15,

2019), the acquisition of Editis (January 31, 2019), the

acquisition of Paylogic by Vivendi Village (April 16, 2018) and the

sale of MyBestPro by Vivendi Village (December 21, 2018). 2

Non-GAAP measures. 3 A reconciliation of EBIT to EBITA, as well as

a reconciliation of earnings attributable to Vivendi SA shareowners

to adjusted net income, are presented in Appendix II.

In 2019, revenues were €15,898 million, compared to

€13,932 million in 2018, up 14.1%, mainly as a result of the growth

of Universal Music Group (UMG), Canal+ Group and the consolidation

of Editis since

February 1, 2019. At constant currency and perimeter1, revenues

increased by 5.6% compared to 2018, primarily driven by the growth

of UMG (+14.0%).

For the fourth quarter of 2019, revenues were

€4,575 million, up 12.8%, mainly as a result of the growth of UMG,

Canal+ Group and the consolidation of Editis. At constant currency

and perimeter1, revenues increased by 2.4% compared to the fourth

quarter of 2018, which was primarily driven by the growth of UMG

(+6.3%).

EBITA was €1,526 million, up 18.5%. At constant currency

and perimeter, EBITA increased by 10.8%, primarily driven by the

growth of UMG, partially offset by the decline of Canal+ Group,

primarily due to restructuring charges.

EBITA included restructuring charges of €161 million,

compared to €115 million in 2018, primarily incurred by Canal+

Group (€92 million linked in particular to the plan to transform

its French operations implemented during the second half of 2019,

compared to €28 million in 2018), Havas Group (€35 million,

compared to €30 million in 2018), UMG (€24 million, compared to €29

million in 2018) and Corporate (€2 million, compared to €19 million

in 2018).

EBIT was €1,381 million, up 16.9% compared to 2018.

Provision for income taxes reported to net income was a

net income of €140 million, compared to a net charge of €357

million in 2018. In 2019, it included a current tax income of €473

million recorded following the favorable decision issued by the

French Council of State (Conseil d’Etat) on December 19, 2019,

concerning the use of foreign tax receivables upon the exit from

the Consolidated Global Profit Tax System with respect to fiscal

years 2012 and 2015. Excluding this impact, provision for income

taxes reported to net income was a net charge of €333 million,

representing a favorable change of €24 million.

Earnings attributable to Vivendi SA shareowners was a

profit of €1,583 million (or €1.28 per share - basic), compared to

€127 million in 2018 (or €0.10 per share - basic), an increase of

€1,456 million. This change reflected in particular the increase in

EBIT (+€199 million), the improvement in other financial charges

and income (+€828 million due to the write-down in 2018 of the

value of the Telecom Italia shares for €1,066 million), and the

current tax income of €473 million mentioned above.

Adjusted net income was a profit of €1,741 million (€1.41

per share - basic), compared to €1,157 million in 2018 (€0.92 per

share - basic), an increase of 50.5%. This change mainly reflected

the increase in EBITA of €238 million and the current tax income of

€473 million.

As of December 31, 2019, Vivendi's Financial Net

Debt was €4.1 billion, compared to a Net cash position of €176

million as of December 31, 2018. This change was due to the

acquisition of Editis (€829 million) and M7 (€1.136 billion) as

well as share repurchases (€2.66 billion) and the dividend payment

(€636 million). The financial net debt to equity ratio (gearing)

was 26%.

Evolution of UMG’s share capital

On December 31, 2019, Vivendi entered into an agreement with a

Tencent-led consortium, which includes Tencent Music Entertainment

and international financial investors, for the planned equity

investment in UMG. This agreement provides for the purchase by the

consortium of 10% of UMG's share capital, based on an enterprise

value of €30 billion for 100% of UMG's share capital.

The Consortium has the option to acquire, on the same price

basis, an additional amount of up to 10% of UMG’s share capital

until January 15, 2021.

This agreement will be shortly complemented by a second

agreement allowing Tencent Music Entertainment to acquire a

minority interest in the share capital of UMG’s subsidiary that

houses its operations in Greater China.

The merger control approvals, to which this transaction was

subject, have been obtained from the relevant regulatory

authorities. The closing of the transaction is expected by the end

of the first half of 2020.

Vivendi is very happy with the arrival of Tencent and its

co-investors. It will enable UMG to further develop in the Asian

market.

In addition, Vivendi's Supervisory Board was informed of ongoing

negotiations regarding the possible sale of additional minority

interests, which negotiation engagement, based on a minimum

valuation of €30 billion, was announced on December 31, 2019. Eight

banks have been mandated by Vivendi to assist it in this matter. An

initial public offering is currently planned for early 2023 at the

latest.

The proceeds from these different operations could be used for

substantial share buyback operations and acquisitions.

Returns to shareholders

Over the past 14 months, Vivendi has returned a total of €3.5

billion to its shareholders, including €3.3 billion paid in 2019

(compared to a return of €568 million in the form of dividends in

2018), as follows:

- Between May 28, 2019, and February 4, 2020, Vivendi repurchased

115.9 million of its own shares for €2.9 billion (including 108

million shares repurchased in 2019 for €2.66 billion), representing

8.85% of the share capital as of the date of implementation of the

program;

- In 2019, Vivendi canceled a total of 130.9 million shares,

i.e.10% of the share capital as of the date of implementation of

the program, of which 96.8 million shares were repurchased under

the current program and 34.1 million shares were previously held;

and

- In April 2019, Vivendi distributed a total of €636 million in

dividends.

Pursuit of the current share buyback program

As of February 13, 2020, Vivendi directly held 22 million

treasury shares, i.e. 1.85% of the share capital as of that date,

of which 19.1 million shares designated for cancellation and 2.9

million shares were allocated to covering performance share

plans.

This program will continue until April 17, 2020 for the

remainder of its authorization, i.e. 15 million shares to be

purchased at a maximum price of €25/share.

General Shareholders’ Meeting on April 20, 2020

The General Shareholders’ Meeting to be held on April 20, 2020

will vote on the renewal of the following two authorizations

granted to the Management Board by the General Shareholders'

Meeting held on April 15, 2019:

- Authorization to repurchase shares of the company at a maximum

price of €26/share, within the limit of 10% of the share capital

(2020-2021 program); with the possibility of cancelling the shares

acquired up to the limit of 10% of the share capital; and

- Authorization to purchase shares of the company by way of a

Public Share Buyback Offer (OPRA) at a maximum price of €26/share,

within the limit of 30% of the share capital (or 20% depending on

the repurchases made under the new program which are deducted from

this 30% limit), and to cancel the shares acquired.

This General Shareholder’s Meeting will also vote on the

proposal for an ordinary dividend of €0.60 per share with respect

to the 2019 fiscal year. This amount represents an increase of 20%

over the dividend paid with respect to fiscal year 2018 (€0.50 per

share) and a yield of 2.4% (based on the average price for Vivendi

shares over the last 12 months). The ex-dividend date would be

April 21, 2020, with payment on April 23, 2020.

The renewal of Yannick Bolloré and the appointment of Laurent

Dassault to the Supervisory Board will also be proposed to

Shareholders.

Diversity

The Supervisory Board considers that gender diversity, and

diversity in general, at senior management level is of the utmost

importance. This process is already well in place within the

Group’s main businesses, in particular with the increasing presence

of women in each Executive Committee. The appointment of a female

member at Vivendi Management Board level is planned before the end

of 2020, and a second one in 2021.

Comments on the Businesses Key

Financials

Universal Music Group

In 2019, Universal Music Group’s (UMG) revenues were €7,159

million, up 14.0% at constant currency and perimeter compared to

2018 (up 18.9% on an actual basis).

Recorded music revenues grew by 11.6% at constant currency and

perimeter thanks to the growth in subscription and streaming

revenues (+21.5%) and the release driven improvement in physical

sales (+3.1%), which more than offset the continued decline in

download sales (-23.2%).

Recorded music best sellers for 2019 included new releases from

Billie Eilish, Post Malone, Taylor Swift, Ariana Grande and the

Japanese band King & Prince, as well as continued sales of the

soundtrack from A Star Is Born, The Beatles 50th anniversary

release of Abbey Road and multiple albums from Queen.

In 2019, UMG had an artist at the top of five major platforms

(Amazon, Apple, Deezer, Spotify and YouTube), and for each

platform, a different top artist (Taylor Swift, Billie Eilish, J

Balvin, Post Malone, Daddy Yankee). In addition, according to

Billboard, UMG had seven of the Top 10 singles and albums in the

United States for 2019 and the top three artists (Post Malone,

Ariana Grande and Billie Eilish).

Music publishing revenues grew by 9.2% at constant currency and

perimeter compared to 2018, also driven by increased subscription

and streaming revenues.

On February 6, 2020, Taylor Swift, one of the music industry’s

most creatively and commercially successful artist-songwriters in

history, signed an exclusive global publishing agreement with

Universal Music Publishing Group.

Merchandising and other revenues were up 73.7% at constant

currency and perimeter compared to 2018, thanks to increased

touring activity and growth in retail and D2C (direct-to-consumer)

revenues.

Driven by the growth in revenues, UMG’s EBITA was €1,124

million, up 22.3% at constant currency and perimeter compared to

2018 (+24.6% on an actual basis).

Canal+ Group

At the end of December 2019, the total subscriber portfolio

(individual and collective) of Canal+ Group's, which now includes

M7’s operations, reached 20.3 million, compared to 17.2 million at

the end of December 2018 on a pro forma basis, including 8.4

million in mainland France.

In 2019, Canal+ Group's revenues were €5,268 million, up 2.0%

compared to 2018 (down 0.9% at constant currency and

perimeter).

- Revenues from television operations in mainland France fell

slightly (down 2.8% at constant currency and perimeter) due to the

decline in the self-distributed individual subscriber base.

However, the Canal+ subscriber base recorded a net increase in

subscribers of 72,000 over the past 12 months.

- Revenues from international operations grew strongly by 13.7%

(up 6.1% at constant currency and perimeter) driven both by organic

growth and the integration of M7.

- Studiocanal's revenues were €434 million, reflecting a

year-on-year decrease of 12.8% at constant currency and perimeter

due to fewer theatrical releases compared to 2018.

EBITA before restructuring charges was €435 million, compared to

€428 million in 2018. EBITA after restructuring charges amounted to

€343 million, compared to €400 million in 2018.

In the fourth quarter of 2019, several important agreements

involving the operations in France were announced, including with

Netflix, UEFA for the Champions League, The Walt Disney Company (in

particular for the marketing of Disney+) and BeIN Sports, the

latter agreement allowing Canal+ to broadcast two matches of Ligue

1 per championship day starting with the upcoming 2020/2021 season.

In January 2020, Canal+ Group extended its agreement with Formula

One Management to remain the exclusive broadcaster for all of the

next three seasons of Formula 1.

Havas Group

Havas Group’s revenues for 2019 were €2,378 million, up 2.6%

(down 1.0% at constant currency and perimeter) compared to 2018.

Net revenues4 increased by 2.8% to €2,256 million. Acquisitions

contributed +1.3% and exchange rates had a positive impact of 2.5%.

Organic growth was down 1.0% compared to 2018.

In a contrasting sector environment, particularly in Europe,

Havas Group’s performance was supported by the media business

thanks to the new Meaningful Media approach launched at the

beginning of 2019. Strong performances were delivered by the

healthcare communications business and the creative pure players

(BETC, Rosapark, Edge), while the general network moved

purposefully ahead with its transformation in order to adapt itself

to evolving client needs.

Havas Group accelerated its financial investments in the second

half of the year, making four acquisitions of strategic importance

in terms of geographic expansion and strengthening its expertise:

Buzzman in France, Langoor and Shobiz in India, and Gate One in the

United Kingdom.

In 2019, Havas Group continued its worldwide development,

winning new clients both locally and globally. In addition, Havas

Group agencies were lavishly awarded in 2019. The Group was named

“Most Sustainable Company in the Communication Industry” by World

Finance magazine in November 2019, and BETC was named

“International Agency of the Year 2019” by Adweek. For a list of

the most significant Havas Group awards and wins in 2019, please

see Appendix VI.

Havas Group consolidated its profitability. EBITA before

restructuring charges was €260 million, up 6.1% compared to 2018.

After restructuring charges, EBITA was €225 million, up 4.5%. Its

EBITA/net revenues margin thus gained an additional 0.2 points.

__________________________

4 Net revenues correspond to revenues less pass-through costs

rebilled to customers.

Editis

Vivendi has fully consolidated Editis since February 1, 2019.

Editis’ contribution to Vivendi’s revenues was €687 million for

eleven months, up 6.3% on a proforma basis at constant currency and

perimeter compared to the same period in 2018.

Since February 1, 2019, Education & Reference revenues have

risen sharply (up 16.8%). Thanks to the reform of high school

curricula in France, Editis reinforced its leading position in

textbook publishing with its strong French brands, Nathan, Bordas

and Le Robert.

Literature continues to grow (up 2.0% on an eleven-month

proforma basis). Editis confirms its leading position in this

segment with 6 authors in the top 10 of the best-selling authors in

France in 2019 and also leads many other segments: N°1 in

thrillers, History, youtubers and influencers, and N°2 in youth,

leisure / practical life and tourism (GfK 2019).

Diffusion & Distribution revenues related to third-party

publishers are also increased (up 4.2% on eleven-month pro forma),

driven in particular by the distribution of the Goncourt Prize,

Tous les hommes n’habitent pas le monde de la même façon from

Jean-Paul Dubois (L’Olivier).

In the second half of 2019, Editis continued its external growth

policy with Robert Laffont’s acquisition of the publishing houses

Seguier, Nathan’s purchase of the publishing houses L’Agrume and

the publishing house Le Retz’s acquisition of l’Ecole Vivante, as

well as the purchase in July 2019 of the l’Archipel publishing

group which specializes in literature and essays.

In August 2019, Editis also entered the graphic novel and comic

book segments following an agreement concluded with Jungle

Publishing (a subsidiary of the Steinkis group).

Editis’ EBITA was €52 million since February 1, 2019, up 46.9%

proforma compared to the same period in 2018, thanks to the

increase in revenues and cost control.

Other businesses

Gameloft

With 1.5 million downloads per day across all platforms during

2019, Gameloft is one of the world’s leading video game

publishers.

In 2019, Gameloft's revenues were €259 million, down 11.8%

year-on-year. Gameloft’s sales on OTT platforms, representing 72%

of Gameloft’s total sales, declined by 11.1%. The postponement to

2020 of three major games initially scheduled for release in the

second half of 2019 and the saturation of the mobile gaming segment

largely explain the lower OTT revenues in 2019. The advertising

business, representing 11.6% of Gameloft’s total revenues, was up

4.8%.

65% of Gameloft’s revenues were generated by its own gaming

franchises and 35% by the franchises of major international groups

such as Disney or Lego. For Disney, Gameloft released Disney

Princess Majestic Quest in October 2019 and Disney Getaway Blast at

the end of January 2020. For Lego, it will release LEGO Legacy:

Heroes Unboxed in March 2020.

Gameloft is developing its presence on all platforms and has

released two games on Nintendo Switch: Modern Combat Blackout and

Asphalt 9: Legends.

The recent subscription-based game distribution model provides

another growth avenue for Gameloft. It developed Ballistic

Baseball, one of the first games included on Apple Arcade, Apple’s

new game subscription service. It also launched a cloud gaming

service, in partnership with Blacknut, which offers operators and

manufacturers a new range of cross-platform games streamed from the

cloud.

In 2019, the decrease in fixed costs only partially offset the

decline in revenues and higher marketing investments. Gameloft’s

EBITA was -€36 million.

Vivendi Village

In 2019, Vivendi Village’s revenues were €141 million, a

significant increase of 38.9% at constant currency and perimeter

(14.6% on an actual basis) compared to 2018.

This growth is mostly attributable to the development of the

live activities in France and Great-Britain, as well as the venues

in France and Africa. Their revenues nearly doubled in a year

(x1.9), reaching €68 million. This change resulted in particular

from the organic growth of the concert and show promotion business,

which currently manages some 75 artists. It is also due to

acquisitions, notably Garorock in France, which attracted 160,000

festival-goers in 2019.

In addition, Olympia Production formed a joint venture with OL

Groupe to produce the Felyn Stadium Festival in Lyons in June

2020.

L’Olympia in Paris enjoyed a record year with slightly over 300

shows. Three new CanalOlympia venues were inaugurated in Africa in

2019 (14 in total in ten countries).

The ticketing businesses, united under the See Tickets brand,

generated revenues of €66 million (up 14.4% compared to 2018 and up

6.5% at constant currency and perimeter). This growth is partly

attributable to the development of the operations in the US, where

revenue has almost doubled in one year. With the acquisition of

Starticket in Switzerland on December 30, 2019, See Tickets is now

present in nine European countries and in the United States,

selling about 30 million tickets annually (25 million in 2019).

Vivendi Village’s EBITA was a loss of €17 million, compared to a

loss of €9 million in 2018. Excluding the investments in Africa,

EBITA was mostly at break-even.

New Initiatives

In 2019, New Initiatives, which brings together entities in the

launch or development phase, recorded revenues of €71 million, up

6.2% compared to 2018 (up 9.3% at constant currency and

perimeter).

GVA continued to roll out its fiber network in Africa in order

to provide its customers with very high-speed internet access.

After Libreville and Lomé, GVA experienced further development in

2019, in Pointe Noire (Republic of Congo).

In 2019, GVA provided more than 25,000 subscribers in the three

cities where the company is established.

Dailymotion entered into over 280 agreements with leading global

publishers in 2019, including 70 in the United States and dozens in

territories where the company had little presence (Indonesia,

Taiwan, Mexico). The audience in these new countries has increased

significantly. At the end of 2019, the premium content audience

represented more than 70% of its global audience, compared to less

than 30% in 2017, and its total monthly users increased by 20% in

two years to exceed 350 million at the end of 2019.

In 2019, Dailymotion also completed the overhaul of its

advertising ecosystem. It created a proprietary programmatic

platform and a content monetization system (live or

programmatic).

New Initiatives' EBITA was a loss of €65 million, compared to a

loss of €99 million in 2018.

For additional information, please refer to the “Financial

Report and Audited Consolidated Financial Statements for the year

ended December 31, 2019” released later on Vivendi’s website

(www.vivendi.com).

About Vivendi

Since 2014, Vivendi has been focused on building a world-class

content, media and communications group with European roots. In

content creation, Vivendi owns powerful, complementary assets in

music (Universal Music Group), movies and series (Canal+ Group),

publishing (Editis) and video games (Gameloft) which are the most

popular forms of entertainment content in the world today. In the

distribution market, Vivendi has acquired the Dailymotion platform

and repositioned it to create a new digital showcase for its

content. The Group has also joined forces with several telecom

operators and platforms to maximize the reach of its distribution

networks. In communications, through Havas, the Group possesses

unique creative expertise in promoting free content and producing

short formats, which are increasingly viewed on mobile devices. In

addition, through Vivendi Village, the Group explores new

commercial activities in live entertainment, franchises and

ticketing that are complementary to its core activities. Vivendi’s

various businesses cohesively work together as an integrated

industrial group to create greater value. www.vivendi.com

Important Disclaimers

Cautionary Note Regarding Forward-Looking Statements. This press

release contains forward-looking statements with respect to

Vivendi’s financial condition, results of operations, business,

strategy, plans and outlook, including the impact of certain

transactions and the payment of dividends and distributions, as

well as share repurchases. Although Vivendi believes that such

forward-looking statements are based on reasonable assumptions,

such statements are not guarantees of future performance. Actual

results may differ materially from the forward-looking statements

as a result of a number of risks and uncertainties, many of which

are outside our control, including, but not limited to, the risks

related to antitrust and other regulatory approvals as well as any

other approvals which may be required in connection with certain

transactions and the risks described in the documents of the Group

filed by Vivendi with the Autorité des Marchés Financiers (the

French securities regulator), which are also available in English

on Vivendi's website (www.vivendi.com). Investors and security

holders may obtain a free copy of documents filed by Vivendi with

the Autorité des Marchés Financiers at www.amf-france.org, or

directly from Vivendi. Accordingly, we caution readers against

relying on such forward-looking statements. These forward-looking

statements are made as of the date of this press release. Vivendi

disclaims any intention or obligation to provide, update or revise

any forward-looking statements, whether as a result of new

information, future events or otherwise.

Unsponsored ADRs. Vivendi does not sponsor an American

Depositary Receipt (ADR) facility in respect of its shares. Any ADR

facility currently in existence is “unsponsored” and has no ties

whatsoever to Vivendi. Vivendi disclaims any liability in respect

of any such facility.

ANALYST CONFERENCE CALL

Speakers:

Arnaud de Puyfontaine

Chief Executive Officer

Hervé Philippe

Member of the Management Board and Chief Financial Officer

Date: February 13, 2020 6:15pm Paris time – 5:15pm London

time – 12:15pm New York time

Media invited on a listen-only basis.

The conference will be held in English.

Internet: The conference can be followed on the Internet

at: www.vivendi.com (audiocast)

Numbers to dial:

- USA : +1 212 999 6659 - France : +33 (0) 1

7099 4740 - UK (Standard international access) : +44 (0) 20 3003

2666

- Password: Vivendi

An audio webcast and the slides of the presentation will be

available on the company’s website www.vivendi.com.

APPENDIX I

VIVENDI

OPERATING RESULTS BY BUSINESS

SEGMENT

(IFRS, audited)

Revenues, Income from operations and EBITA by business

segment

Year ended December 31,

(in millions of euros)

2019

2018

% Change

% Change at

constant currency

% Change at

constant currency

and perimeter (a)

Revenues

Universal Music Group

7,159

6,023

+18.9%

+15.6%

+14.0%

Canal+ Group

5,268

5,166

+2.0%

+2.0%

-0.9%

Havas Group

2,378

2,319

+2.6%

+0.2%

-1.0%

Editis

687

-

na

na

na

Gameloft

259

293

-11.8%

-13.6%

-16.0%

Vivendi Village

141

123

+14.6%

+14.2%

+38.9%

New Initiatives

71

66

+6.2%

+6.2%

+9.3%

Elimination of intersegment

transactions

(65)

(58)

Total Vivendi

15,898

13,932

+14.1%

+12.2%

+5.6%

Income from operations

Universal Music Group

1,168

946

+23.5%

+20.6%

+21.1%

Canal+ Group

431

429

+0.3%

+0.2%

-5.2%

Havas Group

268

258

+3.9%

+2.4%

+0.6%

Editis

59

-

na

na

na

Gameloft

(28)

4

Vivendi Village

(16)

(9)

New Initiatives

(68)

(79)

Corporate

(95)

(110)

Total Vivendi

1,719

1,439

+19.5%

+17.3%

+11.7%

EBITA

Universal Music Group

1,124

902

+24.6%

+21.8%

+22.3%

Canal+ Group

343

400

-14.3%

-14.3%

-19.3%

Havas Group

225

215

+4.5%

+2.7%

+0.5%

Editis

52

-

na

na

na

Gameloft

(36)

2

Vivendi Village

(17)

(9)

New Initiatives

(65)

(99)

Corporate

(100)

(123)

Total Vivendi

1,526

1,288

+18.5%

+16.2%

+10.8%

- Constant perimeter notably reflects the impacts of the

acquisition of M7 by Canal+ Group (September 12, 2019), the

acquisition of the remaining interest in Ingrooves Music Group,

which has been consolidated by Universal Music Group (March 15,

2019), the acquisition of Editis (January 31, 2019), the

acquisition of Paylogic by Vivendi Village (April 16, 2018) and the

sale of MyBestPro by Vivendi Village (December 21, 2018).

APPENDIX I (Cont’d)

VIVENDI

OPERATING RESULTS BY BUSINESS

SEGMENT

(IFRS, audited)

Quarterly revenues by business segment

2019

(in millions of euros)

Three months ended

March 31,

Three months ended

June 30,

Three months ended

September 30,

Three months ended

December 31,

Revenues

Universal Music Group

1,502

1,756

1,800

2,101

Canal+ Group

1,252

1,266

1,285

1,465

Havas Group

525

589

567

698

Editis (a)

89

171

210

217

Gameloft

68

65

61

65

Vivendi Village

23

43

42

33

New Initiatives

15

19

16

20

Elimination of intersegment

transactions

(15)

(15)

(11)

(24)

Total Vivendi

3,459

3,894

3,970

4,575

2018

(in millions of euros)

Three months ended

March 31,

Three months ended

June 30,

Three months ended

September 30,

Three months ended

December 31,

Revenues

Universal Music Group

1,222

1,406

1,495

1,900

Canal+ Group

1,298

1,277

1,247

1,344

Havas Group

506

567

553

693

Gameloft

70

71

74

78

Vivendi Village

23

29

36

35

New Initiatives

16

16

15

19

Elimination of intersegment

transactions

(11)

(14)

(19)

(14)

Total Vivendi

3,124

3,352

3,401

4,055

- As a reminder, Vivendi has fully consolidated Editis since

February 1, 2019.

APPENDIX II

VIVENDI

CONSOLIDATED STATEMENT OF EARNINGS

(IFRS, audited)

Year ended December 31

Year ended December 31,

% Change

2019

2018

REVENUES

15,898

13,932

+ 14.1%

Cost of revenues

(8,845)

(7,618)

Selling, general and administrative

expenses excluding amortization of intangible assets acquired

through business combinations

(5,334)

(4,875)

Income from operations*

1,719

1,439

+ 19.5%

Restructuring charges

(161)

(115)

Other operating charges and income

(32)

(36)

Adjusted earnings before interest and

income taxes (EBITA)*

1,526

1,288

+ 18.5%

Amortization and depreciation of

intangible assets acquired through business combinations

(145)

(113)

Other charges and income

-

7

EARNINGS BEFORE INTEREST AND INCOME

TAXES (EBIT)

1,381

1,182

+ 16.9%

Income from equity affiliates -

non-operational

67

122

Interest

(46)

(47)

Income from investments

10

20

Other financial charges and income

65

(763)

29

(790)

Earnings before provision for income

taxes

1,477

514

x 2.9

Provision for income taxes

140

(357)

Earnings from continuing

operations

1,617

157

x 10.3

Earnings from discontinued operations

-

-

Earnings

1,617

157

x 10.3

Non-controlling interests

(34)

(30)

EARNINGS ATTRIBUTABLE TO VIVENDI SA

SHAREOWNERS

1,583

127

x 12.5

Earnings attributable to Vivendi SA

shareowners per share - basic (in euros)

1.28

0.10

Earnings attributable to Vivendi SA

shareowners per share - diluted (in euros)

1.28

0.10

Adjusted net income*

1,741

1,157

+ 50.5%

Adjusted net income per share - basic (in

euros)*

1.41

0.92

Adjusted net income per share - diluted

(in euros)*

1.41

0.91

In millions of euros, except per share amounts.

* non-GAAP measures.

The non-GAAP measures of “Income from operations”, “adjusted

earnings before interest and income taxes (EBITA)” and “adjusted

net income” should be considered in addition to, and not as a

substitute for, other GAAP measures of operating and financial

performance. Vivendi considers these to be relevant indicators of

the group’s operating and financial performance. Vivendi Management

uses income from operations, EBITA and adjusted net income for

reporting, management and planning purposes because they exclude

most non-recurring and non-operating items from the measurement of

the business segments’ performances.

For any additional information, please refer to the “Financial

Report and Audited Consolidated Financial Statements for the year

ended December 31, 2019“, which will be released online later on

Vivendi’s website (www.vivendi.com).

APPENDIX II (Cont’d)

VIVENDI

CONSOLIDATED STATEMENT OF EARNINGS

(IFRS, audited)

Reconciliation of earnings attributable to Vivendi SA

shareowners to adjusted net income

Year ended December 31,

(in millions of euros)

2019

2018

Earnings attributable to Vivendi SA

shareowners (a)

1,583

127

Adjustments

Amortization and depreciation of

intangible assets acquired through business combinations

145

113

Amortization of intangible assets related

to equity affiliates

60

60

Other financial charges and income

(65)

763

Provision for income taxes on

adjustments

37

104

Impact of adjustments on non-controlling

interests

(19)

(10)

Adjusted net income

1,741

1,157

- As reported in the Consolidated Statement of Earnings.

Adjusted Statement of Earnings

Year ended December 31,

% Change

(in millions of euros)

2019

2018

Revenues

15,898

13,932

+ 14.1%

Income from operations

1,719

1,439

+ 19.5%

EBITA

1,526

1,288

+ 18.5%

Other charges and income

-

7

Income from equity affiliates -

non-operational

127

182

Interest

(46)

(47)

Income from investments

10

20

Adjusted earnings from continuing

operations before provision for income taxes

1,617

1,450

+ 11.5%

Provision for income taxes

177

(253)

Adjusted net income before non-controlling

interests

1,794

1,197

Non-controlling interests

(53)

(40)

Adjusted net income

1,741

1,157

+ 50.5%

APPENDIX III

VIVENDI

CONSOLIDATED STATEMENT OF FINANCIAL

POSITION

(IFRS, audited)

(in millions of euros)

December 31, 2019

January 1, 2019

December 31, 2018

ASSETS

Goodwill

14,690

12,438

12,438

Non-current content assets

2,746

2,194

2,194

Other intangible assets

883

437

437

Property, plant and equipment

1,097

967

986

Rights-of-use relating to leases

1,245

1,131

na

Investments in equity affiliates

3,520

3,418

3,418

Non-current financial assets

2,263

2,102

2,102

Deferred tax assets

782

713

675

Non-current assets

27,226

23,400

22,250

Inventories

277

206

206

Current tax receivables

374

135

135

Current content assets

1,423

1,346

1,346

Trade accounts receivable and other

5,661

5,311

5,314

Current financial assets

255

1,090

1,090

Cash and cash equivalents

2,130

3,793

3,793

Current assets

10,120

11,881

11,884

TOTAL ASSETS

37,346

35,281

34,134

EQUITY AND LIABILITIES

Share capital

6,515

7,184

7,184

Additional paid-in capital

2,353

4,475

4,475

Treasury shares

(694)

(649)

(649)

Retained earnings and other

7,179

6,182

6,303

Vivendi SA shareowners' equity

15,353

17,192

17,313

Non-controlling interests

222

220

221

Total equity

15,575

17,412

17,534

Non-current provisions

1,127

871

858

Long-term borrowings and other financial

liabilities

5,160

3,448

3,448

Deferred tax liabilities

1,037

1,076

1,076

Long-term lease liabilities

1,223

1,122

na

Other non-current liabilities

183

223

248

Non-current liabilities

8,730

6,740

5,630

Current provisions

494

419

419

Short-term borrowings and other financial

liabilities

1,777

888

888

Trade accounts payable and other

10,494

9,513

9,572

Short-term lease liabilities

236

218

na

Current tax payables

40

91

91

Current liabilities

13,041

11,129

10,970

Total liabilities

21,771

17,869

16,600

TOTAL EQUITY AND LIABILITIES

37,346

35,281

34,134

na: not applicable.

Nota: As from January 1, 2019, Vivendi applies the new

accounting standard IFRS 16 – Leases.

APPENDIX IV

VIVENDI

CONSOLIDATED STATEMENT OF CSH FLOWS

(IFRS, audited)

Year ended December 31,

(in millions of euros)

2019

2018

Operating activities

EBIT

1,381

1,182

Adjustments

779

432

Content investments, net

(676)

(137)

Gross cash provided by operating

activities before income tax paid

1,484

1,477

Other changes in net working capital

67

(28)

Net cash provided by operating

activities before income tax paid

1,551

1,449

Income tax (paid)/received, net

(283)

(262)

Net cash provided by operating

activities

1,268

1,187

Investing activities

Capital expenditures

(413)

(351)

Purchases of consolidated companies, after

acquired cash

(2,106)

(116)

Investments in equity affiliates

(1)

(3)

Increase in financial assets

(177)

(575)

Investments

(2,697)

(1,045)

Proceeds from sales of property, plant,

equipment and intangible assets

8

10

Proceeds from sales of consolidated

companies, after divested cash

22

16

Disposal of equity affiliates

-

2

Decrease in financial assets

1,046

2,285

Divestitures

1,076

2,313

Dividends received from equity

affiliates

8

5

Dividends received from unconsolidated

companies

3

13

Net cash provided by/(used for)

investing activities

(1,610)

1,286

Financing activities

Net proceeds from issuance of common

shares in connection with Vivendi SA's share-based compensation

plans

175

190

Sales/(purchases) of Vivendi SA's treasury

shares

(2,673)

-

Distributions to Vivendi SA's

shareowners

(636)

(568)

Other transactions with shareowners

(13)

(16)

Dividends paid by consolidated companies

to their non-controlling interests

(41)

(47)

Transactions with shareowners

(3,188)

(441)

Setting up of long-term borrowings and

increase in other long-term financial liabilities

2,101

4

Principal payment on long-term borrowings

and decrease in other long-term financial liabilities

(6)

(3)

Principal payment on short-term

borrowings

(787)

(193)

Other changes in short-term borrowings and

other financial liabilities

870

65

Interest paid, net

(46)

(47)

Other cash items related to financial

activities

(7)

5

Transactions on borrowings and other

financial liabilities

2,125

(169)

Repayment of lease liabilities and related

interest expenses

(254)

na

Net cash provided by/(used for)

financing activities

(1,317)

(610)

Foreign currency translation adjustments

of continuing operations

(4)

(21)

Change in cash and cash

equivalents

(1,663)

1,842

Cash and cash equivalents

At beginning of the period

3,793

1,951

At end of the period

2,130

3,793

na: not applicable.

APPENDIX V

VIVENDI

KEY CONSOLIDATED FINANCIAL DATA FOR THE LAST

FIVE YEARS

(IFRS, audited)

As from January 1, 2019, Vivendi applies the new accounting

standard IFRS 16 – Leases. In accordance with IFRS 16, the impact

of the change of accounting standard was recorded in the opening

balance sheet as of January 1, 2019. Moreover, Vivendi applied this

change of accounting standard to the Statement of Financial

Position, Statement of Earnings and Statement of Cash Flows in

2019; therefore, the data relative to prior years is not

comparable.

As a reminder, in 2018, Vivendi applied two new accounting

standards:

- IFRS 15 – Revenues from Contracts with Customers: in accordance

with IFRS 15, as from 2017, Vivendi applied this change of

accounting standard to revenues. The data presented below with

respect to fiscal years 2015 to 2016 are historical and therefore

unrestated; and

- IFRS 9 – Financial Instruments: in accordance with IFRS 9, as

from 2018, Vivendi applied this change of accounting standard to

the Statement of Earnings and Statement of Comprehensive Income

restating its opening balance sheet as of January 1, 2018;

therefore, the data relative to prior years in this report is not

comparable.

In addition, Vivendi deconsolidated GVT as from May 28, 2015,

the date of its effective sale by Vivendi. In compliance with IFRS

5, this business was reported as a discontinued operation for 2015

as set out in the table of selected key consolidated financial data

below in respect of data reflected in the Statement of Earnings and

Statement of Cash Flows.

Year ended December 31,

2019

2018

2017

2016

2015

Consolidated

data

Revenues

15,898

13,932

12,518

10,819

10,762

Income from operations (a)

1,719

1,439

1,098

853

1,061

Adjusted earnings before interest and

income taxes (EBITA) (a)

1,526

1,288

969

724

942

Earnings before interest and income taxes

(EBIT)

1,381

1,182

1,018

887

521

Earnings attributable to Vivendi SA

shareowners

1,583

127

1,216

1,256

1,932

of which earnings from continuing

operations attributable to Vivendi SA shareowners

1,583

127

1,216

1,236

699

Adjusted net income (a)

1,741

1,157

1,300

755

697

Net Cash Position/(Financial Net Debt)

(a)

(4,064)

176

(2,340)

1,231

7,172

Total equity

15,575

17,534

17,866

19,612

21,086

of which Vivendi SA shareowners'

equity

15,353

17,313

17,644

19,383

20,854

Cash flow from operations (CFFO) (a)

903

1,126

989

729

892

Cash flow from operations after interest

and income tax paid (CFAIT) (a)

567

822

1,346

341

(69)

Financial investments

(2,284)

(694)

(3,685)

(4,084)

(3,927)

Financial divestments

1,068

2,303

976

1,971

9,013

Dividends paid by Vivendi SA to its

shareholders

636

568

499

2,588

(b)

2,727

(b)

Purchases/(sales) of Vivendi SA's treasury

shares

2,673

-

203

1,623

492

Per share

data

Weighted average number of shares

outstanding

1,233.5

1,263.5

1,252.7

1,272.6

1,361.5

Earnings attributable to Vivendi SA

shareowners per share

1.28

0.10

0.97

0.99

1.42

Adjusted net income per share

1.41

0.92

1.04

0.59

0.51

Number of shares outstanding at the end of

the period (excluding treasury shares)

1,170.6

1,268.0

1,256.7

1,259.5

1,342.3

Equity per share, attributable to Vivendi

SA shareowners

13.12

13.65

14.04

15.39

15.54

Dividends per share paid

0.50

0.45

0.40

2.00

(b)

2.00

(b)

In millions of euros, number of shares in millions, data per

share in euros.

- The non-GAAP measures of Income from operations, EBITA,

Adjusted net income, Net Cash Position (or Financial Net Debt),

Cash flow from operations (CFFO) and Cash flow from operations

after interest and income tax paid (CFAIT) should be considered in

addition to, and not as a substitute for, other GAAP measures of

operating and financial performance as presented in the

Consolidated Financial Statements and the related Notes, or as

described in this Financial Report. Vivendi considers these to be

relevant indicators of the group’s operating and financial

performance. Each of these indicators is defined in the appropriate

section of this Financial Report. In addition, it should be noted

that other companies may have definitions and calculations for

these indicators that differ from those used by Vivendi, thereby

affecting comparability.

- With respect to fiscal year 2015, Vivendi paid an ordinary

dividend of €3 per share, i.e., an aggregate dividend payment of

€3,951 million. This amount included €1,363 million paid in 2015

(first interim dividend of €1 per share) and €2,588 million paid in

2016 (€1,318 million for the second interim dividend of €1 per

share and €1,270 million representing the balance of €1 per share).

In addition, in 2015, Vivendi paid a dividend with respect to

fiscal year 2014 of €1 per share, i.e., €1,364 million.

APPENDIX VI

VIVENDI

HAVAS GROUP: SIGNIFICANT AWARDS AND

WINS

Havas continued its worldwide development in 2019, winning

prestigious new clients and brands in creation, media and

healthcare at both local and global levels.

In creation, Havas signed new local contracts with Boston Beers,

Gap, Lacoste and Core Water in the United States, Huawei, Lloyds

and Compare the Market in the United Kingdom, COOP in Italy and 7TV

and Ferrerro in Germany. Globally, Havas Creative won contracts

with Pimco, Michelin and Bel.

In media, South Korean car manufacturers Hyundai Kia re-selected

Havas Media to handle its media mandate for Europe, Russia and

Turkey. Havas Media has been working with Hyundai Kia for ten

years. Havas Media also won a number of global assignments

including TripAdvisor, Meetic and Visit California. Some multilocal

wins included Continental Foods, Mango, and UPower. Locally, it won

contracts with Sanofi, Planet Fitness and Stop n’ Shop in the

United States, Corby in Canada, Legal & General, Homebase,

Dreams and Starbucks in the United Kingdom, Hassia Group,

Vattenfall and Stepstone in Germany, SFR and GRDF in France,

Carrefour in Belgium, Tinder and Gameskraft in India and Uniqlo in

Singapore.

Havas Health & You had major global and local wins worldwide

with AbbVie, Alcon, Amgen, AstraZeneca, BioMarin, Celgene,

Genentech, Guardant Health, Guidewell, Ipsen, Ironshore,

Klosterfrau, Lundbeck, Merck Inc, Novartis, Takeda, TherapeuticsMD

and Unicef.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200213005782/en/

Media Paris Jean-Louis Erneux +33 (0)1 71 71 15 84

Solange Maulini +33 (0) 1 71 71 11 73

London Paul Durman (Teneo) +44 20 7240 2486

Investor Relations Paris Xavier Le Roy +33 (0)1 71

71 18 77 Nathalie Pellet +33 (0) 1 71 71 11 24 Delphine Maillet +33

(0)1 71 71 17 20

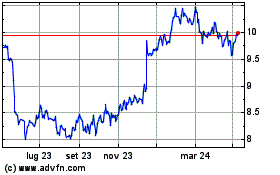

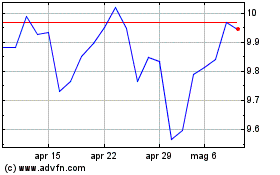

Grafico Azioni Vivendi (EU:VIV)

Storico

Da Apr 2024 a Mag 2024

Grafico Azioni Vivendi (EU:VIV)

Storico

Da Mag 2023 a Mag 2024