TIDMMPO

RNS Number : 1988A

Macau Property Opportunities Fund

19 January 2024

MPO Investor Update H2 2023

Caption: Light installation at Macau's Winter Flower Show with

the Cotai Strip in the background.

KEY DATA

Inception date 5 June 2006

Exchange London Stock Exchange

---------------------- ----------------------

Domicile Guernsey

---------------------- ----------------------

Market capitalisation GBP25.1 million

---------------------- ----------------------

Portfolio valuation US$192.6 million(1) -1.5%

(vs 30 June 2023)

---------------------- ----------------------

Adjusted NAV US$86.1 million(1)

---------------------- ----------------------

Adjusted NAV per share US$1.39(1) /109p(2) -4.8%

(vs 30 June 2023)

---------------------- ----------------------

Share price 40.6p -30.6%

(vs 30 June 2023)

---------------------- ----------------------

Discount to Adjusted 62.8% 51.5%

NAV

(as at 30 June 2023)

---------------------- ----------------------

Cash balance US$2.9 million(1)

---------------------- ----------------------

Total debt US$99.4 million(1)

---------------------- ----------------------

Loan-to-value ratio 50.9%(1)

---------------------- ----------------------

([1]) As at 30 September 2023.

(2) Based on a US$/GBP exchange rate of 1.273642 as at 31

December 2023.

All other data are as at 31 December 2023.

Opening Paragraph

The Company has continued its carefully managed divestment

programme, achieving sales valued at approximately US$52 million

since commencement. Macau's economy, meanwhile, has continued to

rebound following the lifting of COVID-related restrictions in

early 2023, although its property market has remained sluggish.

Looking forward, recently announced government measures to relax

long-standing anti-speculation property restrictions from early

2024, may provide some support to the luxury residential

segment.

Portfolio

The Waterside

Since the divestment programme was initiated in mid-2022, the

Company has sold 19 units - around one in three of the tower's 59

units - generating gross revenues of c.US$52 million . Of the net

proceeds, 75% has been deployed to pay down the Company's debt,

while the balance has been made available for working capital.

During H2 2023, the Company made loan repayments of HK$60 million

(approximately US$7.7 million). A further debt repayment tranche of

HK$75 million is scheduled for the end of Q1 2024, which the

company is aiming to meet through its ongoing divestment

programme.

At the end of 2023, the occupancy rate at The Waterside was 50%,

based on the gross floor area of the unsold units.

The Fountainside

At The Fountainside, four villas, three reconfigured apartments

and two car-parking spaces remain available for sale. The Company

is deploying several active sales and marketing strategies to

divest these assets.

The three reconfigured apartments being modified from two

original duplexes have been the subject of requests for additional

alterations at a very late stage by Macau authorities. Upon

receiving the construction licence, on-site works began at the end

of November, and are expected to be completed imminently. An

application for the occupancy permits will be made once the works

are completed.

Penha Heights

Potential buyers' interest in Penha Heights has picked up since

Macau's pandemic-era travel restrictions were lifted. The number of

inquiries and viewings has increased, but it will take time to

identify a buyer, given the value and unique nature of the

property, one of very few large, detached houses in Macau. The

Company will thus explore a variety of new marketing

opportunities.

Caption: Living and dining area of a duplex unit at the

Waterside

Property

Macau's property sector has remained sluggish due to higher

interest rates and the uneven progress of the territory's economic

recovery following the worst of the COVID pandemic. Economic

headwinds both globally and in mainland China have also weighed on

investor sentiment.

In the residential property segment overall, 2,354 transactions

were recorded during the first three quarters of 2023, a

year-on-year (YoY) improvement of 9% from a 40-year low in 2022.

Prices appeared to have stabilised at HK$5,721 per square foot in

Q3 2023, 1% lower than in Q3 2022. In the luxury residential

segment, comprising units larger than 150 square metres, only 118

units were transacted during the first three quarters of the year,

an increase of 13% YoY, while average prices in Q3 2023 declined

10% YoY.

Sentiment in the luxury segment, however, received a potential

boost when Macau's government announced several measures late in Q4

to rekindle interest in property by rolling back some

anti-speculation policies from January 2024. It has abolished a 5%

stamp duty for transactions involving second homes, and purchasers

of properties valued at MOP8 million (c.US$1 million) or more can

now enjoy 70% ceilings on mortgage loan-to-value ratios, up from

50% previously.

Amid signs of stabilisation of mainland China's property sector,

ongoing efforts to stimulate the Chinese economy, and the

relaxation of Macau's anti-speculation measures, the Company is

cautiously optimistic that investor sentiment towards luxury

residential properties in the territory will gradually improve.

Macau

Economy

Macau registered robust gross domestic product growth of 78% YoY

during the first three quarters of 2023, and full-year 2023 growth

is expected to be 75% YoY. GDP growth has been driven mainly by the

recovery of the territory's twin economic engines - tourism and

gaming - but businesses in other sectors, such as small and

medium-sized enterprises and local retail stores, face an uphill

battle to recover from the damage wrought by the pandemic. Although

Moody's downgraded Macau's credit outlook from "stable" to

"negative" in December 2023 - in tandem with its downgrade of

mainland China's credit outlook, based on the tight institutional,

economic and financial linkages between the territory and the

mainland - its assessment appears to be at variance with Macau's

overall pace of economic recovery.

Tourism and gaming

Total tourist arrivals during 2023 were around 28 million,

translating to a daily average of 77,000 visitors, approximately

72% of Macau's pre-pandemic peak. International visitor arrivals

also recovered steadily, from 1,000 arrivals daily in January to

more than 7,000 in December, which is 90% of the pre-pandemic peak.

Hotel occupancy recovered to an average of 81% during the first 11

months of the year, albeit remaining short of the 91% rate for the

same period in 2019. Visitor spending (excluding gaming) surpassed

2019 levels, with per-capita spending of MOP2,612 during the first

nine months of 2023, 65% higher than in 2019. The extension of the

Barra-Taipa Light Rail Transit ushers in a new era of

transportation for the city, greatly improving accessbetween the

Macau Peninsula and Taipa.

Gross gaming revenue (GGR) for 2023 stood at MOP183 billion

(US$22.68 billion), approximately 62% of 2019 levels. It exceeded

the MOP180 billion threshold that obliges gaming concessionaires to

make additional commitments of up to 20% to non-gaming and overseas

marketing spend. Morgan Stanley predicts that Macau's 2024

full-year GGR will grow 24% YoY to approximately 80% of 2019's

level.

Caption: The new Barra Station has extended the Light Rail's

connectivity from Taipa to Macau.

Outlook

The International Monetary Fund has forecast Macau's GDP to grow

by 27% in 2024, reflecting the general health of the territory's

economy. In addition to recent government measures to boost the

property market, indications from the US Federal Reserve are that

US interest rate hikes are on pause amid a market consensus that

lower rates may be on the horizon. This could provide a much-needed

boost to the market as Macau's interest rates are set with

reference to US rates. Any consequent easing of the Company's debt

service levels alongside a recovery in investment sentiment will

provide a boost to the Company's bottom line and ultimately benefit

its shareholders.

The Company's focus will remain the divestment of its portfolio

and implementing its debt reduction strategy. We will also look to

capitalise on any emerging divestment opportunities that may arise

amid improved investor sentiment.

We thank our shareholders for supporting the continuation of the

Company at the Annual General Meeting in December. We recognise

that although the reduction of debt is necessary, as is the careful

management of our divestment programme, the return of capital is

our single most important objective, upon which all our efforts are

focused.

Investor Relations

Sniper Capital Limited

Tel: +853 2870 5151

info@snipercapital.com

www.snipercapital.com

Corporate Broker

Liberum Capital

Darren Vickers / Owen Matthews

Tel: +44 20 3100 2222

Company Secretary and Administrator

Ocorian Administration (Guernsey) Limited

Kevin Smith

Tel: +44 14 8174 2742

Stock Code

London Stock Exchange: MPO

LEI:

213800NOAO11OWIMLR72

About The Company

Premium listed on the London Stock Exchange, Macau Property

Opportunities Fund Limited is a closed-end investment company

registered in Guernsey and is the only quoted property fund

dedicated to investing in Macau, the world's leading gaming market

and the only city in China where gaming is legalised.

Launched in 2006, the Company targets strategic property

investment and development opportunities in Macau. Its current

portfolio comprises prime residential property assets.

About Sniper Capital Limited

The Company is managed by Sniper Capital Limited, an Asia-based

property investment manager with an established track record in

fund management and investment advisory.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUQKFBDPBKDBDD

(END) Dow Jones Newswires

January 19, 2024 02:00 ET (07:00 GMT)

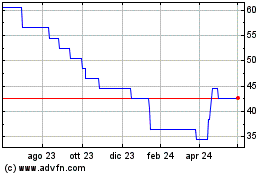

Grafico Azioni Macau Property Opportuni... (AQSE:MPO.GB)

Storico

Da Nov 2024 a Dic 2024

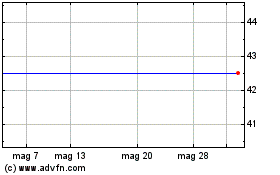

Grafico Azioni Macau Property Opportuni... (AQSE:MPO.GB)

Storico

Da Dic 2023 a Dic 2024