SECURITIES AND EXCHANGE

COMMISSION

WASHINGTON, DC 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS FILED

PURSUANT

TO RULE 13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT

TO RULE 13d-2(a)

(Amendment No. 30)

AGEX THERAPEUTICS, INC.

(Name of Issuer)

Common Stock, par value $0.0001 per share

(Title of Class of

Securities)

00848H108

(CUSIP number)

David Gill

c/o Juvenescence Limited

1st Floor, Viking House

St Pauls Square, Ramsey

Isle of Man, IM8 1GB

+441624639393

(Name, Address and

Telephone Number of Person Authorized to Receive Notices and Communications)

January 16, 2024

(Date of Event Which

Requires Filing of this Statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

13d-1(f) or 13d-1(g), check the following box ¨.

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties

to whom copies are to be sent.

The information required on the remainder of this

cover page shall not be deemed “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 or otherwise

subject to the liabilities of that section of the Act by shall be subject to all other provisions of the Act (however, see the

Notes).

| 1. |

NAME OF REPORTING PERSON

Juvenescence Limited |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS

WC |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

Isle of Man |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE VOTING POWER

88,488,1131 |

| 8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

88,488,1131 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

88,488,1131 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

80.4% |

| 14. |

TYPE OF REPORTING PERSON

CO |

1

Comprised of (i) 16,447,500 shares of Common Stock held directly by JuvVentures (UK) Limited, (ii) 572,417 shares of Common

Stock that may be acquired on exercise of Warrants issued or to be issued in connection with advances under the New Facility, (iii) 10,357,086

shares of Common Stock that may be acquired on exercise of Warrants issued or to be issued in connection with advances under the A&R

Secured Note, (iv) 29,388,888 shares of Common Stock held directly by JuvVentures (UK) Limited that may be issued upon conversion of

211,600 shares of Series A Preferred Stock, (v) 20,611,111 shares of Common Stock held directly by JuvVentures (UK) Limited that may

be issued upon conversion of 148,400 shares of Series B Preferred Stock and (vi) 11,111,111 shares of Common Stock that may be issued

upon conversion of outstanding amounts under the A&R Secured Note at the closing price of the Common Stock on January 12, 2024 (capitalized

terms are defined below).

| 1. |

NAME OF REPORTING PERSON

JuvVentures (UK) Limited |

| 2. |

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3. |

SEC USE ONLY

|

| 4. |

SOURCE OF FUNDS

WC |

| 5. |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO

ITEMS 2(d) OR 2(e)

¨ |

| 6. |

CITIZENSHIP OR PLACE OF ORGANIZATION

United Kingdom |

| NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

7. |

SOLE VOTING POWER

66,447,499 |

| 8. |

SHARED VOTING POWER

0 |

| 9. |

SOLE DISPOSITIVE POWER

66,447,499 |

| 10. |

SHARED DISPOSITIVE POWER

0 |

| 11. |

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

66,447,499 |

| 12. |

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES

¨ |

| 13. |

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW 11

75.6% |

| 14. |

TYPE OF REPORTING PERSON

CO |

SCHEDULE 13D

This amendment (the “Amendment”) amends

and supplements the beneficial ownership statement on Schedule 13D filed with the Securities and Exchange Commission on August 16,

2019 (as amended by Amendment No. 1 filed April 6, 2020, Amendment No. 2 filed July 31, 2020, Amendment No. 3

filed October 7, 2020, Amendment No. 4 filed November 11, 2020, Amendment No. 5 filed January 12, 2021, Amendment

No. 6 filed February 9, 2021, Amendment No. 7 filed February 17, 2021, Amendment No. 8 filed May 11, 2021,

Amendment No. 9 filed May 11, 2021, Amendment No. 10 filed September 14, 2021, Amendment No. 11 filed November 2,

2021, Amendment No. 12 filed November 18, 2021, Amendment No. 13 filed December 13, 2021, Amendment No. 14 filed

February 14, 2022, Amendment No. 15 filed February 22, 2022, Amendment No. 16 filed April 11, 2022, Amendment

No. 17 filed June 24, 2022, Amendment No. 18 filed August 23, 2022, Amendment No. 19 filed October 25, 2022,

Amendment No. 20 filed December 15, 2022, Amendment No. 21 filed January 25, 2023, Amendment No. 22 filed February 17,

2023, Amendment No. 23 filed March 22, 2023, Amendment No. 24 filed April 12, 2023, Amendment No. 25 filed August 24,

2023, Amendment No. 26 filed November 1, 2023, Amendment No. 27 filed November 16, 2023, Amendment No. 28 filed

December 13, 2023 and Amendment No. 29 filed January 9, 2024, the “Original Statement”). The Original Statement,

as amended by this Amendment (the “Statement”) is filed on behalf of Juvenescence Limited, an Isle of Man company, Juvenescence

US Corp., a Delaware corporation and JuvVentures (UK) Limited, a company incorporated in the United Kingdom (each a “Reporting Person”

and collectively as the “Reporting Persons”), and relates to the shares of Common Stock of AgeX Therapeutics, Inc., par

value $0.0001 per share (the “Common Stock”).

Capitalized terms used but not defined in this

Amendment have the meanings ascribed to them in the Original Statement. This Amendment amends the Original Statement as specifically set

forth herein. Except as set forth below, all previous Items in the Original Statement remain unchanged.

| Item 5. |

Interest in Securities of the Issuer. |

Item 5 of the Original Statement is hereby amended and restated in

its entirety to read as follows:

(a) The

Reporting Persons beneficially owns an aggregate of 88,488,113 shares of Common Stock, representing (i) 16,447,500 shares of Common

Stock held directly by JuvVentures (UK) Limited, (ii) 572,417 shares of Common Stock that may be acquired on exercise of Warrants

issued or to be issued in connection with advances under the New Facility (as defined below), (iii) 10,357,086 shares of Common Stock

that may be acquired on exercise of Warrants issued or to be issued in connection with advances under the A&R Secured Note (as defined

below), (iv) 29,388,888 shares of Common Stock held directly by JuvVentures (UK) Limited that may be issued upon conversion of 211,600

shares of Series A Preferred Stock, (v) 20,611,111 shares of Common Stock held directly by JuvVentures (UK) Limited that may

be issued upon conversion of 148,400 shares of Series B Preferred Stock and (vi) 11,111,111 shares of Common Stock that may

be issued upon conversion of outstanding amounts under the A&R Secured Note at the closing price of the Common Stock on January 12,

2024. This aggregate amount represents approximately 80.4% of the Issuer’s outstanding common stock, based upon 37,951,261

shares outstanding as of November 6, 2023, as reported on the Issuer’s Annual Report filed on Form 10-Q on November 14,

2023, and giving effect to the exercise of the Warrants and conversion of amounts outstanding under the A&R Secured Note and the Spring

2023 Note (and assuming the Amendment Caps do not apply).

(b) The

information in Items 7 through 10 of each cover page is incorporated by reference into this Item 5(b).

(c) Except

for the information set forth in Item 6, which is incorporated by reference into this Item 5(c), the Reporting Persons have effected no

transactions relating to the Common Stock during the past 60 days.

(d) - (e) Not applicable.

| Item 6. |

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer. |

Item 6 of the Original Statement is hereby supplemented as follows:

On January 16, 2024, the Reporting Person funded additional advances

to the Issuer each in the principal amount of $500,000.

SIGNATURES

After reasonable inquiry and to the best of their knowledge and belief,

the undersigned certify that the information set forth in this Statement is true, complete and correct.

Date: January 17, 2024

| JUVENESCENCE LIMITED |

|

| |

|

|

| By: |

/s/ Gregory H. Bailey |

|

| Name: |

Gregory H. Bailey |

|

| Title: |

Executive Chairman |

|

Date: January 17, 2024

| JuvVentures (UK) Limited |

|

| |

|

|

| By: |

/s/ David Gill |

|

| Name: |

David Gill |

|

| Title: |

Director |

|

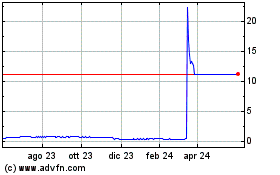

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Dic 2023 a Dic 2024