AgeX Therapeutics, Inc. (“AgeX”; NYSE American: AGE), a

biotechnology company developing therapeutics for human aging and

regeneration, reported that on July 21, 2023, AgeX and Juvenescence

Limited entered into an Exchange Agreement pursuant to which AgeX

agreed to issue to Juvenescence 211,600 shares of a newly

authorized Series A Preferred Stock and 148,400 shares of a newly

authorized Series B Preferred Stock in exchange for the

cancellation of a total of $36 Million of indebtedness consisting

of the outstanding principal amount of certain loans made by

Juvenescence to AgeX and loan origination fees accrued with respect

to those loans.

The exchange of the indebtedness for shares of Series A

Preferred Stock and Series B Preferred Stock (collectively referred

to as the “Preferred Stock”) will be implemented for the purpose of

bringing AgeX common stock back into compliance with the continued

listing requirements of the NYSE American that require AgeX to have

at least $6 Million of stockholders equity; however the continued

listing remains dependent upon a determination by the NYSE American

that AgeX has regained compliance with their listing standards. The

exchange of $36 Million of indebtedness for the Preferred Stock

would, on a proforma basis as of March 31, 2023, increase AgeX’s

stockholders equity to approximately $16 Million from a deficit of

approximately $20 Million. Actual stockholders equity will be

reduced by losses recognized by AgeX subsequent to March 31, 2023

which are not reflected in the pro forma amounts but if the

exchange of indebtedness for Preferred Stock were to be consummated

on the date of this press release, AgeX’s stockholder equity would

exceed the $6 Million amount necessary to meet NYSE American

continued listing requirements. The consummation of the exchange of

indebtedness for Preferred Stock is expected to occur on or around

July 25, 2023 subject to (a) the NYSE American approving a

supplemental application to list the common stock issuable upon

conversion of the Preferred Stock into common stock, and (b) the

filing of a Certificate of Designation of the Series A Preferred

Stock and a Certificate of Designation of the Series B Preferred

Stock with the Secretary of State of Delaware.

The Preferred Stock is not entitled to receive any payment or

distribution of cash or other dividends. In the event of any

voluntary or involuntary liquidation, dissolution or other winding

up of the affairs of AgeX, subject to the preferences and other

rights of any senior stock, before any assets of AgeX shall be

distributed to holders of common stock or other junior stock, all

of the assets of AgeX available for distribution to stockholders

shall be distributed among the holders of Series A Preferred Stock

and Series B Preferred Stock until AgeX shall have distributed to

the holders of those shares an amount of assets having a value

equal to the subscription price per share.

Each share of Preferred Stock will be convertible into a number

of shares of AgeX common stock determined by dividing (x) a number

equal to the number of dollars and cents comprising the

subscription price, by (y) a number equal to the number of dollars

and cents comprising the conversion price. The subscription price

per share of Preferred Stock is $100 which was paid through the

exchange of indebtedness for shares of Preferred Stock. The

conversion price per share of Series A Preferred Stock or Series B

Preferred Stock is $0.72 which was the closing price of AgeX common

stock on the NYSE American on the last trading day immediately

preceding the execution of the Exchange Agreement.

If under the rules of the NYSE American or any other national

securities exchange on which AgeX common stock may be listed,

approval by AgeX stockholders would be required in connection with

the issuance of common stock in excess of the “19.9% Cap” upon any

conversion of Series B Preferred Stock, then unless and until such

stockholder approval has been obtained, the maximum number of

shares of common stock that may be issued upon conversion of all

shares of Series B Preferred Stock shall be an amount equal to the

19.9% Cap. The 19.9% Cap means 7,550,302 shares of common

stock.

If under the rules of the NYSE American or any other national

securities exchange on which AgeX common stock may be listed,

approval by AgeX stockholders would be required in connection with

the issuance of common stock in excess of the 50% Cap upon any

conversion of Series B Preferred Stock, then unless and until such

stockholder approval has been obtained, the maximum number of

shares of common stock that may be issued to a holder of Series B

Preferred Stock upon conversion of such shares shall be an amount

that, when added to other shares of common stock owned by such

holder immediately prior to such conversion would equal one share

less than the 50% Cap.

The Preferred Stock has limited voting rights. The following

matters will require the approval of the holders of a majority of

the shares of a series of Preferred Stock then outstanding, voting

as a separate class: (i) creation of any Preferred Stock ranking as

senior stock to the series with respect to liquidation preferences;

(ii) repurchase of any shares of common stock or other junior stock

except shares issued pursuant to or in connection with a

compensation or incentive plan or agreement approved by the Board

of Directors for any officers, directors, employees or consultants

of AgeX; (iii) any sale, conveyance, or other disposition of all or

substantially all AgeX’s property or business, or any liquidation

or dissolution of AgeX, or a merger into or consolidation with any

other corporation (other than a wholly-owned subsidiary

corporation) but only to the extent that the Delaware General

Corporation Law requires that such transaction be approved by each

class or series of Preferred Stock; (iv) any adverse change in the

powers, preferences and rights of, and the qualifications,

limitations or restrictions on, the series of Preferred Stock; or

(v) any amendment of AgeX’s Certificate of Incorporation or Bylaws

that results in any adverse change in the powers, preferences and

rights of, and the qualifications, limitations or restrictions on,

the series of Preferred Stock. Except as may otherwise be required

by the Delaware General Corporation Law, the Preferred Stock will

have no other voting rights.

About AgeX Therapeutics

AgeX Therapeutics, Inc. (NYSE American: AGE) is focused on

developing and commercializing innovative therapeutics to treat

human diseases to increase healthspan and combat the effects of

aging. AgeX’s PureStem® and UniverCyte™ manufacturing and

immunotolerance technologies are designed to work together to

generate highly defined, universal, allogeneic, off-the-shelf

pluripotent stem cell-derived young cells of any type for

application in a variety of diseases with a high unmet medical

need. AgeX has two preclinical cell therapy programs: AGEX-VASC1

(vascular progenitor cells) for tissue ischemia and AGEX-BAT1

(brown fat cells) for Type II diabetes. AgeX’s revolutionary

longevity platform induced tissue regeneration (iTR™) aims to

unlock cellular immortality and regenerative capacity to reverse

age-related changes within tissues. HyStem® is AgeX’s delivery

technology to stably engraft PureStem or other cell therapies in

the body. AgeX is seeking opportunities to establish licensing and

collaboration arrangements around its broad IP estate and

proprietary technology platforms and therapy product

candidates.

For more information, please visit www.agexinc.com or connect

with the company on Twitter, LinkedIn, Facebook, and YouTube.

Forward-Looking Statements

Certain statements contained in this release are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Any statements that are

not historical fact including, but not limited to statements that

contain words such as “will,” “believes,” “plans,” “anticipates,”

“expects,” “estimates” should also be considered forward-looking

statements. Forward-looking statements involve risks and

uncertainties. Actual results may differ materially from the

results anticipated in these forward-looking statements and as such

should be evaluated together with the many uncertainties that

affect the business of AgeX Therapeutics, Inc. and its

subsidiaries, particularly those mentioned in the cautionary

statements found in more detail in the “Risk Factors” section of

AgeX’s most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission (copies of which may be obtained

at www.sec.gov). Subsequent events and developments may cause these

forward-looking statements to change. AgeX specifically disclaims

any obligation or intention to update or revise these

forward-looking statements as a result of changed events or

circumstances that occur after the date of this release, except as

required by applicable law.

AGEX THERAPEUTICS, INC. AND SUBSIDIARIES CONDENSED

CONSOLIDATED PRO FORMA BALANCE SHEET (in thousands, except

par value amounts) (unaudited) March 31,

Adjusted

2023

Adjustment 1 Adjustment 2 Adjustment 3

Balance ASSETS Current assets: Cash and cash

equivalents $

280

$

-

$

-

$

-

$

280

Accounts and grants receivable, net

6

-

-

-

6

Prepaid expenses and other current assets

1,461

-

-

-

1,461

Total current assets

1,747

-

-

-

1,747

Restricted cash

50

-

-

-

50

Intangible assets, net

705

-

-

-

705

Convertible note receivable

10,029

-

-

-

10,029

TOTAL ASSETS $

12,531

$

-

$

-

$

-

$

12,531

LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT)

Current liabilities: Accounts payable and accrued liabilities $

1,262

$

-

$

-

$

-

$

1,262

Loans due to Juvenescence, net of debt issuance costs, current

portion

20,042

(20,042

)

-

-

-

23,258

(1

)

(21,160

)

(2

)

(4,833

)

(3

)

(2,735

)

(4)

(3,216

)

(1

)

-

-

(3,216

)

Related party payables, net

144

-

-

-

144

Warrant liability

347

-

-

-

347

Insurance premium liability and other current liabilities

730

-

-

-

730

Total current liabilities

22,525

-

(21,160

)

(4,833

)

(3,468

)

Loans due to Juvenescence, net of debt issuance costs, net

of current portion

10,011

(10,011

)

-

-

-

10,355

(1

)

-

(10,007

)

(3

)

348

(344

)

(1

)

-

-

(344

)

-

-

-

-

TOTAL LIABILITIES

32,536

-

(21,160

)

(14,840

)

(3,464

)

Commitments and contingencies

-

-

-

-

-

Stockholders’ equity (deficit): Preferred stock, $0.0001 par

value, authorized 5,000 shares; none issued and outstanding as at

March 31, 2023 and 360 shares issued and outstanding on a pro forma

basis.

-

-

21,160

(2

)

14,840

(3

)

36,000

Common stock, $0.0001 par value, 200,000 shares authorized; and

37,951 as of March 31, 2023

4

-

-

-

4

Additional paid-in capital

99,589

-

-

-

99,589

Accumulated deficit

(119,487

)

-

-

-

(119,487

)

Total AgeX Therapeutics, Inc. stockholders’ equity (deficit)

(19,894

)

-

21,160

14,840

16,106

Noncontrolling interest

(111

)

-

-

-

(111

)

Total stockholders’ equity (deficit)

(20,005

)

-

21,160

14,840

15,995

(5) TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) $

12,531

$

-

$

-

$

-

$

12,531

(1

)

Adjustments to present gross debt amounts owed to Juvenescence

(2

)

Debt exchanged for Preferred Series A shares.

(3

)

Debt exchanged for Preferred Series B shares.

(4

)

The pro forma debt amounts owed to Juvenescence does not reflect

additional drawdowns and origination fees incurred since March 31,

2023

(5

)

The pro forma stockholders' equity balance does not reflect

operating losses incurred since March 31, 2023

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230721797927/en/

Andrea E. Park apark@agexinc.com (510) 671-8620

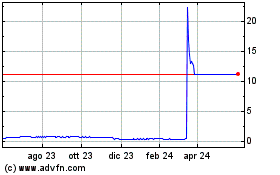

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Dic 2023 a Dic 2024