AgeX Therapeutics, Inc. (“AgeX”; NYSE American: AGE), a

biotechnology company developing therapeutics for human aging and

regeneration, reported its financial and operating results for

fourth quarter and the full year ended December 31, 2022.

Balance Sheet Information

Cash, cash equivalents, and restricted cash totaled $0.7 million

as of December 31, 2022. As of December 31, 2022, AgeX owed

Juvenescence Limited $21.4 million in principal and origination

fees on account of loans extended to AgeX.

Fourth Quarter and Annual 2022 Operating Results

The following comparisons exclude the impact of the operations

of AgeX’s former subsidiary LifeMap Sciences, Inc. which have been

presented in AgeX’s consolidated financial results as discontinued

operations for all periods presented due to the disposition of

AgeX’s shares of LifeMap Sciences in a cash-out merger during March

2021.

Revenues: Total revenues for the fourth quarter of 2022 were

$8,000 as compared with $27,000 for the fourth quarter of 2021.

Total revenues for the year ended December 31, 2022 were $34,000 as

compared with $144,000 in the same period of 2021. Revenues in 2022

are primarily comprised of sales of research products including

stem cell products while 2021 also includes allowable expenses

under a research grant from the National Institutes of Health.

Operating expenses: Operating expenses for the three months

ended December 31, 2022 were $1.8 million as compared with $1.9

million for the same period of 2021. Operating expenses for the

full year 2021 were $7.0 million as compared with $8.2 million in

the same period of 2021.

Research and development expenses for the year ended December

31, 2022 decreased by more than $0.4 million to $1.0 million as

compared to approximately $1.5 million in 2021. The net decrease

was primarily attributable to decreases of: $0.2 million in

scientific consulting; $0.1 million in outside research and

services expenses; $0.1 million in fees incurred related to

sponsored research agreement with a university; and $0.1 million in

cash and noncash stock-based compensation expense to employees.

General and administrative expenses for the year ended December

31, 2022 decreased by $0.7 million to $6.0 million as compared to

$6.7 million in 2021. The net decrease is attributable to decreases

of $0.4 million in consulting expenses, $0.2 million in

professional fees for legal services, $0.2 million in annual

minimum royalties due under certain license agreements and patent

and license maintenance related fees, and $0.1 million in noncash

stock-based compensation expense to directors. These decreases were

offset to some extent by increases of $0.1 million in insurance

expense and $0.1 million in professional fees for tax and

accounting services.

Other expense, net: Net other expense for the year ended

December 31, 2022 consists primarily of $3.3 million of

amortization of deferred debt costs on loans from Juvenescence

while in 2021 the $1.1 million amortization of deferred debt costs

on loans from Juvenescence were offset by approximately $437,000

gain recognized upon forgiveness of Paycheck Protection Program

loan indebtedness.

Net loss attributable to AgeX: The net loss attributable to AgeX

for the year ended December 31, 2022 was $10.5 million, or ($0.28)

per share (basic and diluted) compared to $8.7 million, or ($0.23)

per share (basic and diluted), for 2021. Increased net loss

attributable to AgeX for the year ended December 31, 2022 as

compared to 2021, despite the decrease in operating expenses from

$8.2 million to $7.0 million, is largely attributable to increased

amortization of deferred debt costs on loans from Juvenescence by

approximately $2.2 million year over year.

Going Concern Considerations

As required under Accounting Standards Update 2014-15,

Presentation of Financial Statements-Going Concern (ASC 205-40),

AgeX evaluates whether conditions and/or events raise substantial

doubt about its ability to meet its future financial obligations as

they become due within one year after the date its financial

statements are issued. Based on AgeX’s most recent projected cash

flows, AgeX believes that its cash and cash equivalents and

available sources of debt and equity capital would not be

sufficient to satisfy AgeX’s anticipated operating and other

funding requirements for the twelve months following the filing of

AgeX’s Annual Report on Form 10-K for the year ended December 31,

2022. These factors raise substantial doubt regarding the ability

of AgeX to continue as a going concern.

About AgeX Therapeutics

AgeX Therapeutics, Inc. (NYSE American: AGE) is focused on

developing and commercializing innovative therapeutics to treat

human diseases to increase healthspan and combat the effects of

aging. AgeX’s PureStem® and UniverCyte™ manufacturing and

immunotolerance technologies are designed to work together to

generate highly defined, universal, allogeneic, off-the-shelf

pluripotent stem cell-derived young cells of any type for

application in a variety of diseases with a high unmet medical

need. AgeX has two preclinical cell therapy programs: AGEX-VASC1

(vascular progenitor cells) for tissue ischemia and AGEX-BAT1

(brown fat cells) for Type II diabetes. AgeX’s revolutionary

longevity platform induced tissue Regeneration (iTR™) aims to

unlock cellular immortality and regenerative capacity to reverse

age-related changes within tissues. HyStem® is AgeX’s delivery

technology to stably engraft PureStem or other cell therapies in

the body. AgeX is seeking opportunities to establish licensing and

collaboration arrangements around its broad IP estate and

proprietary technology platforms and therapy product

candidates.

For more information, please visit www.agexinc.com or connect

with the company on Twitter, LinkedIn, Facebook, and YouTube.

Forward-Looking Statements

Certain statements contained in this release are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Any statements that are

not historical fact including, but not limited to statements that

contain words such as “will,” “believes,” “plans,” “anticipates,”

“expects,” “estimates” should also be considered forward-looking

statements. Forward-looking statements involve risks and

uncertainties. Actual results may differ materially from the

results anticipated in these forward-looking statements and as such

should be evaluated together with the many uncertainties that

affect the business of AgeX Therapeutics, Inc. and its

subsidiaries, particularly those mentioned in the cautionary

statements found in more detail in the “Risk Factors” section of

AgeX’s most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission (copies of which may be obtained

at www.sec.gov). Subsequent events and developments may cause these

forward-looking statements to change. AgeX specifically disclaims

any obligation or intention to update or revise these

forward-looking statements as a result of changed events or

circumstances that occur after the date of this release, except as

required by applicable law.

AGEX THERAPEUTICS, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(In thousands, except par value

amounts)

December 31,

2022

2021

ASSETS

Current assets:

Cash and cash equivalents

$

645

$

584

Accounts and grants receivable, net

4

25

Prepaid expenses and other current

assets

1,804

1,625

Total current assets

2,453

2,234

Restricted cash

50

50

Intangible assets, net

738

870

TOTAL ASSETS

$

3,241

$

3,154

LIABILITIES AND STOCKHOLDERS’

DEFICIT

Current liabilities:

Accounts payable and accrued

liabilities

$

1,034

$

771

Loan due to Juvenescence, net of debt

issuance costs, current portion

7,646

7,140

Related party payables, net

141

70

Warrant liability

180

-

Insurance premium liability and other

current liabilities

1,077

986

Total current liabilities

10,078

8,967

Loan due to Juvenescence, net of debt

issuance costs, net of current portion

10,478

6,062

TOTAL LIABILITIES

20,556

15,029

Commitments and contingencies

Stockholders’ deficit:

Preferred stock, $0.0001 par value, 5,000

shares authorized; none issued and outstanding

-

-

Common stock, $0.0001 par value, 200,000

and 100,000 shares authorized, respectively; 37,949 and 37,941

shares issued and outstanding, respectively

4

4

Additional paid-in capital

98,994

93,912

Accumulated deficit

(116,210

)

(105,748

)

Total AgeX Therapeutics, Inc.

stockholders’ deficit

(17,212

)

(11,832

)

Noncontrolling interest

(103

)

(43

)

Total stockholders’ deficit

(17,315

)

(11,875

)

TOTAL LIABILITIES AND STOCKHOLDERS’

DEFICIT

$

3,241

$

3,154

AGEX THERAPEUTICS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(In thousands, except per share

data)

Year Ended December

31,

2022

2021

REVENUES

Grant revenues

$

-

$

104

Other revenues

34

40

Total revenues

34

144

Cost of sales

(13

)

(19

)

Gross profit

21

125

OPERATING EXPENSES

Research and development

1,025

1,456

General and administrative

5,971

6,708

Total operating expenses

6,996

8,164

Gain on deconsolidation of LifeMap

Sciences

-

106

Loss from operations

(6,975

)

(7,933

)

OTHER EXPENSE, NET

Interest expense, net

(3,335

)

(1,097

)

Change in fair value of warrants

(225

)

-

Other income, net

13

448

Total other expense, net

(3,547

)

(649

)

NET LOSS FROM CONTINUING

OPERATIONS

(10,522

)

(8,582

)

NET LOSS FROM DISCONTINUED

OPERATIONS

-

(103

)

NET LOSS

(10,522

)

(8,685

)

Net loss attributable to noncontrolling

interest from continuing operations

60

3

Net loss attributable to noncontrolling

interest from discontinued operations

-

7

NET LOSS ATTRIBUTABLE TO AGEX

$

(10,462

)

$

(8,675

)

NET LOSS PER COMMON SHARE:

BASIC AND DILUTED

Continuing operations

$

(0.28

)

$

(0.23

)

Discontinued operations

-

-

$

(0.28

)

$

(0.23

)

WEIGHTED-AVERAGE NUMBER OF COMMON SHARES

OUTSTANDING:

BASIC AND DILUTED

37,945

37,886

AMOUNTS ATTRIBUTABLE TO AGEX:

Loss from continuing operations

$

(10,462

)

$

(8,579

)

Loss from discontinued operations

-

(96

)

NET LOSS ATTRIBUTABLE TO AGEX

$

(10,462

)

$

(8,675

)

AGEX THERAPEUTICS, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(In thousands)

Year Ended December

31,

2022

2021

OPERATING ACTIVITIES:

Net loss attributable to AgeX from

continuing operations

$

(10,462

)

$

(8,579

)

Net loss attributable to noncontrolling

interest

(60

)

(3

)

Adjustments to reconcile net loss

attributable to AgeX to net cash used in operating activities:

Gain on deconsolidation of LifeMap

Sciences

-

(106

)

Gain on extinguishment of debt (Paycheck

Protection Program loan)

-

(437

)

Change in fair value of warrants

225

-

Amortization of intangible assets

132

131

Amortization of debt issuance costs

3,137

1,114

Stock-based compensation

760

999

Changes in operating assets and

liabilities:

Accounts and grants receivable

21

128

Prepaid expenses and other current

assets

896

760

Accounts payable and accrued

liabilities

144

(772

)

Related party payables

255

-

Insurance premium liability

(983

)

(921

)

Other current liabilities

(4

)

(79

)

Net cash used in operating activities from

continuing operations

(5,939

)

(7,765

)

Net cash used in operating activities from

discontinued operation

-

(90

)

Net cash used in operating activities

(5,939

)

(7,855

)

INVESTING ACTIVITIES:

Proceeds from the sale of LifeMap

Sciences

-

466

Partial collection on loan due from

LifeMap Sciences

-

250

Net cash provided by investing activities

from continuing operations

-

716

Deconsolidation of cash and cash

equivalents from discontinued operations

-

(50

)

Net cash provided by investing

activities

-

666

FINANCING ACTIVITIES:

Draw down on loan facilities from

Juvenescence

6,000

7,000

Proceeds from the issuance of common

stock

-

496

Net cash provided by financing activities

from continuing operations

6,000

7,496

Partial payment on loan due to AgeX from

discontinued operations

-

(250

)

Net cash provided by financing

activities

6,000

7,246

NET CHANGE IN CASH, CASH EQUIVALENTS

AND RESTRICTED CASH

61

57

CASH, CASH EQUIVALENTS AND RESTRICTED

CASH:

At beginning of the year

634

577

At end of the year

$

695

$

634

SUPPLEMENTAL DISCLOSURE OF CASH FLOW

INFORMATION:

Cash paid during the year for interest

$

14

$

13

SUPPLEMENTAL SCHEDULE OF NONCASH FINANCING

AND INVESTING ACTIVITIES:

Issuance of common stock upon vesting of

restricted stock units

$

8

$

16

Issuance of warrants for debt issuance

under the 2020 Loan Agreement

$

178

$

757

Issuance of warrants for debt issuance

under the Secured Note

$

4,148

$

-

Debt refinanced with new debt

$

7,160

$

-

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230331005104/en/

Andrea E. Park apark@agexinc.com (510) 671-8620

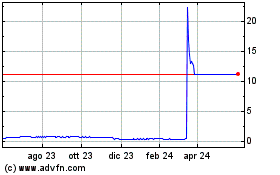

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Dic 2023 a Dic 2024