AgeX Therapeutics, Inc. (“AgeX”; NYSE American: AGE), a

biotechnology company developing therapeutics for human aging and

regeneration, reported that on July 24, 2023, AgeX issued to

Juvenescence Limited 211,600 shares of a newly authorized Series A

Preferred Stock and 148,400 shares of a newly authorized Series B

Preferred Stock in exchange for the cancellation of a total of $36

Million of indebtedness consisting of the outstanding principal

amount of certain loans made by Juvenescence to AgeX and loan

origination fees accrued with respect to those loans. The

cancellation of indebtedness in exchange for the Preferred Stock

was conducted pursuant to an Exchange Agreement between AgeX and

Juvenescence. By completing the exchange of indebtedness for shares

of Series A Preferred Stock and Series B Preferred Stock

(collectively referred to as the “Preferred Stock”), AgeX now has

sufficient stockholders equity to meet the NYSE American continued

listing requirements. Accordingly, the NYSE American staff has

withdrawn its delisting determination and a scheduled hearing of

AgeX’s appeal of that determination has been cancelled. The

exchange of $36 Million of indebtedness for the Preferred Stock, on

a proforma basis as of March 31, 2023, increased AgeX’s stockholder

equity to approximately $16 Million from a deficit of approximately

$20 Million. Actual stockholder equity will be reduced by losses

recognized by AgeX subsequent to March 31, 2023, which are not

reflected in the pro forma amounts, but AgeX’s stockholder equity

now exceeds the $6 Million amount necessary to meet NYSE American

continued listing requirements.

The NYSE American has approved the listing of the 36,939,190

shares of AgeX common stock into which the Preferred Stock is

presently convertible. In order to comply with Section 713 of the

NYSE American Company Guide, the issuance of an additional

13,060,809 shares of AgeX common stock upon conversion of shares of

Series B Preferred Stock is currently restricted by a “cap”

prohibiting issuance of those additional shares without the prior

approval of AgeX stockholders.

The Preferred Stock is not entitled to receive any payment or

distribution of cash or other dividends. In the event of any

voluntary or involuntary liquidation, dissolution or other winding

up of the affairs of AgeX, subject to the preferences and other

rights of any senior stock, before any assets of AgeX shall be

distributed to holders of common stock or other junior stock, all

of the assets of AgeX available for distribution to stockholders

shall be distributed among the holders of Series A Preferred Stock

and Series B Preferred Stock until AgeX shall have distributed to

the holders of those shares an amount of assets having a value

equal to the subscription price per share.

Each share of Preferred Stock will be convertible into a number

of shares of AgeX common stock determined by dividing (x) a number

equal to the number of dollars and cents comprising the

subscription price, by (y) a number equal to the number of dollars

and cents comprising the conversion price. The subscription price

per share of Preferred Stock is $100 which was paid through the

exchange of indebtedness for shares of Preferred Stock. The

conversion price per share of Series A Preferred Stock or Series B

Preferred Stock is $0.72 which was the closing price of AgeX common

stock on the NYSE American on the last trading day immediately

preceding the execution of the Exchange Agreement. However, the

issuance of 13,060,809 shares of common stock upon conversion of

Series B Preferred Stock would require approval by AgeX

stockholders in accordance with NYSE American rules.

The Preferred Stock has limited voting rights. The following

matters will require the approval of the holders of a majority of

the shares of a series of Preferred Stock then outstanding, voting

as a separate class: (i) creation of any Preferred Stock ranking as

senior stock to the series with respect to liquidation preferences;

(ii) repurchase of any shares of common stock or other junior stock

except shares issued pursuant to or in connection with a

compensation or incentive plan or agreement approved by the Board

of Directors for any officers, directors, employees or consultants

of AgeX; (iii) any sale, conveyance, or other disposition of all or

substantially all AgeX’s property or business, or any liquidation

or dissolution of AgeX, or a merger into or consolidation with any

other corporation (other than a wholly-owned subsidiary

corporation) but only to the extent that the Delaware General

Corporation Law requires that such transaction be approved by each

class or series of Preferred Stock; (iv) any adverse change in the

powers, preferences and rights of, and the qualifications,

limitations or restrictions on, the series of Preferred Stock; or

(v) any amendment of AgeX’s Certificate of Incorporation or Bylaws

that results in any adverse change in the powers, preferences and

rights of, and the qualifications, limitations or restrictions on,

the series of Preferred Stock. Except as may otherwise be required

by the Delaware General Corporation Law, the Preferred Stock will

have no other voting rights.

About AgeX Therapeutics

AgeX Therapeutics, Inc. (NYSE American: AGE) is focused on

developing and commercializing innovative therapeutics to treat

human diseases to increase healthspan and combat the effects of

aging. AgeX’s PureStem® and UniverCyte™ manufacturing and

immunotolerance technologies are designed to work together to

generate highly defined, universal, allogeneic, off-the-shelf

pluripotent stem cell-derived young cells of any type for

application in a variety of diseases with a high unmet medical

need. AgeX has two preclinical cell therapy programs: AGEX-VASC1

(vascular progenitor cells) for tissue ischemia and AGEX-BAT1

(brown fat cells) for Type II diabetes. AgeX’s revolutionary

longevity platform induced tissue regeneration (iTR™) aims to

unlock cellular immortality and regenerative capacity to reverse

age-related changes within tissues. HyStem® is AgeX’s delivery

technology to stably engraft PureStem or other cell therapies in

the body. AgeX is seeking opportunities to establish licensing and

collaboration arrangements around its broad IP estate and

proprietary technology platforms and therapy product

candidates.

For more information, please visit www.agexinc.com or connect

with the company on Twitter, LinkedIn, Facebook, and YouTube.

Forward-Looking Statements

Certain statements contained in this release are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995. Any statements that are

not historical fact including, but not limited to statements that

contain words such as “will,” “believes,” “plans,” “anticipates,”

“expects,” “estimates” should also be considered forward-looking

statements. Forward-looking statements involve risks and

uncertainties. Actual results may differ materially from the

results anticipated in these forward-looking statements and as such

should be evaluated together with the many uncertainties that

affect the business of AgeX Therapeutics, Inc. and its

subsidiaries, particularly those mentioned in the cautionary

statements found in more detail in the “Risk Factors” section of

AgeX’s most recent Annual Report on Form 10-K filed with the

Securities and Exchange Commission (copies of which may be obtained

at www.sec.gov). Subsequent events and developments may cause these

forward-looking statements to change. AgeX specifically disclaims

any obligation or intention to update or revise these

forward-looking statements as a result of changed events or

circumstances that occur after the date of this release, except as

required by applicable law.

AGEX THERAPEUTICS, INC. AND

SUBSIDIARIES

CONDENSED CONSOLIDATED PRO

FORMA BALANCE SHEET

(in thousands, except par

value amounts)

(unaudited)

March 31, 2023

Adjustment 1

Adjustment 2

Adjustment 3

Adjusted Balance

ASSETS

Current assets:

Cash and cash equivalents

$

280

$

-

$

-

$

-

$

280

Accounts and grants receivable, net

6

-

-

-

6

Prepaid expenses and other current

assets

1,461

-

-

-

1,461

Total current assets

1,747

-

-

-

1,747

Restricted cash

50

-

-

-

50

Intangible assets, net

705

-

-

-

705

Convertible note receivable

10,029

-

-

-

10,029

TOTAL ASSETS

$

12,531

$

-

$

-

$

-

$

12,531

LIABILITIES AND STOCKHOLDERS’ EQUITY

(DEFICIT)

Current liabilities:

Accounts payable and accrued

liabilities

$

1,262

$

-

$

-

$

-

$

1,262

Loans due to Juvenescence, net of debt

issuance costs, current portion

20,042

(20,042

)

-

-

-

23,258

(1)

(21,160

)(2)

(4,833

)(3)

(2,735

)(4)

(3,216

)

(1)

-

-

(3,216

)

Related party payables, net

144

-

-

-

144

Warrant liability

347

-

-

-

347

Insurance premium liability and other

current liabilities

730

-

-

-

730

Total current liabilities

22,525

-

(21,160

)

(4,833

)

(3,468

)

Loans due to Juvenescence, net of debt

issuance costs, net of current portion

10,011

(10,011

)

-

-

-

10,355

(1)

-

(10,007

)(3)

348

(344

)

(1)

-

-

(344

)

-

-

-

-

TOTAL LIABILITIES

32,536

-

(21,160

)

(14,840

)

(3,464

)

Commitments and contingencies

-

-

-

-

-

Stockholders’ equity (deficit):

Preferred stock, $0.0001 par value,

authorized 5,000 shares; none issued and outstanding as at March

31, 2023 and 360 shares issued and outstanding on a pro forma

basis.

-

-

21,160

(2)

14,840

(3)

36,000

Common stock, $0.0001 par value, 200,000

shares authorized; and 37,951 as of March 31, 2023

4

-

-

-

4

Additional paid-in capital

99,589

-

-

-

99,589

Accumulated deficit

(119,487

)

-

-

-

(119,487

)

Total AgeX Therapeutics, Inc.

stockholders’ equity (deficit)

(19,894

)

-

21,160

14,840

16,106

Noncontrolling interest

(111

)

-

-

-

(111

)

Total stockholders’ equity (deficit)

(20,005

)

-

21,160

14,840

15,995

(5)

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY

(DEFICIT)

$

12,531

$

-

$

-

$

-

$

12,531

(1)

Adjustments to present gross debt amounts

owed to Juvenescence.

(2)

Debt exchanged for Preferred Series A

shares.

(3)

Debt exchanged for Preferred Series B

shares.

(4)

The pro forma debt amounts owed to Juvenescence does not reflect

additional drawdowns and origination fees incurred since March 31,

2023.

(5)

The pro forma stockholders’ equity balance

does not reflect operating losses incurred since March 31,

2023.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230724163190/en/

Andrea E. Park apark@agexinc.com (510) 671-8620

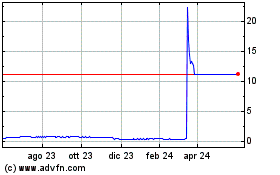

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Dic 2023 a Dic 2024