Asian Shares Mixed as Traders Brace for Fed Tightening

24 Agosto 2016 - 6:20AM

Dow Jones News

Asian equity markets were mixed Wednesday morning as traders

braced for tightening by the U.S. Federal Reserve, broadly

weakening regional currencies against the U.S. dollar.

The Nikkei Stock Average traded 0.5% higher, moderating early

gains made on the back of a weaker yen. Australia's S&P/ASX 200

added 0.1%, while the South Korea Kospi was down 0.3%. Hong Kong's

Hang Seng Index fell 0.6% and the Shanghai Composite Index was

roughly flat.

Despite the yen's slight weakening on Wednesday, the dollar-yen

currency won't likely move much until Federal Reserve Chairwoman

Janet Yellen makes her remarks in Jackson Hole, Wyo., at the Fed's

annual meeting, Mizuho Securities Chief FX Strategist Kengo Suzuki

says in a note.

Among stocks in Japan, Sony Corp. gained 1.7% after the Japanese

electronics giant said it would raise the price of its PlayStation

Plus service, weeks before unveiling two new versions of its

flagship videogame console.

Japanese automobile stocks also rose as any tightening by the

Fed would push the dollar higher, making then yen weaker and

Japanese exports more competitive. Toyota Motor Corp. was up 1.8%

and Nissan Motor Co. Ltd. traded 2.2% higher.

In Australia, Qantas Airways Ltd. gained 2.5% after it reported

record profits for the full fiscal year. The airline operator said

it would pay an ordinary dividend of 7 Australian cents a share,

its first such payment since 2009.

"Qantas remains very cheap in our view and the resumption of

dividends demonstrates management's confidence in the outlook going

forward," Macquarie said in a note Wednesday.

Meanwhile, oil prices were down in Asian trade early Wednesday,

after the industry group American Petroleum Institute said its data

showed an increase of 4.5 million barrels in U.S. crude stockpiles

last week. Still, prices rose in U.S. trade Tuesday on speculation

that Iran might cooperate with other global exporters to keep oil

prices from falling.

Official U.S. oil data by the Energy Information Administration

will be released later Wednesday to shed more light on the state of

U.S. stockpiles. West Texas Intermediate crude prices were recently

down 44 cents at $47.65 a barrel in Asia trade, while Brent crude

prices were down 36 cents at $49.60 a barrel.

Oil-exporting Malaysia's ringgit weakened against the U.S.

dollar on Wednesday. The ringgit has been pressured of late, along

with other Asian currencies, on the view the Fed is veering toward

tightening. High U.S. interest rates would pull money out of Asian

markets and back to the U.S., weakening regional currencies in the

process. The dollar-ringgit pair was last at 4.0360, up from its

Tuesday closing of 4.0250.

Hiroyuki Kachi, Kosaku Narioka, Jenny Hsu and David Winning

contributed to this article.

Write to Kenan Machado at kenan.machado@wsj.com

(END) Dow Jones Newswires

August 24, 2016 00:05 ET (04:05 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

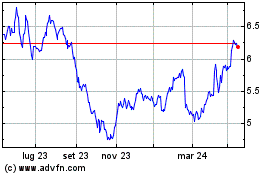

Grafico Azioni Qantas Airways (ASX:QAN)

Storico

Da Dic 2024 a Gen 2025

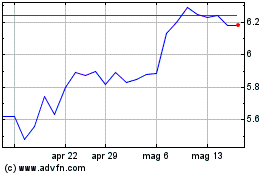

Grafico Azioni Qantas Airways (ASX:QAN)

Storico

Da Gen 2024 a Gen 2025