Italy's Monte Dei Paschi Returns to Institutional Market With Bond Issue

24 Febbraio 2023 - 8:12AM

Dow Jones News

By Mauro Orru

Banca Monte dei Paschi di Siena SpA issued a senior preferred

unsecured bond for 750 million euros ($794.7 million), more than

two years since its last issuance and after swinging to a profit in

the fourth quarter.

The world's oldest bank said late Thursday that it had raked in

orders for about EUR1.6 billion from a pool of more than 150

investors, setting the final yield at 6.75%. The bond has a

three-year maturity.

"The issue represents a successful return of MPS to the

institutional market, more than two years after the last issue,"

the bank said.

The announcement comes a week after Moody's Investors Service

Inc. lifted the bank's long-term senior unsecured debt rating by

three notches to B1 from Caa1, saying fourth-quarter results

"already reflect structural profitability improvements--post large

staff lay-offs-all the more so since the bank reaps the benefits of

rising interest rates."

The Tuscan lender last year completed a EUR2.5 billion capital

increase as it sought to shore up its capital base and turn a page

on a chapter that saw it undergo state recapitalization and the

disposal of billions in bad loans.

Monte dei Paschi has long been weighed down by a mountain of bad

loans and a legal scandal. After the bank teetered near failure,

the Italian government spent some EUR5.4 billion to nationalize it

in 2017, equivalent to more than $6 billion at the time.

Write to Mauro Orru at mauro.orru@wsj.com; @MauroOrru94

(END) Dow Jones Newswires

February 24, 2023 01:57 ET (06:57 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

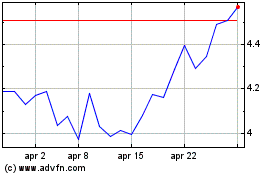

Grafico Azioni Banca Monte Dei Paschi D... (BIT:BMPS)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Banca Monte Dei Paschi D... (BIT:BMPS)

Storico

Da Lug 2023 a Lug 2024