SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

|

£

|

Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934

|

|

|

|

|

S

|

Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934

|

For the fiscal year ended October 31, 2012

Commission File Number 1-9038

Central Fund of Canada Limited

(Exact name of registrant as specified in

its charter)

|

Alberta, Canada

|

|

1040

|

|

Not Applicable

|

|

(Province or Other Jurisdiction of

|

|

(Primary Standard Industrial Classification

|

|

(I.R.S. Employer

|

|

Incorporation or Organization)

|

|

Code)

|

|

Identification No.)

|

Hallmark Estates, #805

1323-15th Avenue S.W.

Calgary, Alberta T3C 0X8

Canada

(403) 228-5861

(Address and telephone number of registrant’s

principal executive offices)

DL Services, Inc.

Columbia Center

701 Fifth Avenue, Suite 6100

Seattle, Washington 98104-7043

(206) 903-8800

(Name, address (including zip code) and

telephone number (including

area code) of agent for service in the United

States)

Securities to be registered pursuant to Section 12(b) of

the Act:

|

Title of Each Class:

|

|

Name of Each Exchange On Which Registered:

|

|

Class A non-voting shares, no par value

|

|

NYSE MKT LLC

|

|

|

|

Toronto Stock Exchange

|

Securities registered pursuant to Section 12(g) of

the Act:

None

Securities for which there is a reporting obligation pursuant

to Section 15(d) of the Act:

None

For annual reports, indicate by check mark the information filed

with this form:

|

x

Annual Information Form

|

|

x

Audited Annual Financial Statements

|

Indicate the number of outstanding shares of each of the registrant’s

classes of capital or common stock as of the close of the period covered by the annual report:

|

|

|

Outstanding at

|

|

Class

|

|

October 31, 2012

|

|

Class A non-voting shares, no par value

|

|

254,432,713

|

|

Common shares, no par value

|

|

40,000

|

Indicate

by check mark whether the Registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the

Exchange Act during the preceding 12 months (or for such shorter period that the Registrant was required to file such reports)

and (2) has been subject to such filing requirements for the past 90 days.

x

Yes

¨

No

Indicate

by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during

the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files).

¨

Yes

¨

No

EXPLANATORY NOTE

Central Fund of Canada Limited (the “Company”

or the “Registrant”) is a Canadian issuer eligible to file its annual report pursuant to Section 13 of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”), on Form 40-F pursuant to the multijurisdictional disclosure

system of the Exchange Act. The Company is a “foreign private issuer” as defined in Rule 3b-4 under the

Exchange Act. Equity securities of the Company are accordingly exempt from Sections 14(a), 14(b), 14(c), 14(f) and

16 of the Exchange Act pursuant to Rule 3a12-3.

NOTE TO UNITED STATES READERS:

DIFFERENCES IN UNITED STATES AND CANADIAN

REPORTING PRACTICES

The Company is permitted, under a multijurisdictional

disclosure system adopted by the United States, to prepare this annual report on Form 40-F (this “Annual Report”)

in accordance with Canadian disclosure requirements, which are different from those of the United States. The Company

prepares its financial statements, which are filed as Exhibits to this Annual Report, in accordance with Canadian generally accepted

accounting practices (“Canadian GAAP”), and they may be subject to Canadian auditing and auditor independence standards. They

may not be comparable to financial statements of United States companies.

CURRENCY

Unless otherwise indicated, all dollar amounts

in this Annual Report are in United States dollars. As of December 11, 2012, the noon buying rate in New York City

for cable transfers in United States dollars as certified for customs purposes by the Federal Reserve Bank of New York was U.S.$1.00

= Cdn.$0.9867.

ANNUAL INFORMATION FORM

The Company’s Annual Information Form

for the fiscal year ended October 31, 2012 is filed as

Exhibit 99.1

and is hereby incorporated by reference in

this Annual Report.

AUDITED ANNUAL FINANCIAL STATEMENTS AND

MANAGEMENT’S DISCUSSION AND ANALYSIS

Audited Annual Financial Statements

The Company’s audited Statements of

Net Assets as of October 31, 2012 and 2011 and its Statements of Income, Statements of Changes in Net Assets and Statements

of Shareholders’ Equity for the years ended October 31, 2012, 2011 and 2010, along with the notes to such financial

statements and the reports of the independent auditors with respect thereto, and the information included under the heading “Management’s

Responsibility for Financial Reporting and Effectiveness of Internal Control over Financial Reporting,” each of which are

filed as part of

Exhibit 99.3

, are hereby incorporated by reference in this Annual Report. For a reconciliation

of important differences between Canadian GAAP and generally accepted accounting principles in the United States of America, see

Note 10 to the Company’s audited financial statements.

Management’s Discussion and Analysis

The management’s discussion and analysis

(“MD&A”) prepared by the Company is filed as

Exhibit 99.2

and is hereby incorporated by reference in

this Annual Report.

TAX MATTERS

Shareholders should be aware that the acquisition,

ownership, and disposition of shares of non-voting, fully participating Class A common stock of the Company (the “Class A

Shares”) may have tax consequences under the laws of both Canada and the United States. Shareholders are solely responsible

for determining the tax consequences applicable to their particular circumstances and should consult their own tax advisors concerning

an investment in the Company’s Class A Shares.

CERTAIN UNITED STATES FEDERAL INCOME

TAX CONSIDERATIONS

The following is a summary of certain material

U.S. federal income tax consequences to a United States Person (as defined below) arising from and relating to the acquisition,

ownership, and disposition of the Company’s Class A Shares.

This summary is only a general discussion

and is not intended to be, and should not be construed to be, legal or United States federal income tax advice to any United States

Person. In addition, this summary does not discuss all aspects of United States federal income taxation that may be relevant

to a United States Person in light of such United States Person’s particular circumstances. Except as specifically

set forth below, this summary does not discuss applicable income tax reporting requirements. No ruling from the Internal Revenue

Service (“IRS”) has been requested, or will be obtained, regarding the United States federal income tax consequences

to United States Persons on the ownership or disposition of Class A Shares. This summary is not binding on the IRS, and

the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in this summary. In

addition, because the authorities on which this summary is based are subject to various interpretations, the IRS and the United States

courts could disagree with one or more of the positions taken in this summary. Moreover, this summary does not include any discussion

of United States state or local, United States federal estate or gift, United States federal alternative minimum tax

or foreign tax consequences.

Scope of this Summary

Authorities

This summary is based on the Internal Revenue

Code of 1986, as amended (the “Code”), Treasury Regulations (whether final, temporary, or proposed), published rulings

of the IRS, published administrative positions of the IRS, the Convention Between Canada and the United States of America with

Respect to Taxes on Income and on Capital, signed September 26, 1980, as amended (the “Canada-U.S. Tax Convention”),

and U.S. court decisions that are applicable and, in each case, as in effect and available, as of the date of this Form 40-F. Any

of the authorities on which this summary is based could be changed in a material and adverse manner at any time, and any such change

could be applied on a retroactive basis. This summary does not discuss the potential effects, whether adverse or beneficial,

of any proposed legislation that, if enacted, could be applied on a retroactive basis.

United States Persons

For purposes of this summary, a “United States

Person” means (i) an individual citizen or resident of the United States, (ii) a corporation, or other entity

treated as a corporation for United States federal income tax purposes, created or organized in or under the laws of the United States,

any state in the United States or the District of Columbia; (iii) an estate, the income of which is subject to United States

federal income taxation regardless of its source; or (iv) a trust if either (a) such trust has validly elected to be

treated as a United States person for United States federal income tax purposes or (b) a United States court

is able to exercise primary supervision over the administration of such trust and one or more United States Persons have the

authority to control all substantial decisions of such trust.

U.S. Person Subject to Special U.S. Federal Income Tax Rules Not

Addressed

This summary does not discuss the United States

federal income tax consequences to United States Persons that are subject to special treatment under the Code (for example,

United States Persons (i) that are tax-exempt organizations, qualified retirement plans, individual retirement accounts,

or other tax-deferred accounts; (ii) that are financial institutions, insurance companies, real estate investment trusts,

or regulated investment companies; (iii) that are dealers in securities or currencies or that are traders in securities that

elect to apply a mark-to-market accounting method; (iv) that have a “functional currency” other than the United States

dollar; (v) that own Class A Shares as part of a straddle, hedging transaction, conversion transaction, constructive

sale, or other arrangement involving more than one position; (vi) that hold Class A Shares other than as a capital asset

within the meaning of Section 1221 of the Code; or (vii) that own (directly, indirectly, or constructively) 10% or more

of the total combined voting power of the outstanding shares of the Company). This summary also does not address the onsequences

of owning Class A Shares by United States Persons who are United States expatriates or former long-term residents of the United

States subject to Section 877 of the Code. United States Persons and others that are subject to special provisions under the

Code, including United States Persons described immediately above, should consult a tax advisor regarding the United States federal

income tax consequences arising from and relating to the ownership and disposition of Class A Shares.

The United States federal income

tax consequences of the ownership and disposition of the Class A Shares are very complex and, in certain cases, uncertain

or potentially unfavorable to United States Persons. Accordingly, a United States Person considering acquiring Class A

Shares is strongly urged to consult its own tax advisor with respect to the United States federal income, United States

state or local, United States federal estate or gift, alternative minimum tax or foreign tax consequences of the ownership

and disposition of Class A Shares in light of such United States Person’s particular facts and circumstances.

Sale or Disposition of Class A Shares

Subject to the passive foreign investment

company (“PFIC”) rules discussed below, a United States Person generally will recognize gain or loss on the sale

or other taxable disposition of Class A Shares in an amount equal to the difference, if any, between (a) the amount of

cash plus the fair market value of any property received and (b) such United States Person’s tax basis in the Class A

Shares sold or otherwise disposed of. Amounts received by a United States Person upon the redemption by the Company of Class A

Shares will be treated either as a distribution by the Company (See “Distributions on Class A Shares” below)

or as a payment in exchange for the Class A Shares, depending on whether and to what extent the redemption reduces the United States

Person’s percentage ownership interest in the Company. Generally, a redemption will be treated as an exchange of Class A

Shares if (taking into account certain constructive ownership rules under Section 318 of the Code) the redemption (a) completely

terminates the United States Person’s interest in the Company under Section 302(b)(3) of the Code, (b) is

“substantially disproportionate” with respect to the United States Person under Section 302(b)(2) of

the Code, or (c) is “not essentially equivalent to a dividend” under Section 302(b)(1) of the Code.

Gain or loss recognized on a sale or other taxable disposition generally will be long-term capital gain or loss if, at the time

of the sale or other disposition, the Class A Shares have been held for more than one year. Preferential tax rates apply to long-term

capital gain of a United States Person that is an individual, estate, or trust. There are currently no preferential tax rates for

long-term capital gain of a United States Person that is a corporation. Deductions for capital losses are subject to significant

limitations under the Code. Because the Company has been, and expects to continue to be, a PFIC, the special rules discussed

below generally will apply to any gain recognized by a United States Person on sales or other taxable dispositions of Class A

Shares. See “Passive Foreign Investment Company Treatment”, below.

Distributions on Class A Shares

Subject to the PFIC rules discussed below,

a distribution paid on a Class A Share, including a constructive distribution, generally will be included in gross income

of a United States Person as ordinary income (without reduction for any amounts withheld in respect of Canadian federal income

tax) to the extent of the Company’s current or accumulated “earnings and profits” (as computed under United States

federal income tax rules). To the extent that a distribution paid on the Class A Shares exceeds the “earnings and profits”

of the Company, such distribution generally will be treated as a non-taxable return of capital to the extent of the tax basis of

the Class A Share and then as gain from the sale or exchange of the Class A Share. Dividends paid on the Class A

Shares will not be eligible for the United States federal income tax rate generally applicable to dividends paid by a “qualified

foreign corporation” to non-corporate United States Persons if the Company is a PFIC for the Company’s taxable

year during which it pays a dividend on the Class A Shares, or for the Company’s immediately preceding taxable year.

In addition, dividends paid on the Class A Shares generally will not be eligible for the deduction for dividends received

by corporations. Notwithstanding the discussion above, because the Company has been, and expects to continue to be, a PFIC, the

special rules discussed below generally will apply to any distribution paid on the Class A Shares. See “Passive

Foreign Investment Company Treatment” below.

Foreign Currency

For U.S. federal income tax purposes,

the amount received by a United States Person as payment with respect to a distribution on or a disposition of Class A

Shares if paid in Canadian dollars, is the U.S. dollar value at ne date of the payment, regardless of whether the payment

is promptly converted into U.S. dollars. If the Canadian dollars are not converted into U.S. dollars on the date of the

payment, the United States Person may recognize additional ordinary income or loss as a result of currency fluctuations between

the date on which the payment is made and the date the payment is converted into U.S. dollars.

Passive Foreign Investment Company Treatment

The Company generally will be a PFIC for

United States federal income tax purposes if, for a taxable year, either (i) 75% or more of the gross income of the Company

for such taxable year is passive income or (ii) on average, 50% or more of the assets held by the Company either produce passive

income or are held for the production of passive income, based on the fair market value of such assets. “Passive income”

includes, for example, dividends, interest, certain rents and royalties, certain gains from the sale of stock and securities, and

certain gains from commodities transactions. The Company has been, and expects to continue to be, a PFIC for United States

federal income tax purposes. The United States federal income tax rules applicable to PFICs are very complex and, in

certain cases, uncertain. Each United States Person is strongly urged to consult its own tax advisor with respect to the PFIC rules.

The United States federal income tax

consequences to a United States Person that owns (directly or, in certain cases, indirectly) Class A Shares will depend

on whether or not a qualified electing fund (a “QEF”) election or a mark-to-market election (a “Mark-to-Market

Election”), each as described below, is made by such United States Person with respect to the Company.

In any year in which the Company is classified

as a PFIC, a United States Person may be required to file an annual report with the IRS containing such information as Treasury

regulations and/or other IRS guidance may require. United States Persons should consult their own tax advisors regarding the requirements

of filing such information returns under these rules, including the requirement to file an IRS Form 8621.

Non-Electing Shareholders

If a QEF election is not made by a United States

Person, or is not in effect with respect to the entire period that such United States Person has held the Class A Shares,

then, unless such United States Person has made the Mark-to-Market Election, any gain recognized on the sale or other taxable

disposition of Class A Shares will be treated as ordinary income realized pro rata over such holding period for such

Class A Shares. A United States Person will be required to include as ordinary income in the year of disposition the

portion of the gain attributed to such year. In addition, such United States Person’s United States federal income

tax for the year of disposition will be increased by the sum of (i) the tax computed by using the highest statutory rate applicable

to such United States Person for each year (without regard to other income or expenses of such United States Person)

on the portion of the gain attributed to years prior to the year of disposition plus (ii) interest on the tax determined under

clause (i), at the rate applicable to underpayments of tax, which interest will not be deductible by non-corporate United States

Persons, from the due date of the United States federal income tax return (without regard to extensions) for each year described

in clause (i) to the due date of the United States federal income tax return (without regard to extensions)

for the year of disposition. Under certain proposed Treasury regulations, a “disposition” for this purpose may include,

under certain circumstances, transfers at death, gifts, pledges, transfers pursuant to tax-deferred reorganizations and other transactions

with respect to which gain ordinarily would not be recognized. Under certain circumstances, the adjustment generally made to the

tax basis of property held by a decedent may not apply to the tax basis of Class A Shares if a QEF election was not in effect

for the deceased United States Person’s entire holding period. Any loss recognized by a United States Person on

the disposition of Class A Shares generally will be capital loss. In addition, rules similar to those applicable to dispositions

generally will apply to “excess distributions” paid on a Class A Share (i.e., distributions that exceed 125%

of the average amount of distributions received on the Class A Share during the preceding three years or, if shorter, during

the United States Person’s holding period for the Class A Share).

QEF Election

A United States Person that owns Class A

Shares may elect (assuming that the Company provides such United States Person with certain information) to have the Company

treated, with respect to that United States Person, as a QEF. A QEF election must be made by a United States Person before

the due date (including extensions) for such United States Person’s United States federal income tax return for

the taxable year for which the QEF election is made, and, once made, will be effective for all subsequent taxable years of such

United States Person, unless revoked with the consent of the IRS. (A United States Person that makes a QEF election

with respect to the Company is referred to in this summary as an “Electing Shareholder”).

The Company now makes,

and intends to continue to make, available to Electing Shareholders the PFIC Annual Information Statement currently required by

the IRS with respect to a QEF election, which will include information as to the allocation of the Company’s “ordinary

earnings” and “net capital gains” (each as computed under United States federal income tax rules) among

the Class A Shares and as to distributions on such Class A Shares. Such PFIC Annual Information Statement may be used

by Electing Shareholders for purposes of complying with the reporting requirements applicable to the QEF election.

Provided that an Electing Shareholder’s

QEF election is in effect with respect to the entire holding period for the Class A Shares, any gain or loss recognized by

such Electing Shareholder on the sale or other taxable disposition of such Class A Shares generally would be a capital gain

or loss. Such capital gain or loss generally would be long-term if such Electing Shareholder had held the Class A Shares for

more than one year at the time of the sale or other taxable disposition. For non-corporate United States Persons, long-term

capital gain is generally subject to a current maximum United States federal income tax rate of 15% (currently scheduled to

increase to 20% on January 1, 2013). Long-term capital gain from the disposition of collectibles such as gold or silver, however,

is subject to a maximum United States federal income tax rate of 28%. The IRS has authority to issue Treasury regulations

applying the 28% tax rate to gain from the sale of an interest in a PFIC with respect to which a QEF election is in effect, to

the extent that such gain is attributable to unrealized appreciation of collectibles held by such PFIC. As no such Treasury regulations

have been issued, the 15% maximum tax rate (currently scheduled to increase to 20% on January 1, 2013) currently should apply

to long-term capital gains arising from the sale or other taxable disposition of Class A Shares by an Electing Shareholder.

There can be no assurance, however, as to whether, when or with what effective date any such Treasury regulations may be issued,

or whether any such Treasury regulations would subject long-term capital gains recognized by an Electing Shareholder from the disposition

of Class A Shares to the 28% maximum tax rate.

A United States Person holding Class A

Shares with respect to which a QEF election is not in effect for the entire holding period may avoid the adverse ordinary income

and interest charge rules described above upon any subsequent disposition of such Class A Shares if such United States

Person elects to recognize any gain in such Class A Shares as of the first day in the first year that the QEF election applies

to such Class A Shares (a “deemed sale” election). Any gain recognized by a United States Person under

such a deemed sale election will, however, be subject to the ordinary income and interest charge rules described above.

An Electing Shareholder will be required

to include currently in gross income such Electing Shareholder’s pro rata share of the annual “ordinary earnings”

and “net capital gains” (but may not include any net loss) of the Company. Such inclusion will be required whether

or not such Electing Shareholder owns Class A Shares for an entire taxable year or at the end of the Company’s taxable

year. For purposes of determining the amounts includable in income by Electing Shareholders under the QEF rules, the tax bases

of the Company’s assets, and the “ordinary earnings” and “net capital gains” of the Company, will

be computed under United States federal income tax rules. Accordingly, it is anticipated that such tax bases, and such “ordinary

earnings” and “net capital gains”, will differ from the figures set forth in the Company’s financial statements.

The amount currently included in income by an Electing Shareholder will be treated as ordinary income to the extent of the Electing

Shareholder’s pro rata share of the Company’s “ordinary earnings” and generally will be treated as

long-term capital gain to the extent of such Electing Shareholder’s pro rata share of the Company’s “net

capital gains.” The Electing Shareholder will be required to include in income such pro rata share of the “ordinary

earnings” and “net capital gains” of the Company, without regard to the amount of cash distributions, if any,

received from the Company. Electing Shareholders will be required to pay United States federal income tax currently on such

pro rata share of “ordinary earnings” and “net capital gains” of the Company, unless, as described

below, an election is made to defer such payment of tax.

Under these QEF rules, in the event that the Company disposes

of a portion of its gold or silver holdings, including dispositions in the course of varying its relative investment between gold

and silver, Electing Shareholders may be required to report substantial amounts of income for United States federal income

tax purposes (in the absence of any cash distributions received from the Company). Historically, the Company has declared

and paid a cash distribution of U.S.$0.01 per share (prior to 1996, Cdn.$0.01 per share) on its outstanding Class A Shares.

In addition, it is the intention of the Company to distribute to holders of record of Class A Shares and common shares as

of the last day of each taxable year (currently October 31) an aggregate amount of cash distributions (including the stated

distributions on the Class A Shares) such that the amount of cash distributions payable to an Electing Shareholder that holds

Class A Shares for the entire taxable year of the Company will be at least equal to the product of (i) the Company’s

“ordinary earnings” and “net capital gains” for such taxable year allocable to such Electing Shareholder

and (ii) the highest marginal rate of United States federal income tax on ordinary income or long-term capital gain,

as appropriate, applicable to individuals. Any such cash distributions (other than certain capital gains dividends) to non-residents

of Canada will be subject to Canadian withholding tax. Because such cash distributions may be subject to Canadian withholding tax

and because the amount of such cash distributions will be determined without reference to possible United States state or

local income tax liabilities or to the rate of United States federal income tax applicable to corporate United States

Persons, such cash distributions may not provide an Electing Shareholder with sufficient cash to pay the United States federal

income tax liability arising from the inclusion in income of the Electing Shareholder’s pro rata share of the Company’s

“ordinary earnings” and “net capital gains” under the QEF rules.

An Electing Shareholder may elect to defer,

until the occurrence of certain events, payment of the United States federal income tax liability arising from the inclusion

in income of the Electing Shareholder’s pro rata share of the Company’s “ordinary earnings” and “net

capital gains” under the QEF rules, but will be required to pay interest on the deferred tax computed by using the statutory

rate of interest applicable to an extension of time for payment of tax.

If an Electing Shareholder demonstrates

to the satisfaction of the IRS that amounts actually distributed on the Class A Shares have been previously included in income

under the QEF rules by such Electing Shareholder (or a previous United States Person), such distributions generally

will not be taxable. An Electing Shareholder’s tax basis in the Class A Shares generally will be increased by any amounts

currently included in income under the QEF rules and generally will be decreased by any subsequent distributions from the

Company that are treated as non-taxable distributions pursuant to the preceding sentence.

Mark-to-Market Election

A United States Person generally may

make a Mark-to-Market Election with respect to shares of “marketable stock” of a PFIC. Under the Code and Treasury

regulations, the term “marketable stock” includes stock of a PFIC that is “regularly traded” on a “qualified

exchange or other market”. Generally, a “qualified exchange or other market” means (i) a national securities

exchange which is registered with the Securities and Exchange Commission or the national market system established pursuant to

Section 11A of the Securities Exchange Act of 1934 or (ii) a foreign securities exchange that is regulated or supervised

by a governmental authority of the country in which the market is located and has the following characteristics: (a) the exchange

has trading volume, listing, financial disclosure, and other requirements designed to prevent fraudulent and manipulative acts

and practices, to remove impediments to and perfect the mechanism of a free and open market, and to protect investors, and the

laws of the country in which the exchange is located and the rules of the exchange ensure that such requirements are actually

enforced; and (b) the rules of the exchange ensure active trading of listed stocks. A class of stock is “regularly

traded” on a qualified exchange or other market for any calendar year during which such class of stock is traded (other than

in de minimis quantities) on at least 15 days during each calendar quarter. The Company believes that the Class A Shares

are, and expects that the Class A Shares will continue to be, “marketable stock” for purposes of the Mark-to-Market

Election rules.

A United States Person that makes a

Mark-to-Market Election would generally be required to report gain or loss annually to the extent of the difference, if any, between

(i) the fair market value of the Class A Shares at the end of each taxable year and (ii) the adjusted tax basis

of the Class A Shares at the end of each taxable year. Any gain under this computation, and any gain recognized on an actual

sale or other taxable disposition of the Class A Shares, generally would be treated as ordinary income. Any loss under this

computation, and any loss recognized on an actual sale or other taxable disposition of the Class A Shares, generally would

be treated as an ordinary loss to the extent of the cumulative net mark-to-market gain, and thereafter would be considered capital

loss. The United States Person’s adjusted tax basis in the Class A Shares generally would be adjusted for any gain

or loss taken into account under the Mark-to-Market Election.

Unless either (i) the Mark-to-Market

Election is made as of the beginning of the United States Person’s holding period for the Class A Shares or (ii) a

QEF election has been in effect for such United States Person’s entire holding period for the Class A Shares, any

mark-to-market gain for the election year generally will be subject to the ordinary income and interest charge rules described

above.

United States Foreign Tax Credit

Subject to complex limitations set forth

in the Code, United States Persons may be entitled to claim a credit against their United States federal income tax liability

for Canadian federal income tax withheld from distributions paid on the Class A Shares. For purposes of applying the limitations

set forth in the Code, dividends paid on the Class A Shares generally will constitute “foreign source” income

and generally will be categorized as “passive category income”. Gain from the sale or other disposition of the Class A

Shares generally will constitute “United States source” income for foreign tax credit purposes unless the gain is subject

to tax in Canada and is resourced as “foreign source” under the Treaty and the United States Person elects to

treat such gains as “foreign source.” United States Persons that do not elect to claim foreign tax credits for

a taxable year may be able to deduct any such Canadian federal income tax withheld. Each United States Person is strongly

urged to consult his, her or its own tax advisor with respect to the foreign tax credit rules.

Additional Tax on Passive Income

For tax years beginning after December 31,

2012, certain individuals, estates and trusts whose income exceeds certain thresholds will be required to pay a 3.8% Medicare surtax

on “net investment income” including, among other things, dividends and net gain from dispositions of property (other

than property held in a trade or business). United States Persons should consult with their own tax advisors regarding the effect,

if any, of this tax on their ownership and disposition of Class A Shares.

Information Reporting and Backup Withholding

Under U.S. federal income tax law and Treasury

regulations, certain categories of United States Persons must file information returns with respect to their investment in, or

involvement in, a foreign corporation. For example, U.S. return disclosure obligations (and related penalties) are imposed

on individuals who are United States Persons that hold certain specified foreign financial assets meeting certain minimum thresholds. The

definition of specified foreign financial assets includes not only financial accounts maintained in foreign financial institutions,

but also, unless held in accounts maintained by a financial institution, any stock or security issued by a non-U.S. person, any

financial instrument or contract held for investment that has an issuer or counterparty other than a U.S. person and any interest

in a foreign entity. United States Persons may be subject to these reporting requirements unless their Class A

Shares are held in an account at a domestic financial institution. Penalties for failure to file certain of these information

returns are substantial. United States Persons should consult with their own tax advisors regarding the requirements

for filing information returns under these rules, including requirements to file an IRS Form 8938.

Payments to a United States Person made

within the United States, or by a United States payor or United States middleman, of dividends on, or proceeds arising

from the sale or other taxable disposition of, Class A Shares generally will be subject to information reporting and backup

withholding tax, at the current rate of 28% (expected to be increased to 31% for payments made after December 31, 2012), if

a United States Person fails to furnish its correct United States taxpayer identification number, and to make certain

certifications, or otherwise fails to establish an exemption. Any amounts withheld under the backup withholding rules from

a payment to a United States Person generally may be refunded (or credited against such United States Person’s

United States federal income tax liability, if any) provided the required information is furnished to the IRS.

The discussion of reporting requirements

set forth above is not intended to constitute an exhaustive description of all reporting requirements that may apply to a U.S.

Person. A failure to satisfy certain reporting requirements may result in an extension of the time period during which the IRS

can assess a tax, and under certain circumstances, such an extension may apply to assessments of amounts unrelated to any unsatisfied

reporting requirement. Each U.S. Person should consult its own tax advisors regarding the information reporting and backup withholding

rules.

DISCLOSURE CONTROLS AND PROCEDURES

The Company carried out an evaluation as

at the end of the fiscal year covered by this Annual Report, under the supervision and with the participation of the Company’s

senior executive officers, including the Company’s President and Chief Executive Officer and Treasurer and Chief Financial

Officer, of the effectiveness of the Company’s disclosure controls and procedures, as defined in Rules 13a-15(e) and

15d-15(e) under the Exchange Act. Based on that evaluation, the President and Chief Executive Officer and Treasurer

and Chief Financial Officer have concluded that as of the end of the fiscal year covered by this Annual Report, the Company’s

disclosure controls and procedures were adequately designed and effective to ensure that i) information required to be disclosed

by the Company in the reports that it files or submits under the Exchange Act is recorded, processed, summarized and reported within

the time periods specified in the applicable rules and forms and ii) information required to be disclosed by the Company in

the reports it files or submits under the Exchange Act is accumulated and communicated to the Company’s senior executive

officers, including its President and Chief Executive Officer and Treasurer and Chief Financial Officer, as appropriate, to allow

for accurate and timely decisions regarding required disclosure.

MANAGEMENT’S REPORT ON INTERNAL

CONTROL OVER FINANCIAL REPORTING

The Company’s senior executive officers

are responsible for establishing and maintaining adequate internal control over financial reporting as defined in Rules 13a-15(f) and

15d-15(f) under the Exchange Act. The Company’s internal control over financial reporting is a process designed

to provide reasonable assurance regarding the reliability of the financial reporting and the preparation and fair presentation

of financial statements for external purposes in accordance with Canadian generally accepted accounting principles.

Because of its inherent limitations, internal

control over financial reporting may not prevent or detect misstatements. Projections of any evaluation of effectiveness to future

periods are subject to the risk that controls may become inadequate because of changes in conditions, or that the degree of compliance

with the policies and/or procedures may deteriorate.

The senior executive officers conducted

an evaluation of the effectiveness, design and operation of the Company’s internal control over financial reporting as of

October 31, 2012 based on the criteria established in

Internal Control — Integrated Framework

, issued by the

Committee of Sponsoring Organizations of the Treadway Commission. This evaluation included review of the documentation of

controls, evaluation of the design effectiveness of controls, testing of the operating effectiveness of controls and a conclusion

on this evaluation. Based on this evaluation, the senior executive officers have concluded that the Company’s internal

control over financial reporting was effective as of October 31, 2012 and no material weaknesses were discovered.

This report is required for U.S. reporting

purposes as the Company is a “foreign private issuer” as defined in Rule 3b-4 of the Exchange Act, and as the

Company is an “accelerated filer,” the Company is required to provide an auditor’s attestation report on management’s

assessment of the Company’s internal control over financial reporting for the fiscal year ended October 31, 2012.

The auditor’s attestation is filed as part of

Exhibit 99.3

and is incorporated by reference in this Annual Report.

CHANGES IN INTERNAL CONTROLS OVER FINANCIAL

REPORTING

During the fiscal year covered by this Annual

Report, no change occurred in the Company’s internal control over financial reporting that has materially affected, or is

reasonably likely to materially affect, the Company’s internal control over financial reporting.

The senior executive officers of the Company,

including the President and Chief Executive Officer and Treasurer and Chief Financial Officer, do not expect that the Company’s

disclosure controls and procedures or internal controls and procedures will prevent all error and all fraud. A control system,

no matter how well conceived and operated, can provide only reasonable, not absolute, assurance that the objectives of the control

system are met. Further, the design of a control system must reflect the fact that there are resource constraints, and the

benefits of controls must be considered relative to their costs. Because of the inherent limitations in all control systems,

no evaluation of controls can provide absolute assurance that all control issues and instances of fraud, if any, within the Company

have been detected. These inherent limitations include the realities that judgments in decision-making can be faulty, and

that breakdowns can occur because of simple error or mistake. Additionally, controls can be circumvented by the individual

acts of some persons, by collusion of two or more people, or by officers’ override of the control. The design of any

system of controls also is based in part upon certain assumptions about the likelihood of future events, and there can be no assurance

that any design will succeed in achieving its stated goals under all potential future conditions; over time, control may become

inadequate because of changes in conditions, or the degree of compliance with the policies or procedures may deteriorate.

Because of the inherent limitations in a cost-effective control system, misstatements due to error or fraud may occur and may not

be detected.

CORPORATE GOVERNANCE

The Company is listed on the Toronto Stock

Exchange and is required to describe its practices and policies with regard to corporate governance with specific reference to

the corporate governance guidelines of the Canadian Securities Administrators on an annual basis by way of a corporate governance

statement contained in the Company’s annual information form or information circular. The Company is also listed on

the NYSE MKT LLC (“NYSE MKT” ) and additionally complies as necessary with the rules and guidelines of NYSE MKT

as well as the United States Securities and Exchange Commission (the “Commission”). The Company reviews its governance

practices on an ongoing basis to ensure it is in compliance with the applicable laws, rules and guidelines both in Canada

and in the United States.

The Company’s board of directors is

responsible for the Company’s corporate governance policies and has separately designated a standing Corporate Governance

Committee. The Company’s board of directors has determined that the members of the Corporate Governance Committee are

independent, based on the criteria for independence and unrelatedness prescribed by the Sarbanes-Oxley Act of 2002, Section 10A(m)(3),

and NYSE MKT.

Corporate governance relates to the activities

of the Company’s board of directors, the members of which are elected by and are accountable to the shareholders, and takes

into account the role of the senior officers who are appointed by the board and who are charged with the day to day administration

of the Company. The Company’s board of directors is committed to sound corporate governance practices that are both

in the interest of its shareholders and contribute to effective and efficient decision making.

NOTICES PURSUANT TO REGULATION BTR

There were no notices required by Rule 104

of Regulation BTR that the Company sent during the fiscal year ended October 31, 2012 to directors and executive officers

concerning any equity security subject to a blackout period under Rule 101 of Regulation BTR.

AUDIT COMMITTEE

The Company’s board of directors has

a separately designated standing Audit Committee established in accordance with Section 3(a)(58)(A) of the Exchange Act.

The members of the Company’s Audit Committee are identified on page 15 of the Annual Information Form, filed as

Exhibit 99.1

to this Annual Report, and incorporated by reference herein. In the opinion of the Company’s board of directors, all

members of the Audit Committee are independent as determined under Rule 10A-3 of the Exchange Act, the rules of NYSE

MKT and the policies of the Canadian Securities Administrators and are financially literate.

Audit Committee Financial Expert

Bruce D. Heagle, Chairman of the Audit Committee,

is the financial expert, in that he has an understanding of generally accepted accounting principles and financial statements;

is able to assess the general application of such accounting principles in connection with the accounting for estimates, accruals

and reserves; has experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level

of complexity of accounting issues that are generally comparable in breadth and complexity of issues that can reasonably be expected

to be raised by the Company’s financial statements (or actively supervising one or more persons engaged in such activities);

has an understanding of internal controls and procedures over financial reporting and an understanding of audit committee functions.

The members of the Audit Committee do not

have fixed terms and are appointed and replaced annually by resolution of the Company’s board of directors.

The Audit Committee meets with the President

and Chief Executive Officer and the Treasurer and Chief Financial Officer of the Company and the Company’s independent auditors

to review and inquire into matters affecting financial reporting, the system of internal accounting and financial controls, as

well as accounting policies, audit procedures and audit plans. The Audit Committee also recommends to the Company’s

board of directors the auditors to be appointed and their compensation. In addition, the Audit Committee reviews and recommends

to the Company’s board of directors for approval the Company’s financial statements and reports, the MD&A and the

Annual Information Form, and undertakes other activities required by regulatory authorities.

Audit Committee Charter

The Company’s Audit Committee Charter

is available on the Company’s website at www.centralfund.com, in the Annual Information Form filed as

Exhibit 99.1

to this Annual Report or in print to any shareholder who provides the Company with a written request made to Catherine A. Spackman,

Treasurer and Chief Financial Officer, at Hallmark Estates, #805, 1323-15th Avenue S.W., Calgary, Alberta T3C 0X8, Canada.

CODE OF CONDUCT AND ETHICS

The Company’s board of directors has

adopted a written Code of Conduct and Ethics by which the principal executive officer, principal financial officer and principal

accounting officer of the Company abide. In addition, the Company’s board of directors, through its meetings with officers

and other informal discussions with officers, encourages a culture of ethical business conduct and believes the Company’s

high caliber officers promote a culture of ethical business conduct throughout the Company’s operations and is expected to

monitor the activities of the Company’s officers, consultants and agents in that regard. The Company’s board

of directors encourages any concerns regarding ethical conduct in respect of the Company’s operations to be raised, on an

anonymous basis, with the President and CEO, the Chairman, or the Secretary, as appropriate.

It is a requirement of applicable corporate

law that directors or directors and officers who have an interest in a transaction or agreement with the Company promptly disclose

that interest at any meeting of the Company’s board of directors at which the transaction or agreement will be discussed

and abstain from discussions and voting in respect to same if the interest is material.

A copy of the Company’s Code of Conduct

and Ethics is available on its website at www.centralfund.com and without charge, upon written request made to Catherine A. Spackman,

Treasurer and Chief Financial Officer, at Hallmark Estates, #805, 1323-15th Avenue S.W., Calgary, Alberta T3C 0X8, Canada.

PRINCIPAL ACCOUNTING FEES AND SERVICES

Ernst & Young LLP acted as

the Company’s independent auditor for the fiscal year ended October 31, 2012. See page 20 of the

Company’s Annual Information Form, which is filed as

Exhibit 99.1

to this Annual Report, for the total

amount in United States dollars billed to the Company by Ernst & Young LLP for services performed in the last two

fiscal years by category of service.

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES

PROVIDED BY

INDEPENDENT AUDITORS

See “Audit Committee Matters”

beginning on page 16 of the Company’s Annual Information Form filed as

Exhibit 99.1

to this Annual

Report and incorporated by reference herein.

OFF-BALANCE SHEET ARRANGEMENTS

The Company does not have any off-balance

sheet arrangements.

CONTRACTUAL OBLIGATIONS

The following table lists, as of October 31,

2012, information with respect to the Company’s known contractual obligations.

|

|

|

|

Payments due by period

|

|

|

Contractual Obligations (1)

|

|

|

Total

|

|

|

|

Less than

1 year

|

|

|

|

1-3 years

|

|

|

|

3-5 years

|

|

|

|

More than

5 years

|

|

|

Long-Term Debt Obligations

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

Capital (Finance) Lease Obligations

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Operating Lease Obligations

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Purchase Obligations

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Other Long-Term Liabilities Reflected on the Registrant’s Balance Sheet under Canadian GAAP

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

|

—

|

|

|

Total

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

|

$

|

—

|

|

(1) The Company pays administrator

and safekeeping fees, as discussed in the items expressly incorporated by reference herein.

NYSE MKT CORPORATE GOVERNANCE

The Company’s Class A Shares

are listed on NYSE MKT. Section 110 of the NYSE MKT Company Guide permits NYSE MKT to consider the laws, customs and practices

of foreign issuers in relaxing certain NYSE MKT listing criteria, and to grant exemptions from NYSE MKT listing criteria based

on these considerations. An issuer seeking relief under these provisions is required to provide written certification from

independent local counsel that the non-complying practice is not prohibited by home country law. A description of the significant

ways in which the Company’s governance practices differ from those followed by domestic companies pursuant to NYSE MKT standards

is as follows:

Shareholder Meeting Quorum Requirement

. The NYSE MKT minimum quorum requirement for a shareholder meeting is one-third of the outstanding shares of common stock.

In addition, a company listed on NYSE MKT is required to state its quorum requirement in its bylaws. The Company’s

quorum requirement is set forth in its bylaws. A quorum for a meeting of shareholders of the Company is two persons who are,

or who represent by proxy, share holders who, in the aggregate, hold at least 10% of the common shares entitled to be voted at

the meeting.

Proxy Delivery Requirement.

NYSE

MKT requires the solicitation of proxies and delivery of proxy statements for all shareholder meetings, and requires that these

proxies shall be solicited pursuant to a proxy statement that conforms to Commission proxy rules. The Company is a “foreign

private issuer” as defined in Rule 3b-4 under the Exchange Act, and the equity securities of the Company are accordingly

exempt from the proxy rules set forth in Sections 14(a), 14(b), 14(c) and 14(f) of the Exchange Act. The Company

solicits proxies in accordance with applicable rules and regulations in Canada.

Independence of Directors.

NYSE MKT requires that the majority of a company’s directors be independent. Under Canadian securities law, subject

to certain exceptions, at least three directors of a company must be independent. The Company currently has four independent

directors, which constitute a majority of its board members.

The foregoing are consistent with the laws,

customs and practices in Canada.

In addition, we may from time-to-time seek

relief from NYSE MKT corporate governance requirements on specific transactions under Section 110 of the NYSE MKT Company

Guide by providing written certification from independent local counsel that the non- complying practice is not prohibited by our

home country law, in which case, we shall make the disclosure of such transactions available on our website at www.centralfund.com.

Information contained on, or accessible through, our website is not part of this Annual Report.

MINE SAFETY DISCLOSURE

Not applicable.

UNDERTAKING

The Registrant undertakes to make available,

in person or by telephone, representatives to respond to inquiries made by the Commission staff, and to furnish promptly, when

requested to do so by the Commission staff, information relating to the securities in relation to which the obligation to file

an annual report on Form 40-F arises or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Registrant has filed an Appointment

of Agent for Service of Process and Undertaking on Form F-X in connection with the class of securities in relation to which

the obligation to file this Annual Report arises.

Any change to the name or address of the

Registrant’s agent for service of process shall be communicated promptly to the Commission by an amendment to the Form F-X

referencing the file number of the Registrant.

SIGNATURES

Pursuant to the requirements of the Exchange

Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual

Report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

CENTRAL FUND OF CANADA LIMITED

|

|

|

|

|

|

/s/ J.C. Stefan Spicer

|

|

|

J.C. Stefan Spicer

|

|

|

President and Chief Executive Officer

|

Date: December 12, 2012

EXHIBIT INDEX

The following documents are being filed

with the Commission as Exhibits to this Annual Report:

|

Exhibit

|

|

Description

|

|

|

|

|

|

99.1

|

|

Annual Information Form

|

|

|

|

|

|

99.2

|

|

Management’s Discussion and Analysis

|

|

|

|

|

|

99.3

|

|

Annual Financial Statements

|

|

|

|

|

|

99.4

|

|

Consent of Ernst & Young LLP

|

|

|

|

|

|

99.5

|

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to Rule 13a-14(a) or 15d-14(a) of the Exchange Act

|

|

|

|

|

|

99.6

|

|

Certification of Chief Executive Officer and Chief Financial Officer pursuant to 18 U.S.C. Section 1350

|

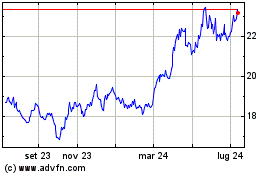

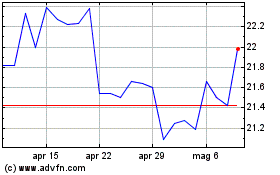

Grafico Azioni Sprott Physical Gold and... (AMEX:CEF)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Sprott Physical Gold and... (AMEX:CEF)

Storico

Da Nov 2023 a Nov 2024