- Merger to result in NYSE American-listed company focused on

developing therapeutics based on Serina’s proprietary POZ Platform™

delivery technology

- Lead program of the combined company will be SER-252

(POZ-apomorphine) for the treatment of advanced Parkinson’s

Disease

- Focus on expanding POZ Platform™ partnering collaborations

across immunology, cancer Rx, and gene therapy fields

Serina Therapeutics, Inc. (“Serina”), a privately-held,

clinical-stage biotechnology company developing a pipeline of

therapies for the treatment of Parkinson’s Disease and other

neurological diseases, entered into a merger agreement with AgeX

Therapeutics, Inc. (NYSE American: AGE) (“AgeX”) on August 29,

2023, under which Serina will merge with a wholly-owned subsidiary

of AgeX in an all-stock transaction. The combined company will

continue under the Serina Therapeutics name and will focus on

advancing Serina’s pipeline of small molecule drug candidates

targeting central nervous system (“CNS”) indications, enabled by

the company’s proprietary POZ Platform™ delivery technology. In

addition to advancing the company’s wholly-owned pipeline assets,

Serina is working with companies in the pharmaceutical industry

currently advancing pre-clinical studies exploring POZ polymer

lipid-nanoparticles (“LNPs”) in next generation RNA vaccines.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230829713838/en/

“The merger with AgeX positions Serina to advance our CNS

pipeline assets and expand our platform partnering opportunities,”

said Milton Harris, PhD, Co-Founder and Chair of the Board of

Serina. “We believe it represents the best path forward for Serina

in accessing transformative capital to advance our platform

technology. As a board director of the combined company, I look

forward to collaborating with our new partners AgeX and

Juvenescence, as we continue the work of translating our science

into innovative therapeutics.”

“We are delighted to announce the proposed merger with Serina,”

said Joanne M. Hackett, PhD, Chairperson and Interim Chief

Executive Officer of AgeX. “The AgeX team thoroughly reviewed and

evaluated numerous strategic alternatives for creating stockholder

value, and we believe this transaction with Serina presented the

most compelling option for our stockholders. We see exciting

potential to generate novel drug candidates with the POZ Platform™

delivery technology.”

"Serina merging with AgeX is an important step towards

recognizing the potential to develop the POZ Platform™ to deliver

novel medicines and treatment modalities,” said Richard Marshall,

Chief Executive Officer of Juvenescence Limited (“Juvenescence”).

“We plan to leverage our deep pharmaceutical expertise and network

to assist the combined company to reach its goal in maximizing

value for stockholders.”

The combined company will focus on advancing Serina’s lead drug

candidate (SER-252, POZ-apomorphine) for the treatment of advanced

Parkinson’s Disease through pre-clinical studies, with the goal of

submitting an investigational new drug submission (“IND”) to the

Food and Drug Administration for the initiation of a Phase I

clinical trial during the fourth quarter of 2024. Serina has two

other pipeline assets that are positioned to enter IND enabling

studies, SER-227 (POZ-buprenorphine) for certain post-operative

pain indications and SER-228 (POZ-cannabidiol) for refractory

epilepsy indications. Additionally, the combined company will focus

on expanding Serina’s LNP and antibody drug conjugate (“ADC”)

partnering collaborations.

About the Transaction, Management and Organization

Under the terms of the merger agreement, pending stockholder

approval of the transaction, Serina will merge with a wholly-owned

subsidiary of AgeX, and stockholders of Serina will receive shares

of AgeX common stock (“merger”). AgeX following the merger is

referred to herein as the “combined company.” The merger has been

approved by the boards of directors of both companies and is

expected to close in the first quarter of 2024, subject to

customary closing conditions.

Upon completion of the merger, pre-merger AgeX stockholders are

expected to own approximately 25% of the newly combined company

while pre-merger Serina stockholders are expected to own

approximately 75% of the newly combined company. The final

percentage of the combined company owned by pre-merger Serina

stockholders and pre-merger AgeX stockholders upon completion of

the merger may be subject to certain adjustments and assumptions.

As part of the merger, pre-merger AgeX stockholders will be issued

Post-Merger Warrants. The Post-Merger Warrants issued to AgeX

stockholder, Juvenescence, have a cash exercise requirement that

will provide an additional $15 million in capital to the combined

company in three equal tranches over the term of the warrant, which

expires July 31, 2025. AgeX stockholders that exercise the

Post-Merger Warrants will additionally receive Incentive Warrants

that expire four (4) years after the merger closing date. The terms

and conditions for each type of warrant will be further detailed in

the forms of warrant agreements that will be negotiated between the

parties prior to the merger closing date.

Prior to the execution of the merger agreement, AgeX invested

$10 million in Serina through the purchase of a Senior Convertible

Loan Note (“CLN”) described on the Current Report on Form 8-K that

AgeX filed with the U.S. Securities and Exchange Commission (“SEC”)

on March 15, 2023. Immediately prior to completion of the merger,

the CLN will be converted into Serina capital stock as a capital

contribution. It is expected that the funds provided by the CLN,

together with the additional $15 million of proceeds from the

Juvenescence required warrant cash exercises, will provide working

capital for the combined company to help fund operations into

calendar year 2026.

Following the merger, it is anticipated that the combined

company will be led by a new Chief Executive Officer (“CEO”).

Current members of the executive team of Serina are expected to

continue in key leadership roles, including Dr. Randall Moreadith

as the Chief Science Officer, and Dr. Tacey Viegas as Chief

Operating Officer and Secretary. Serina’s current Chief Financial

Officer (“CFO”) Steve Ledger is expected to serve as the interim

CEO of the combined company until such time as the new CEO is

hired. AgeX’s current CFO, Andrea Park, is expected to serve as the

interim CFO and Chief Accounting Officer of the combined company

until such time as the new CFO is hired, and is then expected to

continue in the role of Chief Accounting Officer. The board of

directors will be comprised of seven directors and are expected to

include AgeX director Dr. Gregory Bailey, Juvenescence CEO Dr.

Richard Marshall, Serina’s directors Dr. J. Milton Harris and Steve

Ledger, and the Buck Institute for Aging’s Vice President of

Business and Technology Advancement Remy Gross III. Two additional

directors will be appointed in accordance with the merger agreement

to fill the remaining seats on the board of directors.

Upon completion of the transaction, the combined company will

operate under the Serina Therapeutics name, and the combined

company’s common stock is expected to trade on the NYSE American

under the ticker symbol “SER.” The corporate headquarters will be

in Huntsville, Alabama.

Gibson, Dunn & Crutcher LLP is providing legal counsel to

AgeX. Bradley Arant Boult Cummings LLP is legal counsel to

Serina.

About Serina Therapeutics

Serina is a clinical-stage biotechnology company developing a

pipeline of wholly-owned drug product candidates to treat

neurological diseases and pain. Serina’s POZ Platform™ delivery

technology is engineered to provide greater control in drug loading

and more precision in the rate of release of attached drugs,

enabling the potential of certain challenging small molecules,

while addressing the limitations of polyethylene glycol (“PEG”) and

other biocompatible polymers. Our POZ Platform™ partners are at the

forefront in advancing LNP delivery technology to develop novel RNA

therapeutics. Serina is headquartered in Huntsville, Alabama on the

campus of the HudsonAlpha Institute of Biotechnology. For more

information, please visit https://serinatherapeutics.com.

About AgeX Therapeutics

AgeX has been focused on developing and commercializing

innovative therapeutics to treat human diseases to increase health

span and combat the effects of aging. For more information, please

visit http://agexinc.com.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements contained in this communication regarding

matters that are not historical facts are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended (the “Securities Act”) and Section 21E of the

Securities and Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995, known as the PSLRA. These

include statements regarding the anticipated completion and effects

of the proposed merger and related timing, pro forma descriptions

of the combined company, Serina’s and the combined company’s

planned preclinical and clinical programs, including planned

clinical trials, the potential of Serina’s product candidates, the

anticipated cash expected from warrant exercises and the ability

for proceeds to fund the operations of the combined company for as

long as anticipated, the expected trading of the combined company’s

stock on the NYSE American under the ticker symbol “SER,”

management of the combined company and other statements regarding

management’s intentions, plans, beliefs, expectations or forecasts

for the future. All forward-looking statements are based on

assumptions or judgments about future events and economic

conditions that may or may not be correct or necessarily take place

and that are by their nature subject to significant risks,

uncertainties and contingencies. You are cautioned not to place

undue reliance on these forward-looking statements. No

forward-looking statement can be guaranteed, and actual results may

differ materially from those projected. Statements that contain

words such as “anticipates,” “believes,” “plans,” “expects,”

“projects,” “future,” “intends,” “may,” “will,” “should,” “could,”

“estimates,” “predicts,” “potential,” “continue,” “guidance,” and

similar expressions to identify these forward-looking statements

are intended to be covered by the safe-harbor provisions of the

PSLRA.

There are a number of risks and uncertainties that could cause

actual results to differ materially from the forward-looking

statements included in this communication. With respect to the

merger, these risks and uncertainties include: the possibility that

stockholders of AgeX or Serina may not approve the merger; one or

more conditions to consummating the merger may not be satisfied;

one or more material agreements that may be entered into in

connection with the merger may be terminated by a party to the

agreement; AgeX or the combined company may be unable to obtain

approval to list on the NYSE American the shares of AgeX common

stock expected to be issued pursuant to the merger; and the closing

of the merger might be delayed or not occur at all. In addition,

the merger could cause AgeX to face additional risks, including

risks associated with conducting and financing Serina’s current or

future research and product development programs, including risks

that those research and development programs will not result in the

development of products or technologies with the desired clinical

utility, benefits, or market acceptance; risks associated with

conducting clinical trials of Serina product candidates and

obtaining Food and Drug Administration or other regulatory

approvals to market product candidates, including risks with

respect to the timing of initiation of Serina’s planned clinical

trials, the timing of the availability of data or other results

from clinical trials, and the timing of any planned investigational

new drug application or new drug application; risks associated with

the combined company’s ability to identify additional products or

product candidates with significant commercial potential; risks

associated with AgeX’s, Serina’s or the combined company’s ability

to protect its intellectual property position; product liability

risks; the risk that the cash balance of the combined company

following the closing of the merger will be lower than expected or

reduced; the risk that the combined company’s anticipated sources

and related timing of financing following the closing of the merger

will not provide proceeds necessary to fund the operations of the

combined company for as long as anticipated; the risk that the

transactions contemplated by the Side Letter entered into by AgeX,

Serina and Juvenescence on August 29, 2023 are not completed in a

timely manner or at all; risks associated with AgeX’s or Serina’s

estimates regarding future revenue, expenses, capital requirements,

and need for additional financing following the merger; risks

associated with the ability of AgeX and the combined company to

remain listed on the NYSE American; the risk that products may not

be successfully commercialized or that the combined company might

not otherwise be able to generate sufficient revenues to operate at

a profit; potential adverse changes to business or employee

relationships, including those resulting from the announcement or

completion of the merger; the risk that changes in AgeX’s capital

structure, management, business, and governance following the

merger could have adverse effects on the market value of its common

stock; the ability of AgeX and Serina to retain customers and

retain and hire key personnel and maintain relationships with their

suppliers and customers; risks associated with Serina’s or the

combined company’s ability to successfully collaborate with

Serina’s existing collaborators or enter into new collaborations,

or to fulfill its obligations under any such collaboration

agreements; risks associated with the combined company’s

commercialization, marketing and manufacturing capabilities and

strategy; the risk that pursuing and completing the merger and

related transactions could distract AgeX and Serina management from

their respective ongoing business operations or cause AgeX and

Serina to incur substantial costs; risks associated with

competition and developments in the industry in which the combined

company will operate; the impact of world health events, including

the COVID-19 pandemic and any related economic downturn; the risk

of changes in governmental regulations or enforcement practices;

AgeX’s and Serina’s ability to meet guidance, market expectations,

and internal projections; the impact of AgeX stockholders having

their percentage ownership interests in AgeX reduced by the

issuance of AgeX common stock to Serina stockholders in the Merger

and by the issuance of shares of AgeX common stock upon the

exercise of Post-Merger Warrants by Juvenescence, and other

important factors that could cause actual results to differ

materially from those projected or expected by AgeX management or

stockholders. The effects of many of such factors are difficult to

predict and may be beyond AgeX’s or Serina’s control.

New factors emerge from time to time, and it is not possible for

us to predict all such factors, nor can we assess the impact of

each such factor on the business or the extent to which any factor,

or combination of factors, may cause actual results to differ

materially from those contained in any forward-looking statements.

Additional factors that could cause actual results to differ

materially from the results anticipated in these forward-looking

statements are contained in AgeX’s periodic reports filed with the

SEC under the heading “Risk Factors” and other filings that AgeX

may make with the SEC. Forward-looking statements included in this

communication are based on information available to AgeX and Serina

as of the date of this communication. Undue reliance should not be

placed on these forward-looking statements that speak only as of

the date they are made, and except as required by law, AgeX and

Serina each disclaims any intent or obligation to update these

forward-looking statements.

Additional Information and Where to Find It

In connection with the proposed business combination transaction

between AgeX and Serina, AgeX intends to file relevant materials

with the SEC, including a registration statement on Form S-4. AGEX

URGES INVESTORS AND STOCKHOLDERS TO READ THESE MATERIALS CAREFULLY

AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION ABOUT AGEX, SERINA AND THE PROPOSED

TRANSACTION AND RELATED MATTERS. Investors and stockholders will be

able to obtain free copies of the Form S-4 and other documents

filed by AgeX with the SEC (when they become available) through the

website maintained by the SEC at www.sec.gov. In addition,

investors and stockholders will be able to obtain free copies of

the Form S-4 and other documents filed by AgeX with the SEC by

contacting Andrea Park by email at apark@agexinc.com. Investors and

stockholders are urged to read the Form S-4, including the proxy

statement / prospectus contained therein, and the other relevant

materials when they become available before making any voting or

investment decision with respect to the proposed transaction.

Participants in the Solicitation

AgeX and Serina, and each of their respective directors and

executive officers and certain of their other members of management

and employees, may be deemed to be participants in the solicitation

of proxies in connection with the proposed transaction. Information

about AgeX’s directors and executive officers is included in AgeX’s

Annual Report on Form 10-K for the year ended December 31, 2022,

filed with the SEC on March 31, 2023, in the proxy statement for

AgeX’s 2022 annual meeting of stockholders, filed with the SEC on

November 2, 2022, and in AgeX’s Quarterly Report on Form 10-Q for

the three and six months ended June 30, 2023, filed with the SEC on

August 14, 2023. Additional information regarding these persons and

their interests in the transaction will be included in the proxy

statement / prospectus included in the Form S-4 relating to the

transaction when it is filed with the SEC. These documents can be

obtained free of charge from the sources indicated above.

No Offer or Solicitation

This communication relates to a proposed business combination

transaction between AgeX and Serina. This communication is for

informational purposes only and does not constitute an offer to

sell or the solicitation of an offer to buy any securities or a

solicitation of any vote or approval, in any jurisdiction, pursuant

to the proposed business combination transaction or otherwise, nor

shall there be any sale, issuance, exchange or transfer of the

securities referred to in this communication in any jurisdiction in

contravention of applicable law. No offer of securities shall be

made except by means of a prospectus meeting the requirements of

Section 10 of the Securities Act.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230829713838/en/

Investor Contact

Andrea E. Park apark@agexinc.com (510) 671-8620

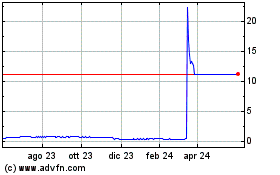

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni AgeX Therapeutics (AMEX:AGE)

Storico

Da Dic 2023 a Dic 2024